TIDMOXB

RNS Number : 3403H

Oxford Biomedica PLC

13 March 2015

OXFORD BIOMEDICA: PRELIMINARY RESULTS FOR THE YEAR ENDED 31

DECEMBER 2014

Oxford, UK - 13 March 2015: Oxford BioMedica plc (LSE: OXB),

("OXB" or "the Group") a leading gene and cell therapy group, today

announces its preliminary results for the twelve months ended 31

December 2014.

OPERATIONAL HIGHLIGHTS:

-- IP, technology and manufacturing capability is validated

- Major new licensing and manufacturing contract with Novartis

worth up to $90 million over the next three years signed in

October

- Licensing royalties when CTL019 is commercialised

-- Revenues increased

- Licensing revenues increased to GBP5.1 million (2013: GBP1.0

million) including GBP4.8 million from Novartis upfront

payments

- Manufacturing revenue increased to GBP7.7 million (2013:

GBP2.6 million) from the provision of manufacturing and process

development services to third parties

- R&D collaboration revenue of GBP0.8 million (2013: GBP1.7

million) representing residual revenue under the 2009 Sanofi

agreement

-- Pipeline advanced

- Four clinical programmes in active development and two other

products being prepared for Phase I/II

- RetinoStat(R) recruitment completed in Phase I trial which will report in 2015

- New CART-5T4 programme initiated in-house, combining both

OXB's LentiVector(R) and 5T4 technology platforms

- GBP2.2 million grant from the Technology Strategy Board (now

Innovate UK) to fund a Phase I/II clinical trial of OXB-102 in

Parkinson's disease commencing in early 2016

- Sanofi granted global rights to StarGen(TM) and UshStat(R)

across all ocular indications; Oxford BioMedica is entitled to

development and commercialisation milestone payments and

royalties

-- Balance sheet strengthened

- Successful fundraising in June which contributed net proceeds of GBP20.1 million

FINANCIAL HIGHLIGHTS(1) :

-- Total revenues of GBP13.6 million (excluding grants) in 2014 (2013: GBP5.4 million)

-- Total revenues include profit-generating revenues(2) of

GBP7.7 million (2013: GBP2.6 million)

-- Cash used in operations, before capital expenditure of GBP7.4

million (2013: GBP13.0 million)

-- Cash burn of GBP11.6 million(3) (2013: GBP11.9 million)

-- GBP14.2 million cash balance at end 2014 (GBP2.2 million at the start of the year)

_______________________________

(1) Audited financial results (2) Revenues from the provision of manufacturing and process development services to third parties (3) Net cash used in/generated from operations plus sales and purchases of non-current assets and interest received

John Dawson, Chief Executive Officer at Oxford BioMedica, said:

"Oxford BioMedica is now demonstrably a world-leading gene and cell

therapy group with a valuable proprietary pipeline. 2014 was a

transformational year for the Group due largely to the signature of

our major contract with Novartis. This second contract with

Novartis further validated the strength of our lentivector IP and

our associated manufacturing expertise. The deal also gave us a

significantly strengthened financial position and so now the group

has a highly promising future. Our overall goal is to deliver

significant value to both patients and shareholders in the

near-term and we are excited and well positioned to do this."

Conference call for analysts

A briefing for analysts will be held at 9am GMT on 13 March 2015

at the offices of Consilium

Strategic Communications, 41 Lothbury, London, EC2R 7HG. There

will be a simultaneous live conference call and the presentation

will be available on the Group's website at

www.oxfordbiomedica.co.uk.

Please visit the website approximately 10 minutes before the

conference call, at 9am GMT, to download the presentation slides.

Conference call details:

Participant dial-in: 08006940257

International dial-in: +44 (0) 1452 555566

Participant code: 2837070

An audio replay file will be made available shortly afterwards

via the Group's website: www.oxfordbiomedica.co.uk

For further information, please contact:

Oxford BioMedica plc: Tel: +44 (0)1865 783 000

John Dawson, Chief Executive Officer

Tim Watts, Chief Financial Officer

Financial PR Enquiries: Tel: +44 (0)20 3709 5700

Mary-Jane Elliott / Matthew Neal / Chris Welsh / Laura

Thornton

Consilium Strategic Communications

Disclaimer

This press release contains "forward-looking statements",

including statements about the discovery, development and

commercialisation of products. Various risks may cause Oxford

BioMedica's actual results to differ materially from those

expressed or implied by the forward-looking statements, including

adverse results in clinical development programmes; failure to

obtain patent protection for inventions; commercial limitations

imposed by patents owned or controlled by third parties; dependence

upon strategic alliance partners to develop and commercialise

products and services; difficulties or delays in obtaining

regulatory approvals and services resulting from development

efforts; the requirement for substantial funding to conduct

research and development and to expand commercialisation

activities; and product initiatives by competitors. As a result of

these factors, prospective investors are cautioned not to rely on

any forward-looking statements. Oxford BioMedica disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Notes for editors

About Oxford BioMedica(R)

Oxford BioMedica plc (LSE: OXB) is a leading gene and cell

therapy group with an unrivalled portfolio of gene therapy products

in development, and a platform of exclusive and pioneering

technologies with which it designs, develops and manufactures

unique gene-based medicines for some of world's largest

pharmaceutical companies. Leveraging its proprietary LentiVector(R)

IP and gene delivery system technology platform and unique tumour

antigen (5T4), Oxford BioMedica is advancing its pipeline of seven

gene therapy products addressing diseases for which there are

currently no treatments or that are inadequately treated today,

including ocular and central nervous system disorders. OXB

Solutions, the Group's industry-leading manufacturing and

development business, provides services to collaborators and

partners working in gene and cell therapy, including Novartis and

Immune Design Corp. In addition, the Group has licenced products

and IP to Sanofi, Pfizer, MolMed, Sigma-Aldrich, Biogen Idec,

Emergent BioSolutions and ImaginAb. Further information is

available at www.oxfordbiomedica.co.uk and

www.oxbsolutions.co.uk

CHAIRMAN'S STATEMENT

The main event in 2014 was undoubtedly the signing of a second

agreement with Novartis following our initial agreement in 2013.

The importance of this deal must not be underestimated for two main

reasons. Firstly, the validation of our patent estate, know-how and

capability to deliver firmly establishes us as the leader in the

industry for lentiviral vector based gene and cell therapy

products. Secondly, in addition to the upfront payment and equity

investment we have already received, the contract promises

significant potential revenues over the next three years and

potentially a royalty stream on CTL019 after that. This provides us

with an opportunity to deliver a balanced business model whereby

revenues support the Group's overheads and help us to fund the

development of our proprietary product pipeline.

Although the Novartis contract gives us financial strength, I

was pleased to see encouraging progress in the development of our

product pipeline in 2014 as I am convinced that this remains our

single most valuable asset. With four programmes in active clinical

development, and two more being readied for the clinic, our

pipeline is full of potential value and we continue evaluating new

pipeline opportunities.

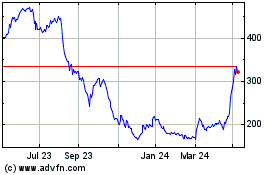

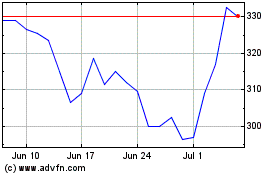

Funding and share price performance

I was delighted with the support we received from our existing

shareholders, and the investment of new shareholders, as part of

our successful GBP21.6m (before expenses) fundraise completed in

June. M&G Investments increased its stake to nearly 20% and

Aviva Investors took a near 10% stake. We are particularly grateful

to Vulpes, now our second largest shareholder, for its continued

support in providing the GBP5.0 million loan facility in 2014.

These timely funds gave us the platform to complete the Novartis

negotiations on the best possible terms.

I would also like to praise the Government for its valuable

support to the Group and to the UK biotech industry in general. I

have no doubt that the Advanced Manufacturing Supply Chain

Initiative (AMSCI) funding announced in 2013 helped to give us

credibility in Novartis' eyes, while the award of a GBP2.2 million

grant from Innovate UK (formerly the Technology Strategy Board) in

2014 will help us fund a Phase I/II clinical trial of OXB-102 in

Parkinson's disease.

It was especially pleasing to see that the strong year

operationally was matched by the performance of our share price

which is now starting to reflect the value in our business.

Gene and cell therapy

It is clear that industry and investors are increasingly excited

and encouraged by developments in the gene and cell therapy field

in general. 2014 saw a number of very successful gene and cell

therapy IPOs in the US led by Juno Therapeutics Inc., which was the

most highly valued biotech IPO of the year, raising $265m with a

market capitalisation in excess of $3bn. We also saw some major,

high-value industry collaborations in the space, including deals

announced between GSK and Adaptimmune (up to $350m) and Pfizer and

Cellectis (up to $2.8bn).

US valuations in the gene and cell therapy space, and in general

in the sector, continue to exceed those in the EU, but we believe

we can close this valuation gap by continuing to invest in our

products and IP.

Investing for growth as industry momentum builds

The growing investment and activity in gene and cell therapy

presents the Group with increasing opportunities for licensing and

partnering across our business. We are starting a programme of

investments in 2015 to substantially expand our manufacturing and

analytical capacity, primarily to ensure that we meet our

obligations under the Novartis contract. However, we will also be

looking to generate further manufacturing related contracts with

the wider industry.

As part of our planned expansion, we are in the process of

relocating our offices and laboratories to a new facility directly

opposite our manufacturing facility in Oxford, UK. In October 2014,

we acquired the freehold of Windrush Court for a cash consideration

of GBP3.2 million. The Board expects to recoup this purchase cost

within four years through savings in rental costs and service

charges once the current lease of the Medawar Centre expires in

March 2016.

Summary

Oxford BioMedica is very well placed to capitalise on the

positive change in sentiment towards gene and cell therapy. I

believe approaches in this field have the potential to become the

mainstay of currently unmet therapies in the future. We saw this

with antibody based products and I believe we will now see this

with gene and cell therapy products.

I would like to thank and congratulate our staff on their

immense achievements during the year. We hope for further successes

in 2015 as we progress our pipeline, expand our manufacturing

business, and seek further technology licensing deals. Our future

is very bright indeed.

Nick Rodgers

Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

2014 was a transformational year for Oxford BioMedica.

Negotiations with Novartis that were starting around this time last

year were successfully completed. This resulted in the October 2014

announcement of a licensing and manufacturing agreement with a

value of up to $90 million over the next three years, and with the

prospect of further royalty revenues on any future product sales.

The new contract with Novartis, together with the completion of a

successful GBP21.6m (before expenses) fundraise, puts us in a

strong financial position from which to leverage our technology

platform.

I am pleased to report that we made good progress across our

clinical development pipeline during the year, while also

initiating an exciting CART-5T4 programme which combines both of

our main technologies (LentiVector(R) and 5T4 platforms), and takes

us directly into the cell therapy space.

The Novartis deal

I am proud to say that it was our strong team performance under

the initial contract signed in May 2013 with Novartis for CTL019

that led to the signing of the expanded agreement with Novartis in

October 2014. The terms of this agreement include:

-- A non-exclusive licence granted to Novartis covering Oxford BioMedica's LentiVector(R) platform IP in oncology

-- A process development collaboration under which any arising IP is owned by Oxford BioMedica and Novartis has an

exclusive licence to such arising IP as it relates to CAR-T cell products

-- An initial three-year manufacturing contract for clinical supply for Novartis' CTL019 programme with the

potential for extension

Financial terms include:

-- $4.3m equity investment that was paid on signing the agreement

-- Consideration for the IP licence was a $9.7m non-refundable upfront payment and undisclosed royalties on CTL019

and other CAR-T products

-- Potential payments of up to $76 million over three years for manufacturing and process development

Fundraising strengthened our negotiating position with

Novartis

We were delighted to announce in June 2014 the completion of a

successful GBP21.6 million (before expenses) fundraise from

existing and new investors. Importantly, this provided us with the

time and a robust financial position from which to complete our

negotiations with Novartis and achieve the best possible terms. It

has been pleasing to see the share price appreciate progressively

following the fundraising and the Novartis announcement, which is a

sign of market confidence in our expertise and a wider realisation

that the field of gene and cell therapy now provides real treatment

options. I would also like to thank Vulpes, who were our largest

shareholder at the time, for the loan facility it agreed with us at

the start of 2014 to help facilitate the fundraising.

Pipeline advances

We made strong progress across our development pipeline during

the year:

LentiVector(R) platform

In February 2014 we announced that we had granted Sanofi a

development and commercialisation license for StarGen(TM) and

UshStat(R) , while providing for the return to us of the full

product rights for EncorStat(R) . Under the new license agreement,

we are eligible for development and commercialisation milestone

payments and royalties on any future sales of StarGen(TM) and

UshStat(R) . Sanofi are now fully responsible for the development

of these products and have taken over management of the current

clinical trials.

We announced in April 2014 the completion of patient recruitment

and dosing in the Phase I study of RetinoStat(R) . We also

announced later that month that Sanofi had decided not to exercise

the option to license RetinoStat(R) , but had confirmed that this

decision was not linked to unexpected results from the study. We

now look forward to receiving the final clinical study report in

mid-2015. We are beginning to evaluate the best way forward for

RetinoStat(R) and alternative ways of achieving this.

In January 2014, The Lancet published encouraging results from

the previously reported Phase I/II study of ProSavin(R) in patients

with advanced Parkinson's disease. These included an excellent

safety profile and a significant improvement in motor function

relative to baseline at six and 12 months. We are fast-tracking

OXB-102 as a second-generation, more potent version of ProSavin(R)

, as we believe OXB-102 could have even greater efficacy in this

indication based on dose response observations. In April 2014 we

were awarded a GBP2.2 million grant from Innovate UK (formerly the

Technology Strategy Board) to fund a Phase I/II clinical trial of

OXB-102 in Parkinson's disease patients, and we are currently

preparing for the start of this study in 2016. I am pleased to

report that our other CNS asset, MoNuDin, continues to progress

well in preclinical development.

5T4 platform

We initiated our own CAR-T programme in 2014, which leverages

both our LentiVector(R) and 5T4 technologies. While relatively

early-stage, this moves us directly into the cell therapy space.

Meanwhile, investigator-led Phase II studies of TroVax(R) in

colorectal cancer, ovarian cancer and mesothelioma remain on course

to report over the next 12-18 months.

Manufacturing operations: OXB Solutions

Our delivery on the 2013 Novartis contract was a major

determinant in the Group being awarded the expanded contract

announced in October 2014. Oxford BioMedica has the potential to

earn up to $76 million over the next three years from delivering on

manufacturing and process development targets agreed with Novartis.

We now need to invest further in our manufacturing facilities to

ensure we have the necessary capacity to achieve these targets, and

a series of investments are planned over the next 12-18 months.

New headquarters acquired

We announced in October 2014 that we had acquired the freehold

of the Windrush Court office and laboratory facilities in Oxford,

England, for a cash consideration of GBP3.2 million. This new

facility, which is opposite our existing manufacturing facility,

will enable us to consolidate all our activities in one location.

This is expected to improve operational efficiency, providing

additional capacity to accommodate our expansion and scale up,

while also delivering significant cost savings in the medium term

compared to our current premises.

Management updates

We further strengthened our management team with a number of

senior management changes during the year. Oxford BioMedica's

senior executive decision-making body is now the Senior Executive

Team, comprising the four executive directors, John Dawson, Tim

Watts, Paul Blake and Peter Nolan, together with Kyriacos

Mitrophanous and James Miskin.

Outlook

It is an exciting time to be at Oxford BioMedica, and in the

gene and cell therapy field in general. We remain focused on

driving our product pipeline forward to deliver its considerable

value, in parallel with delivering under the contract with Novartis

to offset our cash burn and help fund our wider activities. We have

four products in active clinical development and keenly anticipate

the complete results of the RetinoStat(R) Phase I study in

mid-2015. We are busy preparing both EncorStat(R) and OXB-102 for

entry into the clinic in 2016 and also continuing to evaluate new

product opportunities, such as our exciting CART-5T4 cell therapy

programme.

We are actively seeking further revenue-generating opportunities

from licensing our technology or winning further process

development and manufacturing contracts from third parties. I

anticipate that as more gene and cell therapy products enter

clinical development, there will be demand from other companies for

our manufacturing capabilities.

We will be expanding our physical capacity during 2015 and the

first half of 2016 to ensure that we can meet our deliverables

under the Novartis contract. This we believe could put us in a

position that by the end of 2016, revenues from our OXB Solutions

manufacturing business will largely offset our general business

overheads (excluding any project funding requirements). Further

licensing and royalty income beyond the Novartis contract could

allow us to fund our own product pipeline going forwards.

We are working hard across the business to ensure that 2015 is

another year of strong progress for the Group, our shareholders and

ultimately the patients we hope will benefit from our business

success.

John Dawson

Chief Executive Officer

OPERATIONAL REVIEW

2014 performance - progress against strategy

We believe that gene therapy will become a mainstay of patient

therapy in the future. Our long term goal is to become a

standalone, self-financing gene therapy medicines business with the

capabilities and capacity to take our products through to market.

We have made pleasing advances in executing our strategy over the

last 12-24 months, and in particular, taken great strides towards

delivering a balanced business model.

Delivering a balanced portfolio: Lentiviral vector ophthalmology

products

RetinoStat(R)

In April 2014, we announced the completion of the recruitment

and dosing of 21 patients in the Phase I trial. This open-label

study evaluated three dose levels, in four cohorts, to assess

safety and aspects of biological activity in the eye following a

single administration of RetinoStat(R) . We announced in November

2014 that the study had met its primary end points of safety and

tolerability based on a six-month follow up. However, the study

protocol requires the patients to be followed up for 48 weeks after

dosing, meaning that the last patient visit is scheduled for March

2015.

We have conducted interim analysis of patients' samples

available to date, as permitted under the open-label study. As

previously reported, we observed a substantial increase in both the

target gene products in the eye: endostatin and angiostatin

proteins. Encouragingly, protein expression has been sustained for

more than 12 months, the longest time-point assessed to date in the

first three cohorts, and a clear proportional dose response has

been seen.

The final study report should be available in mid-2015 and we

intend to publish the results in an appropriate forum.

We announced in April 2014 that we had regained the worldwide

rights to RetinoStat(R) after Sanofi elected not to exercise their

option to licence the product for development and

commercialisation, for reasons unrelated to the study. Once the

final results have been analysed we will evaluate the best

development pathway for the product and whether to continue the

development internally or to partner with a third party.

StarGen(TM)

StarGen(TM) is currently in a Phase I/II study as an intended

treatment for Stargardt disease. We announced in February 2014,

that Sanofi had licensed the product and taken over responsibility

for the product's continued development and commercialisation.

Management of the ongoing clinical study has been successfully

transferred to Sanofi. We manufactured a new batch of StarGen(TM)

at our own expense to enable the current Phase I/II studies to be

completed by Sanofi. A technology transfer process is underway

which will enable Sanofi to manufacture clinical trial material in

future. Under the license agreement, we are due to receive

development and commercialisation milestone payments and royalties

on any future sales of the product. Although Stargardt disease is

quite rare, the market size for StarGen(TM) is significant, at an

estimated market opportunity of around $500 million.

UshStat(R)

UshStat(R) is currently in a Phase I/II study as an intended

treatment for Usher Syndrome type 1B. We announced in February

2014, that Sanofi had licensed the product and taken over

responsibility for the product's continued development and

commercialisation. Management of the ongoing clinical study has

been successfully transferred to Sanofi and, as for StarGen(TM) ,

we were also required to manufacture a new batch of the product at

our own expense to enable the current Phase I/II studies to be

completed by Sanofi. Sanofi will manufacture the product in future

once the ongoing technology transfer process is complete. Under the

new license agreement, we are eligible to receive development and

commercialisation milestone payments, and royalties on any future

sales of the product. The market size for UshStat(R) is estimated

by Oxford BioMedica to be around $90 million globally per

annum.

EncorStat(R)

We are currently working towards the start of a Phase I/II study

for EncorStat(R) for the prevention of corneal graft rejection.

Clinical study material has been manufactured at our facility and

study design discussions have been held with the MHRA. While good

progress has generally been made in 2014, the completion of

pre-clinical work has taken longer than expected and the study is

now expected to start in 2016. The study will be partially funded

by the Innovate UK grant we announced in 2013. The potential peak

year sales for EncorStat(R) are estimated by Oxford BioMedica to be

$60-$80 million.

Glaucoma-GT: pre-clinical

In November 2013, we announced encouraging results from

pre-clinical studies conducted in conjunction with the Mayo Clinic

in the US. We have demonstrated that the product is well-tolerated,

reaches the intended target cells at the back of the eye following

transcorneal injection, and resulted in long-term gene expression

for five months, the furthest time point evaluated. A pre-clinical

study is now underway to demonstrate proof of concept by lowering

of intraocular pressure, and is likely to complete in 2016.

Delivering a balanced portfolio: Lentiviral vector CNS

products

OXB-102/ProSavin(R)

OXB-102 is a new, more potent, form of ProSavin(R) for the

treatment of Parkinson's disease. ProSavin(R) completed a Phase

I/II clinical trial in 2012, and in January 2014 the results were

published in The Lancet. It was reported that ProSavin(R)

demonstrated excellent safety and tolerability, and also showed a

statistically significant improvement in motor function at both six

and 12 months post-treatment relative to baseline. Patients

receiving the 5x dose appeared to respond the most, suggesting that

even higher doses may be more efficacious. We therefore decided in

April 2012 to evaluate OXB-102, a more potent construct of

ProSavin(R) before progressing further clinical development.

Pre-clinical efficacy studies carried out in 2013 using behavioural

and movement analysis indicate that OXB-102 is at least five times

more potent than ProSavin(R) . OXB-102 also provides the additional

benefits of extended patent protection and a reduction in cost of

goods over ProSavin(R) .

As a result, we are now moving OXB-102 into clinical studies. In

April 2014, we announced that we had been awarded a GBP2.2 million

grant from Innovate UK (formerly the Technology Strategy Board),

under the Biomedical Catalyst funding programme, to fund a Phase

I/II clinical trial of OXB-102 in Parkinson's disease. We have

manufactured the clinical trial material in our Cowley facility and

are preparing for the planned start of the study in 2016. We

believe that OXB-102 could present a major opportunity, given the

high unmet need and an anticipated 2.8 million patients forecasted

by 2021 in the USA, Japan and five largest European markets alone

(source: Datamonitor Epidemiology April 2012).

MoNuDin(R) : pre-clinical

MoNuDin(R) is a gene therapy product designed to deliver a VEGF

gene to the neuronal cells affected by motor neurone disease via

direct administration into the cerebrospinal fluid. An early

version of MoNuDin(R) has shown promising results in initial

pre-clinical studies and we are now optimising the product for

clinical trials. A pre-clinical programme involving two forms of

VEGF is underway in collaboration with VIB/University of Leuven,

and supported by funding from the UK Motor Neurone Disease

Association (MNDA).

5T4 Tumour Antigen platform

The Group has exclusive rights to intellectual property

regarding the 5T4 antigen. This unique protein (onco-foetal tumour

antigen) is expressed on the surface of tumours and appears to be

involved in the metastatic spread of cancers. It is found in

abundance on most common types of solid tumours but is present only

in very low levels in some healthy tissues, making it a potentially

valuable target for novel anti-cancer therapies.

TroVax(R)

TroVax(R) is a therapeutic cancer vaccine designed to stimulate

the immune system to destroy cancerous cells expressing the 5T4

antigen. The product comprises a 5T4 tumour associated

antigen-encoding sequence delivered by a poxvirus (MVA) vector.

One Phase I/II and two Phase II investigator-sponsored studies

are currently underway in the UK to assess the safety and

immunological activity of the product in patients with inoperable

metastatic colorectal cancer, mesothelioma and ovarian cancer. All

of these studies are using a biomarker to select patients for the

studies. To support these studies, Oxford BioMedica is contributing

clinical trial material and retains full product rights to

TroVax(R) . These studies should report towards the end of 2015 and

in 2016, providing a potential value-driver and out-licensing

opportunity should these studies demonstrate efficacy in these

biomarker-selected patients.

PF-06263507

In 2001, Oxford BioMedica licensed a 5T4-antibody to Wyeth

(acquired by Pfizer in 2009). Pfizer's product contains the 5TA

targeting antibody connected to a cytotoxic drug capable of killing

the target cancer cells. In August 2013, Pfizer paid a contractual

US$1 million milestone payment upon the start of clinical

development of the drug, and a Phase I study remains ongoing. We

have the potential to earn up to US$28 million from Pfizer in

upfront, option fees and milestone payments relating to the

development of the product.

5T4 cancer imaging agent

In 2012, ImaginAB acquired an exclusive worldwide license for

commercialisation of an in vivo 5T4-based imaging diagnostic that

was being developed in collaboration with Oxford BioMedica. Under

the terms of this license, Oxford BioMedica could receive up to

US$4 million in future development milestone payments, with an

additional royalty on potential product sales.

CART-5T4 programme

The Group is developing a product which combines both its

LentiVector(R) and 5T4 technology platforms. The product is based

on a gene modified autologous T cell which is engineered using a

lentiviral vector to express an antibody against 5T4. The T-cell is

then infused into the patient where it recognises the 5T4 tumour

antigen and triggers the "normal" T cell killing mechanisms which

kill the cancer cell. This innovative approach directly primes the

immune system against the 5T4 antigen, by presenting the antigen on

T-cells which are responsible for detecting foreign antigens. This

new product is currently in pre-clinical stage development.

Intellectual property and technology licensing

We actively manage our intellectual property estate to provide

robust protection for its products and platform technologies and to

identify and protect new inventions. Granting third parties

licenses to our IP also has the potential to be an increasingly

important revenue stream for the Group through upfront, milestone

and royalty payments. To date, we have granted LentiVector(R) and

other platform licenses to a number of third party companies.

In October 2014, we signed a non-exclusive worldwide development

and commercialisation licence in oncology under the Group's

existing LentiVector(R) platform with Novartis.

In December 2013, we signed an option agreement with

GlaxoSmithKline (GSK) that grants GSK an option to a non-exclusive

licence to our LentiVector(R) platform for six orphan

indications.

Bavarian Nordic have a license for the Group's heterologous

PrimeBoost technology patents and poxvirus patents for PROSTVAC(TM)

which is now in Phase III for advanced prostate cancer. Emergent

BioSolutions, have a license to our heterologous PrimeBoost

technology patents and poxvirus patents for the development of a

tuberculosis vaccine which is now in Phase II.

OXB solutions

We identified a gap in the industry and recognised that a lack

of gene and cell therapy manufacturing expertise in the industry

was a potential bottleneck to bringing these types of products to

market. As a result, we decided to expand our manufacturing

capability to enable the production of clinical trial material for

patient studies and the market. In 2013 we were able to secure a

mix of grant (GBP1.8 million) and loan (GBP5.3 million) funding

under the UK Government's Advanced Manufacturing Supply Chain

Initiative (AMSCI) which was of significant assistance. Expanding

our capacity and resources allows us to seek further process

development and manufacturing contracts with additional industry

partners.

This was confirmed in 2014 when we were able to announce that,

building on an initial contract in 2013, Novartis had commissioned

us for manufacture of batches of CTL019 lentiviral vector for

clinical study, and to carry out further process development work.

The Novartis requirements exceed our current capacity and even the

capacity we will have once the AMSCI project is completed in 2016.

As a result, we decided to expand our current Cowley facilities

still further by establishing a new manufacturing facility at

Yarnton, Oxford, and to move into larger laboratory and office

facilities at Windrush Court.

Management and other operational updates

To support our growing operations we made a number of senior

management changes during the year. Paul Blake was appointed Chief

Development Officer from 1 September 2014, with responsibility for

the clinical development of the Group's pipeline of gene and cell

therapies. Paul was previously a non-Executive Director and remains

a Director of the Group.

Peter Nolan's role has broadened to become Chief Business

Officer, covering Business Development, IP, Quality Control &

Assurance, Health & Safety and Facility Management. Peter

joined Oxford BioMedica in 1997 and has been a Board member since

2002.

Kyriacos Mitrophanous was promoted to Chief Scientific Officer,

covering identification/evaluation of new scientific opportunities,

cell & vector engineering, analytical development, and

pre-clinical product development. Kyriacos joined the Group in

1997.

James Miskin was promoted to Chief Technical Officer, covering

manufacturing operations and manufacturing process development,

including the capacity expansion projects. James joined the Group

in 2000.

Oxford BioMedica's senior executive decision making body is now

the Senior Executive Team, comprising the four Executive Directors,

John Dawson, Tim Watts, Paul Blake and Peter Nolan, together with

Kyriacos Mitrophanous and James Miskin.

We announced in October 2014 that we had acquired the freehold

of the Windrush Court office and laboratory facilities in Oxford,

England, for a total cash consideration of GBP3.2 million. This

6,684 sq m facility is located directly opposite our manufacturing

facility and we intend to relocate our Cowley laboratories and

office activities there in stages before the current lease of the

Medawar Centre, Oxford, expires in March 2016. We anticipate

significant operational advantages from consolidating our

activities on one site, while providing more room for expansion as

we continue to scale our operations.

CHIEF FINANCIAL OFFICER'S REVIEW

In my 2013 review I said that we had started to see the

emergence of new and profitable revenues that could potentially

develop over the next two to three years into a significant and

sustainable cash contributor, offsetting our cash burn. As

evidenced by the signing of our second agreement with Novartis -

this is now being achieved. The agreements with Novartis provide us

with the opportunity to earn significant revenues over the next

three years, potentially allowing the Group to become cash flow

positive by the end of 2016 based on our current plans.

To that end, we saw a substantial step up in manufacturing and

process development revenues in 2014, and these will recur and grow

through 2015 and beyond. After the allocation of relevant and

appropriate costs, these revenues are profitable and are starting

to offset the Group's overall cost base - thereby reducing the cash

burn from R&D expenditure whilst we advance our product

pipeline. We also benefited in 2014 from the receipt of upfront

payments from Novartis worth $9.7 million (GBP6.1 million) for a

licence to use our lentiviral vector IP.

We are now actively increasing our manufacturing capacity to

ensure we are able to meet our delivery targets. We started

expanding our cost base in 2014 with additional employees hired to

support the expansion of manufacturing activities as the Group

scales up work with Novartis. This is set to continue in 2015, and

beyond, particularly as we seek to win further manufacturing

contracts from Novartis and other third parties.

Capital expenditure also increased in 2014. The largest single

item was the GBP3.2 million acquisition of Windrush Court, our new

laboratory and office complex. As well as being operationally more

suitable for our needs, the new site will, over the long term,

reduce our cash burn as we will avoid the significant rental costs

previously incurred at the Medawar Centre. Our capital expenditure

programme will also continue over the next two years as we increase

our manufacturing capacity.

Key performance indicators

-- Profit-generating revenues* GBP7.7 million (2013: GBP2.6 million)

-- Cash used in operations GBP7.4 million (2013: GBP13.0 million)

-- Cash burn** GBP11.6 million (2013: GBP11.9 million)

-- Cash balance GBP14.2 million (GBP2.2 million at the start of the year)

-- Headcount 134 employees at year end (106 at the start of the year)

* Revenues from the provision of manufacturing and process

development services to 3(rd) parties

** Net cash used in/generated from operations plus sales and

purchases of non-current assets and interest received

Revenues (excluding grants) GBP13.6 million (2013: GBP5.4

million)

Revenues grew substantially in 2014 to GBP13.6 million from

GBP5.4 million in 2013. The three main components of revenues

were:

-- GBP7.7 million (2013: GBP2.6 million) from provision of manufacturing and process development services to third

parties. The majority of this came from Novartis for process development activities including optimisation of the

CTL019 lentiviral vector manufacturing process

-- GBP5.1 million (2013: GBP1.0 million) from licence deals. The majority (GBP4.8 million) of the 2014 licence

revenue is from the Novartis upfront payments announced in October

-- GBP0.8 million (2013: GBP1.7 million) residual revenue from the 2009 Sanofi collaboration

Building towards a sustainable revenue-generating business

Importantly, apart from short-term recognition timing

differences, all of our 2014 revenues represent current cash

generation. This differs significantly from recent years when a

very substantial part of our revenues comprised the deferred

recognition of the $26m upfront received from Sanofi in 2009, and

was therefore not current cash generation. The 2014 revenues and

the new Novartis contracts show that we are now building a

sustainable revenue-generating business.

Cost of sales GBP4.4 million (2013: GBP1.1 million)

The bulk of our cost of sales arose from Novartis-related

manufacturing activities. However, small amounts were incurred in

both years relating to royalties payable on licence payments

received from Novartis in 2014, and Pfizer in 2013. The

manufacturing-related cost of sales arose from the fully-over

headed cost of manufacturing viral vectors. This includes raw

materials, direct manufacturing labour, and indirect labour

(including facility support staff and the significant effort

required for quality control and analytical testing), as well as

facility costs and overheads.

Gross profit GBP9.2 million (2013: GBP4.2 million)

Gross profit increased by GBP5.0 million. Of this around GBP3.8

million is due to the higher licence receipts, net of upstream

royalty payments, and around GBP2.1 million from greater

manufacturing and process development activities. These were offset

by a decline in the revenues from Sanofi relating to the 2009

collaboration.

Research & development costs GBP17.0 million (2013: GBP13.8

million)

R&D costs include all costs of manufacturing and R&D

activities excluding the amounts which have been transferred to

cost of sales. Included in R&D are two one-off items:

One-off R&D costs in 2014 of GBP2.3 million

One-off R&D costs in 2014 were associated with two items 1)

the manufacture of new batches of StarGen(TM) and UshStat(R)

required to complete the ongoing Phase I/II clinical studies under

the terms of the agreement with Sanofi. Although these studies have

now been transferred to Sanofi, Oxford BioMedica was responsible

under the 2009 collaboration agreement for the supply of all the

clinical material; and 2) the manufacture of a viral vector in

respect of an unnamed pilot project which may translate to fees in

due course. In aggregate these items amounted to GBP2.3

million.

Without the one-off items in 2014, R&D costs would have been

GBP14.7 million, only 7% above 2013. This increase was partly due

to the need to build up headcount in anticipation of the new

Novartis contracts. There was also expenditure on the previously

announced manufacturing project partially funded by the grant from

the UK Government's Advanced Manufacturing Supply Chain Initiative

(AMSCI). These higher costs are offset by the grants receivable

which are disclosed separately in the financial statements.

Administration expenses GBP4.0 million (2013: GBP3.4

million)

Administration costs of GBP4.0 million were GBP0.6 million

higher than in 2013 mainly due to inflation and slightly higher

manpower costs required to provide support to our rapidly growing

business.

Grants receivable GBP1.1 million (2013: GBP0.1 million)

The increase in grants receivable during 2014 was from the

Advanced Manufacturing Supply Chain Initiative and the Innovate UK

(formerly Technology Strategy Board) grant for EncorStat(R) , both

of which were announced in 2013 but for which the activities

started in 2014.

Loss for the year GBP10.6 million (2013: GBP12.8 million)

The operating loss for the year of GBP10.6 million was GBP2.2

million lower than in 2013. This is explained by the GBP5.0 million

increase in gross profit offset by GBP2.8 million of higher costs,

net of the grants received which offset AMSCI and EncorStat(R)

project costs. If the one-off R&D costs described above were to

be excluded, the loss for the year would have been reduced to

GBP8.3 million.

Finance costs of GBP0.2 million arose primarily from the loan

facility provided by Vulpes Life Sciences Partners in the first

half of 2014. The tax credit at GBP2.1 million is GBP0.5 million

greater than in 2013 due to an increase in the tax credit

percentages which took effect in 2014. The overall after-tax loss

for the year was GBP8.7 million, being GBP2.4 million lower than in

2013.

Balance sheet

-- Property, plant and equipment have increased by GBP4.9 million in 2014, with GBP5.6 million of additions reduced

by GBP0.7 million depreciation. The main additions were the acquisition of Windrush Court, our new office and

laboratory facility in Oxford, which cost GBP3.5 million (GBP3.2 million plus stamp duty and acquisition costs),

GBP1.1 million for the purchase of manufacturing and laboratory equipment, with the bulk of the remainder

comprising expenditure on manufacturing capacity expansion

-- Inventory has increased to GBP1.4 million (2013: GBP0.7 million) as we have built up raw materials to meet the

manufacturing volumes required under the Novartis contract

-- Trade and other receivables at GBP5.2 million are GBP2.6 million greater than 2013, primarily due to Novartis

receivables being higher

-- Cash and cash equivalents are GBP14.2 million, GBP12.0 million above the balance at the end of 2013. The increase

is explained in the cash flow section below

-- Trade and other payables of GBP6.3 million are higher than 2013 (GBP2.9 million), due to a combination of

different timing of payments to suppliers over the year end, accruals for fixed asset purchases, and higher

bonuses in 2014

-- The GBP1.0 million loan is the first drawdown of the GBP5.3 million AMSCI loan facility which was announced in

2013. This loan is being used to finance the capacity expansion programme originally envisaged in early 2013.

However, this programme has now been significantly expanded as a result of the need to meet Novartis' production

needs. Therefore, our total capital expenditure over the next two years will be substantially greater than the

loan facility

-- Deferred income of GBP2.9 million principally arises because, under the manufacturing payment terms agreed with

Novartis, a portion of the price of each batch is invoiced on confirmation of order, and at the start of the

manufacturing process. At the end of the financial year, to the extent that a batch remains as work-in-progress,

a proportion of these invoices have not yet been recognised as revenue

Cash flow

Cash used in operations in 2014 was GBP7.4 million, compared

with GBP13.0 million in 2013. The operating loss was GBP10.6

million (2013: GBP12.8 million) but the cash impact of this was

reduced by GBP1.5 million of non-cash items (depreciation,

amortisation, impairment and share option charges) (2013: GBP1.4

million) and also benefited by a GBP1.7 million favourable movement

in working capital (2013: GBP1.6 million adverse movement).

The R&D tax credit receipt added GBP1.6 million to cash used

(2013: GBP2.0 million), while interest paid of GBP0.2 million

(2013: GBPnil) and, importantly, capital expenditure of GBP5.6

million (2013: GBP0.8 million) increased the cash burn to GBP11.6

million (2013: GBP11.9 million).

Headcount

The increase in headcount during 2014 is explained by the need

to fully staff the manufacturing operations to support the Novartis

contract including manufacturing, quality control and analytical

staff.

Financial outlook

Our key financial objectives for 2015 require that we deliver

the targets under the Novartis contracts - the fulfilment of which

requires recruitment of more staff and significant capital

expenditure on manufacturing capacity.

The Novartis contracts will generate further significant

manufacturing and process development revenues in 2015 and 2016

which will lead to the further reduction of our underlying

operational cash burn, at the same time as we continue to advance

our exciting pipeline in gene and cell therapy. We will also be

seeking similar contracts with other third parties. In conclusion,

Oxford BioMedica's business has been transformed, and is en-route

to becoming potentially cash positive by end 2016.

Going concern

The Group had GBP14.2m of cash at the end of 2014 and is now

generating profitable revenues from its manufacturing activities.

However, it will incur substantial capital expenditure over the

next 15 months as it expands manufacturing and analytical testing

capacity to enable it to meet the volumes expected under the

Novartis contracts. In the absence of any further upfront receipts

from potential product or IP licence deals, the Directors estimate

that the cash held by the Group including known cash inflows will

be sufficient to support the current level of activities into the

first quarter of 2016. Known cash inflows include a proportion of

the contractual milestone payments from Novartis which are based on

process development progress continuing at its current rate.

The Directors have also considered the range of potential

sources of cash to the Group and expect to be able to secure

adequate resources should they be required. Whilst the Directors

have confidence that such resources could be obtained, no such

additional resources are committed at the date of these financial

statements. In the absence of securing such funds or other sources

of cash, the Group would choose to curtail or suspend part of its

capital expenditure programme until such funds were secured.

After due consideration, the Directors are of the view that the

Group will have access to adequate resources to allow the Group to

continue for the foreseeable future and have therefore prepared the

financial statements on a going concern basis.

Tim Watts

Chief Financial Officer

-Ends-

Consolidated statement of comprehensive income

for the year ended 31 December 2014

Group

2014 2013

-------- --------

Continuing operations Total Total

Notes GBP'000 GBP'000

--------------------------- ----- -------- --------

Revenue 13,618 5,375

Cost of sales (4,416) (1,140)

--------------------------- ----- -------- --------

Gross profit 9,202 4,235

--------------------------- ----- -------- --------

Research and development

costs (16,986) (13,750)

Administrative expenses (3,957) (3,422)

Other operating income:

grants receivable 1,128 114

--------------------------- ----- -------- --------

Operating loss (10,613) (12,823)

--------------------------- ----- -------- --------

Finance income 53 64

Finance costs (238) (4)

----- -------- --------

Loss before tax (10,798) (12,763)

Taxation 3 2,137 1,667

--------------------------- ----- -------- --------

Loss for the year (8,661) (11,096)

Basic loss and diluted

loss per ordinary share 4 (0.43p) (0.79p)

--------------------------- ----- -------- --------

The notes on pages 18 to 24 form part of this preliminary

information.

Balance sheet

as at 31 December 2014

Group

2014 2013

Notes GBP'000 GBP'000

---------------------------- ----- --------- ---------

Assets

Non-current assets

Intangible assets 5 2,106 2,633

Property, plant and

equipment 6 8,944 4,070

11,050 6,703

---------------------------- ----- --------- ---------

Current assets

Inventories 7 1,407 680

Trade and other receivables 8 5,153 2,592

Current tax assets 2,000 1,500

Cash and cash equivalents 14,195 2,169

---------------------------- ----- --------- ---------

22,755 6,941

---------------------------- ----- --------- ---------

Current liabilities

Trade and other payables 9 6,304 2,934

Deferred income 10 2,927 1,280

---------------------------- ----- --------- ---------

9,231 4,214

---------------------------- ----- --------- ---------

Net current assets 13,524 2,727

---------------------------- ----- --------- ---------

Non-current liabilities

---------------------------- ----- --------- ---------

Loans 11 1,000 -

Provisions 12 535 532

---------------------------- ----- --------- ---------

1,535 532

---------------------------- ----- --------- ---------

Net assets 23,039 8,898

---------------------------- ----- --------- ---------

Equity attributable

to owners of the parent

Ordinary shares 25,659 14,162

Share premium account 141,615 130,304

Merger reserve 2,291 14,310

Treasury reserve (226) -

Other reserves (682) (682)

Accumulated losses (145,618) (149,196)

---------------------------- ----- --------- ---------

Total equity 23,039 8,898

---------------------------- ----- --------- ---------

The notes on pages 18 to 24 form part of this preliminary

information.

Statement of cash flows

for the year ended 31 December 2014

Group

2014 2013

Notes GBP'000 GBP'000

------------------------------------------------------- ----- ------- --------

Cash flows from operating activities

Cash used in operations 13 (7,431) (13,005)

Interest paid (238) (4)

Tax credit received 1,637 1,990

Net cash used in operating activities (6,032) (11,019)

------------------------------------------------------- ----- ------- --------

Cash flows from investing activities

Purchases of property, plant and equipment (5,577) (839)

Purchases of intangible assets - (98)

Net maturity of available for sale investments - 5,105

Interest received 53 64

Net cash (used in)/generated from investing activities (5,524) 4,232

------------------------------------------------------- ----- ------- --------

Cash flows from financing activities

Proceeds from issue of ordinary share capital 24,268 -

Costs of share issues (1,460) -

Net payments related to share award (226) -

Loans received 1,000 -

------------------------------------------------------- ----- ------- --------

Net cash generated from financing activities 23,582 -

------------------------------------------------------- ----- ------- --------

Net increase/(decrease) in cash and cash equivalents 12,026 (6,787)

Cash and cash equivalents at 1 January 2,169 8,956

Cash and cash equivalents at 31 December 14,195 2,169

------------------------------------------------------- ----- ------- --------

The notes on pages 18 to 24 form part of this preliminary

information.

Statement of changes in equity attributable to owners of the

parent company

for the year ended 31 December 2014

Share

Ordinary premium Merger Treasury Other Accumulated

shares account reserve reserve reserves losses Total equity

Group Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------ -------- -------- -------- -------- --------- ----------- ------------

At 1 January

2013 14,162 130,304 14,310 - (682) (138,451) 19,643

Year ended 31

December 2013:

-------------------- ------ -------- -------- -------- -------- --------- ----------- ------------

Loss for the

year - - - - - (11,096) (11,096)

---------------------------- -------- -------- -------- -------- --------- ----------- ------------

Total comprehensive

expense for

the year - - - - - (11,096) (11,096)

Transactions

with owners:

Share options

Value of employee

services - - - - - 351 351

At 31 December

2013 14,162 130,304 14,310 - (682) (149,196) 8,898

Year ended 31

December 2014:

-------------------- ------ -------- -------- -------- -------- --------- ----------- ------------

Loss for the

year - - - - - (8,661) (8,661)

---------------------------- -------- -------- -------- -------- --------- ----------- ------------

Total comprehensive

expense for

the year - - - - - (8,661) (8,661)

Transactions

with owners:

Share options

Value of employee

services - - - - - 220 220

Issue of shares

excluding options 11,497 12,771 - - - - 24,268

Costs of share

issues - (1,460) - - - - (1,460)

Realisation

of merger reserve - - (12,019) - - 12,019 -

Deferred Share

Award - - - (226) - - (226)

At 31 December

2014 25,659 141,615 2,291 (226) (682) (145,618) 23,039

---------------------------- -------- -------- -------- -------- --------- ----------- ------------

The notes on pages 18 to 24 form part of this preliminary

information.

NOTES TO THE PRELIMINARY FINANCIAL INFORMATION

for the year ended 31 December 2014

1 Basis of preparation

This financial information, for the years ended 31 December 2014

and 31 December 2013, does not constitute the statutory financial

statements for the respective years, and is an extract from the

financial statements. It is based on, and is consistent with, that

in the Group's statutory accounts for the year ended 31 December

2014 and those financial statements will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting. Financial statements for the year ended 31 December 2013

have been delivered to the Registrar of Companies. The auditors'

reports on the financial statements for the years ended 31 December

2014 and 31 December 2013 were unqualified and did not contain

statements under section 498 of the Companies Act 2006. The

financial information in this report does not constitute a

statutory financial statement within the meaning of sections

434-436 of the Companies Act 2006.

The financial statements have been prepared in accordance with

IFRIC interpretations, as applicable to companies using

International Financial Reporting Standards ('IFRS') as adopted by

the European Union and with the Companies Act 2006 under the

historic cost convention. Whilst the financial information included

in this preliminary announcement has been prepared in accordance

with IFRSs adopted for use in the European Union, this announcement

does not itself contain sufficient information to comply with

IFRSs.

Copies of this announcement and the Annual report for 2014 are

available from the Company Secretary, and are on the Group's

website. The audited statutory financial statements for the year

ended 31 December 2014 are expected to be distributed to

shareholders by 30 April 2015 and will be available at the

registered office of the Company, Windrush Court, Transport Way,

Oxford, OX4 6LT. Details can also be found on the Group's website

at: www.oxfordbiomedica.co.uk.

This announcement was approved by the Board of Oxford BioMedica

plc on 12 March 2015.

Going concern

The Group had GBP14.2m of cash at the end of 2014 and is now

generating profitable revenues from its manufacturing activities.

However, it will incur substantial capital expenditure over the

next 15 months as it expands manufacturing and analytical testing

capacity to enable it to meet the volumes expected under the

Novartis contracts. In the absence of any further upfront receipts

from potential product or IP licence deals, the Directors estimate

that the cash held by the Group including known cash inflows will

be sufficient to support the current level of activities into the

first quarter of 2016. Known cash inflows include a proportion of

the contractual milestone payments from Novartis which are based on

process development progress continuing at its current rate.

The Directors have also considered the range of potential

sources of cash to the Group and expect to be able to secure

adequate resources should they be required. Whilst the Directors

have confidence that such resources could be obtained, no such

additional resources are committed at the date of these financial

statements. In the absence of securing such funds or other sources

of cash, the Group would choose to curtail or suspend part of its

capital expenditure programme until such funds were secured.

After due consideration, the Directors are of the view that the

Group will have access to adequate resources to allow the Group to

continue for the foreseeable future and have therefore prepared the

financial statements on a going concern basis.

Critical accounting judgements and estimates

In applying the Group's accounting policies, management is

required to make judgements and assumptions concerning the future

in a number of areas. Actual results may be different from those

estimated using these judgements and assumptions. The key sources

of estimation uncertainty and critical accounting judgements that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below.

Revenue recognition

In October 2014, the Group entered into a series of contractual

arrangements with Novartis, including a licence over the Group's

existing Lentivector platform, a manufacturing and clinical supply

agreement and an agreement covering process development. Total

amounts of up to $90m, plus further potential royalties, are

receivable under these arrangements. These amounts include $4.3m of

shares subscribed for by Novartis on completion of the

arrangements.

Under these arrangements, the Group received $9.7m (GBP6.1m) in

upfront payments of which $7.7m (GBP4.8m) was received in respect

of the non-exclusive worldwide development and commercialisation

licence in oncology under the Group's existing Lentivector

intellectual property platform.

Management has judged that this amount should be recognised as a

separate deliverable in 2014, discrete from amounts to be

recognised over the period of the 3-year manufacturing contract.

This judgement is based on management being satisfied that the

customer is able and intends to realise value from this licence

independently from any further intellectual property generated in

the collaboration, and that its fair value is sufficiently

reliable. In reaching this judgement management had regard to

several considerations including:

- The existing intellectual property covered by the licence is

sufficient to allow CTL019 to be manufactured for commercial use,

and any intellectual property that might arise from the process

development under the contract is not a pre-requisite for its

commercial manufacture,

- The licence allows Novartis to use the existing intellectual

property for other oncology products apart from CTL019,

- The other elements of the arrangements have an appropriate

price and fair value (the residual elements)

- The $7.7m rate is comparable with similar transactions with

third parties that the Group has previously contracted, taking into

account the stage of development and the market potential of the

product.

This judgement reflects both the separability of the licence for

the existing intellectual property and the assessment of the fair

values of each of the components of the Novartis agreements.

Intangible asset impairment

The Group has significant intangible assets arising from

purchases of intellectual property rights and in-process R&D.

Amortisation is charged over the assets' patent life on a straight

line basis from the date that the asset becomes available for use.

When there is an indicator of a significant and permanent reduction

in the value of intangible assets, an impairment review is carried

out. The impairment analysis is principally based on estimated

discounted future cash flows. Actual outcomes could vary

significantly from such estimates of discounted future cash flows

due to the sensitivity of the assessment to the assumptions used.

The determination of the assumptions is subjective and requires the

exercise of considerable judgement. Any changes in key assumptions

about the Group's business and prospects, or changes in market

conditions affecting the Group, or its development partners, could

materially affect whether an impairment exists. This risk is now

concentrated on purchased patent rights which have been sublicensed

to collaborative partners. At 31 December 2014 the book value of

intangible assets was GBP2.1 million of which GBP1.5 million

related to PrimeBoost technology.

Going concern

Management and the Directors have had to make estimates and

important judgements when assessing the going concern status of the

Group. Going concern is as stated in several places in this report

including in note 1 (page 18) and the Financial review (page

10).

2 Segmental analysis

The chief operating decision-maker has been identified as the

Senior Executive Team (SET), comprising the Executive Directors,

Kyriacos Mitrophanous and James Miskin. The SET considers that the

business comprises a single activity, which is biotechnology

research and development, and the related manufacturing. The SET

reviews the Group's financial performance on a whole-company,

consolidated basis in order to assess performance and allocate

resources. Therefore the segment financial information is the same

as that set out in the consolidated statement of comprehensive

income, the consolidated balance sheet, the consolidated statement

of cash flows and the consolidated statement of changes in

equity.

3 Taxation

The Group is entitled to claim tax credits in the United Kingdom

for certain research and development expenditure. The amount

included in the statement of comprehensive income for the year

ended 31 December 2014 comprises the credit receivable by the Group

for the year, less overseas tax paid in the year. The United

Kingdom corporation tax research and development credit is paid in

arrears once tax returns have been filed and agreed. The tax credit

recognised in the financial statements, but not yet received, is

included in current tax assets in the balance sheet. The amounts

for 2014 have not yet been agreed with the relevant tax

authorities.

Group

2014 2013

GBP'000 GBP'000

---------------------------------------------------------------- -------- --------

Current tax

United Kingdom corporation tax research and development credit (2,000) (1,500)

Overseas taxation (51) (3)

---------------------------------------------------------------- -------- --------

(2,051) (1,503)

Adjustments in respect of prior periods

United Kingdom corporation tax research and development credit (86) (142)

Overseas taxation - (22)

---------------------------------------------------------------- -------- --------

Taxation credit (2,137) (1,667)

---------------------------------------------------------------- -------- --------

4 Basic loss and diluted loss per ordinary share

The basic loss per share has been calculated by dividing the

loss for the year by the weighted average number of shares in issue

during the year ended 31 December 2014 (2,019,291,808; 2013:

1,416,149,005). As the Group is loss-making, there were no

potentially dilutive options in either year. There is therefore no

difference between the basic loss per ordinary share and the

diluted loss per ordinary share.

5 Intangible assets

Intellectual

property

rights

Group GBP'000

--------------------------------- ------------

Cost

At 1 January 2014 5,591

Additions -

At 31 December 2014 5,591

----------------------------------- ------------

Accumulated amortisation

and impairment

At 1 January 2014 2,958

Amortisation charge for

the year 396

Impairment charge for the

year 131

----------------------------------- ------------

At 31 December 2014 3,485

----------------------------------- ------------

Net book amount at 31 December

2014 2,106

----------------------------------- ------------

Cost

At 1 January 2013 5,493

Additions 98

At 31 December 2013 5,591

----------------------------------- ------------

Accumulated amortisation

and impairment

At 1 January 2013 2,562

Amortisation charge for

the year 396

At 31 December 2013 2,958

----------------------------------- ------------

Net book amount at 31 December

2013 2,633

----------------------------------- ------------

For intangible assets regarded as having a finite useful life,

amortisation commences when products underpinned by the

intellectual property rights become available for use. Amortisation

is calculated on a straight line basis over the remaining patent

life of the asset. Amortisation of GBP396,000 (2013: GBP396,000) is

included in 'Research and development costs' in the statement of

comprehensive income.

An intangible asset is regarded as having an indefinite useful

life when, based on an analysis of all of the relevant factors,

there is no foreseeable limit to the period over which the asset is

expected to generate net cash inflows for the entity. There are

currently no assets with indefinite useful lives.

Following the cancellation of the Fire and Mello RNai licenses

the related intangible asset was fully impaired resulting in an

impairment charge of GBP131,000.

6 Property, plant and equipment

Short Office Manufacturing

Freehold leasehold equipment & Laboratory

property improvements & computers equipment Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- ------------- ------------ ------------- -------

Cost

At 1 January 2014 3,225 2,623 621 4,265 10,734

Additions at cost 4,142 166 199 1,070 5,577

At 31 December

2014 7,367 2,789 820 5,335 16,311

------------------------- --------- ------------- ------------ ------------- -------

Accumulated depreciation

At 1 January 2014 476 2,515 543 3,130 6,664

Charge for the

year 222 64 52 365 703

At 31 December

2014 698 2,579 595 3,495 7,367

------------------------- --------- ------------- ------------ ------------- -------

Net book amount

at 31 December

2014 6,669 210 225 1,840 8,944

------------------------- --------- ------------- ------------ ------------- -------

Short Office Manufacturing

Freehold leasehold equipment & Laboratory

property improvements & computers equipment Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ---------------- --------------------- ------------ ------------- -------

Cost

At 1 January 2013 3,130 2,604 591 3,570 9,895

Additions at cost 95 19 30 695 839

At 31 December 2013 3,225 2,623 621 4,265 10,734

-------------------------- ---------------- --------------------- ------------ ------------- -------

Accumulated depreciation

At 1 January 2013 258 2,449 467 2,819 5,993

Charge for the year 218 66 76 311 671

At 31 December 2013 476 2,515 543 3,130 6,664

-------------------------- ---------------- --------------------- ------------ ------------- -------

Net book amount at 31

December 2013 2,749 108 78 1,135 4,070

-------------------------- ---------------- --------------------- ------------ ------------- -------

On 13 October 2014, the Group announced that it had acquired the

freehold of the Windrush Court office and laboratory facilities for

a cash consideration of GBP3.2 million. This, together with stamp

duty and other related legal costs constitutes a significant part

of the Freehold property additions for 2014.

7 Inventories

Group

2014 2013

GBP'000 GBP'000

----------------- ------- -----------------

Raw Materials 1,214 558

Work in progress 193 122

Total inventory 1,407 680

----------------- ------- -----------------

Inventories constitute raw materials held for commercial

manufacturing purposes, and work-in-progress inventory related to

contractual manufacturing obligations.

8 Trade and other receivables

Group

2014 2013

GBP'000 GBP'000

---------------------------------- ------- --------

Current

Trade receivables 3,621 1,040

Accrued income 340 637

Other receivables 16 28

Other tax receivable 397 285

Prepayments 779 602

Total trade and other receivables 5,153 2,592

--------------------------------------- ------- --------

The fair value of trade and other receivables are the current

book values.

Included in the Group's trade receivable balance are debtors

with a carrying amount of GBP66,000 (2013: GBP142,000) which are

past due at the reporting date. The Group does not hold any

collateral over these balances. No provision for impairment of

receivables has been recognised as the Directors do not believe

there has been a significant change in credit quality and consider

the remaining amounts to be recoverable in full.

9 Trade and other payables

2014 2013

GBP'000 GBP'000

----------------------------------- ------- -------

Trade payables 2,787 1,218

Other taxation and social security 270 201

Accruals 3,247 1,515

Total trade and other payables 6,304 2,934

------------------------------------- ------- -------

10 Deferred income

2014 2013

Group GBP'000 GBP'000

---------------------- ---------- --------

Current 2,927 1,280

Total deferred income 2,927 1,280

---------------------- ---------- --------

Deferred income arises from contractual agreements with

customers.

11 Loans

During April 2014 the Group drew down a tranche of GBP1.0

million of the GBP5.3 million facility made available under the UK

Government's Advanced Manufacturing Supply Chain Initiative. The

loan carries interest at 6% per annum and is repayable in equal

quarterly instalments between 30 June 2016 and 31 March 2017.

12 Provisions

Dilapidations

Group GBP'000

--------------------------------------------------------------------------------- -------------

At 1 January 2014 532

Unwinding of discount 3

At 31 December 2014 535

----------------------------------------------------------------------------------- -------------

At 1 January 2013 510

Unwinding of discount 4

Change of discount rate - adjustment to recognised property, plant and equipment 18

At 31 December 2013 532

----------------------------------------------------------------------------------- -------------

The dilapidations provision relates to anticipated costs of

restoring the leasehold property in Oxford, UK to its original

condition at the end of the present leases in 2016, discounted

using the rate per the Bank of England nominal yield curve. The

equivalent rate was used in 2014. The provision will be utilised at

the end of the leases if they are not renewed.

13 Cash flows from operating activities

Reconciliation of loss before tax to net cash used in