TIDMOXB

RNS Number : 2197X

Oxford Biomedica PLC

27 August 2015

OXFORD BIOMEDICA PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2015

Oxford, UK - 27 August 2015: Oxford BioMedica plc (LSE: OXB),

("OXB" or "the Group") a leading gene and cell therapy group, today

announces interim results for the six months ended 30 June

2015.

HIGHLIGHTS

STRATEGY:

-- Good progress continued in executing the Group's strategy of

being a world-leading independent gene and cell therapy

business:

- Innovative portfolio of gene and cell therapy product candidates

- Partner of choice for lentiviral vector process development, manufacture and IP

- Revenue from manufacturing and process development helping to offset cash burn

OPERATIONAL:

-- Developments made across wholly-owned lentiviral vector pipeline:

- Encouraging results from RetinoStat(R) Phase I study in wet AMD

- Promising three year follow-up data from ProSavin(R) Phase

I/II study. Phase I/II clinical trial utilising OXB-102, a more

potent version, on schedule to begin in 2016

- EncorStat(R) being prepared for Phase I/II study at Moorfields Eye Hospital, London

- Exciting CAR-T 5T4 research programme, combining

LentiVector(R) and 5T4 technology, progressing well

-- Novartis contract delivery on track:

- Multiple CTL019 lentiviral vector batches manufactured for

Novartis during first half of the year

- Novartis-led global CTL019 trial ongoing, using OXB-manufactured vector

- Process development activities well underway and on target

-- Manufacturing capacity expansion:

- Harrow House first phase expansion due to complete by end of the year

- New Yarnton facility on track and nearing completion

- Windrush Court North Wing refurbishment is on track with new

laboratory construction programme in progress

-- Bolstered Board:

- Daniel Soland appointed Non-Executive Director of the Board

FINANCIAL:

-- Revenue of GBP4.4 million (H1 2014: GBP4.7 million) due in large part to Novartis contract

-- Other operating income of GBP1.4 million (H1 2014: GBP0.4 million)

-- Research & Development costs of GBP9.2 million (H1 2014: GBP6.9 million)

-- Net loss of GBP6.1 million (H1 2014: GBP4.8 million)

-- Capital expenditure GBP4.6 million (H1 2014: GBP0.1 million)

-- Cash of GBP15.1 million (31 December 2014: GBP14.2 million)

-- $50 million (GBP32.6 million) loan facility secured to

finance capacity expansion, pipeline advancements and product

acquisitions

John Dawson, Chief Executive Officer of Oxford BioMedica, said:

"I am very pleased by the progress we have made over the past six

months. We have seen encouraging data from both the RetinoStat(R)

Phase I study and the long-term follow-up of ProSavin(R) patients

which give us further confidence that our lentiviral vector

platform can deliver meaningful and sustained long-term benefit to

patients. We have also made a good start in delivering the Novartis

contract and the Group's sector-leading expertise in integrated

gene and cell therapy is clearly in demand. We are well placed to

benefit from additional manufacturing contracts and from the

opportunities our business model now presents us."

-Ends-

An analyst briefing will be held at 09:30am BST on Thursday, 27

August 2015 at the offices of Consilium Strategic Communications,

41 Lothbury, London, EC2V 8AE. There will be a simultaneous live

conference call and the presentation will be available on the

Group's website at www.oxfordbiomedica.co.uk.

Please visit the website approximately five minutes before the

conference call, at 09:25 am BST, to download the presentation

slides. Conference call details:

Participant dial-in: +44 (0) 1452 555566

Conference ID: 17279692

An audio replay file will be made available by the end of the

day via the Group's website on the "Media/Download centre/Webcasts

and audio" section. Alternatively, you may listen to the replay by

dialling the following number:

Dial-in for replay (available until 24-09-2015): +44

(0)1452550000

Conference ID: 17279692

For further information, please contact:

Oxford BioMedica plc: Tel: +44 (0)1865

John Dawson, Chief Executive Officer 783 000

Tim Watts, Chief Financial Officer

Media/Financial Enquiries: Tel: +44 (0)20

Mary-Jane Elliott/Matthew Neal/Chris Welsh/Laura 3709 5700

Thornton OxfordBioMedica@Consilium-comms.com

Consilium Strategic Communications

Disclaimer

This press release contains "forward-looking statements",

including statements about the discovery, development and

commercialisation of products. Various risks may cause Oxford

BioMedica's actual results to differ materially from those

expressed or implied by the forward-looking statements, including

adverse results in clinical development programmes; failure to

obtain patent protection for inventions; commercial limitations

imposed by patents owned or controlled by third parties; dependence

upon strategic alliance partners to develop and commercialise

products and services; difficulties or delays in obtaining

regulatory approvals and services resulting from development

efforts; the requirement for substantial funding to conduct

research and development and to expand commercialisation

activities; and product initiatives by competitors. As a result of

these factors, prospective investors are cautioned not to rely on

any forward-looking statements. Oxford BioMedica disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Notes to editors

About Oxford BioMedica

Oxford BioMedica plc (LSE: OXB) is a leading gene and cell

therapy group with an unrivalled portfolio of gene therapy products

in development and a platform of exclusive and pioneering

technologies with which it designs, develops and manufactures

unique gene-based medicines for some of world's largest

pharmaceutical companies. Leveraging its proprietary lentiviral

vector IP and gene delivery system technology platform and unique

tumour antigen (5T4), Oxford BioMedica is advancing its proprietary

pipeline of gene therapy products addressing diseases for which

there are currently no treatments or that are inadequately treated

today, including ocular, oncology and central nervous system

disorders. OXB Solutions, the Group's industry-leading

manufacturing and development business, provides services to

collaborators and partners working in gene and cell therapy,

including Novartis and Immune Design. In addition, the Group has

licenced products and IP to Sanofi, Pfizer, MolMed, Sigma-Aldrich,

Biogen, Emergent BioSolutions and ImaginAb. Further information is

available at www.oxfordbiomedica.co.uk and

www.oxbsolutions.co.uk.

Overview

During the first six months of 2015 Oxford BioMedica continued

to make good progress in executing the Group's strategy of building

a world-leading independent gene and cell therapy business with

high value innovation. The Group has unsurpassed expertise in

lentiviral vectors and, as well as advancing its wholly-owned

pipeline, has become the partner of choice for process development,

manufacture and IP.

Oxford BioMedica's innovative proprietary pipeline has

progressed well during the period with encouraging data generated

from RetinoStat(R) and ProSavin(R) clinical studies and the

progression of pre-clinical candidates EncorStat(R) and OXB-102

towards the start of Phase I/II clinical studies in 2016.

Lentiviral vectors have several advantages over other vector

delivery systems and Oxford BioMedica's dominant position in this

arena spans both in vivo and ex vivo therapies including its own

high value portfolio and those of other world-class pharmaceutical

companies.

The Group's existing manufacturing facility (Harrow House) has,

for the first time, operated at full capacity over a six month

period with the revenue generated helping to offset cash burn. The

Group has started a programme of capacity expansion which, in

addition to allowing the Group to meet its commitments to Novartis

and internal Oxford BioMedica needs, will also enable the Group to

offer services and expertise to new collaborators and partners.

Operational review

PRODUCT DEVELOPMENT

Proprietary pipeline of wholly-owned clinical and near-clinical

stage programmes.

RetinoStat(R)

The results of the RetinoStat(R) Phase I study, a product

candidate which uses the Group's lentiviral vector technology, were

announced in May 2015. The study, which was conducted with patients

suffering from severe late-stage wet age-related macular

degeneration (Wet AMD), met the primary endpoints of safety and

tolerability. Patients also showed signs of clinical benefit with

visual acuity stabilisation and a reduction in vascular leakage

consistent with the mechanism of action of endostatin and

angiostatin. The data from the Phase I study will be published in a

peer-reviewed journal and the Group is currently evaluating the

optimal development pathway for this candidate.

EncorStat(R)

The Group is working towards the start of a Phase I/II study for

EncorStat(R) for the prevention of corneal graft rejection. The

clinical Phase I/II study, partially funded by a GBP1.8 million

Innovate UK grant, will be conducted at Moorfields Eye Hospital and

is expected to start in the second half of 2016.

OXB-102 / ProSavin(R)

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 02:02 ET (06:02 GMT)

In May 2015, Professor Stéphane Palfi MD, PhD presented at the

American Association of Neurological Surgeons (AANS) conference the

results of the long term (three year) follow up of the fifteen

Parkinson's disease patients in the Phase I/II study of ProSavin(R)

. A significant improvement in mean unified Parkinson's disease

rating scale (UPDRS) part III motor scores in the off medication

compared to baseline in all patients had been observed at six and

twelve months. The follow up to date has shown that this

improvement has been sustained in the majority of patients for up

to three years in this progressively degenerative disease.

The data supports the continued development of OXB-102, an

enhanced construct of ProSavin(R) , which pre-clinical studies have

shown to be five to ten times more potent than ProSavin(R) .

Clinical trial material has been manufactured and the clinical

Phase I/II study is planned to start in 2016, partially funded by a

GBP2.2 million grant from Innovate UK.

Trovax(R)

One Phase I/II and two Phase II investigator-sponsored studies

to assess the safety and immunological activity of Trovax(R) in

patients with inoperable metastatic colorectal cancer, mesothelioma

and ovarian cancer, are ongoing with a biomarker being used to

select patients. Encouraging interim data from the colorectal

cancer study was presented at The Cancer Vaccine Institute's Second

International Symposium on Immunotherapy in May 2015. This study

and the mesothelioma study are both expected to report towards the

end of 2015 and in 2016. In addition, a Phase I study investigating

Trovax(R) in early-stage prostate cancer patients has recently

opened (sponsored by the University of Oxford and funded from the

European Union Seventh Framework Programme (FP7/2007-2013) under

grant agreement no 602705).

Research/pre-clinical stage programmes

Glaucoma-GT

The glaucoma pre-clinical development with the Mayo Clinic to

demonstrate proof of concept by lowering of intraocular pressure is

likely to complete in 2016.

MoNuDin(R)

MoNuDin(R) continues to progress well in pre-clinical

development with results expected by the end of 2016.

CAR-T 5T4

The Group is researching a potential product which combines both

its lentiviral vector and 5T4 technology platforms. The product is

based on a gene modified autologous T cell which is engineered

using a lentiviral vector to express an antibody against 5T4. The

T-cell would then be infused into the patient where it would

recognise the 5T4 tumour antigen and trigger the normal T cell

killing mechanisms which destroy the cancer cell. This new product

concept is currently in research and is expected to complete this

stage during 2016.

Partnered programmes

SAR 422459 and SAR 421869

Sanofi licensed SAR 422459 and SAR 421869 from Oxford BioMedica

in 2014 for the treatment of orphan ophthalmology diseases

Stargardt disease and Usher syndrome respectively. Sanofi is now

fully responsible for the development of these products and has

taken over management of the current Phase I/II clinical trials.

The Group is eligible to receive development and commercialisation

milestone payments and royalties on any future sales.

Anti-5T4 antibody licence

Due to a reassessment of its portfolio prioritisation Pfizer has

recently terminated recruitment to their Phase I study

(PF-06263507) incorporating an anti-5T4 antibody licensed from

Oxford BioMedica. This decision is not related to data emerging

from the current study nor to any safety concerns and the existing

5T4 license agreement with Pfizer remains unaffected.

PROCESS DEVELOPMENT AND MANUFACTURING

Throughout the first six months of 2015 Oxford BioMedica's

existing manufacturing facility operated at full capacity, apart

from brief periods for routine and planned maintenance and

cleaning. The Group has manufactured a batch of OXB-102, for the

Phase I/II Parkinson's disease study planned to start in 2016, and

also several batches of CTL019 for Novartis. CTL019 is Novartis's

investigational chimeric antigen receptor (CAR) T cell therapy for

the treatment of paediatric and adult patients with

relapsed/refractory acute lymphoblastic leukaemia.

Capacity expansion

To be able to meet its obligations under the Novartis contract,

the Group is in the process of expanding its existing Harrow House

manufacturing facility as well as opening a new manufacturing

facility in Yarnton, also in Oxford, UK. These developments will

ultimately increase the physical space for manufacturing by around

five-fold. Work has also started on expanding and upgrading the

laboratories at Windrush Court so that the Group can complete its

move out of the Medawar Centre by March 2016. The total spend on

these expansion plans is expected to be in the region of GBP20

million with the project scheduled to complete in 2016. The new

facility at Yarnton is expected to be the first of these to come on

line, probably in the fourth quarter of 2015.

The Group has also been hiring new employees to meet the demands

of the Novartis contract. The total number of employees at 30 June

2015 was 192, up from 134 at the end of 2014 and 107 at 30 June

2014. The bulk of the new employees are either directly or

indirectly involved with the production and quality control

processes, although there have also been increases in headcount

working on process and other technical development projects.

The Group is actively seeking further revenue-generating

opportunities from licensing its technology and signing further

process development and manufacturing contracts with third parties.

As more gene and cell therapy products progress into clinical

development, there is increasing interest from other companies for

Oxford BioMedica's process development and manufacturing

capabilities.

LOAN FACILITY

In May 2015 the Group announced that it had secured a $50

million (GBP32.6 million) loan facility from Oberland Capital

Healthcare (Oberland). The funds are being used to invest in the

Group's capacity expansion programme. To date $25 million (GBP16.3

million) of the loan has been drawn down, with the remaining funds

available in minimum tranches of $5 million at the Group's option

prior to 31 December 2016. The UK Government's Advanced

Manufacturing Supply Chain Initiative (AMSCI) GBP5.3 million loan

facility is now terminated and the GBP3 million drawn down has been

repaid.

BOARD UPDATE

On 7 May 2015, Daniel Soland was appointed as a Non-Executive

Director of the Group. Mr Soland has an outstanding track-record of

leadership and innovation and a strong knowledge of the US

environment. His extensive experience of clinical development,

launching of new drugs and manufacturing is highly relevant as

Oxford BioMedica continues the expansion of its already successful

OXB Solutions business. Mr. Soland worked at ViroPharma from 2006

to 2014. He was Senior Vice President and Chief Operating Officer

when it was acquired by Shire in 2014. During his time at

ViroPharma, Mr. Soland managed the commercial, manufacturing and

quality organisations, helped build the company's commercial

infrastructure in the United States, Europe, and Canada and led the

launch of Cinryze(R) , one of the most successful ultra-orphan

drugs in the United States. Previously, he was President at Chiron

Vaccines growing the business to more than $1 billion in sales, and

President and Chief Executive Officer of Epignesis Pharmaceuticals.

He currently serves on the board of directors of Tarsa

Therapeutics, DBV Technologies SA., and ACADIA Pharmaceuticals.

Financial Review

The first six months of 2015 have been notable for a substantial

step up in the Group's activities on several fronts and the impact

of these can be clearly seen in the financial statements. Income

from manufacturing and process development activities for Novartis

increased compared with the comparable period in 2014 although

costs have also risen as the Group has invested in both staff and

facilities to service the increased demand.

The number of employees has increased from 134 at 31 December

2014 (107 at June 2014) to 192 at 30 June 2015. The majority of the

new employees have been recruited to support the expanding

production and process development activities, although there has

also been some increase in supporting staff.

Having secured the Novartis contract in October 2014 Oxford

BioMedica acquired Windrush Court, Oxford, as our new office and

laboratory complex, which requires a complete refurbishment and

re-fit of the laboratories. The Group expects to vacate its

long-standing facility at the Medawar Centre at the end of the

first quarter of 2016, at which point duplication in facility costs

will cease.

As well as investing in the Windrush Court laboratories, the

Group is also incurring substantial capital expenditure on

expanding its manufacturing facilities at Harrow House, and

bringing on line a new facility at Yarnton. The Group expects to

incur expenditure in the region of GBP20 million during 2015 and

2016 on these projects although the later stages of the phased

Harrow House expansion project have yet to be put out to tender and

so resultant costs are not certain.

In May 2015 the Group announced a $50 million loan facility

provided by Oberland of which $25 million has already been drawn

down. Part of the proceeds were used to repay the loan facility

provided under the UK Government's Advanced Manufacturing Supply

Chain Initiative (AMSCI).

The net loss for the six months ended 30 June 2015 was GBP6.1

million (H1 2014: GBP4.8 million), with a cash outflow from

operating activities and capital expenditure of GBP13.9 million (H1

2014: GBP5.0 million). At 30 June 2015, the Group had cash, cash

equivalents and financial assets available for sale totalling

GBP15.1 million.

Income statement

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 02:02 ET (06:02 GMT)

Total income - i.e. the aggregate of Revenue and Other Operating

Income - was GBP5.8 million in H1 2015 compared with GBP5.1 million

in H1 2014, an increase of 14%. Note that process development

income in 2015 arising from the October 2014 Novartis collaboration

is included in Other Operating Income whereas process development

income in 2014, which arose under the May 2013 contract, is

included in Revenue. This difference in accounting treatment is due

to the differing nature of the two contracts with process

development income under the 2014 contract essentially being the

reimbursement of R&D costs incurred in developing IP which

Oxford BioMedica will own.

Over 85 per cent of the Revenue of GBP4.4 million in the first

half of 2015 was derived from the Novartis manufacturing contract

announced in October 2014, with the balance arising from ongoing

work for Sanofi and small, long-standing intellectual property

licence agreements. In the comparable period in 2014 Novartis

manufacturing and process development activities represented

approximately three-quarters of the GBP4.7 million revenues, with

revenues from Sanofi adding around one-fifth.

It is worth noting that the Harrow House "GMP1" manufacturing

facility has operated at full capacity for the whole period, except

for a shut-down period for routine maintenance and cleaning at the

start of the year. Manufacturing revenues from Novartis were nearly

50% higher in the first six months of 2015 than in the same period

of 2014 despite the Group also manufacturing a batch of OXB-102 for

the Phase I clinical trial during the six-month period.

Other Operating Income in 2015 of GBP1.4 million includes income

from both Novartis process development work and grants receivable

whereas in 2014 (GBP0.4 million) only grants were included, with

process development included in Revenue. Process development in

2015 was about 30 per cent lower than in 2014 whereas grants

receivable are more than 80 per cent higher in 2015 than in 2014.

The increase in grants receivable was caused by the step up in

activities related to EncorStat(R) and OXB-102, which both receive

grants from Innovate UK, and also the process development

activities covered by the grant from the AMSCI. Grants from these

bodies typically cover 60 per cent of the actual costs

incurred.

The increase in cost of sales to GBP2.4 million from GBP1.9

million in 2014 is due entirely to the increased manufacturing

activity. Cost of sales includes the costs of raw materials, the

direct and indirect labour associated with manufacture, quality

control, analytical testing, facility costs and overheads.

R&D costs rose from GBP6.9 million in the first half of 2014

to GBP9.2 million in the first half of 2015, an increase of GBP2.3

million. Of the GBP9.2 million, there are GBP1.7 million

production-related costs (2014: GBP1.1 million) which are not

charged as cost of sales, although approximately GBP0.4 million of

this cost has been incurred by the need to recruit and train

production-related staff for the new Yarnton facility which should

start production in the fourth quarter of 2015. Product and

technical development activities, including laboratory support and

facility costs, amount to GBP5.2 million (2014: GBP3.8 million) of

which around GBP2.0 million is covered by revenues from third

parties and grants. The support and facility costs are somewhat

duplicated in 2015 due to the acquisition of Windrush Court whilst

still retaining the Medawar Centre facility on the Oxford Science

Park which the Group plans to vacate next year when the significant

laboratory upgrade at Windrush Court is complete. The remaining

GBP2.3 million (2014: GBP2.6 million) within R&D includes

management costs relating to R&D and business development

activities and also costs incurred in managing the Group's

intellectual property estate.

Administrative expenses were GBP2.5 million (H1 2014: GBP1.8

million). Approximately half of these costs are payroll-related

costs which have risen by around GBP0.4 million due to the need to

increase support and management functions to support the business's

expansion. The rest of the costs include items such as insurance,

IT, and the costs of being a publicly listed company.

Finance costs of GBP348,000 in the first half of 2015 comprise

the interest costs of the AMSCI loan facility from January until it

was repaid at the end of April and the Oberland loan facility for

the period since the start of May. The GBP212,000 in 2014 arose on

the GBP5 million loan facility provided by Vulpes Life Sciences

Fund during the first half of 2014, and which was fully repaid in

June 2014.

The net tax credit of GBP2.5 million (H1 2014: GBP0.8 million)

represents amounts recoverable under current legislation for UK

R&D tax credits. The significant increase in 2015 is caused by

increases in the tax credit rates during 2014 and includes an

upside arising from a successful claim for 2014 which exceeded the

estimate included in the 2014 full year financial statements.

The resulting net loss for the period of GBP6.1million was

GBP1.3 million higher than the GBP4.8 million net loss in the first

half of 2014.

Balance sheet

Non-current assets increased from GBP11.1 million at the start

of the year to GBP15.1 million at 30 June 2015 driven by the

capacity expansion programme. Additions to Property, Plant and

Equipment in the six months amounted to GBP4.6 million, with GBP3.9

million being spent on construction-related work and GBP0.6 million

on new manufacturing and laboratory equipment. During this period

the Group has completed the refurbishment of the warehouse facility

at Windrush Court which will now be used as our primary ambient

materials warehouse and substantial progress has also been made in

building the new clean room facilities at Yarnton (near Oxford).

The Group expects the construction contractors to hand over the

Yarnton facility during the third quarter and that the facility

should become operational in the fourth quarter. Work to expand the

existing manufacturing facility, Harrow House, is underway but the

need to progress carefully so as to avoid disrupting the ongoing

production in the "GMP1" suite means that this development will

last into the second half of next year. The building of the new

laboratory complex in Windrush Court is now underway following an

extensive design phase to ensure the laboratories will meet the

Group's longer term capacity needs for laboratory space and

capabilities.

Current assets have increased from GBP22.8 million at 31

December 2014 to GBP26.4 million at 30 June 2015. The cash balance

is GBP0.9 million greater and the remaining GBP2.7 million increase

arises from higher inventory and R&D tax credit balances,

although trade and other receivables are slightly lower than at the

2014 year end.

Current liabilities at 30 June 2015 at GBP8.5 million are GBP0.7

million lower than at 31 December 2014, although this is somewhat

distorted by the re-allocation of the GBP0.5 million dilapidation

provision in respect of the Medawar centre lease from non-current

to current liabilities. This is because the lease expires in March

2016. Excluding this provision, current liabilities are GBP1.3

million lower than at the year end, mainly due to lower trade and

other payables.

Non-current liabilities have increased from GBP1.5 million at 31

December 2014 to GBP15.7 million at 30 June 2015. The GBP1.0

million loan at 31 December 2014 was the AMSCI loan facility which

has since been fully repaid as it was re-financed by the Oberland

facility, announced in May 2015, of which the Group has drawn down

$25 million (GBP16.3 million). As described above, the dilapidation

provision has been re-allocated from non-current liabilities at the

end of 2014 to current liabilities at 30 June 2015.

Cash resources

Cash, cash equivalents and available for sale investments

increased from GBP14.2 million at 31 December 2014 to GBP15.1

million at 30 June 2015.

Cash used in operations in the period after interest paid was

GBP9.2 million (H1 2014: GBP5.0 million) although it should be

noted that the 2014 cash flow benefitted from the receipt of the

GBP1.6 million R&D tax credit in respect of 2013. The claim in

respect of 2014 had not been settled by 30 June 2015 but was

received in August 2015.

Cash outflows from investing activities were GBP4.6 million in

the first half of 2015 (2014: GBP3.0 million) entirely due to the

capital expenditure programme.

Cash flows from financing activities were predominantly due to

the drawdown of $25 million under the Oberland loan facility

announced in May 2015. The loan facility provided by the UK

Government's Advanced Manufacturing Supply Chain Initiative was

fully repaid following the drawdown of the Oberland loan. The

GBP87,000 proceeds from the issue of share capital arose from the

exercise of share options by employees.

The net impact on cash of the operating, investing and financing

activities was an increase in cash balances of GBP1.3 million.

Financial outlook

The Group has started the second half of 2015 with GBP15.1

million cash and a further $25 million which can be drawn down from

the Oberland loan facility. The Group will continue to utilise cash

in operating activities although, during the fourth quarter of

2015, it is expected that the Yarnton manufacturing facility will

come on line and double manufacturing capacity. This will lead to

an increase in revenues without a commensurate increase in costs as

the employees required for productions at Yarnton have already been

recruited and are being trained. The Group also anticipates that a

portion of the process development milestones which may be earned

under the Novartis contract could be recognised in the second half

of 2015. Capital expenditure will increase in the second half of

2015 as the Group completes the Yarnton facility and continues with

the current Harrow House expansion phase. Most of the work on the

Windrush Court laboratories is also expected to be carried out

during the next six months.

Principal risks and uncertainties

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 02:02 ET (06:02 GMT)

The principal risks and uncertainties facing the Group are those

set out in the 2014 Annual Report & Accounts which is available

on the Group's website at www.oxfordbiomedica.co.uk. The principal

risks and uncertainties remain the same for the second six months

of the year.

Going concern

Having reassessed the principal risks and uncertainties in the

business, the Directors consider it appropriate to adopt the going

concern basis of accounting in preparing the interim financial

information.

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2015

Six months ended 30 June 2015 Six months ended 30 June 2014

Notes GBP'000 GBP'000

------------------------------------------------ ------ ----------------------------- -----------------------------

Revenue 4,382 4,727

Cost of sales (2,385) (1,861)

-------------------------------------------------------- ----------------------------- -----------------------------

Gross profit 1,997 2,866

Research & Development costs (9,201) (6,857)

Administrative expenses (2,507) (1,823)

Other operating income 1,439 396

-------------------------------------------------------- ----------------------------- -----------------------------

Operating loss (8,272) (5,418)

Finance income 20 6

Finance costs (348) (212)

-------------------------------------------------------- ----------------------------- -----------------------------

Loss before tax (8,600) (5,624)

Taxation 2,475 823

-------------------------------------------------------- ----------------------------- -----------------------------

Loss for the period (6,125) (4,801)

Total recognised comprehensive expense for the period

attributable to owners of the parent (6,125) (4,801)

-------------------------------------------------------- ----------------------------- -----------------------------

Basic loss and diluted loss per ordinary share (0.24p) (0.32p)

-------------------------------------------------------- ----------------------------- -----------------------------

The notes on pages 13 to 17 form part of this financial

information.

Consolidated Balance Sheet

as at 30 June 2015

30 June 31 December

2015 2014

Notes GBP'000 GBP'000

------------------------------ ----- --------- -----------

Assets

Non-current assets

Intangible assets 1,924 2,106

Property, plant and equipment 6 13,138 8,944

15,062 11,050

------------------------------ ----- --------- -----------

Current assets

Inventory 7 2,023 1,407

Trade and other receivables 8 4,749 5,153

Current tax assets 4,480 2,000

Cash and cash equivalents 9 15,116 14,195

------------------------------ ----- --------- -----------

26,368 22,755

------------------------------ ----- --------- -----------

Current liabilities

Trade and other payables 10 5,226 6,304

Deferred income 11 2,719 2,927

Provisions 13 536 -

------------------------------ ----- --------- -----------

8,481 9,231

------------------------------ ----- --------- -----------

Net current assets 17,887 13,524

------------------------------ ----- --------- -----------

Non-current liabilities

Loans 12 15,694 1,000

Provisions 13 - 535

------------------------------ ----- --------- -----------

15,694 1,535

------------------------------ ----- --------- -----------

Net assets 17,255 23,039

------------------------------ ----- --------- -----------

Shareholders' equity

Share capital 14 25,686 25,659

Share premium 14 141,675 141,615

Merger reserve 2,291 2,291

Treasury reserve (102) (226)

Other reserves (682) (682)

Accumulated losses (151,613) (145,618)

------------------------------ ----- --------- -----------

Total equity 17,255 23,039

------------------------------ ----- --------- -----------

The notes on pages 13 to 17 form part of this financial

information.

Consolidated Statement of Cash Flows

for the six months ended 30 June 2015

Six months

ended Six months

30 June ended

2015 30 June 2014

Notes GBP'000 GBP'000

-------------------------------------- ----- ---------- -------------

Cash flows from operating activities

Cash used in operations 15 (8,913) (6,358)

Tax credit received - 1,603

Interest paid (321) (212)

Overseas tax paid (5) -

-------------------------------------- ----- ---------- -------------

Net cash used in operating activities (9,239) (4,967)

-------------------------------------- ----- ---------- -------------

Cash flows from investing activities

Purchases of property, plant and

equipment (4,644) (50)

Net maturity of available for

sale investments - (3,000)

Interest received 23 6

-------------------------------------- ----- ---------- -------------

Net cash generated by investing

activities (4,621) (3,044)

-------------------------------------- ----- ---------- -------------

Cash flows from financing activities

Loans received / repaid 12 15,107 1,000

Proceeds from issue of ordinary

share capital 87 21,568

Costs of share issues - (1,472)

-------------------------------------- ----- ---------- -------------

Net cash generated by financing

activities 15,194 21,096

-------------------------------------- ----- ---------- -------------

Net increase in cash and cash

equivalents 1,334 13,085

Cash and cash equivalents at 1

January 14,195 2,169

Effects of exchange rate changes (413) -

-------------------------------------- ----- ---------- -------------

Cash and cash equivalents at period

end 9 15,116 15,254

-------------------------------------- ----- ---------- -------------

The notes on pages 13 to 17 form part of this financial

information.

Statement of Changes in Equity Attributable to Owners of the

Parent

for the six months ended 30 June 2015

Share Share Merger Treasury Accumulated

capital premium reserve reserve Other reserves Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

At 1 January 2014 14,162 130,304 14,310 - (682) (149,196) 8,898

Six months ended 30 June

2014:

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Exchange adjustments - - - - - - -

Loss for the period - - - - - (4,801) (4,801)

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Total comprehensive expense

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 02:02 ET (06:02 GMT)

for the period - - - - - (4,801) (4,801)

Transactions with owners:

Share options

Value of employee services - - - - - 102 102

Issue of shares excluding

options 10,784 10,784 - - - - 21,568

Cost of share issues - (1,472) - - - - (1,472)

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

At 30 June 2014 24,946 139,616 14,310 - (682) (153,895) 24,295

Six months ended 31 December

2014:

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Exchange adjustments - - - - - - -

Loss for the period - - - - - (3,860) (3,860)

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Total comprehensive expense

for the period - - - - - (3,860) (3,860)

Transactions with owners:

Share options

Value of employee services - - - - - 118 118

Issue of shares excluding

options 713 1,987 - - - - 2,700

Costs of share issue - 12 - - - - 12

Realisation of merger reserve - - (12,019) - - 12,019 -

Deferred share award - - - (226) - - (226)

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

At 31 December 2014 25,659 141,615 2,291 (226) (682) (145,618) 23,039

Six months ended 30 June

2015:

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Exchange adjustments - - - - - - -

Loss for the period - - - - - (6,125) (6,125)

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

Total comprehensive expense

for the period - - - - - (6,125) (6,125)

Transactions with owners:

Share options

Value of employee services - - - - - 254 254

Issue of shares excluding

options 27 60 - - - - 87

Vesting of deferred share

award - - - 124 - (124) -

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

At 30 June 2015 25,686 141,675 2,291 (102) (682) (151,613) 17,255

------------------------------ -------- -------- -------- -------- -------------- ----------- --------

The notes on pages 13 to 17 form part of this financial

information.

Notes to the Financial Information

1. General information and basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 June 2015 have been prepared in accordance

with the Disclosure and Transparency Rules of the Financial

Services Authority and with IAS 34 Interim Financial Reporting as

adopted by the European Union. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2014.

These condensed consolidated interim financial statements do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

December 2014 were approved by the Board of Directors on 12 March

2015 and have been delivered to the Registrar of Companies. The

report of the Auditors on the 2014 accounts was unqualified.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 26 August 2015. They have not

been audited.

The Company is a public limited company incorporated and

domiciled in the UK. The Company is listed on the London Stock

Exchange.

2. Going concern

Having reassessed the principal risks and uncertainties in the

business, the Directors consider it appropriate to adopt the going

concern basis of accounting in preparing the interim financial

information.

3. Accounting policies

The accounting policies applied in these interim financial

statements are consistent with those of the annual financial

statements for the year ended 31 December 2014, as described in

those annual financial statements.

Accounting developments

The Directors have considered all new standards, amendments to

standards and interpretations which are mandatory for the first

time for the financial year beginning 1 January 2015 and there are

none which impact the group in the period.

Use of estimates and assumptions

In applying the Group's accounting policies, management is

required to make judgements and assumptions concerning the future

in a number of areas. Actual results may be different from those

estimated using these judgements and assumptions.

In preparing these interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were in the

same areas as those that applied to the consolidated financial

statements for the year ended 31 December 2014. Specifically these

are revenue recognition, intangible asset impairment, and going

concern.

Seasonality

The Group's operations are not subject to seasonal

fluctuations.

4. Segmental analysis

The chief operating decision-maker has been identified as the

Senior Executive Team (SET), comprising the Executive Directors,

Kyriacos Mitrophanous and James Miskin. The SET considers that the

business comprises a single activity, which is biotechnology

research and development, and the related manufacturing. The SET

reviews the Group's financial performance on a whole-company,

consolidated basis in order to assess performance and allocate

resources. Therefore the segment financial information is the same

as that set out in the consolidated statement of comprehensive

income, the consolidated balance sheet, the consolidated statement

of cash flows and the consolidated statement of changes in

equity.

5. Basic loss and diluted loss per ordinary share

The basic loss per share has been calculated by dividing the

loss for the period by the weighted average number of shares of

2,567,485,430 in issue during the six months ended 30 June 2015

(six months ended 30 June 2014: 1,499,563,938).

As the Group is loss-making, there were no potentially-dilutive

ordinary shares in either period which would serve to increase the

loss per ordinary share. There is therefore no difference between

the loss per ordinary share and the diluted loss per ordinary

share.

6. Property, plant & equipment

Short Office Manufactu-ring Assets

Freehold leasehold equipment and Laboratory under

property improvements and computers equipment construc-tion(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- ------------- -------------- --------------- ----------------- -------

Cost

At 1 January 2015 6,887 2,623 820 5,335 646 16,311

Additions at cost 454 - 198 575 3,417 4,644

At 30 June 2015 7,341 2,623 1,018 5,910 4,063 20,955

------------------ --------- ------------- -------------- --------------- ----------------- -------

Depreciation

At 1 January 2015 698 2,579 595 3,495 - 7,367

Charge for the

period 112 21 58 259 - 450

At 30 June 2015 810 2,600 653 3,754 - 7,817

------------------ --------- ------------- -------------- --------------- ----------------- -------

Net book amount

at

30 June 2015 6,531 23 365 2,156 4,063 13,138

------------------ --------- ------------- -------------- --------------- ----------------- -------

(1) Assets under construction represents the capitalisation of

ongoing construction works at the Harrow House and Yarnton

manufacturing facilities. The opening balance within Assets under

construction was included in Freehold property and Short leasehold

improvements in the 2014 year-end financial statements

7. Inventory

30 June 31 December

2015 2014

GBP'000 GBP'000

----------------- -------- -----------

Raw materials 1,440 1,214

Work-in-progress 583 193

----------------- -------- -----------

Inventory 2,023 1,407

----------------- -------- -----------

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 02:02 ET (06:02 GMT)

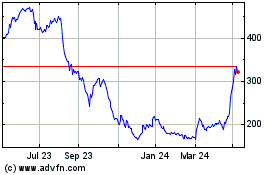

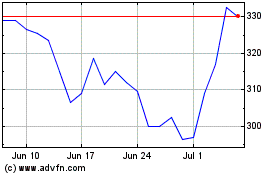

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Apr 2023 to Apr 2024