TIDMOSI

RNS Number : 9694D

Osirium Technologies PLC

03 May 2017

For immediate release

3 May 2017

Osirium Technologies plc

("Osirium" or "Group")

Final Results

Osirium Technologies plc (AIM: OSI.L), a UK based cyber-security

software provider, today announces its final results for the 14

months ended 31 December 2016.

Operational highlights

-- Significant contract win with leading global asset management company in August 2016

-- Pilot contract signed with a UK based contextual surveillance

company in October 2016, fully integrated and operational by

December 2016

-- Simon Hember, Founder and Managing Director of Acumin

Consulting appointed as a Non-Executive Director in September

2016

-- Having laid the foundations in the period under review, our

strategy is clearly showing early signs of success since period

end, adding customers, distributors and moving offices to

accommodate the growing Osirium business

Post year end

-- Three new customers won in the first few months of 2017: one

of the world's largest insurance companies, a critical national

infrastructure business and a retail mobile technology provider

-- Senior management team strengthened with the appointments of

Stephen Roberts as Marketing Director and Tim Ager as Sales

Director in November 2016 and January 2017 respectively

-- Distology signed as UK distribution partner

-- Business Development Director appointed in Middle East

-- Distribution agreement signed with Spectrami as Middle East distributor

-- Footprint extended to APAC with two Business Development

Directors appointed to service the region followed shortly

afterwards by an agreement signed with distributor CHJ Technologies

in Singapore

Financial highlights

-- Total Revenue of GBP477,577 (2015: GBP290,150), comprising:

o SaaS Revenue of GBP440,582 (2015: GBP252,430)

o Professional Services Revenue of GBP36,995 (2015:

GBP37,720)

-- Total Bookings of GBP540,836 (2015: GBP267,722)

-- Operating loss of GBP1,822,497 (2015: GBP847,138), primarily

reflecting increased investment in sales and marketing and

additional headcount in the R&D and Customer Support teams

-- Balance sheet strengthened - Total Shareholders' Equity of GBP4,483,922 (2015: GBP699,499)

-- Cash and cash equivalents at 31 December 2016 of GBP3,572,794 (2015: GBP273,486)

David Guyatt, Chief Executive Officer, commented:

"Overall we are pleased with Osirium's performance for the 14

months ended 31 December 2016. Whilst our revenue growth rate in

2016 was slower than we had originally expected, the Group

outperformed the other performance targets set by the Board for the

period, both operationally and financially, when compared with the

prior period. We have also been careful to deploy the proceeds from

our IPO in a controlled manner.

The global cyber-security market continues to grow and, despite

an increasingly competitive market, we believe Osirium is well

positioned and sufficiently differentiated to take advantage of

this opportunity through continued product innovation and

marketing. Our primary investment focus remains on driving growth

in our UK and global distribution network and augmenting the team

which manages our channel partners and direct customer

relationships.

2016 has provided a strong foundation for the year ahead. As

evidenced by our recent new customer wins, we are now seeing the

signs of significant progress."

- Ends -

For further information:

Osirium Technologies plc Tel: 44 (0) 118 324

2444

David Guyatt, Chief Executive

Officer

Rupert Hutton, Chief Financial

Officer

www.osirium.com

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886

(Nominated Adviser and 2500

Broker)

Andrew Godber / Peter Steel

- Corporate Finance

Charles Leigh-Pemberton

- Corporate Broking

Yellow Jersey PR Tel: +44 (0) 7764 947137

(Financial PR)

Sarah Hollins

The information communicated in this announcement is inside

information for the purposes of Article 7 of Market Abuse

Regulation 596/2014 ("MAR").

Photography

Photography is available, please contact Sarah Hollins at

sarah@yellowjerseypr.com

Notes to Editors

Osirium Technologies plc (AIM: OSI.L), is a UK based

cyber-security software provider. Osirium protects critical IT

assets, infrastructures and devices by preventing targeted

cyber-attacks from directly accessing Privileged Accounts, removing

unnecessary access and powers of Privileged Account users,

deterring legitimate Privileged Account users from abusing their

roles and containing the effects of a breach if one does

happen.

Osirium has defined and delivered what the Directors view as the

next generation PAM (Privileged Access Management) solution. The

team has developed the concept of Virtual Air Gap to separate users

from passwords, with Osirium's Privileged Task Management module

further strengthening Privileged Account security and delivering

impressive return on investment benefits for customers.

Founded in 2008 and with its headquarters in Reading, UK, the

Group was admitted to AIM in April 2016. For further information

please visit www.osirium.com

CHAIRMAN'S AND CHIEF EXECUTIVE'S STATEMENT

We are very pleased to report the final results for the 14

months ended 31 December 2016, the first following the Group's

admission to AIM in April 2016. Since becoming a public company,

our corporate profile has increased considerably and the Group has

seen growing and positive recognition and a strengthening pipeline,

both for direct sales and through our channel partners.

The Group has made significant progress during the period. The

focus since our IPO has been to lay the foundations to support our

UK and global distribution network and build a team which manages

channel partner and direct customer relationships.

The Board is pleased by the operational and commercial progress

achieved during the 2016 period under review. Activity levels for

the 14 months ended 31 December 2016 were in line with the Board's

expectations, whilst the Company's administrative costs were lower

than previously anticipated.

Osirium has taken time to find the right team and, as a result,

the revenue growth rate in 2016 was slower than the Board

originally expected. With the foundations of the team now firmly in

place, the Board will remain disciplined and selective with future

recruitment and expansion of the Group's overhead base, and

believes that Osirium's strengthened sales, marketing and delivery

teams will provide the momentum to accelerate trading in 2017 and

beyond.

Results

Osirium's loss before tax for the 14 months to 31 December 2016

was GBP1,812,843, compared with a loss before tax of GBP857,052 for

the year ended 31 October 2015. Revenue was GBP477,577 for the 14

months compared with GBP290,150 for the prior 12 month period of

2015, however SaaS revenue was up 64% to GBP441,000 versus the same

period in 2015. The balance of revenue in each period was generated

by chargeable professional services. Invoiced sales (bookings),

increased 102% to GBP540,906 (2015: GBP267,722) during the period.

As at 31 December 2016, the Group had cash balances of GBP3,572,794

(2015: GBP273,486).

The Group continued to increase its investment in research and

development, with GBP915,476 capitalised in the period (2015:

GBP404,385), an increase of 126%. This investment has been focused

on refining and further developing our next generation Privileged

Access Management solution PXM proposition and working to meet and

exceed new and prospective clients' expectations. The Group expects

SaaS revenues to increase further during 2017 and, with the

addition of extra consultancy resource, increased service revenues

are also being targeted.

Strategy and market

The growth in demand for mid-market cyber-security services,

predicted by Gartner and other industry analysts, is beginning to

emerge resulting in the acceleration of new customer enquiries and

partner acquisitions for Osirium. Privileged accounts remain

critical targets for cyber-attacks, and Osirium protects critical

IT assets and manages Privileged Account activities, denying

intruders a foothold. As Privileged Access Management moves from

being a technology only considered by large corporations to a

solution that mid-sized businesses can benefit from, a variety of

regulatory compliance standards are helping to drive mainstream and

mid-sized business adoption. Now, companies with 200 to 2,000

employees are looking at Privileged Access Management as a way to

protect their internal layers of security, and this presents a

significant greenfield opportunity for the Group.

Organisations are increasingly realising the importance of

identifying, controlling and minimising the risks from within their

enterprise, even the common faux pas of authentic system

administrators unwittingly performing over privileged tasks without

the necessary authority or skills to safely do so. Osirium has a

100% focus on the Privileged Access Management market, an

increasingly important part of the larger identity access

management market.

The key demand drivers for Privileged Access Management

solutions hitherto are expected to continue into the future:

-- Scale and frequency of cyber-attacks

-- Damage to corporate reputations and erosion of public confidence

-- Cyber-security focused legislation and regulation

-- Outsourcing of IT functions

-- Privileged Accounts will remain critical targets for cyber-attacks

-- Increasing number of internet connected devices Internet of Things(IOT)

Market review

The market outlook undertaken by TechNavio (a leading market

research company with global coverage) suggests that the Privileged

Access Management market is set to grow at a compound annual growth

rate of approximately 20%, as organisations' buying habits shift

further away from completed projects to secure the perimeter i.e.

firewalls, towards those that add internal layers of security.

TechNavio also expects that the anticipated growth will be

supported by the significant greenfield opportunity in the

mid-market. According to market reference point Gartner, market

growth remains robust. Additionally, the overall Privileged Access

Management market is still very much dominated by the sale of

on-premises software. Gartner estimates that the combined revenue

of all Privileged Access Management vendors in 2015 was $690

million, representing a 33% growth rate over a 2014 market size of

$521 million.

Executing our strategy

One of the purposes of the IPO was to access growth capital.

The following strategic priorities have been identified by

Osirium's senior leadership team:

- Completing a senior management team with the knowledge and

experience of driving successful businesses at a truly

international level.

- Building a robust and growing pipeline of prospects and

customers, in the wider mid-market space as well as meeting the

more demanding operational requirements of high-end enterprises and

the unabating requirements of Managed Service Providers ("MSPs")

and Management Security Service Providers ("MSSPs").

- Changing an "opportunistic" sales team into a group focused on

helping the Company deliver its long term strategic objectives,

transitioning sales to a 100% channel-led mid-market fulfilment

focus, whilst looking to the Group's high-end enterprise and MSSP

engagement for driving scale resilience and service-led

innovation.

- Upscaling our marketing team, nurturing and evolving the brand

into a confident and assertive world-beating icon, projecting

global leadership ambitions that are real and measurable.

- Transforming the R&D team from a tactical start-up group

into a world-class cyber-security IP factory. Innovative

cyber-security vendors need to balance mid-market "reactive" needs

with the "upper-registers" of strategic, scalable and resilient

functionality demanded by Enterprise-class and MSSP customers.

- Implementing a Global Technical Support culture and

infrastructure that is an equally critical and defining service

which will help customers and partners alike decide that Osirium is

the right team to work with.

- The Company has three pending patent applications for

inventions related to Osirium's PAM technology.

New customer acquisitions in existing and new markets

Osirium's management team has extensive experience in

successfully driving mid-market channels and partner programs to

scale up demand and fulfilment volumes, and our support services

team has worked hard this year to establish an expanding global

support infrastructure that is capable of providing 24/7

follow-the-sun support to our customers and partners, wherever they

are in the world. Fully committed to our channels, our solution is

designed with simplicity and ease of deployment in mind, allowing

our partners to quickly realise meaningful technical progress when

deploying at their customer sites.

Using established routes to market will deliver the required

footprint for growth, and the Group's recent decision to engage all

customers through our channels is expected to have an accelerated

effect on customer acquisitions. Regional partnerships are now in

place with proven distribution partners including Distology in the

UK and Spectrami covering the MENA region. As a result, the Group

expects that technology resellers will take Osirium's Privileged

Access Management solution to their clients as an incremental and

valued proposition as they seek additional technologies to drive

new revenue opportunities.

Another important route to market exists in the MSSP market

segment. The Managed Security Service Provider market size is

estimated to grow from USD17 Billion in 2016 to USD34 Billion by

2021, at a Compound Annual Growth Rate (CAGR) of 14.6%. With a

number of MSSP partners already engaged, the Group sees this market

opportunity as a key area for new engagements and relationships to

develop as many providers as possible and invest in their Security

Operations Centres (SOC) and Data Centres to differentiate their

service offerings.

Building on the Group's reputation with its existing customers,

which include blue chip enterprises in the defence and

telecommunications industries, MSSPs and the financial services

sector, Osirium plans to continue its aggressive sales and

marketing strategy and expand into these sectors as well as new

industries.

In August 2016, the Group announced a significant contract win

with a leading global asset management company within the financial

services industry. With daily conference calls and quarterly senior

management review meetings the project is progressing well. In

addition, a pilot contract was signed with a UK based contextual

surveillance company in October 2016 which was fully integrated and

operational by December 2016.

Osirium has, in recent months, also strengthened its management

team with two senior hires. Stephen Roberts joined Osirium as

Marketing Director and Tim Ager as Sales Director in November 2016

and January 2017 respectively. Both bring a wealth of sector

knowledge; Tim has over nineteen years' experience in the IT

security market and was formerly European Managing Director and VP

of Sales at Celestix Networks, a leading provider of secure remote

access and identity management solutions. Stephen has spent over 20

years working in senior strategic marketing roles and was

previously Marketing Director at Wallix, a Privileged Access

Management Company. He is particularly experienced in building

brand momentum for emerging cyber technology companies.

In March 2017, the Group announced that its market leading

Privileged Access Management (PAM) product is now available in the

Asia Pacific region (APAC). Hugh Sunderland and Mike Stephens were

appointed as Business Development partners for the region which was

closely followed by an agreement signed with CHJ Technologies in

Singapore. In addition, Distology, a value-added distributor in the

IT security field, was appointed to strengthen Osirium's UK channel

distribution presence. In February 2017, Duncan Fiskin was

appointed Business Development Director for the Middle East North

Africa region (MENA) followed shortly by the Group signing a

distribution agreement with Spectrami in the region. Spectrami is a

Dubai based value added distributor in the MENA region which is

armed with the innovative approach to channel empowerment through

knowledge sharing and skill building.

The Group has also recently appointed a Business Development

Director in Germany to address the opportunity in this significant

market.

In April 2017, we took the decision to move to larger offices in

Theale near Reading, also the location of our current head office,

to accommodate our growing team.

Finally, we are pleased to announce that the first few months of

the current financial year have included three new customer wins -

one of the world's largest insurance companies, our first sale into

a critical national infrastructure business and a retail mobile

technology provider.

Growth within the existing client base

Through the delivery of excellent support and thorough account

management, Osirium continues to grow its position within existing

key accounts. Customer retention has remained strong over the past

trading period with all customers retained and many expanding the

use of the Osirium products.

Sales and marketing investment

The management team has invested in enhancing the current skills

base and technology to scale our sales and marketing processes. We

have the depth of experience to realise the benefits of best

practice in driving sales momentum through marketing automation

tools. The Group has invested in technology that efficiently

manages prospects through a nurturing and lead scoring process,

evolving them through to conversion.

Also, through a significant investment in the new Osirium.com

website, the goal has been set to attract and drive new prospects

to a platform that now reflects the global ambitions of Osirium.

The reach of this new digital offer has also extended to present a

truly global presence but delivering a local connection wherever we

do business. The new platform fully integrates into the sales

process and complements the attract phase of all engagements.

Delivering on plans at IPO

Following completion of the IPO, we have been able to execute on

those critical deliverables stated in the Admission Document,

ultimately with a view to establishing Osirium as the dominant

cyber-security brand in the UK. By 2018, the Group fully expects to

have built a robust self-sufficient and loyal channel to complement

the existing direct sales model. Although this has meant that

initial bookings will be less, due to commissions to the channel,

we believe that this route will increase our overall ability to

scale and maintain our revenue growth in the medium to long term.

The channel approach will allow us to take advantage and accelerate

the take-up of Proof of Concepts and deployments so as to meet our

growth expectations, and take advantage of this market opportunity

as forecast by industry analysts, Gartner and Kuppinger Cole.

The Group has also completed the transformation of our R&D

and Software Development with a successful recruitment campaign

from a single start-up group of seven, to four teams with a total

of 23 engineers.

Board and employees

In September 2016, the Group strengthened the Board and

appointed Simon Hember, Founder and Managing Director of Acumin

Consulting, a cyber-security recruitment business, as a

Non-Executive Director. In December 2016, John Townsend stepped

down from the Board having served as a Non-Executive Director since

2011. We are grateful to John for his very significant and valuable

contribution to the Company's early development.

Osirium, like any organisation, is only as good as its

employees. On behalf of the Board, we would like to thank the whole

team for their continued support and hard work.

Summary and Outlook

Overall we are pleased with Osirium's performance for the 14

months ended 31 December 2016. Whilst our revenue growth rate in

2016 was slower than we had originally expected, the Group

outperformed the other performance targets set by the Board for the

period, both operationally and financially when compared with the

prior period. We have also been careful to deploy the proceeds from

our IPO in a controlled manner.

The global cyber-security market continues to grow and, despite

an increasingly competitive market, we believe Osirium is well

positioned and sufficiently differentiated to take advantage of

this opportunity through continued product innovation and

marketing. Our primary investment focus remains on driving growth

in our UK and global distribution network and augmenting the team

which manages our channel partners and direct customer

relationships.

2016 has provided a strong foundation for the year ahead. As

evidenced by our recent new customer wins, we are now seeing the

signs of significant progress.

Simon Lee David Guyatt

Chairman Chief Executive

3 May 2017 Officer

3 May 2017

FINANCIAL REVIEW

Overview

For the fourteen month period ended 31 December 2016, revenue

was GBP477,577, an increase of 65% (compared with the 12 months

ended 31 October 2015: GBP290,150).

Bookings for the fourteen month period ended 31 December 2016,

represented by total invoiced sales, were GBP540,836, an increase

of 102% compared with the twelve months ended 31 October 2015 where

bookings were GBP267,722. Part of the increase was due to the

extension of the accounting period by two months, but the majority

due to greater customer engagement.

The fourteen month loss before tax for the Group was

GBP1,812,843, an increase from a loss of GBP857,052 for the twelve

month period to 31 October 2015. The losses of the Group have

increased following significant investment in increasing headcount

and activity levels in our sales, marketing and engineering

departments.

Our balance sheet strengthened through the IPO with total

Shareholders' Equity of GBP4,483,922 (2015: GBP699,499).

Revenue analysis

Revenue for the fourteen month period ended 31 December 2016 was

GBP477,577 (2015: GBP290,150). Bookings in the first six months of

the period ended 31 December 2016 were GBP206,000 compared with

GBP334,836 for the second eight month period demonstrating the

increasing momentum felt within the business as we add more

customers.

Our deferred revenues as at 31 December 2016 were GBP275,650,

compared with deferred revenues at the end of October 2015 of

GBP212,392, helping provide a degree of visibility and certainty

over our future revenues.

Taxation

The Group has benefited from the tax relief given on development

expenditure, which has resulted in a research and development tax

credit of GBP290,000 being claimed for the fourteen month period to

31 December 2016, compared with GBP120,430 for the previous 12

month period to 31 October 2015. This further demonstrates the

investment made in the Company's innovative cyber-security

products.

Loss per share

Loss per share for the fourteen month period on both a basic and

fully diluted basis was 13p. In the prior twelve month period the

basic and diluted loss per share was 7p.

Results and dividend

The Directors are not recommending the payment of a final

dividend (2015: GBPnil).

Research and development & capital expenditure

The Group spent GBP915,476 (2015: GBP404,385) on direct staff

and contractor costs for research and development, of which all was

capitalised in both years.

This expenditure relates to the development of new and enhanced

software offerings. The Group invests in new product development

and the continual modification and improvement of its existing

products to meet technological advances, customer and new market

requirements of the fast paced cyber-security market.

Future developments

The Group has embarked upon a strategy which will extend its

activities to the provision of cyber-security services into new

areas such as financial services, critical national infrastructure

and other market sectors as the need for Osirium's software is

sector agnostic, in addition to developing its activities outside

of the UK.

Cash flow

At 31 December 2016 the Group had cash balances of GBP3,572,794

(2015: cash balances of GBP273,486). Operating cash outflow for the

year was GBP789,443 (2015: operating cash outflow was

GBP132,631).

Key performance indicators

The Group's progress against its strategic objectives is

monitored by the Board of Directors by reference to key performance

indicators ("KPIs"), as mentioned in the Chairman's and Chief

Executive's statement. Progress made is a reflection of the

performance of the business since flotation and the Group's

achievement against its strategic plans.

The Group's major financial KPIs are bookings, revenue, new

channel partners signed up, new customer acquisition, retaining and

growing customer renewals, the number of proof of concepts and

software evaluations installed, increasing at any one time.

Bookings are monitored on a monthly basis and reported in detail

at board meetings. Bookings have increased by 102% to GBP540,836

for the 14 month period to 31 December 2016 from GBP267,722 for the

12 months ended 31 October 2015.

As a result of the increase in booking, the revenue KPI is

performing well, with total revenue up 165% to GBP477,577 (2015:

GBP290,150), for the periods under review.

Non-financial KPIs include new channel partners and, with a UK

distributor and two overseas distributors signed up to date and a

business development director now appointed in Germany, the Board

is pleased with this progress. A further KPI is the retention of

existing customers leading to the renewal of sales contracts. All

customers were retained in the period and new customers added, with

increasing contract values from our existing customer base. Proof

of concepts have also increased now that the Group has more

resources to support this activity, not only in the UK but with our

fledgling partners overseas.

During the year and after the year end we signed up Distology as

a distributor in the UK and Spectrami in MENA and CHJ Technologies

in Singapore, for further details please see the Chairman's and

Chief Executive's statement. The Group did not lose a customer

during the period and each significant renewal was at a higher

level than the year before. With the increases in sales and

marketing and market awareness, the number of proof of concepts

being demanded is increasing, not only in the UK, but also in our

identified overseas markets.

The Group also measures and monitors brand recognition and

momentum increases in the Osirium name as we continue to build a

global brand. Brand recognition includes monitoring Osirium's

Search Engine Optimisation Position and quarterly growth in

qualified sales leads with a quantified 'call to action'.

Principal Risks and uncertainties

Apart from the normal commercial and economic risks facing any

UK based business looking to not only become the dominant company

in its home market, but also expand into overseas territories, the

major risks to the Group are the:

-- loss of a major client and supporter;

-- loss of a relationship with a major supplier; and

-- development of new technologies which may adversely impact

the Group's proprietary software.

In order to mitigate these risks, the Group:

-- has specific relationship management systems in place for

managing both new and existing client and supplier relationships;

and

-- undertakes research and development into various technologies on an ongoing basis.

Other risks include:

Competitor risk

The market for Cyber security software is becoming increasingly

competitive. To mitigate against this risk, management is of the

view that the years of investment that preceded the recent maturing

of the Privileged Access Management market and the continued

investment in the product will maintain Osirium's leadership

position in this market.

Commercial relationships

The Osirium software products are developed and released using

open source. To mitigate against this risk, all elements and

components used within the software are kept under constant review.

The Group continues to expand the various sales channels and

reseller network, so the Group is not dependent on any one

partner.

Personnel/key executives

The Group's future performance is substantially dependent on the

continued services and performance of its Directors and senior

management as well as its ability to attract and retain suitably

skilled and experienced personnel in the future.

Although certain key executives and personnel have joined

Osirium since flotation, there can be no assurance that the Group

will retain their services. The loss of any key executives or

personnel may have a material adverse effect on the business,

operations, relationships and/or prospects of the Group.

The Company believes that it has the appropriate incentivisation

structures to attract and retain the calibre of employees necessary

to ensure the efficient management and development of the Group.

However, any difficulties encountered in hiring appropriate

employees and the failure to do so may have a detrimental effect on

the trading performance of the Group. The ability to attract new

employees with the appropriate expertise and skills cannot be

guaranteed.

Customer attraction, retention and competition

The Group's future success depends on its ability to increase

sales of its products to new prospects. The rate at which new and

existing end customers purchase products and existing customers

renew subscriptions depends on a number of factors, including the

efficiency of the Group's products and the development of the

Group's new offerings, as well as factors outside of the Group's

control, such as end customers' perceived need for security

solutions, the introduction of products by the Group's competitors

that are perceived to be superior to the Group's products, end

customers' IT budgets and general economic conditions. A failure to

increase sales due to any of the above could materially adversely

affect the Group's financial condition, operating results and

prospects. The Group's success depends on its ability to maintain

relationships and renew contracts with existing customers and to

attract and be awarded contracts with new customers. A substantial

portion of the Group's future revenues will be directly or

indirectly derived from existing contractual relationships as well

as new contracts driven at least in part by the Group's ability to

penetrate new partners, verticals and territories. The loss of key

contracts and/or an inability to successfully penetrate new

verticals or deploy its skill sets into new territories could have

a significant impact on the future performance of the Group.

Reputation

The Group's reputation, regarding the service it delivers, the

way in which it conducts its business and the financial results

which it achieves, are central to the Group's future success.

The Group's services and software are complex and may contain

undetected defects when first introduced, and problems may be

discovered from time to time in existing, new or enhanced product

iterations. Undetected errors could damage the Group's reputation,

ultimately leading to an increase in the Group's costs or reduction

in its revenues.

Other issues that may give rise to reputational risk include,

but are not limited to, failure to deal appropriately with legal

and regulatory requirements in any jurisdiction (including as may

result in the issuance of a warning notice or sanction by a

regulator or an offence (whether, civil, criminal, regulatory or

other) being committed by a member of the Group or any of its

employees or directors), money-laundering, bribery and corruption,

factually incorrect reporting, staff difficulties, fraud (including

on the part of customers), technological delays or malfunctions,

the inability to respond to a disaster, privacy, record-keeping,

sales and trading practices, the credit, liquidity and market risks

inherent in the Group's business.

Further reputational risks include failure to meet the

expectations of the customers, operators, suppliers, employees and

intellectual property and technology. The Group's technology is

primarily comprised of software and other code ("Software"). Some

of the Software has been developed internally and is owned by the

Group. Also, some of the Software has been developed by third

parties that have licensed rights in the Software to the Group or

provided access under free and open source licence. However, a

significant proportion of the Software has been developed by third

parties and is provided to the Group under licence. It is not

uncommon for any company's technology, particularly where it is

primarily embodied in Software, to comprise both owned and licensed

code. This, nevertheless, means that the Group's continuing right

to use such Software is dependent on the relevant licensors

continuing to license Software to the Group. Again, as is usual,

such agreements may be terminated by the licensors due to a breach

of their terms by the Group. Any failure by the Group to comply

with the terms of the licences granted could, therefore, result in

such licences being terminated and the Group no longer being

entitled to continue to use the Software in question. Also, use

outside of the terms of any relevant licence could expose the Group

to legal action for infringement of the rights of the

licensor(s).

Further, and in any event, the Group may not have adequate

measures in place to ensure that its use of third party software

complies with all terms under which such software has been licensed

to the Group.

Operations

The Group's facilities could be disrupted by events beyond its

control such as fire and other issues. The Group undertake nightly

back ups in 'the cloud' and prepares recovery plans for the most

foreseeable situations so that its business operations would be

able to continue.

This report was approved by the Board on 2 May 2017

Rupert Hutton

Chief Financial Officer

3 May 2017

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

14 month

Period Year

ended ended

31 Dec 16 31-Oct-15

Notes GBP GBP

CONTINUING OPERATIONS

Revenue 477,577 290,150

Administrative

expenses (2,300,074) (1,137,288)

----------------------- ------------

OPERATING

LOSS (1,822,497) (847,138)

Finance costs - (9,986)

Finance income 9,654 72

----------------------- ------------

LOSS BEFORE

TAX (1,812,843) (857,052)

Income tax

credit 2 453,288 121,046

----------------------- ------------

LOSS FOR THE PERIOD

ATTRIBUTABLE TO

THE OWNERS OF OSIRIUM TECHNOLOGIES

PLC (1,359,555) (736,006)

======================= ============

Loss per share from continuing operations:

Basic and diluted loss per share 3 (13p) (7p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at

31-Dec-16 31-Oct-15

Notes GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible

assets 4 1,134,452 793,256

Property, plant

& equipment 44,315 6,439

------------ ------------

CURRENT

ASSETS

Trade and other

receivables 380,891 154,647

Cash and cash

equivalents 3,572,794 273,486

------------ ------------

3,953,685 428,133

------------ ------------

TOTAL ASSETS 5,132,452 1,227,828

============ ============

LIABILITIES

CURRENT LIABILITIES

Trade and other

payables 648,530 365,041

------------ ------------

648,530 365,041

------------ ------------

NON-CURRENT LIABILITIES

Deferred

tax - 163,288

------------ ------------

- 163,288

------------ ------------

TOTAL LIABILITIES 648,530 528,329

------------ ------------

EQUITY

SHAREHOLDERS

EQUITY

Called up share

capital 5 103,944 65,482

Share premium 5,008,619 -

Share option

reserve 337,559 240,662

Merger reserve 4,008,592 4,008,592

Retained

earnings (4,974,792) (3,615,237)

------------ ------------

TOTAL EQUITY ATTRIBUTABLE

TO THE

OWNERS OF OSIRIUM

TECHNOLOGIES PLC 4,483,922 699,499

------------ ------------

TOTAL EQUITY AND LIABILITIES 5,132,452 1,227,828

============ ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called

up Share

share Retained Share Merger option Total

capital earnings premium reserve reserve equity

GBP GBP GBP GBP GBP GBP

Balance at 1

November 2014 65,482 (2,879,231) - 2,922,100 184,263 292,614

Changes

in Equity

Merger reserve

adjustment - - - 1,086,492 - 1,086,492

Loss for the

period - (736,006) - - - (736,006)

Share option

charge - - - - 56,399 56,399

-------- ------------ ---------- ---------- -------- ------------

Balance at 31

October 2015 65,482 (3,615,237) - 4,008,592 240,662 699,499

-------- ------------ ---------- ---------- -------- ------------

Changes

in Equity

Issue of share

capital 38,462 - 5,961,537 - - 5,999,999

Issue costs - - (952,918) - - (952,918)

Loss for the

period - (1,359,555) - - - (1,359,555)

Share option

charge - - - - 96,897 96,897

-------- ------------ ---------- ---------- -------- ------------

Balance at 31

December 2016 103,944 (4,974,792) 5,008,619 4,008,592 337,559 4,483,922

======== ============ ========== ========== ======== ============

CONSOLIDATED STATEMENT OF CASHFLOWS

14 month

Period

ended Year ended

31-Dec-16 31-Oct-15

Notes GBP GBP

Cash flows from operating

activities

Cash used in operations 6 (909,873) (257,217)

Interest

paid - (9,986)

Tax received 120,430 134,572

---------- -----------

Net cash used in operating

activities (789,443) (132,631)

---------- -----------

Cash flows from investing

activities

Purchase of intangible

fixed assets (915,476) (404,385)

Purchase of tangible fixed

assets (52,508) (2,944)

Interest

received 9,654 72

---------- -----------

Net cash used in investing

activities (958,330) (407,257)

---------- -----------

Cash flows from financing

activities

Share issue (net of issue

costs) 5,047,081 762,753

---------- -----------

Net cash from financing

activities 5,047,081 762,753

---------- -----------

Increase in cash and cash

equivalents 3,299,308 222,865

Cash and cash equivalents

at beginning of period 273,486 50,621

---------- -----------

Cash and cash equivalents

at end of period 3,572,794 273,486

========== ===========

1. SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The above audited financial information in this announcement

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. The above figures for the period ended 31

December 2016 are an abridged version of the Company's accounts

which have been reported on by the Company's auditor but have not

been dispatched to shareholders or filed with the Registrar of

Companies. These accounts received an audit report which was

unqualified and did not include a statement under section 498(2) or

section 498(3) of the Companies Act 2006.

Merger Accounting

On 6 April 2016 Osirium Technologies plc acquired Osirium

Limited. This transaction did not meet the definition of a business

combination as set out in IFRS 3. It is noted that such

transactions are outside the scope of IFRS 3 and there is no other

guidance elsewhere in IFRS covering such transactions. IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors,

requires that where IFRS does not include guidance for a particular

issue, the Directors may also consider the most recent

pronouncement of other standard setting bodies that use a similar

conceptual framework to develop accounting standards when

developing an appropriate accounting policy. In this regard, it is

noted that the UK Accounting Standards Board has, in issue, an

accounting standard covering business combinations (FRS 102 Section

19) that permits the use of the merger accounting principles for

such transactions. The Directors have therefore chosen to adopt

these principles and the financial information has been prepared as

if Osirium Limited had been owned and controlled by the company

throughout the year ended 31 October 2015 and the 14 month period

ended 31 December 2016. Accordingly, the assets and liabilities of

Osirium Limited have been recognised at their historical carrying

amounts, the results for the periods prior to the date the company

legally obtained control have been recognised and the financial

information and cash flows reflect those of Osirium Limited. The

amount recognised in equity is based on the historical carrying

amounts recognised by Osirium Limited. However, the share capital

balance is adjusted to reflect the equity structure of the

outstanding share capital of the Company, and any corresponding

differences are reflected as an adjustment to a merger reserve.

Internally-generated development intangible assets

An internally-generated development intangible asset arising

from Osirium's product development is recognised if, and only if,

Osirium can demonstrate all of the following:

-- The technical feasibility of completing the intangible asset

so that it will be available for use of sale

-- Its intention to complete the intangible asset and use or sell it

-- Its ability to use or sell the intangible asset

-- How the intangible asset will generate probable future economic benefits

-- The availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset

-- Its ability to measure reliably the expenditure attributable

to the intangible asset during its development

Internally-generated development intangible assets are amortised

on a straight-line basis over their useful lives. Amortisation

commences in the financial year of capitalisation. Where no

internally-generated intangible asset can be recognised,

development expenditure is recognised as an expense in the period

in which it is incurred. The amortisation cost is recognised as

part of administrative expenses in the statement of comprehensive

income.

Development costs - 20% per annum, straight line

Impairment of tangible and intangible assets

At each statement of financial position date, Osirium reviews

the carrying amounts of its assets to determine whether there is

any indication that those assets have suffered an impairment loss.

If any such indication exists, the recoverable amount of the asset

is estimated in order to determine the extent of the impairment

loss (if any). Where the asset does not generate cash flows that

are independent from other assets, Osirium estimates the

recoverable amount of the cash-generating unit to which the asset

belongs. An intangible asset with an indefinite useful life is

tested for impairment at least annually and whenever there is an

indication that the asset may be impaired.

The recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised as an expense

immediately, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash- generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in profit or loss,

unless the relevant asset is carried at a revalued amount, in which

case the reversal of the impairment loss is treated as a

revaluation increase.

Going concern

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on the Going Concern Basis of Accounting

and Reporting on Solvency and Liquidity Risks (2016)".

The Directors have prepared detailed financial forecasts and

cash flows looking beyond 12 months from the date of these

Financial Statements. In developing these forecasts the Directors

have made assumptions based upon their view of the current and

future economic conditions that will prevail over the forecast

period.

On the basis of the above projections, the Directors are

confident that Osirium has sufficient working capital to honour all

of its obligations to creditors as and when they fall due.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the Financial Statements.

NOTES TO THE ACCOUNTS

2. INCOME TAX

Analysis of tax

income

14 month

Period

ended Year ended

31-Dec-16 31-Oct-15

GBP GBP

Current Tax:

Tax (290,000) (120,430)

Adjustment for

prior year tax - -

---------- -----------

Total current

tax (290,000) (120,430)

Deferred tax (163,288) (616)

---------- -----------

Total credit in the

statement of (453,288) (121,046)

========== ===========

comprehensive

income

========== ===========

Within the overall tax credit contained in the statement of

comprehensive income there has been during the period to 31

December 2016 successful claims made to HM Revenue & Customs in

connection with Research and Development tax credits being claimed

for the current period.

Factors affecting the tax income

Tax on the loss before tax differs from the theoretical amount

that would arise using the weighted average tax rate applicable to

losses of the group as follows:

14 month

Period

ended Year ended

31-Dec-16 31-Oct-15

GBP GBP

Loss before

tax (1,812,843) (857,052)

------------ -----------

Loss before tax multiplied

by the applicable

Rate of corporation tax

of 20% (2015: 20%) (362,569) (171,410)

Expenses not deductible

for tax purposes 664 7,287

Unrelieved tax

losses 361,905 164,123

R&D tax credit

relief 290,000 120,430

Deferred tax 163,288 616

------------ -------------

Tax credit for

the period 453,288 121,046

============ ===========

As at 31 December 2016 the group had unutilised tax losses of

GBP2,359,884 (31 October 2015: GBP1,194,557) available to offset

against future profits. A deferred tax asset has been recognised in

respect of tax losses carried forward to the extent that it offsets

the deferred tax liabilities in respect of research and development

credits and accelerated capital allowances.

Factors affecting future tax charges

The UK corporation tax rate has reduced to 19% from 1 April 2017

and the UK Government has indicated that it intends to reduce the

main rate of corporation tax to 17% from 1 April 2020.

3. EARNINGS PER SHARE

14 month

Period

ended Year ended

31-Dec-16 31-Oct-15

Weighted average

no. of shares in

issue 10,394,255 10,394,255

------------ -----------

Weighted average no. of shares for

the purposes of basic earnings per

share 10,394,255 10,394,255

------------ -----------

Effect of dilutive potential

ordinary shares:

Share options - -

------------ -----------

Weighted average no. of shares for

the purposes of diluted earnings

per share 10,394,255 10,394,255

------------ -----------

Basic losses attributable

to equity shareholders (1,359,555) (736,006)

------------ -----------

Losses for the purposes of diluted

earnings per share (1,359,555) (736,006)

------------ -----------

Basic loss per

share (13p) (7p)

============ ===========

Diluted loss

per share (13p) (7p)

============ ===========

Earnings per share has been calculated using the following

methodology:

Basic losses per share are calculated by dividing the losses

attributable to ordinary shareholder by the number of weighted

average ordinary shares during the period.

At 31 December 2016, there were 1,723,958 share options

outstanding that could potentially dilute basic earnings or losses

per share in the future, but are not included in the calculation of

diluted losses per share because they are anti-dilutive for the

periods presented.

4. INTANGIBLE FIXED ASSETS

Development

Costs

GBP

Cost

At 1 November

2014 1,906,186

Additions 404,385

------------

At 1 November

2015 2,310,571

Additions 915,476

------------

Cost c/f as at 31

December 2016 3,226,047

============

Amortisation:

At 1 November

2014 1,110,473

Charge for the

year 406,842

------------

At 1 November

2015 1,517,315

Charge for the

period 574,280

------------

Amortisation as at

31 December 2016 2,091,595

============

Carrying

Amount:

At 31 December

2016 1,134,452

============

At 31 October

2015 793,256

============

All development costs are amortised over their estimated useful

lives, which is on average 5 years.

Amortisation is charged in full in the financial year of

capitalisation.

All amortisation has been charged to administrative expenses in

the statement of comprehensive income and total comprehensive

loss.

5. CALLED UP SHARE CAPITAL

The company was incorporated on 3 November 2015 with 100 shares

of 1p each. On 6 April 2016 6,548,102 1p shares were issued in

consideration for the acquisition of Osirium Limited. On 15 April

2016 3,846,153 1p shares were issued on listing of the company on

the AIM exchange at a price of GBP1.56 per share for a total

consideration of GBP6m.

Allotted, issued

and fully paid

No. of

Nominal Value GBP0.01 per share shares GBP

On incorporation on 3 November

2015 100 1

Shares issued as consideration

for Osirium Limited on 6 April

2016 6,548,102 65,481

Shares issued on listing on AIM

Exchange on 15 April 2016 3,846,153 38,462

----------- --------

10,394,355 103,944

=========== ========

Voting rights

Shares rank equally for voting purposes. Each member will have

one vote per share held.

Dividend rights

Each share ranks equally for any dividend declared.

6. RECONCILIATION OF LOSS BEFORE INCOME TAX TO CASH GENERATED

FROM OPERATIONS

Group

14 month

Period

ended Year ended

31-Dec-16 31-Oct-15

GBP GBP

Loss before income

tax (1,812,843) (857,052)

Depreciation charges 14,632 6,026

Amortisation charges 574,280 406,842

Share option

charge 96,897 56,399

Finance costs - 9,986

Finance income (9,654) (72)

------------ -----------

(1,136,688) (377,871)

(Increase)/decrease in trade

and other receivables (56,674) 49,813

Increase/(decrease) in trade

and other payables 283,489 70,841

------------ -----------

Cash used in operations (909,873) (257,217)

============ ===========

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SSAFMEFWSEII

(END) Dow Jones Newswires

May 03, 2017 02:00 ET (06:00 GMT)

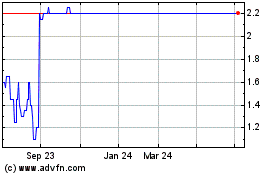

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Apr 2023 to Apr 2024