Origo Partners PLC Dispute Resolution and Proposed Restructuring (4691A)

September 29 2015 - 2:01AM

UK Regulatory

TIDMOPP

RNS Number : 4691A

Origo Partners PLC

29 September 2015

29 September 2015

Origo Partners PLC

("Origo" or the "Company")

Dispute Resolution and Proposed Restructuring

In November 2014, Origo shareholders approved a revised

investing policy, under which the Company is now, through an

orderly realisation programme, seeking to divest its entire

portfolio over a period of no longer than 4 years at such time and

under such conditions as the independent directors of Origo may

determine in order to maximise value on behalf of the Company's

shareholders.

Shareholders will also be aware that the Company's articles of

association (the "Articles") include the requirement for the

Company to undertake a US$12 million convertible zero dividend

preference share ("CZDP") tender offer by 8 March 2016.

Whilst the Company remains confident of the delivery of the

objectives of its investing policy, the continuing uncertainty in

relation to the Chinese economy and depressed commodity markets

have meant that realisations of the Company's assets at attractive

valuations have been challenging in the short term. It is therefore

possible that the Company might not be in a position to redeem

US$12 million of CZDPs by March 2016.

The Company has therefore worked with the main CZDP shareholders

to form a set of proposals which would restructure the CZDPs and

would provide Origo with greater flexibility to implement its

orderly realisation strategy - with a view to maximising value on

behalf of Origo's shareholders. The key elements of the proposals

are expected to include the following:

-- The removal of the requirement for the Company to undertake a

US$12 million CZDP tender offer by 8 March 2016;

-- The accreted principal amount per CZDP be reset to US$1.28.

In the event that aggregate distributions equal to the aggregate

CZDP accreted principal amount (US$1.28 per CZDP) have not been

made to the holders of the CZDPs ("CZDP Shareholders") by 31

December 2017, the remaining aggregate undistributed accreted

principal amount shall increase at an accrued rate of return of 5%

p.a. from 1 January 2018 and at an accrued rate of return of 10%

p.a. from 1 January 2019 until repaid through distributions to CZDP

Shareholders;

-- Origo's ordinary shareholders ("Ordinary Shareholders") to receive a proportion of all future distributions alongside CZDP Shareholders, pro rata as follows:

- in respect of the first US$40 million of distributions, 87.5%

to CZDP Shareholders and 12.5% to Ordinary Shareholders;

- in respect of the next US$40 million of distributions, 70% to

CZDP Shareholders and 30% to Ordinary Shareholders;

- in respect of distributions in excess of US$80 million:

o until such time as distributions equal to the accreted capital

amount have been made to the CZDP Shareholders, 30% to CZDP

Shareholders and 70% to Ordinary Shareholders; and

o thereafter, 100% to Ordinary Shareholders.

-- The Articles be amended to remove the mandatory CZDP conversion clause; and

-- The settlement of the dispute with Brooks Macdonald Group plc ("BM").

In addition, an additional independent non-executive director of

Origo, acceptable to BM, will be identified and appointed to the

board of directors of Origo.

The Proposals remain subject to the negotiation of appropriate

agreements and amendments to Origo's articles of association and

approval at a general meeting of Origo and separate class meetings

of the CZDP Shareholders and of the Ordinary Shareholders.

The directors of the Company believe that that the proposed

settlement of the dispute and restructuring will benefit the

Company and all of its shareholders. The Company is in the process

of finalising a set of detailed proposals, which will be put to

Origo's shareholders as soon as is practicable.

Further announcements will be made in this regard in due

course.

For further information about Origo please visit

www.origoplc.com or contact:

Origo Partners plc niklas@origoplc.com

Niklas Ponnert

Nominated Adviser

Smith & Williamson Corporate Finance

Limited

Azhic Basirov

Ben Jeynes +44 (0)20 7131 4000

Public Relations

Aura Financial

Andy Mills +44 (0)20 7321 0000

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEDFAAFISEDU

(END) Dow Jones Newswires

September 29, 2015 02:01 ET (06:01 GMT)

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

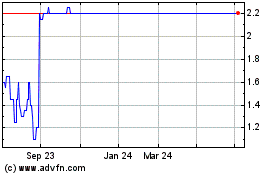

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Apr 2023 to Apr 2024