Oracle Sells $14 Billion in Bonds as Investment Grade Weathers Brexit

June 29 2016 - 4:50PM

Dow Jones News

Oracle Corp. sold $14 billion of bonds Wednesday, underscoring

the strength of the investment-grade corporate bond market in the

aftermath of the U.K.'s vote to leave the European Union last

week.

Split among five tranches, the offering from the Redwood City,

Calif., maker of business software is the third-largest bond deal

of the year, behind Anheuser-Busch InBev NV's $46 billion issuance

in January and Dell Inc.'s $20 billion placement last month. It

comes a day after Molson Coors Brewing Co. broke an unusual

four-day drought of new issuance by selling $5.3 billion of new

bonds.

Although bankers were hesitant to test investors immediately

before or after the Brexit vote, the sales show the resilience of

demand for high-quality bonds, which offer investors a relatively

safe place to put their money while offering a little more yield

than U.S. government bonds.

Pulled down by falling Treasury yields, the average yield of

investment-grade corporate bonds was 2.9% at the end of Tuesday,

down from 3.03% last Thursday before the Brexit vote was tallied,

according to Barclays PLC data. Over the same period, the yield the

benchmark 10-year Treasury note fell to 1.463% from 1.741%.

Bond yields fall when their prices rise.

Oracle's bond offering included a $3 billion, 10-year note

priced to yield 1.2 percentage points above Treasurys. Proceeds

from the offering are earmarked for general corporate purposes,

which could include share repurchases and future acquisitions,

according to SEC filings.

Express Scripts Holding Co. and General Motors Financial Company

Inc., a subsidiary of General Motors Co., were also poised to price

substantial bond deals Wednesday. Express Scripts is selling $4

billion of new bonds, while General Motors is issuing $2 billion of

bonds, according to LCD, a unit of S&P Global Market

Intelligence.

The new issue market for junk-rated corporate bonds, on the

other hand, has yet to pick up since the Brexit vote. That

lower-rated debt is suffering from reduced demand for riskier

assets amid uncertainty over the global economy, investors and

analysts said.

No corporate junk bond has priced since June 20, when the

propane gas distributor AmeriGas Partners LP issued $1.35 billion

of new bonds, according to LCD.

The average yield of U.S. junk-rated bonds was 7.5% Tuesday, up

from 7.09% last Thursday, according to Barclays.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

June 29, 2016 16:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

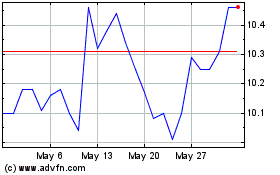

Pacific Current (ASX:PAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

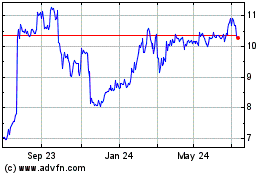

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2023 to Apr 2024