Transaction Enables On Assignment to Meet

Growing Demand for Professionals with Digital/Creative and IT

Skills

Acquisition Expected to be Accretive to On

Assignment EPS

Complementary End Markets Create New

Opportunities for Growth

On Assignment, Inc. (NYSE: ASGN), a leading global provider of

diversified professional staffing solutions, announced today that

it has signed a definitive agreement to acquire privately-held

Creative Circle, LLC for $570 million in cash and equity, and up to

an additional $30 million based on future operating performance.

With the addition of Creative Circle, On Assignment will be able to

provide broader staffing services that support its clients as they

transform their business models and marketing demands towards

digital enterprises. The acquisition is expected to be immediately

accretive to On Assignment’s GAAP earnings per share and adjusted

earnings per share (without any synergy savings) in 2015.

Creative Circle is one of the largest digital/creative staffing

firms in North America and provides digital, marketing,

advertising, and creative talent to both creative agencies and

marketing departments of leading companies. Creative Circle has

achieved a three- year compounded annual growth rate of 26% since

2011. In 2014, the company had approximately $226 million in

revenues with an EBITDA margin of approximately 21%. Creative

Circle expects to achieve double-digit top line growth in 2015.

“Technology has accelerated digital innovation and the way

consumers access content. As such, our clients are faced with the

need to remain competitive by transforming their business models to

effectively respond to consumer demand for digital information and

services on a real time basis,” said Peter T. Dameris, On

Assignment’s President and Chief Executive Officer. “By working

together, we can do more for our clients to accelerate their

transformation to a digital platform by providing our respective

clients with a more complete solution in the technology and

digital/creative space.

“Our two companies share a common goal of putting people to work

in challenging roles and the timing could not be better as the

lines between IT and marketing departments are starting to converge

as consumers demand real time content from any device anywhere in

the world.

“On Assignment's strength in technology staffing combined with

Creative Circle’s expertise in the digital/creative space will

allow us to engage the CMO along with the CIO to provide solutions

that meet the increasing needs of both groups while driving greater

demand for our traditional services.”

Creative Circle will become a division of On Assignment and

continue to operate under the Creative Circle brand name. The

current leadership team will continue to oversee the day-to-day

operations of the business.

“On Assignment is one of the more innovative and competitive

companies within the professional staffing space,” said Lawrence

Serf, Creative Circle’s Chief Executive Officer. “Like On

Assignment, Creative Circle provides its clients with the highest

quality solutions to staffing challenges and offers professionals

unparalleled employment opportunities in their chosen field. We are

excited to be an important part of On Assignment’s ongoing

growth.”

“On Assignment and Creative Circle share a very similar culture

and vision,” said Dennis Masel, Creative Circle’s Chief Operating

Officer. “As we analyzed how best to continue to grow our company,

joining On Assignment quickly became the logical choice.”

The transaction will expand On Assignment’s consolidated gross

and EBITDA margins. On a pro forma basis, 2014 revenues and EBITDA

margin were $2 billion and 12.4% respectively.

Dameris concluded, “Additionally, this acquisition brings us

closer to achieving our $3 billion target in annual revenues by

2018.”

Transaction Details

Under terms of the definitive agreement, On Assignment will

acquire all of Creative Circle’s equity for consideration of $570

million to be paid at closing, plus additional consideration of up

to $30 million if certain performance targets for 2015 are

achieved. The consideration at closing is comprised of $540 million

in cash and $30 million of common stock.

In connection with the transaction, On Assignment has obtained a

secured financing commitment for $975 million from Wells Fargo

Bank, National Association. The new credit facility consists of a

$100 million revolving credit facility (undrawn at close) and an

$875 million term loan. The proceeds of the term B loan will be

used to finance the cash portion of the purchase price and

refinance existing On Assignment debt. Upon closing of the

transaction, funded debt of the combined company is expected to

total approximately 3.7x estimated pro forma adjusted EBITDA for

the twelve months ended June 30, 2015.

For income tax reporting purposes, the acquisition will be

treated as an asset purchase rather than a stock purchase.

Consequently, the Company’s tax basis in the net assets acquired

will equal the purchase consideration, resulting in an annual cash

income tax savings of approximately $14 million over the next 15

years from the amortization of intangible assets.

On Assignment expects its increased scale, along with strong

revenue and free cash flow generation, to result in rapid

deleveraging, creating further equity value. In connection with the

acquisition, On Assignment intends to make grants of restricted

stock units to certain employees of Creative Circle as employment

inducement awards pursuant to the NYSE rules.

The acquisition remains subject to regulatory approvals and

customary closing conditions. The transaction is expected to close

before the end of the second quarter.

Financial Estimates for the Second Half of 2015

On Assignment is providing estimates of its operating results

from continuing operations for the second half of 2015, which

assume no significant deterioration in the staffing markets that On

Assignment serves. These estimates do not include any (i)

acquisition, integration or strategic planning expenses or (ii)

write-off of deferred loan costs on the current credit facility

that will be replaced by the previously discussed new credit

facility.

- Revenues of $1.087 billion to $1.103

billion

- Gross margin of 33.6 percent to 34.0

percent

- SG&A expense (excludes amortization

of intangible assets) of $245.5 million to $251.0 million (includes

$8.4 million in depreciation and $10.0 million in equity-based

compensation expense)

- Amortization of intangible assets of

$22.5 million

- Adjusted EBITDA of $138.0 million to

$142.1 million

- Effective tax rate of 40.0 percent

- Interest expense of $20.6 million

(includes $1.6 million of non-cash amortization of deferred loan

costs)

- Adjusted income from continuing

operations of $80.7 million to $83.2 million

- Adjusted income from continuing

operations per diluted share of $1.53 to $1.57

- Income from continuing operations of

$45.9 million to $48.4 million

- Income from continuing operations per

diluted share of $0.87 to $0.92

- Diluted shares outstanding of 52.8

million

The above estimates assume billable days of 123.6 for the second

half of the year, which are 2.0 days more than the first half of

the year and 1.5 fewer days than the second half of 2014. The

estimates also assume a foreign currency exchange rate of 1.08 (US

dollar to the EURO).

The mid-point of the revenue range above implies year-over-year

pro forma growth of 8.4 percent (9.2 percent on a constant currency

basis). The revenue estimates assume mid-to-high single-digit

growth for Apex and Oxford, and a year-over-year decline for Life

Sciences Europe (flat on a constant currency basis). The estimates

assume Creative Circle will generate revenues of $138.9 million to

$151.7 million in the second half of 2015 (year-over-year growth of

15.2% to 25.8%).

Legal and Financial Advisors

On Assignment retained Sullivan & Cromwell LLP as legal

counsel on the transaction, Latham & Watkins LLP as legal

counsel on the secured financing commitment and Moelis &

Company as exclusive financial advisor. Creative Circle retained

Debevoise & Plimpton LLP as legal counsel and Wells Fargo

Securities as exclusive financial advisor.

Conference Call

On Assignment will hold a conference call with analysts and

stockholders today at 8:30 a.m. EDT. The dial-in number is

(888) 254-2817 ((913) 312-0376 for callers outside the United

States), and the conference ID number is 359694. Participants

should dial in ten minutes before the call. A replay of the

conference call will be available beginning today at 11:30

a.m. EDT and ending at midnight EDT on May 25,

2015. The access number for the replay is (800) 475-6701 ((320)

365-3844 for callers outside the United States), and the

conference ID number 359694.

This call is being webcast by Thomson/CCBN and can be

accessed via On Assignment’s web site

at www.onassignment.com. Individual investors can also listen

at Thomson/CCBN’s site at www.fulldisclosure.com or

by visiting any of the investor sites in Thomson/CCBN’s

Individual Investor Network. We have also posted on our website a

presentation regarding this transaction.

About Creative Circle

Founded in 2002, Creative Circle is one of the largest creative

staffing agencies in North America, providing digital, marketing,

advertising, and creative talent to a wide range of companies.

Creative Circle has developed a business model that enables it to

attract and place high-level talent on demand. The collaborative,

team-based approach between account executives and recruiters

include a diligent screening process of all candidates to ensure

the right fit for each and every placement.

About On Assignment

On Assignment, Inc. is a leading global provider of

in-demand, skilled professionals in the growing technology and life

sciences sectors, where quality people are the key to

success. The Company goes beyond matching résumés with

job descriptions to match people they know into positions they

understand for temporary, contract-to-hire, and direct hire

assignments. Clients recognize On Assignment for its

quality candidates, quick response, and successful assignments.

Professionals think of On Assignment as career-building

partners with the depth and breadth of experience to help them

reach their goals.

On Assignment, which is based in Calabasas,

California, was founded in 1985 and went public in 1992. The

Company has a network of branch offices throughout the United

States, Canada, United

Kingdom, Netherlands, Ireland, Belgium, Spain,

and Switzerland. To learn more,

visit http://www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial

Measures

Statements in this release may include non-GAAP financial

measures. Such information is provided as additional information,

not as an alternative to our consolidated financial statements

presented in accordance with Generally Accepted Accounting

Principles in the United States ("GAAP"). Such measures also are

used to determine a portion of the compensation for some of our

executives and employees. We believe the non-GAAP financial

measures provide useful information to management, investors and

prospective investors by excluding certain charges and other

amounts that we believe are not indicative of our core operating

results. These non-GAAP measures are included to provide

management, our investors and prospective investors with an

alternative method for assessing our operating results in a manner

that is focused on the performance of our ongoing operations and to

provide a more consistent basis for comparison between quarters.

One of the non-GAAP financial measures presented is EBITDA

(earnings before interest, taxes, depreciation, and amortization of

intangible assets), other terms include Adjusted EBITDA (EBITDA

plus equity-based compensation expense, impairment charges,

write-off of loan costs, and acquisition, integration and strategic

planning expenses) and Non-GAAP income from continuing operations

(Income from continuing operations, plus write-off of loan costs,

and acquisition, integration and strategic planning expenses, net

of tax) and Adjusted income from continuing operations and related

per share amounts. These terms might not be calculated in the same

manner as, and thus might not be comparable to, similarly titled

measures reported by other companies.

Safe Harbor

Certain statements made in this news release are

“forward-looking statements” within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended, and involve a

high degree of risk and uncertainty. Forward-looking statements

include statements regarding the Company's anticipated financial

and operating performance in 2015, the expected timing of the

closing of the transaction and other statements regarding the

expected performance of On Assignment and of the combined company.

All statements in this release, other than those setting forth

strictly historical information, are forward-looking statements.

Forward-looking statements are not guarantees of future

performance, and actual results might differ materially. In

particular, the Company makes no assurances that the estimates of

revenues, gross margin, SG&A, Adjusted EBITDA, income from

continuing operations, adjusted income from continuing operations,

earnings per share or earnings per diluted share set forth above

will be achieved. Factors that could cause or contribute to such

differences include actual demand for our services, our ability to

attract, train and retain qualified staffing consultants, our

ability to remain competitive in obtaining and retaining clients,

the availability of qualified temporary professionals, management

of our growth, continued performance of our enterprise-wide

information systems, our ability to manage our potential or actual

litigation matters, the successful integration of our recently

acquired subsidiaries, the successful implementation of our

five-year strategic plan, and other risks detailed from time to

time in our reports filed with the Securities and Exchange

Commission ("SEC"), including our Annual Report on Form 10-K

for the year ended December 31, 2014, as filed with

the SEC on March 2, 2015. We specifically disclaim

any intention or duty to update any forward-looking statements

contained in this news release.

Media Inquiries:Muirfield PartnersMickey MandelbaumMaya

Pogoda(310) 785-0810orInvestor Inquiries:On Assignment, Inc.Ed

PierceChief Financial Officer(818) 878-7900

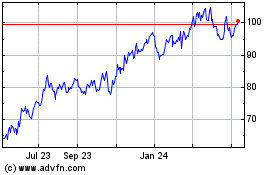

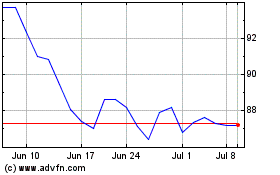

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024