Revenues Were within Our Estimates

Earnings & Adjusted EBITDA (a non-GAAP

measure) Exceeded Our Estimates

On Assignment, Inc. (NYSE: ASGN), a leading global provider of

diversified professional staffing solutions, today reported results

for the quarter ended September 30, 2017.

Third Quarter Highlights

- Revenues were $667.1 million, up 6.0

percent over the third quarter of 2016 (up 6.6 percent on a same

"Billable Days" and "Constant Currency" basis).

- Net income was $34.9 million ($0.66 per

diluted share), up from $29.8 million ($0.55 per diluted share) in

the third quarter of 2016.

- Adjusted EBITDA (a non-GAAP measure)

was $83.4 million (12.5 percent of revenues), up from $77.8 million

(12.4 percent of revenues) in the third quarter of 2016.

- Acquired StratAcuity Staffing Partners,

Inc. ("StratAcuity"), a life sciences staffing firm, for $25.9

million, and its operating results are included in the Apex Segment

from the date of its acquisition (August 8, 2017). StratAcuity

contributed approximately $3.0 million in revenues during the

quarter.

- Repurchased 999,618 shares for $47.9

million during the quarter, at an average per share price of

$47.90.

- Since our $150 million repurchase

authorization began in June 2016, we have purchased approximately

2.4 million shares for $101.2 million, at an average per share

price of $42.81.

- Leverage ratio (a non-GAAP measure) was

2.08 to 1 at September 30, 2017, up from 2.04 to 1 at June 30,

2017. Subsequent to the end of the quarter, we paid down our debt

by an additional $14.0 million.

- Amended credit facility resulting in a

25 basis point reduction in the interest rate.

Commenting on the results, Peter Dameris, Chief Executive

Officer of On Assignment, said: “Our financial results reflect a

marketplace that continues to embrace our delivery/development

model and each of our divisions performed in line with our

expectations for the quarter. The progress we made in the second

quarter of 2017, in improving the overall financial performance of

the Oxford Segment, continued into the third quarter.”

Third Quarter 2017 Financial Results

Revenues for the quarter were $667.1 million, up 6.0 percent

year-over-year (6.6 percent on a "Same Billable Days" and "Constant

Currency" basis, non-GAAP measures). Revenues for the quarter were

adversely affected by approximately $1.0 million from the

hurricanes and related flooding in Texas and Florida and included

$3.0 million from our StratAcuity acquisition. Our largest segment,

Apex, accounted for 77.6 percent of total revenues and grew 9.3

percent year-over-year. Our Oxford Segment accounted for 22.4

percent of total revenues and was down 4.0 percent

year-over-year.

Gross profit was $218.3 million, up $11.2 million or 5.4 percent

year-over-year. Gross margin for the quarter was 32.7 percent, down

from 32.9 percent in the third quarter of 2016. The compression in

gross margin was primarily the result of a lower mix of permanent

placement revenues (4.9 percent of revenues in the current quarter,

down from 5.2 percent in the third quarter of 2016).

Selling, general and administrative (“SG&A”) expenses were

$149.2 million (22.4 percent of revenues) and included $0.8 million

SG&A expenses from StratAcuity, compared with $142.0 million

(22.6 percent of revenues) in the third quarter of 2016. SG&A

expenses for the quarter included acquisition, integration and

strategic planning expenses of $1.5 million, compared with $0.7

million in the third quarter of 2016.

Amortization of intangible assets was $8.2 million, down from

$9.7 million in the third quarter of 2016. The decrease was due to

the accelerated amortization method for certain acquired

intangibles, which have higher amortization rates at the beginning

of their useful life. Amortization of StratAcuity intangible assets

was $0.2 million.

Interest expense for the quarter was $7.1 million compared with

$8.3 million in the third quarter of 2016. Interest expense for the

quarter was comprised of (i) $5.4 million of interest on the credit

facility, (ii) $0.9 million of amortization of deferred loan costs

and (iii) $0.8 million of costs related to the two amendments to

our credit facility during the quarter. These amendments resulted

in a 25 basis point reduction in the interest rate of our credit

facility. The decrease in interest expense reflected a lower debt

balance and a lower interest rate as a result of the amendments to

our credit facility.

The effective tax rate for the quarter was 35.1 percent, down

from 37.8 percent in the second quarter of 2017. The sequential

improvement primarily related to a change in our estimate for

hiring-related tax credits. The provision for the quarter also

benefited from $0.4 million in excess tax benefits related to

stock-based compensation (prior to 2017, these benefits were

accounted for as an adjustment to stockholders' equity).

Net income was $34.9 million ($0.66 per diluted share), up from

$29.8 million ($0.55 per diluted share) in the third quarter of

2016. Adjusted EBITDA (a non-GAAP measure) was $83.4 million, or

12.5 percent of revenues, up from $77.8 million (12.4 percent of

revenues) in the third quarter of 2016.

Cash flows from operating activities were $53.7 million and free

cash flow (a non-GAAP measure) was $48.9 million. At September 30,

2017, our leverage ratio (a non-GAAP measure) was 2.08 to 1, up

from 2.04 to 1 at June 30, 2017.

Financial Estimates for Q4 2017

On Assignment is providing financial estimates for the fourth

quarter of 2017. These estimates do not include acquisition,

integration or strategic planning expenses and assume no

deterioration in the staffing markets that On Assignment serves.

These estimates also assume no significant change in foreign

exchange rates. Reconciliations of estimated net income to the

estimated non-GAAP measures are presented herein.

- Revenues of $658.0 million to $668.0

million

- Gross margin of 32.5 percent to 32.7

percent

- SG&A expense (excludes amortization

of intangible assets) of $149.0 million to $150.5 million (includes

$6.6 million in depreciation and $5.9 million in stock-based

compensation expense)

- Amortization of intangible assets of

$8.4 million

- Effective tax rate of 38.5

percent(1)

- Net income of $30.9 million to $32.7

million

- Earnings per diluted share of $0.59 to

$0.62

- Diluted shares outstanding of 52.5

million

- Adjusted EBITDA (a non-GAAP measure) of

$77.5 million to $80.5 million

- Adjusted Net Income(2) (a non-GAAP

measure) of $38.9 million to $40.6 million

- Adjusted Net Income per diluted

share(2) (a non-GAAP measure) of $0.74 to $0.77

(1) Does not

include excess tax benefits related to stock-based compensation.

Effective January 1, 2017, these tax benefits (the tax effect of

the difference between book and tax expense for stock-based

compensation) are included in the determination of the provision

for income taxes. Prior to the accounting rule change, these

benefits were recorded as an adjustment to stockholders' equity.

(2) Does not include the “Cash Tax Savings on Indefinite-lived

Intangible Assets.” These savings total $6.7 million each quarter,

or $0.13 per diluted share, and represent the economic value of the

tax deduction that we receive from the amortization of goodwill and

trademarks.

Our financial estimates above assume a $5.0 million revenue

contribution from StratAcuity and were based on our estimate of

“Billable Days,” which are Business Days (calendar days for the

period less weekends and holidays) adjusted for other factors, such

as the day of the week a holiday occurs, additional time taken off

around holidays, year-end client furloughs and inclement weather.

For the fourth quarter, we estimate billable days of 60.0, which is

0.2 fewer than the fourth quarter of 2016 and 2.6 fewer than the

third quarter of 2017. Each "Billable Day" is approximately $11.0

million in revenues. On a same "Billable Days" basis, our implied

year-over-year revenue growth rate for the fourth quarter ranges

from 6.3 to 7.9 percent (5.5 to 7.1 percent excluding the

contribution from StratAcuity) and our sequential growth rate

ranges from 2.9 to 4.4 percent (2.6 to 4.1 percent excluding the

contribution from StratAcuity).

Conference Call

On Assignment will hold a conference call today at 5:00 p.m. EDT

to review its financial results for the third quarter. The dial-in

number is 800-288-8975 (+1-612-332-0932 for callers outside the

United States) and the conference ID number is 431498. Participants

should dial in ten minutes before the call. The prepared remarks

and supplemental materials for this call will be available via On

Assignment's web site at www.onassignment.com. This call is being webcast

by CCBN and can be accessed at www.onassignment.com. Individual investors can

also listen at CCBN's site at www.fulldisclosure.com or by visiting any of the

investor sites in CCBN's Individual Investor Network.

A replay of the conference call will be available beginning

Wednesday, October 25, 2017, at 7:00 p.m. EDT until midnight on

Wednesday, November 8, 2017. The access number for the replay is

800-475-6701 (+1-320-365-3844 outside the United States) and the

conference ID number is 431498.

About On Assignment

On Assignment, Inc. is a leading global provider of highly

skilled, hard-to-find professionals in the growing technology, life

sciences, and creative sectors, where quality people are the key to

success. The Company goes beyond matching résumés with job

descriptions to match people they know into positions they

understand for temporary, contract-to-hire, and direct hire

assignments. Clients recognize On Assignment for its quality

candidates, quick response, and successful assignments.

Professionals think of On Assignment as career-building partners

with the depth and breadth of experience to help them reach their

goals. The Company has a network of branch offices

throughout the United States, Canada and Europe. To

learn more, visit http://www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial

Measures

Statements in this release and the accompanying financial

information include non-GAAP financial measures. Such information

is provided as additional information, not as an alternative to our

consolidated financial statements presented in accordance with

accounting principles generally accepted in the United States

("GAAP"), and is intended to enhance an overall understanding of

our current financial performance. These terms might not be

calculated in the same manner as, and thus might not be comparable

to, similarly titled measures reported by other companies. The

financial statement tables that accompany this press release

include a reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP financial measure. Below is a

discussion of our non-GAAP financial measures.

EBITDA (earnings before interest, taxes, depreciation and

amortization of intangible assets) and Adjusted EBITDA (EBITDA plus

stock-based compensation expense and, as applicable, write-off of

loan costs, acquisition, integration and strategic planning

expenses, and impairment charges) are used to determine a portion

of the compensation for some of our executives and employees.

Stock-based compensation expense is added to arrive at Adjusted

EBITDA because it is a non-cash expense. Write-off of loan costs,

acquisition, integration and strategic planning expenses, and

impairment charges are added, as applicable, to arrive at Adjusted

EBITDA as they are not indicative of the performance of our core

business on an ongoing basis.

Non-GAAP net income (net income, less income (loss) from

discontinued operations, net of tax, plus, as applicable,

refinancing costs, acquisition, integration and strategic planning

expenses, accretion of fair value discount on contingent

consideration, impairment charges, and the tax effect of these

items) provides a method for assessing our operating results in a

manner that is focused on the performance of our core business on

an ongoing basis. Adjusted Net Income (Non-GAAP net income plus

amortization of intangible assets, less income taxes on

amortization for financial reporting purposes not deductible for

income tax purposes) provides a method for assessing our operating

results in a manner that is focused on the performance of our core

business on an ongoing basis, adjusted for some of the cash flows

associated with amortization of intangible assets to more fully

present the performance of our acquisitions.

Constant currency information removes the effect of

year-over-year changes in foreign currency exchange rates. Constant

currency information is calculated using the foreign currency

exchange rates from the same period in the prior year.

Billable Days are Business Days (calendar days for the period

less weekends and holidays) adjusted for other factors, such as the

day of the week a holiday occurs, additional time taken off around

holidays, year-end client furloughs and inclement weather. In order

to remove the fluctuations caused by comparable periods having

different billable days, revenues on a Same Billable Days basis are

calculated by taking the current period average revenue per

billable day, multiplied by the number of billable days from the

same period in the prior year.

The term Same Billable Days and Constant Currency basis means

that the impact of year-over-year changes in foreign currency

exchange rates has been removed from Same Billable Days basis

calculation.

Free cash flow is defined as net cash provided by (used in)

operating activities, less capital expenditures. Management

believes this provides useful information to investors about the

amount of cash generated by the business that can be used for

strategic opportunities. Our leverage ratio provides information

about our compliance with loan covenants and is calculated in

accordance with our credit agreement, as filed with the Securities

and Exchange Commission (“SEC”), by dividing our total indebtedness

by trailing 12 months Adjusted EBITDA.

Reasons for Presentation of Operating Metrics

Operating metrics are intended to enhance the overall

understanding of our business and our current financial

performance. These operating metrics might not be calculated in the

same manner as, and thus might not be comparable to, similarly

titled metrics reported by other companies. The operating metrics

presented on this release are calculated as follows: average number

of staffing consultants are full time equivalent staffing

consultant headcount in the quarter; average number of contract

professionals and average number of customers are the number of

contract professionals employed each week and the number of

customers served each week, averaged for the quarter, respectively

(average is weighted by total number of hours billed per week); top

10 customers as a percentage of revenue are the 10 largest clients

defined by the revenue generated in the quarter, divided by total

revenues in the quarter; gross profit per staffing consultant is

gross profit for the quarter divided by the average number of

staffing consultants; average bill rate is total assignment revenue

client billings in the quarter divided by total hours billed in the

quarter.

Safe Harbor

Certain statements made in this news release

are “forward-looking statements” within the meaning of

Section 21E of the Securities Exchange Act of 1934, as

amended, and involve a high degree of risk and uncertainty.

Forward-looking statements include statements regarding the

Company's anticipated financial and operating performance. All

statements in this release, other than those setting forth strictly

historical information, are forward-looking statements.

Forward-looking statements are not guarantees of future

performance, and actual results might differ materially. In

particular, the Company makes no assurances that the estimates of

revenues, gross margin, SG&A, amortization, effective tax rate,

net income, diluted shares outstanding, Adjusted EBITDA, Adjusted

Net Income and related per share amounts (as applicable) set forth

above will be achieved. Factors that could cause or contribute to

such differences include actual demand for our services, our

ability to attract, train and retain qualified staffing

consultants, our ability to remain competitive in obtaining and

retaining clients, the availability of qualified contract

professionals, management of our growth, continued performance and

improvement of our enterprise-wide information systems, our ability

to manage our litigation matters, the successful integration of our

acquired subsidiaries, the successful implementation of our

five-year strategic plan, and other risks detailed from time to

time in our reports filed with the SEC, including our Annual Report

on Form 10-K for the year ended December 31, 2016, as filed with

the SEC on March 1, 2017, and our Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2017 and June 30, 2017, as filed

with the SEC on May 10, 2017 and August 7, 2017, respectively. We

specifically disclaim any intention or duty to update any

forward-looking statements contained in this news release.

SUMMARY CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)

(In thousands, except per share

amounts)

Three Months Ended Nine Months Ended September 30,

June 30, September 30, 2017 2016

2017 2017 2016 Revenues $ 667,048 $

629,401 $ 653,313 $ 1,946,889 $ 1,819,529 Costs of services 448,733

422,281 440,376 1,317,493 1,222,541

Gross profit 218,315 207,120 212,937 629,396 596,988

Selling, general and administrative expenses 149,197 141,968

145,177 440,446 423,199 Amortization of intangible assets 8,248

9,742 8,299 25,011 29,918

Operating income 60,870 55,410 59,461 163,939 143,871 Interest

expense (7,099 ) (8,294 ) (6,067 ) (21,667 ) (25,278 ) Income

before income taxes 53,771 47,116 53,394 142,272 118,593 Provision

for income taxes 18,892 17,341 20,158 51,775

45,457 Income from continuing operations 34,879

29,775 33,236 90,497 73,136

Income (loss) from discontinued

operations, net of tax

(23 ) (7 ) (139 ) (153 ) 37 Net income $ 34,856 $

29,768 $ 33,097 $ 90,344 $ 73,173

Basic earnings per common share: Income from continuing

operations $ 0.66 $ 0.56 $ 0.63 $ 1.72 $ 1.37 Income from

discontinued operations — — — — —

$ 0.66 $ 0.56 $ 0.63 $ 1.72 $

1.37 Diluted earnings per common share: Income from

continuing operations $ 0.66 $ 0.55 $ 0.62 $ 1.70 $ 1.36 Income

from discontinued operations — — — — —

$ 0.66 $ 0.55 $ 0.62 $ 1.70 $

1.36

Number of shares and share equivalents

used to calculate earnings per share:

Basic 52,500 53,275 52,823 52,660

53,281 Diluted 53,173 53,768 53,473

53,319 53,787

SEGMENT FINANCIAL INFORMATION

(Unaudited)

FOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2017 AND 2016

(Dollars in millions)

Three Months Ended Nine Months Ended 2017

2016 Year-Over-Year

Growth Rates

2017 2016 Year-Over-Year

Growth Rates

Revenues by segment: Apex: Assignment $ 506.4 $ 462.0 9.6 % $

1,469.0 $ 1,325.5 10.8 % Permanent placement 11.1 11.6

(3.4 )% 33.5 34.9 (4.1 )% 517.5 473.6 9.3 %

1,502.5 1,360.4 10.4 % Oxford: Assignment 128.0 134.4 (4.8 )% 379.9

394.8 (3.8 )% Permanent placement 21.6 21.4 0.6 %

64.5 64.3 0.3 % 149.6 155.8 (4.0 )% 444.4 459.1 (3.2

)% Consolidated: Assignment 634.4 596.4 6.4 % 1,848.9 1,720.3 7.5 %

Permanent placement 32.7 33.0 (0.8 )% 98.0

99.2 (1.2 )% $ 667.1 $ 629.4 6.0 % $ 1,946.9

$ 1,819.5 7.0 % Percentage of total revenues: Apex

77.6 % 75.2 % 77.2 % 74.8 % Oxford 22.4 % 24.8 % 22.8 % 25.2 %

100.0 % 100.0 % 100.0 % 100.0 % Assignment 95.1 % 94.8 %

95.0 % 94.5 % Permanent placement 4.9 % 5.2 % 5.0 % 5.5 % 100.0 %

100.0 % 100.0 % 100.0 % Domestic 94.8 % 95.3 % 95.0 % 95.2 %

Foreign 5.2 % 4.7 % 5.0 % 4.8 % 100.0 % 100.0 % 100.0 % 100.0 %

Gross profit: Apex $ 155.7 $ 143.7 8.4 % $ 445.9 $ 408.0 9.3 %

Oxford 62.6 63.4 (1.4 )% 183.5 189.0

(2.9 )% Consolidated $ 218.3 $ 207.1 5.4 % $ 629.4

$ 597.0 5.4 % Gross margin: Apex 30.1 % 30.3 % 29.7 %

30.0 % Oxford 41.8 % 40.7 % 41.3 % 41.2 % Consolidated 32.7 % 32.9

% 32.3 % 32.8 %

SELECTED CASH FLOW INFORMATION

(Unaudited)

FOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2017 AND 2016

(In thousands)

Three Months Ended Nine Months Ended 2017

2016 2017 2016 Cash provided by

operating activities(1) $ 53,683 $ 42,783 $ 137,276 $ 142,907

Capital expenditures (4,830 ) (6,642 ) (18,038 ) (20,551 ) Free

cash flow (non-GAAP measure) $ 48,853 $ 36,141 $

119,238 $ 122,356 Cash used in investing

activities(2) $ (29,599 ) $ (7,079 ) $ (42,955 ) $ (15,338 ) Cash

used in financing activities(1) $ (15,525 ) $ (53,737 ) $ (94,817 )

$ (134,683 ) (1) On January 1, 2017, we

adopted Accounting Standards Update 2016-09 Compensation - Stock

Compensation (Topic 718). Under this new guidance excess tax

benefits and deficiencies are recognized as income tax benefit or

expense in the consolidated statements of operations and

comprehensive income, instead of paid in capital, on a prospective

basis from the date of adoption. On the statement of cash flows,

excess tax benefits and deficiencies are presented as cash flows

from operating activities, instead of financing activities. For the

statement of cash flows we elected to retrospectively adopt this

new presentation and for the three and nine months ended September

30, 2016, cash flows from excess tax benefits of $0.1 million, and

$2.6 million respectively were reclassified from financing

activities to operating activities. (2)

The three and nine months ended September

30, 2017, included cash used for the StratAcuity acquisition. The

nine months ended September 30, 2016, included $6.0 million in cash

provided by investing activities related to the release of cash

held in escrow from the sale of the Physician Segment.

SELECTED CONSOLIDATED BALANCE SHEET

DATA

AS OF SEPTEMBER 30, 2017 AND DECEMBER

31, 2016

(In thousands)

2017 2016 (Unaudited) Cash and cash equivalents $ 27,977 $

27,044 Accounts receivable, net 432,718 386,858 Total current

assets 485,754 437,524 Goodwill and intangible assets, net

1,254,916 1,251,243 Total assets 1,804,868 1,752,667 Total current

liabilities 189,196 162,499 Working capital 296,558 275,025

Long-term debt 609,997 640,355 Other long-term liabilities 80,697

80,874 Stockholders’ equity 924,978 868,939

RECONCILIATION OF NET INCOME TO EBITDA

(NON-GAAP MEASURE) AND

ADJUSTED EBITDA (NON-GAAP MEASURE)

(Unaudited)

FOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2017 AND 2016

(In thousands)

Three Months Ended Nine Months Ended 2017

2016 2017 2016 Net income $ 34,856 $

29,768 $ 90,344 $ 73,173

(Income) loss from discontinued

operations, net of tax

23 7 153 (37 ) Interest expense 7,099 8,294 21,667 25,278 Provision

for income taxes 18,892 17,341 51,775 45,457 Depreciation 6,403

5,598 18,482 16,253 Amortization of intangible assets 8,248

9,742 25,011 29,918 EBITDA (non-GAAP measure)

75,521 70,750 207,432 190,042 Stock-based compensation 6,382 6,345

17,943 19,803 Acquisition, integration and strategic planning

expenses 1,480 670 3,115 4,463 Adjusted

EBITDA (non-GAAP measure) $ 83,383 $ 77,765 $ 228,490

$ 214,308

RECONCILIATION OF NET INCOME TO

NON-GAAP NET INCOME AND

ADJUSTED NET INCOME (NON-GAAP

MEASURE) (Unaudited)

FOR THE THREE AND NINE MONTHS ENDED

SEPTEMBER 30, 2017 AND 2016

(In thousands, except per share

amounts)

Three Months Ended Nine Months Ended 2017

2016 2017 2016 Net income $ 34,856 $

29,768 $ 90,344 $ 73,173 (Income) loss from discontinued

operations, net of tax 23 7 153 (37 ) Refinancing costs(1) 804 889

2,728 889 Acquisition, integration and strategic planning expenses

1,480 670 3,115 4,463 Accretion of discount on contingent

consideration — — — 863 Tax effect on adjustments (891 ) (608 )

(2,279 ) (2,408 ) Non-GAAP net income 36,272 30,726 94,061 76,943

Amortization of intangible assets 8,248 9,742 25,011 29,918 Income

taxes on amortization for financial reporting purposes not

deductible for income tax purposes (405 ) (439 ) (1,217 ) (1,587 )

Adjusted Net Income (non-GAAP measure)(2) $ 44,115 $ 40,029

$ 117,855 $ 105,274 Per diluted share:

Net income $ 0.66 $ 0.55 $ 1.70 $ 1.36 Adjustments 0.17 0.19

0.51 0.60 Adjusted Net Income (non-GAAP

measure)(2) $ 0.83 $ 0.74 $ 2.21 $ 1.96

Weighted average common and common equivalent shares

outstanding (diluted) 53,173 53,768 53,319

53,787 (1) In February, August and

September 2017, we amended our credit facility and incurred $3.3

million in fees, of which $2.7 million were included in interest

expense and the remaining $0.6 million were capitalized and will be

amortized over the term of the credit facility. In August 2016, we

amended our credit facility and incurred $0.9 million in fees which

are included in interest expense for the third quarter of 2016. (2)

Does not include the “Cash Tax Savings on Indefinite-lived

Intangible Assets.” These savings total $6.7 million per quarter

(approximately $0.13 per diluted share) and represent the economic

value of the tax deduction that we receive from the amortization of

goodwill and trademarks.

OPERATING METRICS (Unaudited)

Apex Oxford Consolidated Average number of staffing

consultants: Q3 2017 1,567 925 2,492 Q2 2017 1,441 925 2,366 Q3

2016 1,402 1,001 2,403 Average number of customers: Q3 2017

3,530 1,048 4,578 Q2 2017 3,502 1,063 4,565 Q3 2016 3,530 1,057

4,587 Average number of contract professionals(1): Q3 2017

18,236 2,896 21,132 Q2 2017 17,525 2,818 20,343 Q3 2016 16,047

2,913 18,960 Top 10 customers as a percentage of revenues:

Q3 2017 26.7 % 11.3 % 20.9 % Q2 2017 26.9 % 10.1 % 21.1 % Q3 2016

25.3 % 15.6 % 19.2 % Average bill rate: Q3 2017 $ 58.16 $

100.78 $ 63.49 Q2 2017 $ 57.81 $ 100.14 $ 63.23 Q3 2016 $ 56.46 $

101.60 $ 62.45 Gross profit per staffing consultant: Q3 2017

$ 99,000 $ 68,000 $ 88,000 Q2 2017 $ 104,000 $ 68,000 $ 90,000 Q3

2016 $ 102,000 $ 63,000 $ 86,000 (1) Average

number of contract professionals placed on assignment each week

that are considered our employees; this number does not include

employees of our subcontractors.

FINANCIAL ESTIMATES FOR Q4 2017

RECONCILIATION OF ESTIMATED NET INCOME

TO ESTIMATED NON-GAAP MEASURES

(In millions, except per share data)

Low High Net income(1)(2) $ 30.9 $ 32.7 Interest expense 6.3

6.3 Provision for income taxes(2) 19.4 20.6 Depreciation 6.6 6.6

Amortization of intangible assets 8.4 8.4 EBITDA

(non-GAAP measure) 71.6 74.6 Stock-based compensation 5.9

5.9 Adjusted EBITDA (non-GAAP measure) $ 77.5 $ 80.5

Low High Net income(1)(2) $ 30.9 $ 32.7

Amortization of intangible assets 8.4 8.4 Income taxes on

amortization for financial reporting purposes not deductible for

income tax purposes (0.4 ) (0.4 ) Other — (0.1 ) Adjusted

Net Income (non-GAAP measure)(3) $ 38.9 $ 40.6

Per diluted share: Net income $ 0.59 $ 0.62 Adjustments 0.15

0.15 Adjusted Net Income (non-GAAP measure)(3) $ 0.74

$ 0.77 Weighted average common and common equivalent

shares outstanding (diluted) 52.5 52.5 (1)

These estimates do not include acquisition,

integration, or strategic planning expenses. (2) These estimates do

not include excess tax benefits related to stock-based

compensation. (3) Does not include the “Cash Tax Savings on

Indefinite-lived Intangible Assets.” These savings total $6.7

million per quarter ($0.13 per diluted share) and represent the

economic value of the tax deduction that we receive from the

amortization of goodwill and trademarks.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171025006307/en/

On Assignment, Inc.Ed PierceChief Financial

Officer818-878-7900

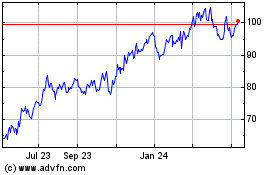

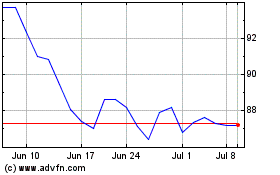

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024