Revenues, Adjusted EBITDA & Adjusted EPS

above Previously-announced Estimates

Completes $100 million Stock Repurchase

Program & Board Approves new $100 million Program

Closes Sale of Physician Segment

On Assignment, Inc. (NYSE: ASGN), a leading global provider of

diversified professional staffing solutions, today reported results

for the three months and year ended December 31, 2014.

Fourth Quarter Highlights

- Revenues were $475.8 million, up 12.5

percent year-over-year and 8.3 percent on a pro forma basis (pro

forma assumes the acquisitions of Whitaker Medical, LLC and

CyberCoders Holdings, Inc. in December 2013 had occurred at the

beginning of 2013).

- Adjusted income from continuing

operations (a non-GAAP measure defined below) was $31.4 million

($0.60 per diluted share).

- Income from continuing operations was

$21.8 million ($0.41 per diluted share). Income from continuing

operations included $1.8 million ($1.1 million net of tax, or $0.02

per diluted share) in acquisition, integration and strategic

planning expenses, which were not included in our previously

announced estimates.

- Adjusted EBITDA (a non-GAAP measure

defined below) was $54.7 million.

- Repurchased 1.0 million shares of

common stock at an average price of $30.50 per share during the

quarter and for the full year repurchased 3.4 million shares at an

average price of $29.78.

- On February 1, 2015, completed the sale

of the Physician Segment for $123.0 million (net proceeds of

approximately $102.0 to $105.0 million after income taxes and

transaction expenses).

- Leverage ratio (total indebtedness to

trailing 12 months Adjusted EBITDA) was 2.06 to 1 at December 31,

2014, unchanged from September 30, 2014 despite the stock

repurchases during the quarter.

- Closed European retained search unit in

December 2014. Consolidated results for all periods presented have

been restated to exclude operations of this unit from continuing

operations and report them in discontinued operations. Revenues and

EBITDA from this unit in 2014 were approximately $2.0 million and

negative $1.3 million, respectively.

Commenting on the results, Peter Dameris, President and Chief

Executive Officer of On Assignment, Inc., said, “We are pleased

with our solid operating performance for the quarter in which we

exceeded our financial estimates for revenues, Adjusted EBITDA and

Adjusted EPS. Operating performance of our operating units was in

line with or above expectations. Furthermore, we believe the

actions that we took in 2014 of divesting our remaining healthcare

assets, the repurchase of $100 million of our common stock,

completing the realignment of our operating units and our

accelerated hiring of additional sales consultants and recruiters

have positioned us to perform well, both operationally and

financially, in 2015 and beyond.”

Fourth Quarter 2014 Financial Results

Revenues for the quarter were $475.8 million, up 12.5 percent

year-over-year (8.3 percent on a pro forma basis (pro forma assumes

the acquisitions of CyberCoders and Whitaker Medical had occurred

at the beginning of 2013).

Our largest segment Apex, which accounts for approximately 64.7

percent of total revenues, grew 9.5 percent year-over-year. Our

Oxford Segment, which accounts for approximately 26.0 percent of

total revenues, grew 18.6 percent year-over-year and 6.7 percent on

a pro forma basis. Our Physician Segment, which accounted for 7.3

percent of total revenues, grew 29.6 percent and 9.6 percent on a

pro forma basis.

Gross profit was $153.5 million, up 18.9 percent year-over-year

(9.7 percent on a pro forma basis). This improvement was primarily

due to growth in revenues (which included the results of the

businesses acquired in December 2013) and expansion in gross

margin. Gross margin for the quarter was 32.3 percent, up from 30.5

percent in the fourth quarter of 2013. The year-over-year expansion

in gross margin was mainly attributable to a higher mix of

permanent placement revenues (4.4 percent of revenues for the

quarter compared with 1.9 percent in the fourth quarter of 2013)

and higher contract margins. The higher mix of permanent placement

revenues in the quarter was attributable to the inclusion of

CyberCoders, which accounted for $15.0 million of the $21.1 million

in permanent placement revenues.

Selling, general and administrative (“SG&A”) expenses were

$108.6 million (22.8 percent of revenues), up from $89.4 million

(21.1 percent of revenues) in the fourth quarter of 2013 ($97.2

million, or 22.1 percent of revenues on a pro forma basis).

SG&A expenses for the quarter included acquisition, integration

and strategic planning expenses of $1.8 million. The increase in

our reported SG&A as a percent of revenues was due to the

inclusion of CyberCoders (which has higher gross margin and higher

SG&A as a percent of revenues than our other business units),

and higher branch expenses related to the acceleration in hiring of

additional sales consultants and recruiters.

Amortization of intangible assets was $6.1 million, compared

with $5.9 million in the fourth quarter of 2013. The increase

related to amortization from the businesses acquired in December

2013.

Interest expense for the quarter was $3.2 million compared with

$3.4 million in the fourth quarter of 2013. Interest expense for

the quarter was comprised of interest on the credit facility of

$2.9 million and amortization of capitalized loan costs of $0.3

million. The leverage ratio (total indebtedness to trailing 12

months Adjusted EBITDA) at December 31, 2014 was 2.06 to 1,

unchanged from September 30, 2014.

The effective income tax rate for the quarter was 39.0 percent.

The effective tax rate for the full year was 40.8 percent, down

from 41.5 percent for the full year 2013. The improvement in the

effective tax rate relates to higher growth of pre-tax income

relative to growth of permanent differences between financial and

tax income.

Adjusted EBITDA (earnings before interest, taxes, depreciation,

and amortization of intangible assets plus equity-based

compensation expense, impairment charges, acquisition, integration

and strategic planning expenses), was $54.7 million, up from $48.5

million for the fourth quarter of 2013.

Adjusted income from continuing operations was $31.4 million

($0.60 per diluted share). Income from continuing operations (which

includes acquisition, integration and strategic planning expenses

of $1.8 million, or $1.1 million net of tax) was $21.8 million

($0.41 per diluted share) compared with $17.5 million ($0.32 per

diluted share) for the fourth quarter of 2013.

Net income was $20.5 million ($0.39 per diluted share) compared

with $32.4 million ($0.59 per diluted share) in the fourth quarter

of 2013. Net income for the fourth quarter of 2013 included a gain

of $16.4 million ($0.30 per diluted share) related to the sale of

the Allied Healthcare unit.

Sale of Physician Segment

Effective February 1, 2015, the Company completed the sale of

its Physician Segment for $123 million in cash. Net proceeds from

the sale (after income taxes and transaction expenses) are

estimated to be approximately $102.0 to $105.0 million. Revenues

from the Physician Segment were approximately $135.2 million and

EBITDA was approximately $12.9 million for 2014.

In this release and the Company’s Annual Report on Form 10-K for

the year ending December 31, 2014, which is expected to be filed

with the Securities and Exchange Commission (“SEC”) on or before

March 2, 2015, this sale is treated as a subsequent event and

operating results of the segment are included in the Company’s

consolidated results of operations from continuing operations. In

subsequent Company releases and filings with the SEC, operating

results of this segment will be reported as discontinued operations

on a retrospective basis for all periods presented. Included in

this release is quarterly historical financial information for 2013

and 2014 that has been restated to report operating results of the

Physician Segment as discontinued operations.

Share Repurchase Programs

During the quarter, the Company repurchased 1.0 million share of

its common stock at an average price per share of $30.50, thus

completing the $100 million repurchase program approved by its

Board of Directors in July 2014. During 2014, the Company

repurchased 3.4 million shares of its common stock at an average

price of $29.78.

On January 16, 2015, the Company’s Board of Directors authorized

a new $100 million share repurchase program effective for two

years. Under this new program, the Company may begin share

repurchases on February 23, 2015.

Financial Estimates for Q1 2015

On Assignment is providing financial estimates for continuing

operations for the first quarter of 2015. These estimates do not

include acquisition, integration, or strategic planning expenses

and assume no deterioration in the staffing markets that On

Assignment serves.

- Revenues of $432.0 million to $439.0

million

- Gross margin of 31.5 percent to 31.9

percent

- SG&A expenses (excludes

amortization of intangible assets) of $105.5 to $107.0 million

(includes $3.5 million in depreciation and $3.9 million in

equity-based compensation expense)

- Amortization of intangible assets of

$4.9 million

- Adjusted EBITDA of $38.0 million to

$40.5 million

- Effective tax rate of 40.0 percent

- Adjusted income from continuing

operations of $21.5 million to $23.0 million

- Adjusted income from continuing

operations per diluted share of $0.41 to $0.44

- Income from continuing operations of

$13.8 million to $15.3 million

- Income from continuing operations per

diluted share of $0.26 to $0.29

- Diluted shares outstanding of 52.2

million

The revenues estimates include approximately $2.5 to $3.5

million for the adverse effect of the inclement weather in the

first quarter. The above estimates also include the effects of the

payroll tax reset, which occurs at the beginning of every year.

This reset results in an estimated sequential increase in cost of

sales of $4.0 to $4.5 million and a sequential increase in SG&A

expenses of approximately $3.0 million.

Conference Call

On Assignment will hold a conference call today at 4:30 p.m. EST

to review its fourth quarter financial results. The dial-in number

is 800-230-1059 (+1-612-234-9959 for callers outside the United

States) and the conference ID number is 351312. Participants should

dial in ten minutes before the call. A replay of the conference

call will be available beginning today at 6:30 p.m. EST and ending

at midnight EST on March 4, 2015. The access number for the replay

is 800-475-6701 (+1-320-365-3844 for callers outside the United

States) and the conference ID number 351312.

This call is being webcast by Thomson/CCBN and can be

accessed via On Assignment's web site at www.onassignment.com. Individual investors can

also listen at Thomson/CCBN's site at www.fulldisclosure.com or by visiting any of the

investor sites in Thomson/CCBN's Individual Investor

Network.

About On Assignment

On Assignment, Inc. (NYSE: ASGN), is a leading global provider

of in-demand, skilled professionals in the growing technology and

life sciences sectors, where quality people are the key to

success. The Company goes beyond matching résumés with

job descriptions to match people they know into positions they

understand for temporary, contract-to-hire, and direct hire

assignments. Clients recognize On Assignment for our quality

candidates, quick response, and successful assignments.

Professionals think of On Assignment as a career-building partner

with the depth and breadth of experience to help them reach their

goals.

On Assignment was founded in 1985 and went public in 1992. The

Company, which is headquartered in Calabasas, California, operates

through a network of branch offices throughout the United States,

Canada, United Kingdom, Netherlands, Ireland and Belgium. To learn

more, visit http://www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial

Measures

Statements in this release and the accompanying Supplemental

Financial Information include non-GAAP financial measures. Such

information is provided as additional information, not as an

alternative to our consolidated financial statements presented in

accordance with GAAP, and is intended to enhance an overall

understanding of our current financial performance. The

Supplemental Financial Information sets forth financial measures

reviewed by our management to evaluate our operating performance.

Such measures also are used to determine a portion of the

compensation for some of our executives and employees. We believe

the non-GAAP financial measures provide useful information to

management, investors and prospective investors by excluding

certain charges and other amounts that we believe are not

indicative of our core operating results. These non-GAAP measures

are included to provide management, our investors and prospective

investors with an alternative method for assessing our operating

results in a manner that is focused on the performance of our

ongoing operations and to provide a more consistent basis for

comparison between quarters. One of the non-GAAP financial measures

presented is EBITDA (earnings before interest, taxes, depreciation,

and amortization of intangible assets), other terms include

Adjusted EBITDA (EBITDA plus equity-based compensation expense,

impairment charges, write-off of loan costs, and acquisition,

integration and strategic planning expenses) and Non-GAAP Income

from continuing operations (Income from continuing operations, plus

write-off of loan costs, and acquisition, integration and strategic

planning expenses, net of tax) and Adjusted income from continuing

operations and related per share amounts. These terms might not be

calculated in the same manner as, and thus might not be comparable

to, similarly titled measures reported by other companies. The

financial statement tables that accompany this press release

include reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP financial measure.

Safe Harbor

Certain statements made in this news release are

“forward-looking statements” within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended, and involve a

high degree of risk and uncertainty. Forward-looking statements

include statements regarding the Company's anticipated financial

and operating performance in 2014. All statements in this release,

other than those setting forth strictly historical information, are

forward-looking statements. Forward-looking statements are not

guarantees of future performance, and actual results might differ

materially. In particular, the Company makes no assurances that the

estimates of revenues, gross margin, SG&A, Adjusted EBITDA,

income from continuing operations, adjusted income from continuing

operations, earnings per share or earnings per diluted share set

forth above will be achieved. Factors that could cause or

contribute to such differences include actual demand for our

services, our ability to attract, train and retain qualified

staffing consultants, our ability to remain competitive in

obtaining and retaining temporary staffing clients, the

availability of qualified temporary professionals, management of

our growth, continued performance of our enterprise-wide

information systems, our ability to manage our potential or actual

litigation matters, the successful integration of our recently

acquired subsidiaries, the successful implementation of our

five-year strategic plan, and other risks detailed from time to

time in our reports filed with the Securities and Exchange

Commission, including our Annual Report on Form 10-K for the year

ended December 31, 2013, as filed with the SEC on March 3, 2014 and

our Quarterly Reports on Form 10-Q for the periods ended March 31,

2014, June 30, 2014 and September 30, 2014 as filed with the SEC on

May 9, 2014, August 11, 2014 and November 7, 2014, respectively. We

specifically disclaim any intention or duty to update any

forward-looking statements contained in this news release.

SUMMARY CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited)

(In thousands, except per share

amounts)

Three Months Ended Year

Ended December 31, September 30,

December 31,

2014 2013 (1) 2014 (1) 2014

2013 (1) Revenues $ 475,808 $

422,906 $ 477,391 $ 1,859,922 $ 1,628,927 Cost of services 322,274

293,812 322,209 1,262,010 1,143,438

Gross profit 153,534 129,094 155,182 597,912 485,489

Selling, general and administrative expenses 108,567 89,433 108,030

427,241 339,423 Amortization of intangible assets 6,055

5,919 6,018 24,401 21,686 Operating

income 38,912 33,742 41,134 146,270 124,380 Interest expense, net

(3,198 ) (3,429 ) (3,101 ) (12,730 ) (15,863 ) Write-off of loan

costs — — — — (14,958 ) Income before

income taxes 35,714 30,313 38,033 133,540 93,559 Provision for

income taxes 13,924 12,826 15,795 54,527

38,848 Income from continuing operations 21,790

17,487 22,238 79,013 54,711 Gain on sale of discontinued

operations, net of tax — 16,428 — — 30,840 Income (loss) from

discontinued operations, net of tax (1,317 ) (1,505 ) (233 ) (1,829

) (1,039 ) Net income $ 20,473 $ 32,410 $ 22,005

$ 77,184 $ 84,512 Basic earnings per

common share: Income from continuing operations $ 0.42 $ 0.32 $

0.42 $ 1.48 $ 1.02 Income from discontinued operations (0.03 ) 0.28

(0.01 ) (0.04 ) 0.56 $ 0.39 $ 0.60 $

0.41 $ 1.44 $ 1.58 Diluted earnings per

common share: Income from continuing operations $ 0.41 $ 0.32 $

0.41 $ 1.46 $ 1.00 Income from discontinued operations (0.02 ) 0.27

— (0.04 ) 0.55 $ 0.39 $ 0.59 $

0.41 $ 1.42 $ 1.55 Number of shares and

share equivalents used to calculate earnings per share: Basic

51,900 53,868 53,374 53,437 53,481

Diluted 52,679 54,880 54,129 54,294

54,555

______

(1) Amounts have been restated to give retroactive effect to the

closure of the European retained search unit in December 31, 2014.

The results of that unit are included in discontinued operations

for all periods presented. Accordingly, the results shown above

differ from the results in our previous filings with the Securities

and Exchange Commission.

SUPPLEMENTAL SEGMENT FINANCIAL

INFORMATION (unaudited)

(In thousands)

Three Months Ended

Year Ended December 31,

September 30, December 31, 2014 2013 (1) 2014

(1) 2014 2013 (1) Revenues:

Apex $ 307,724 $ 281,032 $ 306,027 $ 1,190,052 $ 1,059,993

Oxford 123,872 104,416 125,944 493,320 423,670 Physician 34,785

26,836 34,948 135,181 105,827 Life Sciences Europe 9,427

10,622 10,472 41,369 39,437 $ 475,808 $

422,906 $ 477,391 $ 1,859,922 $ 1,628,927

Gross profit: Apex $ 87,816 $ 78,864 $ 87,323 $ 335,322 $

294,611 Oxford 51,703 38,586 54,267 208,607 147,348 Physician

10,997 8,109 10,344 40,477 30,614 Life Sciences Europe 3,018

3,535 3,248 13,506 12,916 $ 153,534 $

129,094 $ 155,182 $ 597,912 $ 485,489 ____

(1) Amounts have been restated to give retroactive effect to the

closure of the European retained search unit in December 31, 2014.

The results of that unit are included in discontinued operations

for all periods presented. Accordingly, the results shown above

differ from the results in our previous filings with the Securities

and Exchange Commission.

SELECTED CASH FLOW INFORMATION

(Unaudited)

(In thousands)

Three Months Ended

Year Ended December 31, September 30, December 31,

2014 2013 2014 2014

2013 Cash provided by operations $ 28,064 $

36,576 $ 42,949 $ 96,022 $ 110,524 Capital expenditures $

5,469 $ 4,238 $ 4,622 $ 19,729 $ 16,531

SELECTED CONSOLIDATED BALANCE SHEET

DATA (Unaudited)

(In thousands)

December 31, September

30, 2014 2014 Cash and cash equivalents $ 31,714 $ 29,881

Accounts receivable, net 298,761 296,506 Goodwill and intangible

assets, net 833,266 840,799 Total assets 1,274,174 1,263,673

Current portion of long-term debt 18,250 18,250 Total current

liabilities 165,566 170,659 Working capital 220,338 200,611

Long-term debt 396,875 385,438 Other long-term liabilities 77,325

64,561 Stockholders’ equity 634,408 643,015

RECONCILIATION OF GAAP INCOME FROM

CONTINUING OPERATIONS AND EARNINGS PER

DILUTED SHARE TO NON-GAAP ADJUSTED

EBITDA AND ADJUSTED EBITDA

PER DILUTED SHARE (Unaudited)

(In thousands, except per share

amounts)

Three Months Ended

December 31,

2014

2013 (1)

September 30, 2014 (1)

Net income $ 20,473 $ 0.39 $ 32,410

$ 0.59 $ 22,005 $

0.41 Income (loss) from discontinued operations, net of tax (1,317

) (0.02 ) 14,923 0.27 (233

)

— Income from continuing operations 21,790 0.41 17,487 0.32 22,238

0.41 Interest expense, net 3,198 0.06 3,429 0.06 3,101 0.06

Provision for income taxes 13,924 0.26 12,826 0.23 15,795 0.29

Depreciation 3,643 0.07 2,285 0.04 3,594 0.07 Amortization of

intangibles 6,055 0.12 5,919 0.11 6,018

0.11 EBITDA 48,610 0.92 41,946 0.76 50,746 0.94

Equity-based compensation 4,308 0.09 3,923 0.07 4,607 0.08

Acquisition, integration and strategic planning expenses 1,811

0.03 2,623 0.05 1,002

0.02 Adjusted EBITDA $ 54,729 $ 1.04 $ 48,492

$ 0.88 $ 56,355 $ 1.04 Weighted average

common and common equivalent shares outstanding (diluted) 52,679

54,880 54,129

Year Ended 2014 2013 (1) Net

income $ 77,184 $ 1.42 $ 84,512 $ 1.55 Income from discontinued

operations, net of tax (1,829 ) (0.04

)

29,801 0.55 Income from continuing operations 79,013

1.46 54,711 1.00 Interest expense, net 12,730 0.23 15,863 0.29

Write-off of loan costs — — 14,958 0.27 Provision for income taxes

54,527 1.00 38,848 0.71 Depreciation 13,344 0.25 7,961 0.15

Amortization of intangibles 24,401 0.45 21,686

0.40 EBITDA 184,015 3.39 154,027 2.82 Equity-based

compensation 16,200 0.29 14,078 0.26 Acquisition, integration and

strategic planning expenses 5,733 0.11 4,409

0.08 Adjusted EBITDA $ 205,948 $ 3.79

$ 172,514 $ 3.16 Weighted average

common and common equivalent shares outstanding (diluted) 54,294

54,555

______

(1) Amounts have been restated to give

retroactive effect to the closure of the European retained search

unit in December 31, 2014. The results of that unit are included in

discontinued operations for all periods presented. Accordingly, the

results shown above differ from the results in our previous filings

with the Securities and Exchange Commission.

RECONCILIATION OF GAAP INCOME AND

DILUTED EPS TO NON-GAAP INCOME

AND DILUTED EPS (Unaudited)

(In thousands, except per share

amounts)

Three Months Ended December 31,

September 30, 2014 2013 (1) 2014 (1) Net income $

20,473 $ 0.39 $ 32,410 $ 0.59 $

22,005 $ 0.41 Income (loss) from discontinued

operations, net of tax (1,317 ) (0.02 ) 14,923 0.27

(233

)

— Income from continuing operations 21,790 0.41 17,487 0.32 22,238

0.41 Acquisition, integration and strategic planning expenses, net

of tax 1,105 0.02 1,542 0.03 611

0.01 Non-GAAP income from continuing operations $ 22,895

$ 0.43 $ 19,029 $ 0.35 $ 22,849

$ 0.42 Weighted average common and common equivalent

shares outstanding (diluted) 52,679

54,880 54,129

Year Ended 2014 2013 (1) Net income $ 77,184 $

1.42 $ 84,512 $ 1.55 Income from discontinued operations, net of

tax (1,829 ) (0.04 ) 29,801 0.55 Income from continuing

operations 79,013 1.46 54,711 1.00 Write-off of loan costs related

to refinancing, net of income taxes — — 9,181

0.17

Acquisition, integration and strategic planning expenses, net of

tax 3,479 0.06 2,619 0.05 Non-GAAP income from

continuing operations $ 82,492 $ 1.52 $ 66,511

$ 1.22 Weighted average common and common equivalent shares

outstanding (diluted) 54,294

54,555

______

(1) Amounts have been restated to give retroactive effect to the

closure of the European retained search unit in December 31, 2014.

The results of that unit are included in discontinued operations

for all periods presented. Accordingly, the results shown above

differ from the results in our previous filings with the Securities

and Exchange Commission.

CALCULATION OF ADJUSTED EARNINGS PER

DILUTED SHARE (Unaudited)

(In thousands, except per share

amounts)

Three Months Ended Year

Ended December 31, 2014 2013 2014

2013

Non-GAAP Income from continuing operations

(1)

$ 22,895 $ 19,029 $ 82,492 $ 66,511 Adjustments:

Amortization of intangible assets (2)

6,055 5,919 24,401 21,686

Cash tax savings on indefinite-lived

intangible assets (3)

4,023 4,015 16,098 15,565

Excess of capital expenditures over

depreciation, net of tax (4)

(1,025 ) (1,050 ) (4,100 ) (4,200 )

Income taxes on amortization for financial

reporting purposes not deductible for income tax purposes (5)

(532 ) (347 ) (2,125 ) (347 ) Adjusted income from continuing

operations $ 31,416 $ 27,566 $ 116,766 $

99,215 Adjusted earnings per diluted share from

continuing operations $ 0.60 $ 0.50 $ 2.15 $

1.82 Weighted average common and common equivalent

shares outstanding (diluted) 52,679 54,880 54,294

54,555

______

(1) Non-GAAP income from continuing operations as calculated on

preceding page. Non-GAAP income from continuing operations excludes

acquisition, integration and strategic planning expenses.

(2) Amortization of intangible assets of acquired

businesses.

(3) Income tax benefit (using 39 percent marginal tax rate) from

amortization for income tax purposes of certain indefinite-lived

intangible assets (goodwill and trademarks), on acquisitions in

which the Company received a step-up tax basis. For income tax

purposes, these assets are amortized on a straight-line basis over

15 years. For financial reporting purposes, these assets are not

amortized and a deferred tax provision is recorded that fully

offsets the cash tax benefit in the determination of net

income.

(4) Excess capital expenditures over depreciation is equal to

one-quarter of the estimated full year difference between capital

expenditures less depreciation, tax affected using an estimated

marginal combined federal and state tax rate of 39 percent.

(5) Income taxes (assuming a 39 percent marginal rate) on the

portion of amortization of intangible assets, which are not

deductible for income tax purposes (mainly amortization associated

with the CyberCoders acquisition that the Company was not able to

step-up the tax basis in those acquired assets for tax

purposes).

SUPPLEMENTAL FINANCIAL AND OPERATING

DATA (Unaudited)

(Dollars in thousands)

Apex Oxford Physician

Life SciencesEurope

Consolidated Revenues: Q4 2014 $ 307,724 $ 123,872 $

34,785 $ 9,427 $ 475,808 Q3 2014 $ 306,027 $ 125,944 $ 34,948 $

10,472 $ 477,391 % Sequential change 0.6 % (1.6 )% (0.5 )% (10.0 )%

(0.3 )% Q4 2013 $ 281,032 $ 104,416 $ 26,836 $ 10,622 $ 422,906 %

Year-over-year change 9.5 % 18.6 % 29.6 % (11.3 )% 12.5 %

Direct hire and conversion revenues: Q4 2014 4,146 15,782 959 226

21,113 Q3 2014 3,930 18,245 793 278 23,246 Q4 2013 3,221 3,892 746

193 8,052 Gross margins: Q4 2014 28.5 % 41.7 % 31.6 % 32.0 %

32.3 % Q3 2014 28.5 % 43.1 % 29.6 % 31.0 % 32.5 % Q4 2013 28.1 %

37.0 % 30.2 % 33.3 % 30.5 % Average number of staffing

consultants: Q4 2014 942 836 140 33 1,951 Q3 2014 875 813 142 32

1,862 Q4 2013 805 660 106 34 1,605 Average number of

customers: Q4 2014 1,276 897 269 153 2,595 Q3 2014 1,475 863 261

150 2,749 Q4 2013 1,381 892 215 156 2,644 Top 10 customers

as a percentage of revenue: Q4 2014 29.1 % 12.9 % 20.0 % 55.4 %

18.8 % Q3 2014 29.8 % 13.6 % 19.0 % 53.0 % 19.1 % Q4 2013 31.1 %

14.6 % 20.9 % 57.9 % 20.7 % Average bill rate: Q4 2014 $

54.59 $ 114.35 $ 176.75 $ 51.01 $ 65.67 Q3 2014 $ 54.65 $ 112.33 $

176.80 $ 54.06 $ 65.57 Q4 2013 $ 53.41 $ 113.75 $ 186.44 $ 51.91 $

64.11 Gross profit per staffing consultant: Q4 2014 $ 93,000

$ 62,000 $ 79,000 $ 91,000 $ 79,000 Q3 2014 $ 100,000 $ 67,000 $

73,000 $ 102,000 $ 83,000 Q4 2013 $ 98,000 $ 58,000 $ 77,000 $

104,000 $ 80,000

SUPPLEMENTAL FINANCIAL INFORMATION –

KEY METRICS (Unaudited)

Three Months Ended

December 31,2014

September 30,2014

Percentage of revenues: Top ten clients 18.8% 19.1% Direct

hire/conversion 4.4% 4.9% Bill rate: % Sequential change

0.2% 0.0% % Year-over-year change 2.4% 0.4% Bill/Pay spread:

% Sequential change (0.7%) (2.0%) % Year-over-year change 0.8% 0.2%

Average headcount: Contract professionals (CP) 12,859 12,961

Staffing consultants (SC) 1,951 1,862 Productivity: Gross

profit per SC $79,000 $83,000

Sale of Physician Segment

Effective February 1, 2015, the Company completed the sale of

its Physician segment. The following tables reflect the statements

of operations, with the results of the Physician segment included

in discontinued operations.

ON ASSIGNMENT, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (Unaudited)

FOR EACH OF THE THREE-MONTH PERIODS IN

THE YEAR ENDED DECEMBER 31, 2014

AND THE YEAR ENDED DECEMBER 31,

2014

(In thousands, except per share

amounts)

Three Months Ended

Year Ended Mar. 31 Jun. 30

Sept. 30 Dec. 31

Dec. 31 Revenues

$

406,851

$

434,424

$

442,443

$

441,023

$

1,724,741

Cost of services 278,696 292,519

297,605 298,486 1,167,306 Gross

profit 128,155 141,905 144,838 142,537 557,435 Selling, general and

administrative expenses 96,109 99,614 100,608 101,192 397,523

Amortization of intangible assets 5,538 5,522

5,532 5,538 22,130

Operating income 26,508 36,769 38,698 35,807 137,782 Interest

expense (3,328 ) (3,103 ) (3,101 )

(3,198 ) (12,730 ) Income from continuing operations before

income taxes 23,180 33,666 35,597 32,609 125,052 Provision for

income taxes 9,575 14,025 14,874

13,083 51,557 Net income from

continuing operations 13,605 19,641 20,723 19,526 73,495 Income

from discontinued operations, net of tax 312

1,148 1,282 947 3,689

Net income

$

13,917

$

20,789

$

22,005

$

20,473

$

77,184

Basic earnings per common share: Income from

continuing operations $ 0.25 $ 0.36 $ 0.39 $ 0.38 $ 1.38 Income

from discontinued operations 0.01 0.02

0.02 0.01 0.06

Net income

$ 0.26 $ 0.38 $ 0.41 $ 0.39 $ 1.44

Diluted earnings per common share: Income from

continuing operations $ 0.25 $ 0.36 $ 0.38 $ 0.37 $ 1.35 Income

from discontinued operations — 0.02

0.03 0.02 0.07

Net income

$ 0.25 $ 0.38 $ 0.41 $ 0.39 $ 1.42

Number of shares and share equivalents used to

calculate earnings per share: Basic 54,104

54,372 53,374 51,900

53,437 Diluted 54,975 55,173

54,129 52,679 54,294

ON ASSIGNMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (Unaudited)

FOR EACH OF THE THREE-MONTH PERIODS IN THE YEAR ENDED DECEMBER

31, 2013 AND THE YEAR ENDED DECEMBER 31, 2013 (In

thousands, except per share amounts)

Three Months Ended Year Ended Mar.

31 Jun. 30 Sept. 30 Dec.

31 Dec. 31 Revenues $ 351,852 $ 380,779 $

394,400 $ 396,070 $ 1,523,101 Cost of services 250,083

267,674 275,384 275,085

1,068,226 Gross profit 101,769 113,105 119,016

120,985 454,875 Selling, general and administrative expenses 76,141

78,034 79,652 83,518 317,345 Amortization of intangible assets

5,170 5,066 5,068

5,639 20,943 Operating income 20,458 30,005

34,296 31,828 116,587 Interest expense (3,808 ) (3,437 ) (3,257 )

(3,429 ) (13,931 ) Write-off of deferred loan costs —

(14,958 ) — — (14,958 )

Income from continuing operations before income taxes 16,650 11,610

31,039 28,399 87,698 Provision for income taxes 7,136

4,961 12,383 12,078

36,558 Net income from continuing operations 9,514

6,649 18,656 16,321 51,140 Gain on sale of discontinued operations,

net of tax 14,412 — — 16,428 30,840 Income from discontinued

operations, net of tax 687 690

1,494 (339 ) 2,532

Net income

$

24,613

$

7,339

$

20,150

$

32,410

$

84,512

Basic earnings per common share: Income from

continuing operations $ 0.18 $ 0.12 $ 0.35 $ 0.30 $ 0.96 Income

from discontinued operations 0.28 0.02

0.03 0.30 0.62

Net income

$ 0.46 $ 0.14 $ 0.38 $ 0.60 $ 1.58

Diluted earnings per common share: Income from

continuing operations $ 0.18 $ 0.12 $ 0.34 $ 0.30 $ 0.94 Income

from discontinued operations 0.28 0.02

0.03 0.29 0.61

Net income

$ 0.46 $ 0.14 $ 0.37 $ 0.59 $ 1.55

Number of shares and share equivalents used to

calculate earnings per share: Basic 53,046

53,378 53,620 53,868

53,481 Diluted 54,036 54,327

54,624 54,880 54,555

ON ASSIGNMENT, INC. AND

SUBSIDIARIES

PROJECTED ADJUSTMENTS TO GAAP NET

INCOME TO CALCULATED ADJUSTED NET INCOME (Unaudited)

(REVISED TO EXCLUDE PHYSICIAN

SEGMENT (4))

(In thousands)

Year Ending December 31, 2015 2016

2017 2018 2019 Add-backs:

Amortization of intangible assets (1)

$ 19,504 $ 16,470 $ 12,155 $ 9,731 $ 8,023

Cash tax savings on indefinite-lived

intangible assets for income tax purposes (Goodwill&

Trademarks) (2)

15,530 15,530 15,530 15,530 15,530 Deductions: Estimated excess of

capital expenditures over depreciation, net of tax (1,880 ) (1,474

) (945 ) (269 ) —

Income taxes on amortization for financial

reporting purposes not deductible for income tax purposes (3)

(2,022 ) (1,595 ) (1,229 ) (1,229 ) (1,144 ) Net Adjustment to GAAP

Net Income to Calculate Adjusted Net Income $ 31,132 $

28,931 $ 25,511 $ 23,763 $ 22,409

______

The table above shows adjustments to GAAP net income to

calculate Adjusted Net Income

(1) Amortization of identifiable intangible assets (e.g.,

customer/contractor relationships, non-compete agreements, etc.)

related to the acquired businesses. The year-over-year reductions

in this add-back will result in a corresponding increase in

operating income for GAAP purposes.

(2) Income tax benefit (using 39 percent marginal tax rate) from

amortization for income tax purposes of certain indefinite-lived

intangible assets (goodwill and trademarks), on acquisitions in

which the Company received a step-up tax basis. For income tax

purposes, these assets are amortized on a straight-line basis over

15 years. For financial reporting purposes, these assets are not

amortized and a deferred tax provision is recorded that fully

offsets the cash tax benefit in the determination of net

income.

(3) Income taxes (assuming a 39 percent marginal rate) on the

portion of amortization of intangible assets, which are not

deductible for income tax purposes (mainly amortization associated

with the CyberCoders acquisition that the Company was not able to

step-up the tax basis in those acquired assets for tax

purposes).

(4) Projections have been updated to remove amounts related to

the Physician Segment that was sold effective February 1, 2015.

ON ASSIGNMENT, INC. AND

SUBSIDIARIES

BILLABLE DAYS

2014 2015 Restated

(1) Projected Billable days per quarter: First Quarter 62.0 62.0

Second Quarter 63.8 63.5 Third Quarter 63.6 63.5 Fourth Quarter

61.4 60.0 Total Year 250.8 249.0 _____

(1) Restated to exclude Physician

Segment

On Assignment, Inc.Ed Pierce, 818-878-7900Chief Financial

Officer

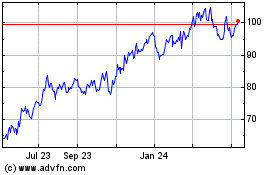

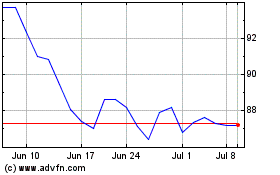

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024