Revenue Growth Exceeded Previously Announced

Estimates

Income & Adjusted EBITDA (a non-GAAP

measure) were within our Estimates

On Assignment, Inc. (NYSE: ASGN), a leading global provider of

diversified professional staffing solutions, today reported results

for the quarter ended March 31, 2017.

First Quarter Highlights

- Revenues were $626.5 million, up 7.6

percent over the first quarter of 2016 (up 8.2 percent on a same

"Billable Day" basis, a non-GAAP measure).

- Net income was $22.4 million ($0.42 per

diluted share), up from $17.4 million ($0.32 per diluted share) in

the first quarter of 2016.

- Adjusted EBITDA (a non-GAAP measure)

was $64.6 million (10.3 percent of revenues), compared with $62.4

million (10.7 percent of revenues) in the first quarter of

2016.

- Operating results included the

following items that were not in our previously announced

estimates: (i) interest expense of $2.0 million ($1.2 million after

tax, or $0.02 per diluted share) related to the amendment of the

credit facility in February, (ii) acquisition, strategy and

integration expenses of $0.9 million ($0.5 million after tax, or

$0.01 per diluted share) and (iii) tax benefits of $1.1 million

($0.02 per diluted share) related to a change in accounting for the

tax effect of equity-based compensation (tax effect of a higher tax

than book deduction for equity-based compensation, which now is

included in the calculation of the provision for income taxes for

financial reporting purposes, whereas in prior periods it was

treated as an adjustment to stockholders' equity).

- Repurchased 228,831 shares for $10.1

million during the quarter, at an average per share price of

$44.31.

- Since our $150 million repurchase

authorization began in June 2016, we have purchased approximately

1.4 million shares for $53.2 million, at an average per share price

of $39.07.

- Leverage ratio (a non-GAAP measure) was

2.21 to 1 at March 31, 2017, down from 2.32 to 1 at December 31,

2016.

- Amended credit facility on February 21,

2017, resulting in a 50 basis point reduction in the interest rate

for the term B loan and the revolving credit facility was increased

to $200.0 million, with its maturity date extended to February 21,

2022.

Commenting on the results, Peter Dameris, Chief Executive

Officer of On Assignment, said, "Many positive developments

occurred in the first quarter for our Company and our industry. A

renewed focus by customers on work being performed by domestic

labor and the continued adoption of our delivery/development model

has permitted us to once again report solid results. As we look

forward, economic and legislative factors remain positive and we

continue to invest in and alter our divisions' operating strategies

to deliver higher growth."

First Quarter 2017 Financial Results

Revenues for the quarter were $626.5 million, up 7.6 percent

year-over-year. Our largest segment, Apex, accounted for 77.0

percent of total revenues and grew 11.4 percent year-over-year. Our

Oxford Segment accounted for 23.0 percent of total revenues.

Gross profit was $198.1 million, up $10.4 million or 5.5 percent

year-over-year. Gross margin for the quarter was 31.6 percent, down

from 32.3 percent in the first quarter of 2016. The year-over-year

change in gross margin was primarily the result of (i) a lower mix

of permanent placement revenues (5.1 percent of revenues in the

current quarter, down from 5.6 percent in the first quarter of

2016) and (ii) a change in business mix related to the higher

growth at Apex, which has lower gross margins than Oxford.

Selling, general and administrative (“SG&A”) expenses were

$146.1 million (23.3 percent of revenues), compared with $139.9

million (24.0 percent of revenues) in the first quarter of 2016.

The increase in SG&A was commensurate with the year-over-year

growth of the business. SG&A for the quarter included

acquisition, integration and strategic planning expenses of $0.9

million. These expenses included approximately $0.5 million related

to a strategic study performed by an outside consulting firm to

evaluate our current IT staff augmentation and project based

service offerings.

Amortization of intangible assets was $8.5 million, compared

with $10.1 million in the first quarter of 2016. The decrease is

due to the accelerated amortization method for certain acquired

intangibles, which have higher amortization rates at the beginning

of their useful life.

Interest expense for the quarter was $8.5 million compared with

$9.0 million in the first quarter of 2016. Interest expense for the

quarter was comprised of $5.6 million of interest on the credit

facility, $2.0 million of costs related to the February 21, 2017

amendment to our credit facility and $0.9 million of amortization

of deferred loan costs. This amendment resulted in a 50 basis point

reduction in the interest rate for the term B loan and the

revolving credit facility was increased to $200.0 million, with its

maturity date extended to February 21, 2022.

The effective tax rate for the quarter was 36.2 percent, which

benefited from the change in accounting for excess tax benefits and

deficiencies related to stock-based compensation. This tax benefit,

which reduced our provision for income taxes, was $1.1 million for

the quarter. Prior to the change in accounting, which was effective

January 1, 2017, these excess tax benefits (which is the tax effect

of the difference between the book and tax expense for equity-based

compensation), were accounted for as an adjustment to stockholders'

equity.

Net income was $22.4 million ($0.42 per diluted share), up from

$17.4 million ($0.32 per diluted share) in the first quarter of

2016. Adjusted EBITDA (a non-GAAP measure) was $64.6 million, or

10.3 percent of revenues, compared with $62.4 million (10.7 percent

of revenues) in the first quarter of 2016.

Cash flows from operating activities were $43.8 million and free

cash flow (a non-GAAP measure) was $37.0 million. During the

quarter, we repaid $24.0 million of long-term debt. At March 31,

2017, our leverage ratio (a non-GAAP measure) was 2.21 to 1, down

from 2.32 to 1 at December 31, 2016.

Financial Estimates for Q2 2017

On Assignment is providing financial estimates for the second

quarter of 2017. These estimates do not include acquisition,

integration or strategic planning expenses and assume no

deterioration in the staffing markets that On Assignment serves.

These estimates also assume no significant change in foreign

exchange rates. Reconciliations of estimated net income to the

estimated non-GAAP measures are presented herein.

- Revenues of $650.0 million to $660.0

million

- Gross margin of 32.5 percent to 32.7

percent

- SG&A expense (excludes amortization

of intangible assets) of $148.3 to $149.9 (includes $6.4 million in

depreciation and $6.3 million in stock-based compensation

expense)

- Amortization of intangible assets of

$8.3 million

- Effective tax rate of 39

percent(1)

- Net income of $29.4 million to $31.3

million

- Earnings per diluted share of $0.55 to

$0.59

- Diluted shares outstanding of 53.3

million

- Adjusted EBITDA (a non-GAAP measure) of

$76.0 million to $79.0 million

- Adjusted Net Income(2) (a non-GAAP

measure) of $37.3 million to $39.0 million

- Adjusted Net Income per diluted

share(2) (a non-GAAP measure) of $0.70 to $0.73

_______________

(1) Does not include excess tax benefits related to

stock-based compensation. Effective January 1, 2017, these tax

benefits (the tax effect of the difference between book and tax

expense for equity-based compensation) are included in the

determination of the provision for income taxes. Prior to the

accounting rule change, these benefits were recorded as an

adjustment to stockholders' equity. (2) Does not include the “Cash

Tax Savings on Indefinite-lived Intangible Assets.” These savings

total $6.7 million each quarter, or $0.13 per diluted share, and

represent the economic value of the tax deduction that we receive

from the amortization of goodwill and trademarks.

Our financial estimates above are based on our estimate of

“Billable Days,” which are Business Days (calendar days for the

period less weekends and holidays) adjusted for other factors, such

as the day of the week a holiday occurs, additional time taken off

around holidays, year-end client furloughs and inclement weather.

For the second quarter, we estimate billable days of 63.8, which is

0.1 fewer than the second quarter of 2016.

Conference Call

On Assignment will hold a conference call today at 5:00 p.m. EDT

to review its financial results for the first quarter. The dial-in

number is 800-288-8967 (+1-612-234-9960 for callers outside the

United States) and the conference ID number is 422747. Participants

should dial in ten minutes before the call. The prepared remarks

for this call will be available via On Assignment's web site at

www.onassignment.com. This call is

being webcast by CCBN and can be accessed at www.onassignment.com. Individual investors can

also listen at CCBN's site at www.fulldisclosure.com or by visiting any of the

investor sites in CCBN's Individual Investor Network.

A replay of the conference call will be available beginning

Wednesday, April 26, 2017 at 7:00 p.m. EDT until midnight on

Wednesday, May 10, 2017. The access number for the replay is

800-475-6701 (+1-320-365-3844 outside the United States) and the

conference ID number is 422747.

About On Assignment

On Assignment, Inc. is a leading global provider of highly

skilled, hard-to-find professionals in the growing technology, life

sciences, and creative sectors, where quality people are the key to

success. The Company goes beyond matching résumés with job

descriptions to match people they know into positions they

understand for temporary, contract-to-hire, and direct hire

assignments. Clients recognize On Assignment for its quality

candidates, quick response, and successful assignments.

Professionals think of On Assignment as career-building partners

with the depth and breadth of experience to help them reach their

goals. The Company has a network of branch offices

throughout the United States, Canada and Europe. To

learn more, visit http://www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial

Measures

Statements in this release and the accompanying financial

information include non-GAAP financial measures. Such information

is provided as additional information, not as an alternative to our

consolidated financial statements presented in accordance with

accounting principles generally accepted in the United States

("GAAP"), and is intended to enhance an overall understanding of

our current financial performance. These terms might not be

calculated in the same manner as, and thus might not be comparable

to, similarly titled measures reported by other companies. The

financial statement tables that accompany this press release

include a reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP financial measure. Below is a

discussion of our non-GAAP measures.

EBITDA (earnings before interest, taxes, depreciation and

amortization of intangible assets) and Adjusted EBITDA (EBITDA plus

equity-based compensation expense and, as applicable, write-off of

loan costs, acquisition, integration and strategic planning

expenses, and impairment charges) are used to determine a portion

of the compensation for some of our executives and employees.

Equity-based compensation expense is added to arrive at Adjusted

EBITDA because it is a non-cash expense. Write-off of loan costs,

acquisition, integration and strategic planning expenses, and

impairment charges are added, as applicable, to arrive at Adjusted

EBITDA as they are not indicative of the performance of our core

business on an ongoing basis.

Non-GAAP net income (net income, less income (loss) from

discontinued operations, net of tax, plus, as applicable,

refinancing costs, acquisition, integration and strategic planning

expenses, accretion of fair value discount on contingent

consideration, impairment charges, and the tax effect of these

items) provides a method for assessing our operating results in a

manner that is focused on the performance of our core business on

an ongoing basis. Adjusted Net Income (Non-GAAP net income plus

amortization of intangible assets, less income taxes on

amortization for financial reporting purposes not deductible for

income tax purposes) provides a method for assessing our operating

results in a manner that is focused on the performance of our core

business on an ongoing basis, adjusted for some of the cash flows

associated with amortization of intangible assets to more fully

present the performance of our acquisitions.

Free cash flow is defined as net cash provided by (used in)

operating activities, less capital expenditures. Management

believes this provides useful information to investors about the

amount of cash generated by the business that can be used for

strategic opportunities. Our leverage ratio provides information

about our compliance with loan covenants and is calculated in

accordance with our credit agreement, as filed with the Securities

and Exchange Commission ("SEC"), by dividing our total indebtedness

by trailing 12 months Adjusted EBITDA.

Reasons for Presentation of Operating Metrics

Operating metrics are intended to enhance the overall

understanding of our business and our current financial

performance. These operating metrics might not be calculated in the

same manner as, and thus might not be comparable to, similarly

titled metrics reported by other companies. The operating metrics

presented on this release are calculated as follows: average number

of staffing consultants are full time equivalent staffing

consultant headcount in the quarter; average number of contract

professionals and average number of customers are the number of

contract professionals employed each week and the number of

customers served each week, averaged for the quarter, respectively

(average is weighted by total number of hours billed per week); top

10 customers as a percentage of revenue are the 10 largest clients

defined by the revenue generated in the quarter, divided by total

revenues in the quarter; gross profit per staffing consultant is

gross profit for the quarter divided by the average number of

staffing consultants; average bill rate is total assignment revenue

client billings in the quarter divided by total hours billed in the

quarter.

Safe Harbor

Certain statements made in this news release are

“forward-looking statements” within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended, and involve a

high degree of risk and uncertainty. Forward-looking statements

include statements regarding the Company's anticipated financial

and operating performance. All statements in this release, other

than those setting forth strictly historical information, are

forward-looking statements. Forward-looking statements are not

guarantees of future performance, and actual results might differ

materially. In particular, the Company makes no assurances that the

estimates of revenues, gross margin, SG&A, amortization,

effective tax rate, net income, diluted shares outstanding,

Adjusted EBITDA, Adjusted Net Income and related per share amounts

(as applicable) set forth above will be achieved. Factors that

could cause or contribute to such differences include actual demand

for our services, our ability to attract, train and retain

qualified staffing consultants, our ability to remain competitive

in obtaining and retaining temporary staffing clients, the

availability of qualified temporary professionals, management of

our growth, continued performance of our enterprise-wide

information systems, our ability to manage our litigation matters,

the successful integration of our recently acquired subsidiaries,

the successful implementation of our five-year strategic plan, and

other risks detailed from time to time in our reports filed with

the SEC, including our Annual Report on Form 10-K for the year

ended December 31, 2016, as filed with the SEC on March 1, 2017. We

specifically disclaim any intention or duty to update any

forward-looking statements contained in this news release.

SUMMARY CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)(In thousands, except per share

amounts)

Three Months Ended March 31, December 31, 2017

2016 2016 Revenues $ 626,528 $ 582,040 $

620,884 Costs of services 428,384 394,258 422,689

Gross profit 198,144 187,782 198,195 Selling, general and

administrative expenses 146,072 139,881 142,630 Amortization of

intangible assets 8,464 10,144 9,710 Operating

income 43,608 37,757 45,855 Interest expense (8,501 ) (9,025 )

(7,049 ) Income before income taxes 35,107 28,732 38,806 Provision

for income taxes 12,725 11,384 14,746 Income

from continuing operations 22,382 17,348 24,060

Income (loss) from discontinued

operations, net of tax

9 53 (32 ) Net income $ 22,391 $ 17,401

$ 24,028 Basic earnings per common share: Income from

continuing operations $ 0.43 $ 0.33 $ 0.45 Income from discontinued

operations — — — $ 0.43 $ 0.33 $

0.45 Diluted earnings per common share: Income from

continuing operations $ 0.42 $ 0.32 $ 0.45 Income from discontinued

operations — — — $ 0.42 $ 0.32 $

0.45 Number of shares and share equivalents

used to calculate earnings per share:

Basic 52,658 53,147 52,924 Diluted 53,249

53,644 53,521

SEGMENT FINANCIAL INFORMATION

(Unaudited)FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND

2016(Dollars in millions)

2017 2016

Year-Over-YearGrowth Rates

Revenues by segment: Apex: Assignment $ 471.3 $ 422.1 11.6 %

Permanent placement 11.2 11.0 1.9 % 482.5 433.1 11.4

% Oxford: Assignment 123.2 127.4 (3.3 )% Permanent placement 20.8

21.5 (3.2 )% 144.0 148.9 (3.3 )% Consolidated:

Assignment 594.5 549.5 8.2 % Permanent placement 32.0 32.5

(1.5 )% $ 626.5 $ 582.0 7.6 %

Percentage of total revenues:

Apex 77.0 % 74.4 % Oxford 23.0 % 25.6 % 100.0 % 100.0 %

Assignment 94.9 % 94.4 % Permanent placement 5.1 % 5.6 % 100.0 %

100.0 % Domestic 95.2 % 95.3 % Foreign 4.8 % 4.7 % 100.0 %

100.0 % Gross profit: Apex $ 139.9 $ 126.2 10.9 % Oxford 58.2

61.6 (5.5 )% Consolidated $ 198.1 $ 187.8

5.5 % Gross margin: Apex 29.0 % 29.1 % Oxford 40.4 % 41.4 %

Consolidated 31.6 % 32.3 %

SELECTED CASH FLOW INFORMATION

(Unaudited)FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND

2016(In thousands)

2017 2016 Cash provided by operating

activities(1) $ 43,800 $ 38,228 Capital expenditures (6,792 )

(7,282 ) Free cash flow (non-GAAP measure) $ 37,008 $ 30,946

Cash used in investing activities(2) $ (6,775 ) $

(1,106 ) Cash used in financing activities(1) $ (40,215 ) $ (32,567

) (1)

On January 1, 2017, we adopted Accounting

Standards Update 2016-09 Compensation - Stock Compensation (Topic

718). Under this new guidance, excess tax benefits and deficiencies

are recognized as income tax benefit or expense in the consolidated

statements of operations and comprehensive income, instead of paid

in capital, on a prospective basis from the date of adoption. On

the statement of cash flows, excess tax benefits and deficiencies

are presented as cash flows from operating activities, instead of

financing activities. For the statement of cash flows, we elected

to retrospectively adopt this new presentation and for the three

months ended March 31, 2016, cash flows from excess tax benefits of

$0.9 million were reclassified from financing activities to

operating activities.

(2) The three months ended March 31, 2016, included $6.0

million in cash provided by investing activities related to the

release of cash held in escrow from the sale of the Physician

Segment.

SELECTED CONSOLIDATED BALANCE SHEET

DATAAS OF MARCH 31, 2017 AND DECEMBER 31, 2016(In

thousands)

2017 2016 (Unaudited) Cash and cash equivalents $ 24,005 $

27,044 Accounts receivable, net 394,394 386,858 Total current

assets 441,984 437,524 Goodwill and intangible assets, net

1,243,211 1,251,243 Total assets 1,752,087 1,752,667 Total current

liabilities 167,659 162,499 Working capital 274,325 275,025

Long-term debt 617,068 640,355 Other long-term liabilities 81,050

80,874 Stockholders’ equity 886,310 868,939

RECONCILIATION OF NET INCOME TO EBITDA

(NON-GAAP MEASURE) ANDADJUSTED EBITDA (NON-GAAP MEASURE)

(Unaudited)FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND

2016(In thousands)

2017 2016 Net income $ 22,391 $ 17,401

Income from discontinued operations, net

of tax

(9 ) (53 ) Interest expense 8,501 9,025 Provision for income taxes

12,725 11,384 Depreciation 6,011 5,283

Amortization of intangible assets

8,464 10,144 EBITDA (non-GAAP measure) 58,083 53,184

Equity-based compensation 5,570 6,924 Acquisition, integration and

strategic planning expenses 910 2,326 Adjusted EBITDA

(non-GAAP measure) $ 64,563 $ 62,434

RECONCILIATION OF NET INCOME TO

NON-GAAP NET INCOME ANDADJUSTED NET INCOME (NON-GAAP

MEASURE) (Unaudited)FOR THE THREE MONTHS ENDED MARCH 31,

2017 AND 2016(In thousands, except per share amounts)

2017 2016 Net income $ 22,391 $ 17,401 Income from

discontinued operations, net of tax (9 ) (53 ) Refinancing costs(1)

2,028 —

Acquisition, integration and strategic

planning expenses

910 2,326 Accretion of discount on contingent consideration — 863

Tax effect on adjustments (1,146 ) (1,228 ) Non-GAAP net income

24,174 19,309 Amortization of intangible assets 8,464 10,144

Income taxes on amortization for financial

reporting purposes not deductible for income tax purposes

(406 ) (601 ) Adjusted Net Income (non-GAAP measure)(2) $ 32,232

$ 28,852 Per diluted share: Net income $ 0.42

$ 0.32 Adjustments 0.19 0.22 Adjusted Net Income

(non-GAAP measure)(2) $ 0.61 $ 0.54

Weighted average common and common

equivalent shares outstanding (diluted)

53,249 53,644 (1) In February

2017, we amended our credit facility and incurred $2.6 million in

fees, of which $2.0 million were included in interest expense and

the remaining $0.6 million were capitalized and will be amortized

over the term of the credit facility. (2) Does not include

the “Cash Tax Savings on Indefinite-lived Intangible Assets.” These

savings total $6.7 million ($0.13 per diluted share) for the three

months ended March 31, 2017, and $6.6 million ($0.12 per diluted

share) for the three months ended March 31, 2016, and represent the

economic value of the tax deduction that we receive from the

amortization of goodwill and trademarks.

OPERATING METRICS (Unaudited)

Apex Oxford Consolidated

Average number of staffing

consultants:

Q1 2017 1,423 977 2,400 Q4 2016 1,453 1,016 2,469 Q1 2016 1,296 988

2,284 Average number of customers: Q1 2017 3,569 1,085 4,654

Q4 2016 3,611 1,088 4,699 Q1 2016 3,368 1,049 4,417

Average number of contract

professionals(1):

Q1 2017 16,596 2,634 19,230 Q4 2016 17,060 2,903 19,963 Q1 2016

14,638 2,794 17,432

Top 10 customers as a percentage of

revenues:

Q1 2017 26.5 % 9.3 % 20.4 % Q4 2016 26.3 % 12.9 % 20.5 % Q1 2016

22.9 % 11.6 % 17.1 % Average bill rate: Q1 2017 $ 57.51 $

97.79 $ 62.67 Q4 2016 $ 56.57 $ 99.12 $ 62.12 Q1 2016 $ 55.74 $

101.77 $ 62.04

Gross profit per staffing consultant:

Q1 2017 $ 98,000 $ 60,000 $ 83,000 Q4 2016 $ 97,000 $ 57,000 $

80,000 Q1 2016 $ 97,000 $ 62,000 $ 82,000 (1)

Average number of contract professionals placed on assignment each

week that are considered our employees; this number does not

include employees of our subcontractors.

FINANCIAL ESTIMATES FOR Q2

2017RECONCILIATION OF ESTIMATED NET INCOME TO ESTIMATED

NON-GAAP MEASURES(In millions, except per share data)

Low High Net income(1)(2) $ 29.4 $ 31.3 Interest expense 6.8

6.8 Provision for income taxes(2) 18.8 19.9 Depreciation 6.4 6.4

Amortization of intangible assets 8.3 8.3 EBITDA

(non-GAAP measure) 69.7 72.7 Equity-based compensation 6.3

6.3 Adjusted EBITDA (non-GAAP measure) $ 76.0 $ 79.0

Low High Net income(1)(2) $ 29.4 $ 31.3

Amortization of intangible assets 8.3 8.3 Income taxes on

amortization for financial reporting purposes not deductible for

income tax purposes (0.4 ) (0.4 ) Other — (0.2 ) Adjusted

Net Income (non-GAAP measure)(3) $ 37.3 $ 39.0

Per diluted share: Net income $ 0.55 $ 0.59 Adjustments 0.15

0.14 Adjusted Net Income (non-GAAP measure)(3) $ 0.70

$ 0.73 Weighted average common and common equivalent

shares outstanding (diluted) 53.3 53.3 (1)

These estimates do not include acquisition,

integration, or strategic planning expenses. (2) These

estimates do not include excess tax benefits related to stock-based

compensation. (3) Does not include the “Cash Tax Savings on

Indefinite-lived Intangible Assets.” These savings total $6.7

million each quarter, or $0.13 per diluted share, and represent the

economic value of the tax deduction that we receive from the

amortization of goodwill and trademarks.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170426006632/en/

On Assignment, Inc.Ed Pierce, 818-878-7900Chief Financial

Officer

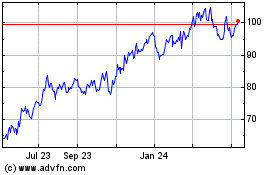

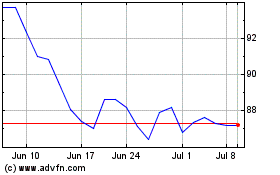

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024