On Assignment, Inc. (NYSE: ASGN) (the “Company”) announced today

that it has entered into a definitive purchase agreement to sell

its physician staffing segment, VISTA Staffing Solutions, Inc.

(“Vista”) to Envision Healthcare (NYSE: EVHC) (“Envision”) for

$123.0 million. Net proceeds from the sale (after income taxes and

transaction expenses) are estimated to be $102.0 to $105.0 million.

The transaction is expected to close in February pending completion

of certain closing conditions. Estimated revenues from Vista for

2014 were approximately $135.0 million.

Envision, and its more than 34,000 employees and affiliated

physicians, offers an array of physician-led healthcare related

services to consumers, hospitals, healthcare systems, health plans

and local, state and national government entities. Envision

Healthcare (NYSE: EVHC) is a leading provider of physician-led,

outsourced medical services. The company provides a broad range of

coordinated, clinically-based care solutions across the continuum

of care, from medical transportation to hospital encounters to

comprehensive care alternatives in various settings.

"We were approached by Envision, one of the largest and most

respected healthcare companies in the industry, to acquire Vista

and determined that this would greatly benefit both organizations,

our employees, and our stockholders," said Peter Dameris, President

and CEO of On Assignment. "This is an incredible opportunity for

Vista to align with a world class healthcare organization.

Furthermore, this transaction will provide us with additional cash

to pursue strategic acquisitions, execute repurchases of shares,

increase investments in our organic growth strategy, and pay down

debt.”

“We staff thousands of clinicians each year so joining forces

with the very talented team of one of the largest locum tenens

physician staffing firms in the nation was a logical move,” said

William A. Sanger, Chairman, President and Chief Executive Officer

of Envision. “We are dedicated to being pioneers in each area of

healthcare we operate and that includes the staffing of our

workforce. VISTA’s business practices and systems will be key

differentiators for us as we develop our comprehensive

multi-specialty staffing practice for all levels of

clinicians.”

Financial Treatment of Vista’s Results of Operations

In the Company’s Annual Report on Form 10-K for the year ended

December 31, 2014, which is expected to be filed with the

Securities and Exchange Commission (“SEC”) on or before March 2,

2015, Vista’s results of operations for 2014 will be included in

the Company’s consolidated results of operations, and the sale of

Vista will be disclosed as a subsequent event. In all subsequent

filings with the SEC, Vista’s operating results will be reported as

discontinued operations on a retrospective basis for all periods

presented. In the Company’s press release covering its financial

results for the fourth quarter of 2014, which is scheduled to be

released on February 18, 2015, the Company will include historical

quarterly operating results of the Company for 2013 and 2014 that

have been restated to report Vista as discontinued operations.

Board Authorizes New $100 Stock Repurchase Program

In December 2014, the Company completed its existing $100

million share repurchase program whereby the Company repurchased

3.4 million shares at an average per share price of $29.78.

On January 16, 2015, the Company’s Board of Directors authorized

a new $100 million share repurchase program subject in part to

amendment of its credit facility. The new share repurchase will be

effective beginning after close of trade two days after the

Company’s next release of earnings.

Conference Call

The Company will hold a brief conference call on Tuesday,

January 20 at 4:30 p.m. EST to discuss this transaction. The

dial-in number for this conference call is 800-230-1074

(+1-612-234-9959 outside the United States). Please reference

Conference ID number 351321. The call will be hosted by Peter

Dameris, President and Chief Executive Officer of On Assignment,

Inc. A replay of the conference call will be available from 6:30

p.m. EST on, Tuesday, January 20, 2015 until 11:30 p.m. EST on

Tuesday, February 3, 2015. The dial-in number for the replay is

800-475-6701 (+1-320-365-3844 outside the United States). The

replay access code is 351321. This call is being webcast by CCBN

and can be accessed through On Assignment's website at

www.onassignment.com.

Fourth Quarter 2014 Financial Results

As previously announced, the Company will release its financial

results for the fourth quarter of 2014 on Wednesday, February 18,

2015, to be followed by its regular quarterly conferenced call

scheduled for 4:30 p.m. EST. With respect to financial results for

the fourth quarter of 2014, the Company expects its revenues and

Adjusted EBITDA (a non-GAAP measure defined below) for the fourth

quarter of 2014 will be slightly above the high end of its

previously-announced financial estimates.

About On Assignment

On Assignment, Inc. is a leading global provider of in-demand,

skilled professionals in the growing technology, healthcare and

life sciences sectors, where quality people are the key to

success. The Company goes beyond matching résumés with

job descriptions to match people they know into positions they

understand for temporary, contract-to-hire, and direct hire

assignments. Clients recognize On Assignment for its

quality candidates, quick response, and successful assignments.

Professionals think of On Assignment as a career-building

partner with the depth and breadth of experience to help them reach

their goals.

On Assignment, which is based in Calabasas,

California, was founded in 1985 and went public in 1992. The

Company has a network of branch offices throughout the United

States, Canada, United Kingdom, Netherlands,

Ireland, and Belgium. To learn more,

visit www.onassignment.com.

Reasons for Presentation of Non-GAAP Financial

Measures

Statements in this release and the Supplemental Financial

Information accompanying include non-GAAP financial measures. Such

information is provided as additional information, not as an

alternative to our consolidated financial statements presented in

accordance with GAAP, and is intended to enhance an overall

understanding of our current financial performance. The

Supplemental Financial Information sets forth financial measures

reviewed by our management to evaluate our operating performance.

Such measures also are used to determine a portion of the

compensation for some of our executives and employees. We believe

the non-GAAP financial measures provide useful information to

management, investors and prospective investors by excluding

certain charges and other amounts that we believe are not

indicative of our core operating results. These non-GAAP measures

are included to provide management, our investors and prospective

investors with an alternative method for assessing our operating

results in a manner that is focused on the performance of our

ongoing operations and to provide a more consistent basis for

comparison between quarters. One of the non-GAAP financial measures

presented is EBITDA (earnings before interest, taxes, depreciation,

and amortization of intangible assets), other terms include

Adjusted EBITDA (EBITDA plus equity-based compensation expense,

impairment charges, write-off of loan costs, and acquisition,

integration and strategic planning expenses) and non-GAAP income

from continuing operations (income from continuing operations, plus

write-off of loan costs, and acquisition, integration and strategic

planning expenses, net of tax) and adjusted income from continuing

operations and related per share amounts. These terms might not be

calculated in the same manner as, and thus might not be comparable

to, similarly-titled measures reported by other companies. The

financial statement tables that accompany this press release

include reconciliation of each non-GAAP financial measure to the

most directly comparable GAAP measure.

Safe Harbor

Certain statements made in this news release are

“forward-looking statements” within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and involve a high

degree of risk and uncertainty. Forward-looking statements include

statements regarding the Company's anticipated financial and

operating performance in 2014. All statements in this release,

other than those setting forth strictly historical information, are

forward-looking statements. Forward-looking statements are not

guarantees of future performance, and actual results might differ

materially. In particular, the Company makes no assurances that the

estimates of revenues, gross margin, SG&A, Adjusted EBITDA,

income from continuing operations, adjusted income from continuing

operations, earnings per share or earnings per diluted share set

forth above will be achieved. Factors that could cause or

contribute to such differences include actual demand for our

services, our ability to attract, train and retain qualified

staffing consultants, our ability to remain competitive in

obtaining and retaining temporary staffing clients, the

availability of qualified temporary professionals, management of

our growth, continued performance of our enterprise-wide

information systems, our ability to manage our potential or actual

litigation matters, the successful integration of our recently

acquired subsidiaries, the successful implementation of our

five-year strategic plan, and other risks detailed from time to

time in our reports filed with the SEC, including our Annual Report

on Form 10-K for the year ended December 31, 2013, as filed with

the SEC on March 3, 2014 and our Quarterly Reports on Form 10-Q for

the periods ended March 31, 2014, June 30, 2014 and September 30,

2014 as filed with the SEC on May 9, 2014, August 11, 2014 and

November 7, 2014, respectively. We specifically disclaim any

intention or duty to update any forward-looking statements

contained in this news release.

On Assignment, Inc.Ed PierceChief Financial

Officer818-878-7900

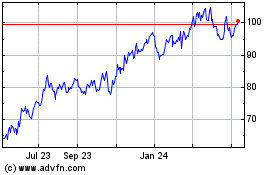

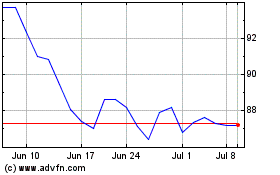

ASGN (NYSE:ASGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASGN (NYSE:ASGN)

Historical Stock Chart

From Apr 2023 to Apr 2024