TIDMOEX

RNS Number : 7936W

Oilex Ltd

29 April 2016

29 April 2016

OILEX LTD - MARCH 2016 QUARTERLY REPORT

HIGHLIGHTS

CAMBAY FIELD, ONSHORE GUJARAT, INDIA

>> Gas sales from Cambay-77H continue with an average gas

production rate for the quarter of 248,870 scfd, 43 boepd (Oilex

net 111,992 scfd, 19 boepd) and with an average associated

condensate rate of 11 bopd (Oilex net 5 bopd).

>> A cost cutting programme has been undertaken covering

field operations and office costs in India in response to continued

low oil & gas prices and the reduced activity level.

>> A phased development plan for Cambay-77H and Cambay-73

is being finalised for government approval to allow continued

production from Cambay-77H and to bring Cambay-73 back on line.

>> Technical work is underway investigating alternative

low cost drilling and development strategies to access hydrocarbon

volumes present in the Eocene formation.

>> Geological review work is underway to identify workover

and/or new drilling opportunities in the shallower conventional

Oligocene OSII formation with the possibility of combining deeper

targets in one well.

>> Negotiations continue with our joint venture partner to

address payment of outstanding cash calls, contributions to

programmed activities, and annual budget resulting in delays to

planned activities and cashflows.

>> A revised base budget has been submitted to the JV

partner for the financial year starting April 2016.

BHANDUT FIELD, ONSHORE GUJARAT, INDIA

>> Preparation for production start-up continued during the quarter.

>> Gas production commenced in early April flowing at the

expected stabilised rate of 700,000 scfd, 120 boepd (Oilex net

280,000 scfd, 48 boepd) through a 8/64" choke.

>> The JV approved the Work Programme & Budget for

Bhandut Field for the Indian financial year starting April

2016.

CORPORATE

>> A cost cutting programme has been undertaken covering

Perth office in response to continued low oil & gas prices and

the reduced activity level.

>> Oilex continues to negotiate with Zeta Resources

Limited (Zeta) to resolve the current dispute. Zeta filed and

served its reply and defence to Oilex's cross claim in the Federal

Court.

>> Brad Lingo, who has 30 years of experience in the

industry was appointed as an independent non- executive director in

February.

>> Jonathan Salomon, was appointed as Managing Director following the resignation of Ron Miller.

OVERVIEW

While the Indian energy market remains relatively strong,

protracted low oil and gas prices have impacted Oilex's Indian

operations. A cost cutting initiative has been undertaken in both

the Perth and Indian offices and in field activities resulting in

the reduction of personnel and reduced work activity. Our JV

partner, GSPC, continues to be in arrears in paying cash calls and

in delaying approvals for budgets and work programmes. GSPC's

larger financial problems have recently been the subject of a

report from the Comptroller and Auditor General of India and

reported in the Indian press. As a result, Oilex has prepared a

reduced budget for the Cambay Field for the Indian financial year

starting 1 April 2016. The associated work programme concentrates

primarily on maintenance of the asset. The option to drill a well

would require a budget revision later in the year.

The project retains its strong fundamentals centred around the

proven rich petroleum system of the Cambay Basin and the multiple

wells that have intersected and produced hydrocarbons. Multiple

targets are present at stacked stratigraphic levels and commercial

success requires the further refining of proven technologies

focussed around long horizontal well sections, and the application

of optimal drilling and completions technology.

India's ongoing requirement for gas resources provides the

opportunity to displace imported LNG with domestic production,

particularly from a new generation of unconventional projects such

as the Cambay Project. While the excess of demand over supply is

clear, each sale contract needs to take into account any local

constraints in accessing both buyers and infrastructure.

A technical review of the EP IV (Y Zone) potential is currently

underway, incorporating the results of the Cambay-77H well, and all

associated geological and engineering data. It had been previously

identified that new core samples are required to complete the

evaluation of the susceptibility of the rock to reservoir

stimulation through induced fracturing. Oilex is now broadening the

approach to include available drill cuttings and existing core in

adjoining blocks. The Oilex technical team is also reviewing

alternative, potentially lower cost, completion technologies.

Following current production data from Cambay-77H, and as a

consequence of current depressed oil and gas prices, a revised

resource and reserves estimate will be undertaken in respect of the

Cambay Field.

HEALTH, SAFETY, SECURITY AND ENVIRONMENT

No lost time incidents recorded during the quarter.

CAMBAY FIELD, GUJARAT, INDIA

(Oilex: Operator and 45% interest)

The main production during the quarter occurred from Cambay-77H.

The well averaged production of 248,870 scfd, 43 boepd (Oilex net

111,992 scfd, 19 boepd) with an average associated condensate rate

of 11 bopd (Oilex net 5 bopd) under Government of India (GoI)

approval to produce test gas. A phased field development plan is

being prepared to gain approval for continued production and to

bring Cambay-73 well back on line at an anticipated gas rate of

80,000 scfd, 14 boepd (Oilex net 36,000 scfd, 6 boepd) with an

associated condensate rate of 3 bopd (Oilex net 1.4 bopd).

Additional oil production occurred from nine intermittent low

rate wells. Five of these will be shut in as they no longer produce

economically.

Cambay gas continues to be sold into the low pressure gas market

in the vicinity of the field.

BHANDUT FIELD, GUJARAT, INDIA

(Oilex: Operator and 40% interest)

Gas production from the Bhandut Field commenced after the end of

the quarter at a stabilised rate of 700,000 scfd, 120 boepd (Oilex

net 280,000 scfd, 48 boepd) from one well. Gas produced from

Bhandut-3 is initially processed at the on-site production

facilities and then delivered to a third party operated gas

processing plant where it is further treated to the required

pipeline specification. It is subsequently compressed for entry

into the high pressure gas network for delivery to an end user. All

environmental clearances for the commencement of gas production

have been obtained from the relevant authorities.

A field development plan is being prepared to gain approval to

continue production after September 2016.

Figure 1:Bhandut Facility

Figure2: Map Showing Bhandut location and surrounding

peipelines

Joint Venture Management

Oilex continues to engage with its joint venture partner GSPC to

resolve the unpaid cash calls and to obtain a commitment from GSPC

to participate in future activities or to find an alternative

solution. At the end of the quarter, the total unpaid cash calls

were $US7.4 million. Adjustments have been made to the JV

receivable balance for reduced head office recharges, insurance

claim adjustment and reversal of accrued costs no longer required.

Two payments were received following the end of the quarter from

GSPC totalling A$275,000, of which A$120,000 was for Cambay, and

A$155,000 for Bhandut. Oilex continues to manage payment of JV

creditors under a staged plan.

Negotiations on a budget acceptable to the JV partner have been

ongoing. Oilex has prepared a reduced budget for the Cambay Project

for the Indian financial year starting 1 April 2016. The associated

work programme concentrates primarily on maintenance of the asset.

Any wells drilled within the year will require the submission of a

budget revision and approvals by the JV partner and the GoI.

The Cambay Production Sharing Contract (PSC) primary term

expires in September 2019, and the JV has the possibility of

applying for two five year extensions, such that the PSC could be

extended to 2029, subject to a field development plan being

submitted. The GoI has recently issued a policy proposal to extend

the term of 28 small and medium sized fields, which includes the

Cambay Field, to the economic life of the field. The GoI proposal

is anticipated to be finalised in 2016.

The JV Partner has approved the Work Programme & Budget

(WP&B) for the Bhandut Field for the Indian financial year

starting 1 April 2016. JV Partner approval of the WP&B for

Cambay Field for the same period has not yet been received.

WALLAL GRABEN, WESTERN AUSTRALIA (CANNING BASIN)

(Oilex: Operator and 100% interest)

The Wallal Graben asset is located adjacent to the Pilbara, a

global resource centre for iron ore and LNG in Western Australia.

The Company has a low cost entry into a province with the key

determinates for successful development, being:

-- Markets

-- Infrastructure

-- Geology

-- Suitable Joint Venture funding support

Figure 3: Significant infrastructure within and adjacent to

OIlex's Wallal Graben permits

The Wallal Graben blocks are frontier exploration blocks that

represent a potential low cost entry to an underexplored area.

Oilex continues to investigate low cost exploration de-risking

tools and approaches that address the geological uncertainties in

this basin.

Final award of the blocks requires signing of Heritage

Agreements with the Nyangumarta people in the two northern blocks

and is linked to a request to the Department of Mines and Petroleum

(DMP) that all three blocks be awarded simultaneously.

Consultations on the Heritage Agreements for all blocks are

ongoing. Subsequent to finalising Heritage Agreements with the

Native Title parties, the DMP will make an offer to grant a

Petroleum Exploration Permit for each of the three blocks to the

Company for acceptance.

JPDA 06-103, TIMOR SEA

(Oilex: Operator and 10% interest)

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 03:39 ET (07:39 GMT)

Oilex as operator and on behalf of the joint venture

participants continues to seek a resolution to the dispute with

Autoridade Nacional do Petroleo (ANP). The ANP has rejected a Joint

Venture request to terminate the PSC by mutual agreement, in good

standing and without penalty and is seeking to impose a penalty

US$13,585,790 (net US$1.4m to OEX) as full and final settlement.

The Joint Venture rejected this offer on the basis that it

considers a nil penalty should be imposed, and a much lower

settlement figure is applicable. The Joint Venture has made

significant overpayments in the work programme, and is of the

opinion that the excess expenditure should be included as part of

any financial assessment incorporated in the termination process.

The Joint Venture continues to discuss the financial liability upon

termination with the ANP and is attempting to reach an amicable

settlement.

WEST KAMPAR PSC, CENTRAL SUMATRA, INDONESIA

(Oilex: 45% interest and further 22.5% secured(2) )

A Court approved Scheme of Arrangement has been implemented over

the Operator, however Oilex continues to pursue enforcement of the

Arbitration Award and a commercial settlement.

CORPORATE

At the end of the quarter the Company retained cash resources of

$8.1 million.

During the quarter the Company continued to implement cost

reductions to reduce ongoing operating costs by 47% per annum in

India and 23% per annum on its overhead and corporate costs. Cost

reduction initiatives being implemented include:

-- 45% reduction in headcount in India

-- 25% reduction in headcount in Perth

-- 10% reduction in salaries and wages for remaining personnel across both India and Australia

-- 10% reduction in directors' fees as at 31 January 2016

-- Reduced travel and other corporate costs

Cost savings implemented in the quarter were partially offset by

redundancy costs incurred. In addition, significant legal fees

continue to be incurred with respect to Zeta legal action.

Zeta Litigation

The Company continues to seek resolution to legal action

instituted in the Federal Court of Australia by Zeta on or about 12

November 2015 against the Company. On 16 December 2015 the Company

filed its defence in the Federal Court against proceedings

initiated by Zeta. The Company has also filed a cross-claim against

Zeta seeking orders of specific performance requiring Zeta to

perform its obligations and complete the relevant share

subscription and convertible note agreements (or otherwise pay

damages to the Company).

The parties had agreed to a standstill on legal action until 1

March 2016 to explore a possible commercial resolution. A

resolution was unable to be agreed by that date, and as a result,

Zeta filed and served its reply and defence to Oilex's cross claim

on 29 March 2016. The parties are continuing discussions in an

effort to find a commercial resolution.

The Company has incurred significant legal fees during the

quarter as a result of this litigation which is reflected in the

administration cash outflows reported in the Appendix 5B

attached.

Board Composition

On 11 February 2016 the Company announced the appointment of Mr

Brad Lingo as an independent non-executive director. Mr Lingo has

over 30 years' experience in a diverse range of oil and gas

leadership roles, including business development, new ventures,

mergers and acquisitions and corporate finance.

On 18 March 2016 the Company announced the appointment of

Jonathan (Joe) Salomon, who at that time was an independent

non-executive director, as the new Managing Director of the Company

following the resignation of Mr Ron Miller.

Capital Structure as

at 31 March 2016

Ordinary Shares 1,180,426,999

Unlisted Options 21,150,000

Qualified Petroleum Reserves and Resources Evaluator

Statement

Pursuant to the requirements of Chapter 5 of the ASX Listing

Rules, the information in this report relating to petroleum

reserves and resources is based on and fairly represents

information and supporting documentation prepared by or under the

supervision of Mr. Peter Bekkers, Chief Geoscientist employed by

Oilex Ltd. Mr. Bekkers has over 20 years' experience in petroleum

geology and is a member of the Society of Petroleum Engineers and

AAPG. Mr. Bekkers meets the requirements of a qualified petroleum

reserve and resource evaluator under Chapter 5 of the ASX Listing

Rules and consents to the inclusion of this information in this

report in the form and context in which it appears. Mr. Bekkers

also meets the requirements of a qualified person under the AIM

Note for Mining, Oil and Gas Companies and consents to the

inclusion of this information in this report in the form and

context in which it appears.

Board of Directors

Max Cozijn Non-Executive Chairman

Brad Lingo Independent Non-Executive

Director

Joe Salomon Managing Director

Company Secretary

Chris Bath CFO & Company Secretary

Stock Exchange

Listing

Australian Securities Code: OEX

Exchange

AIM London Stock Code: OEX

Exchange

Share Registry

Australia United Kingdom

Link Market Services Limited Computershare Investor

Central Park Services PLC

Level 4 The Pavilions

152 St. Georges Terrace Bridgwater Road

Perth, WA 6000 Australia Bristol BS13 8AE United

Telephone: 1300 554 474 Kingdom

Website: Telephone: +44 (0) 870

http://investorcentre.linkmarketservices.com.au 703 6149

Facsimile: +44 (0) 870

703 6116

Website:

www.computershare.com

PERMIT SCHEDULE - 31 MARCH 2016

-----------------------------------------------------------------------------

ASSET LOCATION ENTITY EQUITY OPERATOR

%

---------------- ------------------ -------------- -------- -------------

Cambay Field Gujarat, Oilex Ltd 30.0 Oilex Ltd

PSC India

---------------- ------------------ -------------

Oilex NL

Holdings

(India)

Limited 15.0

-------------------------------------------------- -------- -------------

Bhandut Gujarat, Oilex NL 40.0 Oilex NL

Field PSC India Holdings Holdings

(India) (India)

Limited Limited

---------------- ------------------ -------------- -------- -------------

Sabarmati Gujarat, Oilex NL 40.0 Oilex NL

Field PSC(1) India Holdings Holdings

(India) (India)

Limited Limited

---------------- ------------------ -------------- -------- -------------

West Kampar Sumatra, Oilex (West 67.5 PT Sumatera

PSC Indonesia Kampar) (2) Persada

Limited Energi

---------------- ------------------ -------------- -------- -------------

JPDA 06-103 Joint Petroleum Oilex (JPDA 10.0 Oilex (JPDA

PSC Development 06-103) 06-103)

Area Ltd Ltd

Timor-Leste

& Australia

---------------- ------------------ -------------- -------- -------------

STP-EPA-0131 Western Admiral 100.0 Admiral

Australia Oil Pty Oil Pty

Ltd (3) Ltd (3)

---------------- ------------------ -------------- -------- -------------

STP-EPA-0106 Western Admiral 100.0 Admiral

Australia Oil and Oil and

Gas (106) Gas (106)

Pty Ltd Pty Ltd

(3) (3)

---------------- ------------------ -------------- -------- -------------

STP-EPA-0107 Western Admiral 100.0 Admiral

Australia Oil and Oil and

Gas (107) Gas (107)

Pty Ltd Pty Ltd

(3) (3)

---------------- ------------------ -------------- -------- -------------

(1) Sabarmati Field relinquishment proposal has been submitted

to the Government of India and accepted. Awaiting formal approval

for the cancellation of the Sabarmati Field PSC.

(2) Oilex (West Kampar) Limited is entitled to have assigned an

additional 22.5% to its holding through the exercise of its rights

under a Power of Attorney granted by PT Sumatera Persada Energi

(SPE) following the failure of SPE to repay funds due. The

assignment has been provided to BPMigas (now SKKMigas) but has not

yet been approved or rejected. If Oilex is paid the funds due it

will not pursue this assignment.

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 03:39 ET (07:39 GMT)

(3) Ultimate parent entity is Oilex Ltd.

Barrel/bbl Standard unit of measurement for all

oil and condensate production. One barrel

is equal to 159 litres or 35 imperial

gallons.

------------- ------------------------------------------------

MMBO Million standard barrels of oil or condensate

------------- ------------------------------------------------

SCFD Standard cubic feet (of gas) per day

------------- ------------------------------------------------

MSCFD Thousand standard cubic feet (of gas)

per day

------------- ------------------------------------------------

MMSCFD Million standard cubic feet (of gas)

per day

------------- ------------------------------------------------

BBO Billion standard barrels of oil or condensate

------------- ------------------------------------------------

BCF Billion Cubic Feet of gas at standard

temperature and pressure conditions

------------- ------------------------------------------------

Discovered Is that quantity of petroleum that is

in place estimated, as of a given date, to be

volume contained in known accumulations prior

to production

------------- ------------------------------------------------

Undiscovered Is that quantity of petroleum estimated,

in place as of a given date, to be contained

volume within accumulations yet to be discovered

------------- ------------------------------------------------

PSC Production Sharing Contract

------------- ------------------------------------------------

Prospective Those quantities of petroleum which

Resources are estimated, as of a given date, to

be potentially recoverable from undiscovered

accumulations.

------------- ------------------------------------------------

Contingent Those quantities of petroleum estimated,

Resources as of a given date, to be potentially

recoverable from known accumulations

by application of development projects,

but which are not currently considered

to be commercially recoverable due to

one or more contingencies.

Contingent Resources may include, for

example, projects for which there are

currently no viable markets, or where

commercial recovery is dependent on

technology under development, or where

evaluation of the accumulation is insufficient

to clearly assess commerciality. Contingent

Resources are further categorized in

accordance with the level of certainty

associated with the estimates and may

be sub-classified based on project maturity

and/or characterised by their economic

status.

------------- ------------------------------------------------

Reserves Reserves are those quantities of petroleum

anticipated to be commercially recoverable

by application of development projects

to known accumulations from a given

date forward under defined conditions.

Proved Reserves are those quantities

of petroleum, which by analysis of geoscience

and engineering data, can be estimated

with reasonable certainty to be commercially

recoverable, from a given date forward,

from known reservoirs and under defined

economic conditions, operating methods

and government regulations.

Probable Reserves are those additional

Reserves which analysis of geoscience

and engineering data indicate are less

likely to be recovered than Proved Reserves

but more certain to be recovered than

Possible Reserves.

Possible Reserves are those additional

reserves which analysis of geoscience

and engineering data indicate are less

likely to be recoverable than Probable

Reserves.

Reserves are designated as 1P (Proved),

2P (Proved plus Probable) and 3P (Proved

plus Probable plus Possible).

Probabilistic methods

P90 refers to the quantity for which

it is estimated there is at least a

90% probability the actual quantity

recovered will equal or exceed. P50

refers to the quantity for which it

is estimated there is at least a 50%

probability the actual quantity recovered

will equal or exceed. P10 refers to

the quantity for which it is estimated

there is at least a 10% probability

the actual quantity recovered will equal

or exceed.

------------- ------------------------------------------------

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report

Introduced 1/07/96. Origin: Appendix 8. Amended 1/07/97,

1/07/98, 30/09/01, 1/06/10, 17/12/10, 01/05/13.

Name of entity

OILEX LTD

ABN Quarter ended (current

quarter)

50 078 652 632 31 March 2016

----------------- ----------------------

1 Consolidated statement of cash flows

----- -----------------------------------------------------------------------------

Current Year to

quarter date

$A'000 (9 months)

$A'000

--------- ------------

Cash flows related to operating

activities

Receipts from product

1.1 sales and related debtors 91 253

Payments for (a) exploration

1.2 and evaluation (1,373) (5,808)

(b) development (25) (222)

(c) production (287) (717)

(d) administration (net) (1,709) (3,584)

1.3 Dividends received - -

Interest and other items

1.4 of a similar nature received 26 54

1.5 Interest and other costs

of finance paid - -

1.6 Income taxes paid - -

1.7 Other - R&D Grant 325 325

--------- ------------------------------------------------ --------- ------------

Net operating cash flows (2,952) (9,699)

------- -------------------------------------------------- --------- ------------

Cash flows related to investing

activities

Payment for purchases

of:

(a) prospects - -

(b) equity investments - -

1.8 (c) other fixed assets (13) (38)

Proceeds from sale of:

(a) prospects (refer

2.2 below) - -

(b) equity investments - -

1.9 (c) other fixed assets - 3

Loans from/(to) other

1.10 entities (216) (191)

Loans repaid by other - -

1.11 entities

1.12 Other - -

--------- ------------------------------------------------ --------- ------------

Net investing cash flows (229) (226)

--------- ------------------------------------------------ --------- ------------

Total operating and investing

1.13 cash flows (carried forward) (3,181) (9,925)

--------- ------------------------------------------------ --------- ------------

Current Year to

quarter date

$A'000 (9 months)

$A'000

--------------------------------------- -------------------------------------- ------------------- ----------------

Total operating and investing

1.13 cash flows (brought forward) (3,181) (9,925)

--------------------------------------- -------------------------------------- ------------------- ----------------

Cash flows related to financing

activities

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 03:39 ET (07:39 GMT)

Proceeds from issues of

1.14 shares, options, etc (net) 92 17,270

Proceeds from sale of - -

1.15 forfeited shares

Proceeds from borrowings - -

1.16 (net)

1.17 Repayment of borrowings - -

1.18 Dividends paid - -

1.19 Other - -

--------------------------------------- -------------------------------------- ------------------- ----------------

Net financing cash flows 92 17,270

--------------------------------------- -------------------------------------- ------------------- ----------------

Net (decrease) / increase

in cash held (3,089) 7,345

Cash at beginning of quarter/year

1.20 to date 11,547 1,187

Exchange rate adjustments

1.21 to item 1.20 (322) (396)

--------------------------------------- -------------------------------------- ------------------- ----------------

1.22 Cash at end of quarter 8,136 8,136

--------------------------------------- -------------------------------------- ------------------- ----------------

Payments to directors of the entity and Current

associates of the directors quarter

Payments to related entities of the entity $A'000

and associates of the related entities

------------------------------------------------------------------------------------------------------ --------------

Aggregate amount of payments to the

1.23 parties included in item 1.2 239

--------------------------------------- ------------------------------------------------------------- --------------

Aggregate amount of loans to the

1.24 parties included in item 1.10

--------------------------------------- ------------------------------------------------------------- --------------

1.25 Explanation necessary for an understanding

of the transactions

2 Non-cash financing and investing activities

----------------------------------------- ---------------------------------------------------------------------------

2.1 Details of financing and investing transactions

which have had a material effect on consolidated

assets and liabilities but did not involve

cash flows

---------------------------------------------------------------------------

N/A

----------------------------------------- ---------------------------------------------------------------------------

2.2 Details of outlays made by other entities

to establish or increase their share in projects

in which the reporting entity has an interest

---------------------------------------------------------------------------

N/A

----------------------------------------- ---------------------------------------------------------------------------

3 Financing facilities Amount available Amount used

available $A'000 $A'000

Add notes as necessary

for an understanding

of the position.

----------------------------------- ----------------------------------------

3.1 Loan facilities - -

------------------- ------------------

3.2 Credit standby arrangements - -

----------------------------------- ---------------------------------------- ------------------- ------------------

4 Estimated cash outflows for next $A'000

quarter

----------------

4.1 Exploration and evaluation 1,900

----------------

4.2 Development -

----------------

4.3 Production 300

----------------

4.4 Administration 1,900

----------------

Total 4,100

------------------------------------- ----------------------------------------------------------- ----------------

5 Reconciliation of cash

-------- ------------------------------------------------------------------------------------------------------------

Reconciliation of cash

at the end of the quarter

(as shown in the consolidated

statement of cash flows)

to the related items in Current quarter Previous quarter

the accounts is as follows. $A'000 $A'000

------------------------------------------------------------ ---------------------- --------------------------------

Cash on hand and at

5.1 bank 7,620 8,034

5.2 Deposits at call 516 3,513

5.3 Bank overdraft - -

5.4 Other (provide details) - -

---------------------- --------------------------------

Total: cash at end

of quarter (item 1.22) 8,136 11,547

-------- -------------------------------------------------- ---------------------- --------------------------------

6 Changes in interests in mining tenements

and petroleum tenements

--------

Nature of Interest Interest

Tenement interest at beginning at end

reference (note (2)) of quarter of quarter

-------- ------------------------------ ---------------- ------------------ -------------------- ----------------

6.1 Interests

in mining

tenements

and petroleum Refer to

tenements Permit

relinquished, Schedule

reduced or in Quarterly

lapsed Report

-------- ------------------------------ ---------------- ------------------ -------------------- ----------------

6.2 Interests

in mining

tenements Refer to

and petroleum Permit

tenements Schedule

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 03:39 ET (07:39 GMT)

acquired in Quarterly

or increased Report

-------- ------------------------------ ---------------- ------------------ -------------------- ----------------

7 Issued and quoted securities at end of current

quarter

Description includes rate of interest and

any redemption or conversion rights together

with prices and dates.

-------- ------------------------------------------------------------------------------------------------------------

Issue Amount

Total Number price paid up

number quoted per security per security

------------------------------------------ ---------------- ------------------ ------------------ ----------------

7.1 Preference

+securities

(description) - - - -

7.2 Changes during

quarter

(a) Increases

through issues - - - -

(b) Decreases

through returns

of capital,

buy-backs,

redemptions - - - -

-------- -------------------------------- ---------------- ------------------ ------------------ ----------------

7.3 +Ordinary securities 1,180,426,999 1,180,426,999 Various -

---------------- ------------------ ------------------ ----------------

7.4 Changes during

quarter

(a) Increases

through rights

issue or placement - - - -

(b) Increases

through employee

performance

rights issues - - - -

(c) Increases

through issues

(options exercised) - - - -

(d) Decreases - - - -

through returns

of capital,

buy-backs

-------- -------------------------------- ---------------- ------------------ ------------------ ----------------

Amount

Issue paid

Total Number price up per

number quoted per security security

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

7.5 +Convertible

debt securities

(description) - - - -

---------------- -------------------- ------------------ --------------

7.6 Changes during

quarter

(a) Increases

through issues - - - -

(b) Decreases

through securities

matured, converted - - - -

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

Exercise Expiry

7.7 Options price date

---------------- -------------------- ------------------ --------------

(description

and conversion

factor)

500,000 - $0.15 27/06/2016

2,000,000 - $0.15 04/11/2016

2,000,000 - $0.15 11/11/2016

3,000,000 - $0.15 05/12/2016

500,000 - $0.25 27/06/2017

1,075,000 - $0.25 05/08/2017

1,500,000 - $0.25 25/08/2017

2,000,000 - $0.25 11/11/2017

5,000,000 - $0.10 22/12/2017

500,000 - $0.25 16/02/2018

1,075,000 - $0.35 05/08/2018

500,000 - $0.35 16/02/2019

1,500,000 - $0.35 25/08/2019

---------------- --------------------

Total 21,150,000 -

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

7.8 Issued during - - - -

quarter

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

7.9 Exercised during - - - -

quarter

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

Expired during

7.10 quarter 5,000,000 - $0.25 08/03/2016

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

7.11 Debentures Nil Nil

(totals only)

-------- -------------------------------- ---------------- --------------------

7.12 Unsecured notes Nil Nil

(totals only)

-------- -------------------------------- ---------------- -------------------- ------------------ --------------

Compliance statement

1 This statement has been prepared under accounting policies

which comply with accounting standards as defined in the

Corporations Act or other standards acceptable to ASX.

2 This statement does give a true and fair view of the matters disclosed.

Sign here: Date: 29 April 2016

CFO & Company Secretary

Print name: Chris Bath

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAXLNAAPKEEF

(END) Dow Jones Newswires

April 29, 2016 03:39 ET (07:39 GMT)

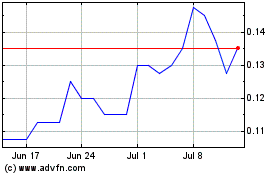

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Apr 2023 to Apr 2024