TIDMOEX

RNS Number : 8564G

Oilex Ltd

25 November 2015

ASX Announcement

25 November 2015

ASX: OEX

AIM: OEX

Chairman's Address to Shareholders

Good morning ladies and gentlemen, and welcome to the 2015 Oilex

Annual General Meeting.

We regret to advise that, as previously announced, Mr Sundeep

Bhandari has withdrawn his nomination for re-election as a director

pursuant to Resolution 3 of the Notice of Annual General Meeting.

In addition, there has been a large negative vote recorded against

all of the resolutions covering the remuneration report (Resolution

1), replacement of the Constitution (Resolution 2) and the

re-election of Jeffrey Auld as an Independent Non-Executive

Director (Resolution 4), all of which will be decided by a poll.

Should Resolution 4 not be carried at this meeting, this will

necessitate the appointment of an additional director following

this AGM to ensure the Company complies with Australian

Corporations Law requirements.

The remaining Board members recognise the dissatisfaction

demonstrated by these votes, and we are setting in train the

following measures to address some of those concerns;

-- The Company is reviewing its strategic plan and financing of our core asset at Cambay.

-- Progress negotiation of a commercial resolution of the Cambay

Joint Venture program, cash calls and potential joint venture

restructure.

-- Defending the Zeta litigation with the assistance of external counsel.

-- Review existing board structure and participants, and appoint

suitably qualified and experienced directors.

-- Reviewing Executive management and staffing levels

appropriate to the current amended development timetable, including

review of ongoing operating costs.

The current year has seen a continuation in the softening of the

global resources and energy markets. During this challenging time

the Board and management has continued the transformation of the

Company into an emerging energy supplier in the Cambay Basin

located in Gujarat State, India.

2014/15 has been a landmark year for your company with the

delivery of the proof-of-concept well, Cambay 77-H, and the

reporting of significant independently certified reserves. Oilex is

the first company to successfully apply proven North American

drilling and completion technology to tight oil and gas in India in

the Cambay Basin, India. The success of this step-change technology

has resulted in an upgrade to the reserves and contingent resources

of our Cambay Field.

Alongside this technological success at Cambay, the Company has

made significant progress on the work-over component of the

approved 2015/16 work programme.

The Cambay Field is located adjacent to an existing gas pipeline

grid with surplus capacity in the State of Gujarat and this should

facilitate cost-effective commercialisation of Cambay natural gas.

While global energy markets are experiencing significant price

constraints, being close to existing infrastructure and growing

local energy demand should ensure that domestic prices will be

somewhat resilient to external price pressures.

With delivery of the proof of concept well at Cambay, Oilex is

now progressing the transition from junior explorer to producer.

This transition will not be without its challenges. Having achieved

the technical proof of concept and independently certified

reserves, the focus and priorities of the Board and management are

increasingly concentrated on the commercial, regulatory and funding

challenges that commencing the next phase of production from Cambay

will bring. In addition to addressing the structural joint venture

funding issues that have arisen.

In July 2015, we announced a capital funding programme to raise

A$30 million (before expenses) to fund the approved 2015/16 work

programme in India, estimated minimum work commitments in the

Canning Basin and working capital requirements. This included a

A$9.4 million deferred settlement component with Zeta Resources

Limited, who currently have a 10.3% shareholding in Oilex.

Earlier this month we advised that Zeta had failed to settle the

subscription for the deferred settlement portion of its placement

and convertible note and was pursuing legal action against Oilex.

With the assistance of external legal counsel, we are presently

considering the remedies available to us and we will act in the

best interests of all shareholders to defend any legal action.

This development has obviously had a significant impact on the

company's share price, however in the short term our focus is to

complete the current Cambay work-overs and the Bhandut-3 production

facilities to increase our net revenue stream. Both programmes are

in progress at present and completion of these activities is an

important step in transforming Oilex into a sustainable business

based upon production, cash flow and reserves growth.

In the medium to longer term our focus remains the

commercialisation of significant hydrocarbon reserves located in an

energy market with strong fundamentals. While the schedule for the

approved 2015/16 drilling campaign at Cambay is currently being

reconsidered with our Joint Venture partner, in addition to their

outstanding cash calls, we anticipate that these wells will be

commercially viable and the first steps in the field development

plan, and should ultimately create significant value for all

shareholders and stakeholders through delivering domestically

sourced energy to the India market offsetting imported LNG. The

Board is also actively reviewing alternative funding opportunities

to assist in realising these goals.

Your Board believes that India offers a compelling investment

proposition as the world's fourth largest energy consumer with a

large unsatisfied gas demand. India is forecast to be the world's

fastest growing large economy over the next two years. Strong

growth, combined with a growing middle class forecast to be 475

million people by 2030 is anticipated to result in significant

growth in energy and natural gas consumption.

On behalf of the Board I wish to record our appreciation for the

support and dedication of our Executive Management, staff, Joint

Venture partners, contractors, local communities, shareholders and

stakeholders during the year and look forward to the successful

restructuring of the Board, capital structure and commercialisation

of the Cambay Field.

In addition, I would like to record mine and the Board's

appreciation for the significant contribution made by Mr Sundeep

Bhandari who has decided to retire as a non-executive director from

the close of this Annual General Meeting.

Yours Sincerely,

MDJ Cozijn

Chairman

For further information, please contact:

Investor Enquiries Nominated Adviser Media Enquires

Oilex Ltd Strand Hanson Limited Vigo Communications

Ron Miller Nominated Adviser Public Relations UK

Managing Director Rory Murphy /Ritchie Patrick d'Ancona /

Email: oilex@oilex.com.au Balmer Chris McMahon

Tel: +61 8 9485 3200 Email: oilex@strandhanson.co.uk Email: patrick.dancona@vigocomms.com

Australia Tel: +44 20 7409 3494 chris.mcmahon@vigocomms.com

UK Tel: +44 20 7016 9570

UK

=========================== ================================= ======================================

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFEISEIFISELF

(END) Dow Jones Newswires

November 25, 2015 02:00 ET (07:00 GMT)

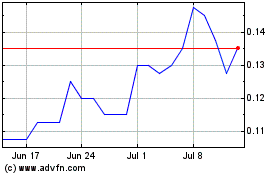

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synergia Energy (LSE:SYN)

Historical Stock Chart

From Apr 2023 to Apr 2024