Oil and Gas Giants to Join Wind-Energy Battle, Says Dong CEO

May 13 2016 - 12:35PM

Dow Jones News

By Selina Williams

LONDON--The offshore wind-energy industry will soon be flooded

by competition as big oil companies join utilities and small

renewable players in the growing sector, said the chief executive

of the world's biggest offshore wind company, Dong Energy.

Henrik Poulsen also said some new investment in offshore wind

energy was coming from companies primarily associated with

traditional oil and gas markets, like Royal Dutch Shell PLC, Eni

SpA of Italy and Total SA France.

"They have been hesitant," said Mr. Poulsen, president and chief

executive of Dong Energy said in an interview with The Wall Street

Journal.

"But I think they've come to a point where they're thinking

'Gee, maybe we should start mobilizing behind renewables, maybe the

green transformation won't slow down.'"

Dong was once one of Europe's most coal intensive utilities but

the state-owned enterprise has steered its business away from coal

and oil and gas extraction in the past decade toward offshore wind.

The move has helped lift profits thanks to Europe's significant

wind power subsidies.

The company says it has a 26% share of the installed offshore

wind-energy capacity in the world, more than twice as much as its

nearest rival.

Dong on Thursday announced its plans for an initial public

offering this summer in what could be one of Europe's biggest stock

market listings this year. The IPO is expected to consist of a sale

of at least 15% of the company. The Danish government has a 58.8%

stake in Dong but plans to retain a controlling stake of 50.1%.

Other shareholders include Goldman Sachs, which has a 17.9%

stake.

Mr. Poulsen said he was bracing for more competition from bigger

companies.

"We're talking about huge companies with significant capital and

execution power. We need to just keep sharpening our sword," he

added.

For instance, Dong is bidding against Shell, the Anglo-Dutch oil

giant, for a contract to develop two 350-megawatt wind farms off

the coast of the Netherlands.

Shell said it had substantial expertise in the North Sea and in

managing large projects and expected to be able to put its broader

experience and capabilities to use in making the Netherlands

project a success.

This week Italy's Eni SpA said it plans to build renewable

energy projects in Italy, Pakistan and Egypt, while French oil

major Total SA has set up a natural gas, renewables and power

division and this week announced a $1 billion acquisition of French

high-technology battery company Saft. A spokeswoman said Total was

committed to renewable energy.

Norway's Statoil, which last year established a separate energy

unit to capitalize on the growing renewable energy sector, said in

April it had joined with with utility E. ON AG to develop an

offshore wind farm off the coast of Germany.

While the investments of Europe's biggest energy companies in

renewable energy represent only a tiny fraction of investments in

their traditional oil and gas business, their interest in the

sector marks their growing efforts to deal with investor concerns

about climate change and growing global political commitment in the

past two years to reduce carbon emissions.

"Oil and gas will remain import for decades to come, but growth

in renewables will be steep and we believe we can take part in that

growth and create value," a spokesman for Statoil said.

Write to Selina Williams at selina.williams@wsj.com

(END) Dow Jones Newswires

May 13, 2016 12:20 ET (16:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

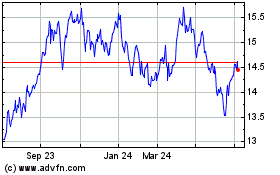

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024