Oil Prices Fall After Iraq Signals Doubts Over OPEC Cut

October 24 2016 - 4:28PM

Dow Jones News

By Sarah McFarlane and Jenny W. Hsu

Oil prices tumbled Monday amid doubts over OPEC's proposed

output cut, after Iraq signaled it wants to be excluded from the

pact.

Light, sweet crude for December delivery settled down 33 cents,

or 0.6%, at $50.52 a barrel on the New York Mercantile Exchange.

U.S. oil nearly fell as low as $49.62 a barrel before a rebound

throughout the afternoon. Brent, the global benchmark, fell 32

cents, or 0.6%, to $51.46 a barrel.

Iraqi oil officials Sunday were reported to have said they

wouldn't scale back output, which currently stands at 4.77 million

barrels a day. Iraq is the second largest Organization of the

Petroleum Exporting Countries producer after Saudi Arabia, making

its commitment to any cut to OPEC's oil output key.

"This shift by OPEC's second-largest producer could become a

deal breaker," said Tim Evans, analyst at Citi Futures Perspective

in New York.

Enterprise Products Partners also announced Monday a leak led it

to shutter its Seaway Pipeline, which can carry 400,000 barrels a

day to the Gulf Coast from the Cushing, Okla., hub for U.S. oil.

That had some concerned about oil supplies backing up and initially

caused U.S. prices to fall much further than international

prices.

But the market pared those losses throughout the day, a further

sign that many bullish traders are eager to jump in and bet the

market is ending a long period of oversupply, said Scott Shelton,

broker at ICAP PLC. OPEC members are scheduled to meet Nov. 30 to

discuss limiting the group's production under 33 million barrels a

day, which already had helped the market rally 30% in less than

three months.

Skeptics are also still active, though, and the market has given

back 2.1% since hitting a new one-year high last week. Many are

bracing for the OPEC deal to flop given the members' record of not

complying with quotas.

"There is a risk that Iraq's refusal could trigger a domino

effect that other producers would ask to be exempt from the cuts

too," said Gao Jian, an energy analyst at SCI International.

OPEC members Iran, Libya and Nigeria already expected to be

exempt from the deal, while nonmember Russia is also looking

unlikely to join any action to curb production.

"If they do nothing, OPEC production next year is likely to

average at least 34 mbpd (million barrels a day) with a real threat

of it reaching close to 35 mbpd if the chaos in Libya and Nigeria

were to be resolved," brokerage PVM said.

Oil prices are also under pressure as the number of active oil

rigs in the U.S. continue to climb. Last week, the oil-rig count

rose by 11 to 443, according to oil-field services company Baker

Hughes Inc.

The U.S. oil-rig count is typically viewed as a proxy for

activity in the sector. After peaking at 1,609 in October 2014, low

oil prices put downward pressure on production and the rig count

fell sharply. The oil-rig count has generally been rising since the

beginning of the summer and the uptrend is likely to continue,

Morgan Stanley said in a note.

"Rig count typically lags prices by three to four months, so we

would expect to see more rigs added, especially near year-end," the

bank said.

China's crude oil imports surged 18% in September, while

gasoline exports rose 37% and diesel exports were up 44% versus the

same period a year ago. Independent refiners in China have emerged

as an important force in oil markets this year. They accounted for

the vast majority of the 14% surge in imports this year by China,

which now rivals the U.S. as world's largest crude importer.

Political developments in Venezuela are being monitored after

the congress announced they would begin impeachment proceedings

against President Nicolás Maduro. The country's oil-dependent

economy has been hit hard by the prolonged collapse in crude price.

Its oil production in the 12 months to September declined 11% to

2.3 million barrels and the economy is expected to contract by at

least 10% this year.

Gasoline futures lost 2.76 cents, or 1.8%, to $1.5038, its

largest daily decline since Sept. 20. Diesel futures gained 0.58

cent, or 0.4%, to $1.5798 a gallon, its fourth gain in five

sessions.

Timothy Puko and Alison Sider contributed to this article

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com and Jenny W.

Hsu at jenny.hsu@wsj.com

(END) Dow Jones Newswires

October 24, 2016 16:13 ET (20:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

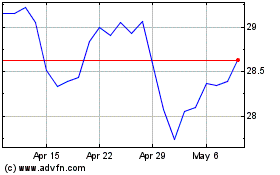

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024