OFT Refers Acquisition By Dorf Ketal Chemicals Of Johnson Matthey Unit

November 19 2010 - 10:40AM

Dow Jones News

The Office of Fair Trading, or OFT, said Friday it referred the

anticipated acquisition by Dorf Ketal Chemicals AG of the titanate

and zirconate business of Johnson Matthey PLC (JMAT.LN) to the

Competition Commission for further investigation.

MAIN FACTS:

-Dorf and the Johnson Matthey Business are the two largest

suppliers of titanate and zirconate in the U.K., as well as on a

European and global basis.

-The OFT is concerned that the proposed merger would enable Dorf

to increase prices and/or decrease quality, range and service to

customers as a result of the loss of competition.

-During its investigation, the OFT received a significant number

of submissions from third parties, supporting the view that there

is a substantial degree of competition between Dorf and the Johnson

Matthey Business.

-OFT considered carefully whether there would be sufficient

constraints on Dorf from existing rival suppliers and/or new

entrants into the market.

-However, the evidence available indicated that barriers to

entry in the U.K. are high and existing suppliers will have

significant difficulty competing with the merged entity, and

therefore there remains a realistic prospect of a substantial

lessening of competition.

-Johnson Matthey shares at 1505 GMT down 1.21% at 1874 pence

valuing the company at GBP4.03 billion.

-By Jana Weigand, Dow Jones Newswires; 44-20-7842-9314;

jana.weigand@dowjones.com

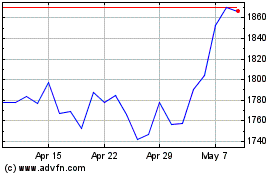

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

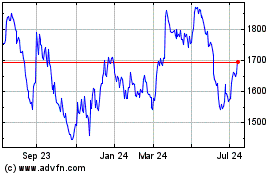

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024