NuSkin Climbs on Minimal China Fine - Analyst Blog

March 25 2014 - 5:00PM

Zacks

Shares of Nu Skin Enterprises, Inc. (NUS)

surged 18.2% on March 24 after the company escaped a harsh judgment

from China regulators, having to pay a smaller-than-expected fine.

The move sent waves of optimism with the company believing that an

investigation into its sales practices in China could have come to

an end. Nu Skin can now normally operate in the country.

The regulatory reviews conducted by China's Administration of

Industry and Commerce in Shanghai and Beijing disclosed that Nu

Skin will be penalized only $781,000 for illegal product sales and

for misleading consumers. Nu Skin will have to pay $524,000 for the

sale of certain products by direct sellers, which were not

registered appropriately in the country, $16,000 for product claims

that lack sufficient documents, and $241,000 for unauthorized

promotional activities carried out by six Nu Skin employees.

The penalty came as a warning to all direct-selling companies

operating in China of the pitfalls of not abiding by Chinese laws.

And just adhering to these laws does not seem to be enough. It is

also important to train the staff about the correct protocol and

trade practices.

Nu Skin, on its part, said that it is taking up necessary steps

to correct the issues raised in the review and will cooperate with

the government with the investigation. The company is also working

towards enhancing training programs for its sales representatives

in order to resume normal business in China.

The investigation by the Chinese government began in Jan 2014

following claims by a local newspaper People’s Daily (on Jan 15)

that the company was operating an illegal pyramid scheme in the

country.

The news of the investigation not only affected the share price

of Nu Skin but also that of several other companies like

Herbalife Ltd. (HLF) and USANA Health

Sciences Inc. (USNA). These companies have the same

distribution model and therefore investors feared that the

investigation could extend to these direct selling companies as

well.

Multi-level marketers like Nu Skin and Herbalife have always

been under the scanner, as they employ sales representatives to

sell their products. Most recently, Herbalife has received a Civil

Investigative Demand from the U.S. Federal Trade Commission to

investigate its operations. Herbalife welcomed the inquiry and

insisted that its business model complied with anti-pyramid

regulations.

Chinahas always been suspicious about direct selling companies.

These were earlier banned by the Communist Party in 1998. Since

then, any kind of pyramid selling scheme is illegal in the country.

In 2005, the ban was lifted after multilevel-marketing companies

changed their agent payment structure.

Nu Skin holds a Zacks Rank #4 (Sell). A better-ranked company in

the cosmetics and toiletries industry is Helen of Troy

Limited (HELE), which holds a Zacks Rank #1 (Strong

Buy).

HELEN OF TROY (HELE): Free Stock Analysis Report

HERBALIFE LTD (HLF): Free Stock Analysis Report

NU SKIN ENTERP (NUS): Free Stock Analysis Report

USANA HLTH SCI (USNA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

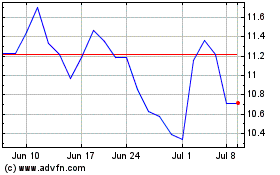

Herbalife (NYSE:HLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

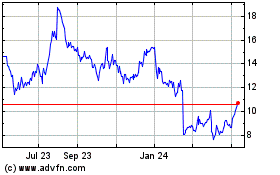

Herbalife (NYSE:HLF)

Historical Stock Chart

From Apr 2023 to Apr 2024