Novo Nordisk A/S has pledged to limit price increases in the

U.S. for its drugs, acknowledging that many diabetes patients

struggle to afford its products.

Jakob Riis, Novo's U.S. chief, said the company would limit

future increases in list prices of its drugs to no more than

single-digit percentages annually. He made the pledge in an article

posted on the company's website last week.

The move underlines the pressure the pharmaceutical industry is

under, amid public outrage over sky-high drug prices. The price of

insulin, which accounts for about half of Novo's revenue, has drawn

particular ire because many people depend on it for their

survival.

Denmark-based Novo Nordisk makes insulin and other drugs for

diabetes, as well as some treatments for hemophilia.

Insulin, a hormone produced by the pancreas, converts sugar to a

form that can be stored for future use. People with Type-1 diabetes

can't produce insulin, while those with Type-2 diabetes don't

produce enough.

More than six million Americans use insulin, according to the

Centers for Disease Control and Prevention.

Novo's pledge, which followed a similar promise in September

from Allergan PLC, is likely to have only a limited effect on the

price that most patients pay for its drugs because of the

convoluted system through which prices are set in the U.S.

List prices tend not to reflect the actual price paid because

pharmaceutical companies offer discounts to pharmacy-benefit

managers who negotiate drug prices on behalf of insurers and

employers.

That means that although Novo Nordisk and other rival insulin

makers Sanofi SA and Eli Lilly Co. have sharply boosted list prices

in recent years, the amount they receive for the medicines after

discounts, or the net price, has risen more gradually. In some

limited cases, however, net prices have fallen of late, a trend

that has forced both Novo Nordisk and Sanofi to warn that revenue

growth from insulin will slow.

Mr. Riis wrote that Novo had repeatedly raised its list prices

in the past to offset increased rebates, discounts and price

concessions offered to pharmacy-benefit managers, and it admitted

that some patients were disadvantaged by the way in which drug

prices were set.

"While we can debate who pays what in different scenarios, it

doesn't change the fact that many patients simply can't afford the

medicine they need," he said.

Despite such discounts from Novo and its rivals, the average

price that diabetes patients pay for insulin has soared in recent

years to $736.09 a year in 2013 from $231.48 in 2002, according to

research published in the medical journal JAMA in April.

What's more, some patients are more exposed to price increases

than others and are being forced to make trade-offs. Paul Laak,

from Wenatchee, Wash., recently faced a $500 bill for a two-month

supply of insulin and blood-sugar testing equipment. Mr. Laak, who

has Type-1 diabetes, instead switched to an older version of

insulin that is much cheaper, but more difficult to use.

Irl Hirsch, a diabetologist at the University of Washington

Medical Center, said around one in seven of his patients were using

this older version of insulin, known as human insulin. Five years

ago, that number was virtually zero, he said.

Dr. Hirsch said that while human insulin is more difficult to

use than the newer forms, the alternative—cutting back on insulin

or not taking it at all—would be worse. "The bottom line is, we

have no choice," he said.

Such stories have made insulin prices a hot-button political

issue. Sen. Bernie Sanders (D., Vt.) and Rep. Elijah Cummings (D.,

Md.) recently called for a federal investigation into rising in

insulin prices, and the American Diabetes Association has asked for

government action to ensure insulin is affordable.

While Novo's list-price pledge won't necessarily stop insulin

prices from rising, it does signal the company is willing to tackle

the issue.

Mr. Riis acknowledged that for insulin to be affordable for more

patients, the system by which drug prices are set needs a big

overhaul. To do so, he said, would need the cooperation of

drugmakers, pharmacy-benefit managers, insurance companies,

employers, patient organizations and policy makers. "We are poised

to do more, but can't do it alone," he said.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

December 06, 2016 15:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

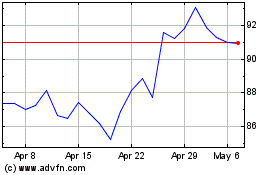

Sanofi (EU:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

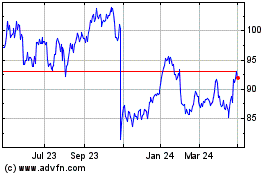

Sanofi (EU:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024