Novo Nordisk Buys Rights to Xoma's Diabetes Treatment for $295 Million

December 01 2015 - 9:52AM

Dow Jones News

By Chelsey Dulaney

Novo Nordisk A/S has agreed to buy the global rights to Xoma

Corp.'s Type 2 diabetes treatment in a deal worth up to $295

million.

The price tag includes a $5 million upfront payment to Xoma and

up to $290 million in milestones. Xoma also is eligible for

royalties on product sales.

Shares of Xoma rose 24% in recent premarket trading to $1.65 a

share.

Novo Nordisk will receive the exclusive development and

commercialization rights to Xoma's allosteric monoclonal antibodies

that regulate insulin receptors. Xoma will keep the

commercialization rights for rare diseases, though Novo Nordisk has

the right to add those indications to its license.

Novo Nordisk has been growing its roster of diabetes

treatments.

In September, Novo Nordisk's diabetes treatment, Tresiba, was

approved by the Food and Drug Administration after being rejected

in 2013. At the time, Novo Nordisk said it expected a U.S. launch

for Tresiba in the first quarter of 2016.

Novo Nordisk also has submitted a New Drug Application for

Xultophy, a once-daily single-injection combination of Tresiba and

the company's diabetes drug Victoza.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 09:37 ET (14:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

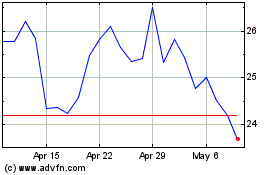

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024