Novartis Says Drug-Unit Chief To Leave Firm -- WSJ

May 18 2016 - 3:03AM

Dow Jones News

By Denise Roland

Novartis AG said its head of pharmaceuticals, David Epstein, is

to leave the company amid a restructuring that will split his role

in two.

The Basel, Switzerland-based drug giant said Mr. Epstein, who is

American, had decided to leave the company "to explore new

challenges from the U.S." Chief Executive Joe Jimenez said Mr.

Epstein had "steered our pharmaceuticals division through a period

of excellence in innovation, execution and improved financial

results."

Novartis disclosed Mr. Epstein's departure as the company

announced plans to separate its cancer unit from the rest of the

pharmaceuticals business.

Bruno Strigini, who already leads the oncology business, will

report directly to Mr. Jimenez as of July 1. The rest of the

pharmaceuticals business, which sells treatments for ailments from

heart failure to multiple sclerosis, will be led by Paul Hudson,

currently AstraZeneca PLC's head of North America. All changes are

effective from July 1.

The reorganization comes as Novartis battles falling sales of

blockbuster cancer drug Gleevec, which lost exclusivity earlier

this year. One of the recently launched drugs it is depending on to

help replace that lost revenue, Entresto for heart failure, has had

a disappointing start due to doctors' hesitation to switch stable

patients onto a new medicine and delays in securing reimbursement

from health insurers in the U.S.

It also closely follows a restructuring of eye-care unit Alcon,

which is struggling amid increased competition in the lens-implant

market and the entry of cheaper copycats of some ophthalmic drugs.

That move, announced in January, shifted Alcon's drugs into the

pharmaceuticals division, leaving behind surgical equipment and

vision-care products, such as contact lenses. It also involved the

departure of Jeff George as CEO of that division.

The company said the restructuring reflected the importance of

the oncology business following the integration of the cancer drugs

Novartis acquired from GlaxoSmithKline PLC following a $20 billion

asset-swap deal between the two companies. That deal, which closed

in the first quarter of 2015, involved Novartis trading its

vaccines for Glaxo's cancer franchise.

A Novartis spokesman said the cancer business was around the

same size as the rest of the pharmaceuticals division combined but

operated on a different business model. He added that the

restructuring would simplify decision-making at that unit.

Novartis's most prominent research program is for a cutting-edge

approach involving the re-engineering of patients' immune cells to

make them more powerful at fighting cancer. The company is aiming

to win regulatory approval for the approach in the U.S. by

2017.

Novartis shares, which have lost 23% of their value over the

past 12 months, slid 9 cents to $75.54 in afternoon trading in New

York.

--Anne Steele contributed to this article.

Write to Denise Roland at denise.roland@wsj.com

(END) Dow Jones Newswires

May 18, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

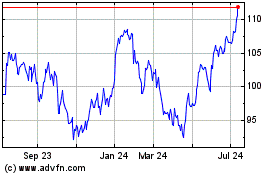

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

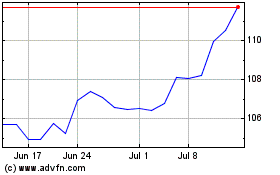

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024