SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

Commission File Number 001-34591

NOTIFICATION OF LATE FILING

|

☒

Form 10-K

|

☐

Form 11-K

|

☐

Form 20-F

|

☐

Form 10-Q

|

|

☐

Form N-SAR

|

☐

Form N-CSR

|

|

|

For Period Ended: December 31, 2016

|

☐

Transition Report on Form

10-K

|

☐

Transition Report on Form 10-Q

|

|

☐

Transition

Report on Form 20-F

|

☐

Transition Report on Form N-SAR

|

For the Transition Period Ended: _______________________________________

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein.

If the notification relates to a portion of

the filing checked above, identify the item(s) to which the notification relates: _______________________________________

PART I

REGISTRANT INFORMATION

|

Full name of registrant

|

|

Cleantech Solutions International, Inc.

|

|

Address of principal executive office City, state and zip code

|

|

No. 9 Yanyu Middle Road

Qianzhou Village, Huishan District, Wuxi City

Jiangsu Province, People’s Republic of China

|

PART II

RULE 12b-25 (b) AND (c)

If the subject report could not be filed without

unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25 (b), the following should be completed.

(Check box if appropriate.)

|

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense

|

|

☒

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, 20-F, 11-K or Form 10-Q, or portion thereof will

be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition

report on Form 10-Q, or portion thereof will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III

NARRATIVE

State below in reasonable detail the reasons

why Form 10-K, 11-K, 20-F, 10-Q, N-SAR or the transition report portion thereof could not be filed within the prescribed time period.

On December 30, 2016, the Company sold

the stock of its subsidiary, Wuxi Fulland Wind Energy Equipment Co., Ltd., which operated its wind power equipment segment, as

a result of which the wind power equipment segment has been classified as a discontinued operations. On December 28, 2016, the

Company invested approximately RMB60 million (approximately $8.6 million) for a 30% interest in a company which plans to develop,

construct and maintain photovoltaic power generation projects in China. In addition, the Company needs to complete its financial

statements, including an impairment analysis, as of December 31, 2016. As a result, the Company requires additional time to complete

its financial statements for the year ended December 31, 2016 and any related changes affecting the year ended December 31, 2015.

The registrant undertakes the responsibility

to file such report no later than 15 days after its original prescribed due date.

Part

IV

Other

Information

(1) Name and telephone number of person to contact in regard to

this notification

|

Adam Wasserman, Consultant

|

(800)

|

867-0078, ext. 702

|

|

(Name)

|

(Area Code)

|

(Telephone Number)

|

(2) Have all other periodic reports required under Section 13 or

15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months

or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

☒

Yes

☐ No

(3) Is it anticipated that any significant change in results of

operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in

the subject report or portion thereof?

☒

Yes ☐ No

If so: attach an explanation of the anticipated change, both narratively

and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

On December 30, 2016, the Company sold

the stock of its subsidiary, Wuxi Fulland Wind Energy Equipment Co., Ltd., which operated its wind power equipment segment, as

a result of which the wind power equipment segment has been classified as a discontinued operations. On December 28, 2016, the

Company invested approximately RMB60 million (approximately $8.6 million) for a 30% interest in a company which plans to develop,

construct and maintain photovoltaic power generation projects in China. In addition, the Company needs to complete its financial

statements, including an impairment analysis, as of December 31, 2016. As a result, the Company requires additional time to complete

its financial statements for the year ended December 31, 2016 and any related changes affecting the year ended December 31, 2015.

Based on preliminary financial statements,

the Company expects to report for 2016 revenue of approximately $17.5 million, a loss from continuing operations of approximately

$3.6 million, a loss from discontinued operations of approximately $8.1 million, a net loss of approximately $11.7 million and

a comprehensive loss of approximately $16.5 million. For 2015, the Company reported revenues of approximately $38.0 million, a

loss from continuing operations of approximately $7.0 million, a loss from discontinued operations of approximately $5.8 million,

a net loss of approximately $12.8 million and a comprehensive loss of approximately $17.5 million.

The financial results presented above

for the year ended December 31, 2016 reflect preliminary estimates of the Company’s results of operations and anticipated

changes for the corresponding prior period as of the date of the filing of the Form 12b-25. These estimates are subject to change

upon the completion of the reporting process and review of the Company’s financial statements, and actual results may vary

significantly from these estimates.

Cautionary Note on Forward-Looking Statements

This notification contains or may contain,

among other things, certain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements involve significant risks and uncertainties. Such statements may include, without limitation,

statements with respect to the Company’s plans, objectives, projections, expectations and intentions and other statements

identified by words such as “projects”, “may”, “could”, “would”, “should”,

“believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”

or similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management

and are subject to significant risks and uncertainties, including those detailed in the Company’s filings with the Securities

and Exchange Commission. Actual results may differ significantly from those set forth in the forward-looking statements. These

forward-looking statements involve certain risks and uncertainties that are subject to change based on various factors (many of

which are beyond the Company’s control). The Company does not intend to publicly update any forward-looking statements,

whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

2

Cleantech Solutions International, Inc.

Name of Registrant as Specified in Charter.

Has caused this notification to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

Date: March 31, 2017

|

By:

|

/s/ Jianhua Wu

|

|

|

Name:

Title:

|

Jianhua Wu

Chief Executive Officer

|

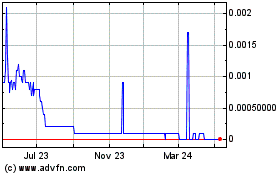

Sharing Economy (CE) (USOTC:SEII)

Historical Stock Chart

From Mar 2024 to Apr 2024

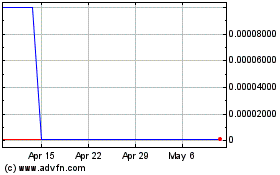

Sharing Economy (CE) (USOTC:SEII)

Historical Stock Chart

From Apr 2023 to Apr 2024