Norway Unexpectedly Trims Key Rates; Hints At Further Cuts

September 24 2015 - 4:22AM

RTTF2

Norway's central bank unexpectedly lowered its key policy rate

by a quarter point as fall in oil prices dampened economic growth,

and suggested that further reduction may be forthcoming in the

coming year.

The Executive Board of Norges Bank decided to cut its key rate

to a record low 0.75 percent from 1.00 percent. The bank was widely

expected to leave its rates unchanged on Thursday.

This was the second reduction in interest rates so far this

year. The bank last reduced the rate in June, when it cut policy

rate by 25 basis point.

Governor Øystein Olsen said the current outlook for the economy

suggests that the key policy rate may be reduced further in the

coming year.

Jack Allen, a European economist at Capital Economics, expects

an interest rate cut of 0.5 percent could come in the second

quarter of next year.

The scope for rates to undershoot the Bank's forecasts is

smaller than in the past, but he said he would not be surprised to

see further rate cuts later in 2016.

"Growth prospects for the Norwegian economy have weakened, and

inflation is projected to abate further out," Olsen said.

Mainland Norway expanded at a slower pace in the second quarter

largely due to the weakness in industries supplying the petroleum

industry. The economy grew only 0.2 percent from the first

quarter.

According to the central bank, economic growth is likely to

remain low for a longer period than projected due to falling oil

prices. Oil investment is also forecast to fall more than estimated

in June. Unemployment is also expected to continue to rise.

At the same time, the krone depreciation has pushed up consumer

price inflation. Low wage growth is keeping down cost growth, and

inflation will edge down as the effects of the krone depreciation

unwind, the governor said.

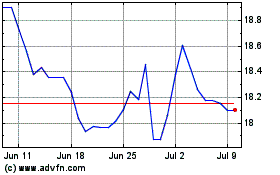

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Mar 2024 to Apr 2024

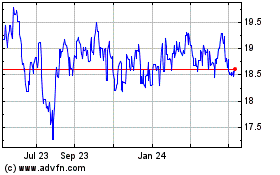

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Apr 2023 to Apr 2024