Norsk Hydro AS Norsk Hydro : Sapa (joint venture) - Announcement Of Results For The Fourth Quarter 2015

February 11 2016 - 1:30AM

Dow Jones News

TIDMNHY

Compared to the previous quarter, underlying EBIT for Sapa declined

mainly due to seasonally lower demand.

Underlying EBIT for Sapa increased compared to the same quarter of the

previous year mainly due to the effects of the improvement programs,

continued growth in North American demand and increased added value

operations. Underlying EBIT for the fourth quarter was negatively

affected by Sapa's measures to address, and consequences of,

unsanctioned quality testing practices in North America.

The restructuring program initiated in 2013, targeting annual synergies

of around NOK one billion by the end of 2016, reached its target in

2015, one year ahead of time. In addition to the factors mentioned above,

reported EBIT for the fourth quarter was affected by charges related to

restructuring activities, partly offset by unrealized gains from

derivatives.

Underlying EBIT for 2015 improved compared with 2014 supported mainly by

internal improvements and strong performance in the North American

operation. Positive effects from a weakening Norwegian krone was offset

by sharply falling metal premiums.

Net interest-bearing debt at the end of 2015 amounted to roughly NOK 1.8

billion, which is at the same level as when the Sapa joint venture was

established on September 1, 2013.

Key Figures Fourth Third Fourth

- Sapa quarter quarter quarter

(50%) 2015 2015 2014 Year 2015 Year 2014

NOK million,

except sales

volumes

Revenue* 6 410 6 948 5 921 27 626 23 105

Underlying

EBITDA 245 367 171 1 364 958

Underlying

EBIT 64 202 (27) 704 326

Underlying

Net Income

(loss) 70 120 (22) 454 199

Sales

volumes

(kmt) 156 171 161 682 699

Earnings

before

financial

items and

tax (EBIT) 44 87 (339) 264 (158)

*Historical revenues have been reclassified

Market

Demand for extruded products in North America decreased by 9 percent

compared to the previous quarter, due to seasonality. Compared to the

same quarter of the previous year demand increased 1 percent as a result

of increased building and construction activity and strong automotive

demand. For the full year, North American extrusion demand grew 5

percent over 2014.

In Europe, extruded products demand declined 7 percent compared with the

previous quarter, due to seasonality. Demand was overall stable both for

the full year and the quarter when compared to the previous year. A weak

European building and construction market was offset by most other

segments.

Demand for extruded products is expected to seasonally improve going

into the first quarter of 2016.

Investor contact

Contact Pål Kildemo

Cellular +47 97096711

E-mail Pal.Kildemo@hydro.com

Press contact

Contact Halvor Molland

Cellular +47 92979797

E-mail Halvor.Molland@hydro.com

Certain statements included within this announcement contain

forward-looking information, including, without limitation, those

relating to (a) forecasts, projections and estimates, (b) statements of

management's plans, objectives and strategies for Hydro, such as planned

expansions, investments or other projects, (c) targeted production

volumes and costs, capacities or rates, start up costs, cost reductions

and profit objectives, (d) various expectations about future

developments in Hydro's markets, particularly prices, supply and demand

and competition, (e) results of operations, (f) margins, (g) growth

rates, (h) risk management, as well as (i) statements preceded by

"expected", "scheduled", "targeted", "planned", "proposed", "intended"

or similar statements.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, these forward-looking

statements are based on a number of assumptions and forecasts that, by

their nature, involve risk and uncertainty. Various factors could cause

our actual results to differ materially from those projected in a

forward-looking statement or affect the extent to which a particular

projection is realized. Factors that could cause these differences

include, but are not limited to: our continued ability to reposition and

restructure our upstream and downstream aluminium business; changes in

availability and cost of energy and raw materials; global supply and

demand for aluminium and aluminium products; world economic growth,

including rates of inflation and industrial production; changes in the

relative value of currencies and the value of commodity contracts;

trends in Hydro's key markets and competition; and legislative,

regulatory and political factors.

No assurance can be given that such expectations will prove to have been

correct. Hydro disclaims any obligation to update or revise any forward

looking statements, whether as a result of new information, future

events or otherwise.

This information is subject of the disclosure requirements pursuant to

section 5-12 of the Norwegian Securities Trading Act.

.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Norsk Hydro via Globenewswire

HUG#1985320

http://www.hydro.com/en/?WT.mc_id=Pressrelease

(END) Dow Jones Newswires

February 11, 2016 01:15 ET (06:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

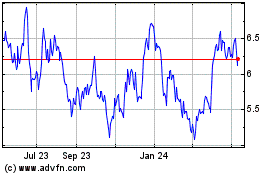

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

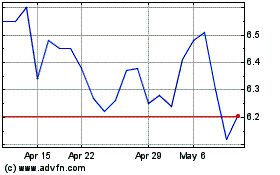

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024