No Turnaround in Sight for Starbucks -- Ahead of the Tape

January 25 2017 - 1:56PM

Dow Jones News

By Steven Russolillo

Between slowing growth and a management shake-up, it is no

wonder Starbucks Corp.'s stock is in need of a caffeine rush.

Shares fell 7.5% last year, their first annual drop since 2008

and only the sixth since Starbucks hit the public markets 25 years

ago. Missing sales targets in the U.S. -- its largest market -- for

four straight quarters will do that to a share price.

Adding more pressure was news late last year that Howard Schultz

will again relinquish the chief executive role, passing the torch

to Chief Operating Officer Kevin Johnson. The last time Mr. Schultz

stepped aside from the CEO role was during the lackluster stretch

from 2000 to 2008. The difference now is that he will remain with

the company as executive chairman but focus on high-end coffee bars

-- yet another attempt to change how Americans drink the

beverage.

But that venture won't be material to Starbucks's bottom line

soon, or perhaps ever. Meanwhile, there is little evidence ahead of

Thursday's fiscal first-quarter report to suggest Starbucks has

regained its mojo.

Analysts polled by FactSet forecast earnings for the period

ending in December of 52 cents a share, up from 46 cents a year

earlier. Revenue is expected to have risen 8.9% to $5.85 billion.

An important metric to watch is same-store sales, with analysts

projecting just 3.8% growth from a year earlier. That would be the

lowest since the financial crisis and far below the historic rate

of at least 5% that Starbucks is targeting.

Starbucks has noted how the presidential election and overall

economic uncertainty has played a role in its recent performance.

Or as Mr. Schultz put it at December's investor day: "the slight

slowdown in comps that has you all so nervous." Yet Starbucks is

struggling to peddle affordable luxuries despite numerous surveys

of consumer confidence surging to multiyear highs.

As Starbucks matures, finding new ways to keep growing is a

challenge. In December, it laid out aggressive five-year targets of

15%-20% earnings growth and double-digit revenue growth thanks to

more store openings and new digital initiatives. Membership is

growing on its mobile app, which helps its cafes operate more

efficiently. Mobile payments now make up 25% of U.S. transactions,

up from 20% in the year-ago period.

But shorter-term trends are working against Starbucks. Although

U.S. consumers say they are confident, they are spending their

money differently these days and eating out less. Foot traffic at

U.S. fast-food restaurants dropped 1% in the third quarter, the

first decline in five years, according to the most recent data from

industry tracker NPD Group. Starbucks isn't immune to this.

Fetching 26 times projected earnings over the next 12 months,

Starbucks is no bargain either. Its multiple is pricier than peers

Dunkin' Brands Group Inc., McDonald's Corp. and Yum Brands Inc.

Perhaps investors should stick to decaf.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

January 25, 2017 13:41 ET (18:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

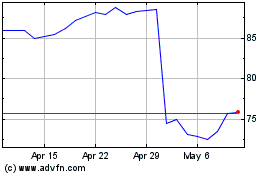

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

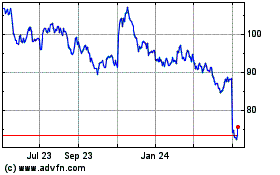

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024