NextEra Works to Overcome Image Problem in Oncor Deal

November 01 2016 - 9:50AM

Dow Jones News

NextEra Energy Inc. wants to buy the biggest utility in Texas

for $18.7 billion, and it is hoping to avoid the state opposition

that sunk its plan to buy the largest utility in Hawaii earlier

this year.

The fast-growing utility and renewable power company filed

papers late Monday requesting regulatory approval for two

transactions that would give it ownership of Oncor Electric

Delivery Co., part of bankrupt Energy Future Holdings Corp.

The filing formally starts the clock running with the Public

Utility Commission of Texas, which now has six months to rule or

approval is automatically granted.

NextEra Chief Executive Jim Robo and others have held private

discussions with Texas officials in recent weeks to determine what

the company must do to satisfy concerns. After a bumpy process in

Hawaii, and acrimonious dealings with regulators in its home state

of Florida, NextEra has an image problem to overcome.

It is "not known for playing well with other people," Texas

Commissioner Ken Anderson said. "They have a reputation among

regulators and others as 'my way or the highway.' That's not going

to work in Texas."

Oncor plays a pivotal role in Texas' deregulated power market.

As the state's biggest energy-delivery utility, it ensures

generators are able to hook up to the grid and that electricity

retailers can reach consumers in North Texas.

Some observers fear NextEra, which has invested $8 billion in

energy assets in the state including wind farms and a retail

electricity provider, might pressure Oncor to favor NextEra

affiliates.

To address that concern, NextEra is proposing a code of conduct

for Oncor "to ensure separation and independence from the business

of NextEra Energy's competitive affiliates." It is also proposing

to maintain a separate board of directors at the utility, headed by

Bob Shapard, Oncor's current chief executive, who would become

chairman of the board.

NextEra isn't offering to share merger savings with Oncor

customers or to freeze rates, common features of many utility

deals. Instead it says it will flow through lower financing costs

from its higher credit rating.

"We have tried to be very thoughtful," said Rob Gould, a NextEra

spokesman. "But ultimately, it's the commission that must decide

how we run our business."

NextEra stumbled badly earlier this year when it failed to win

approval to buy Hawaiian Electric Industries Inc. for $4.3 billion.

Hawaii wants to get all its electricity from renewable sources by

2045. NextEra is the biggest green-energy producer in the U.S. and

Canada, with more than 100 wind farms and two dozen solar

farms.

But state officials never much liked NextEra. Emails between

Hawaiian utility managers, for example, said they believed NextEra

saw HEI as a "snack" before a big dish of mainland utilities.

"It was offensive and showed their true colors," said Jeff Ono,

Hawaii's consumer advocate for utility matters.

NextEra has also faced criticism that it opposed efforts by

consumers and businesses to produce their own solar power on-site

in Florida, which despite its Sunshine State nickname is only 14th

in solar penetration, according to the Solar Energy Industries

Association. The company has poured $8 million into a Nov. 8 ballot

measure that environmentalists say will further cripple solar

growth in Florida in coming years.

"NextEra likes solar if they own it and can bill customers for

it," said Patrick Altier, incoming Florida president of the Solar

Energy Industries Association.

NextEra's Mr. Gould said solar hasn't taken off because its

flagship utility, Florida Power & Light Co., has rates 30%

below the national average.

Some of the company's harshest critics in Florida are former

regulators, who say it goes to unusual lengths to silence

critics.

Nancy Argenziano, a Republican, joined the Florida Public

Service Commission in 2006 after 12 years in the Florida

legislature. In 2009, the PSC gave FPL a rate increase of $75

million—not the $1.3 billion it wanted.

The utility complained to legislators. Within months, Mrs.

Argenziano and three other commissioners were rejected for

reappointment or not confirmed by the state senate. "You get in

their way and you'll get hurt," she said.

NextEra's Mr. Gould said he knows "there's this perception about

our company being aggressive" but said it didn't retaliate against

anyone, adding, "we take offense to anyone that would suggest

that."

Write to Rebecca Smith at rebecca.smith@wsj.com

(END) Dow Jones Newswires

November 01, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

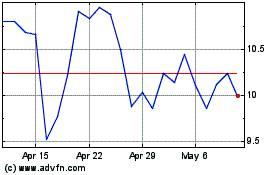

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024