By Rebecca Smith and Peg Brickley

NextEra Energy Inc. outbid rivals for Energy Future Holdings

Corp.'s controlling stake in the biggest power provider in Texas,

in an $18.4 billion deal that thrusts the Florida company into the

big leagues among U.S. utilities.

Selling Dallas-based Oncor is vital to lifting Energy Future --

the former TXU Corp. -- out of a bankruptcy that has dragged on

since April 2014. Oncor is widely regarded as Energy Future's crown

jewel, a regulated electric utility business with steady returns

that was hived off without heavy debt as a condition of Energy

Future's purchase of TXU in 2007.

NextEra, the parent company of Florida Power & Light, has

morphed into a national electric powerhouse by purchasing

unregulated renewable-energy projects across the U.S.

The company has also signaled it wants to expand its footprint

as a regulated utility. In late 2014 NextEra proposed buying the

Hawaiian Electric Co. in a $4.3 billion deal that ultimately

collapsed just two weeks ago. State officials rejected the deal,

saying they were unconvinced NextEra would help Hawaii achieve its

aggressive goal to generate 100% of its electricity from green

sources by 2045.

NextEra's bid for Oncor is unlikely to face similar scrutiny in

Texas, a state with limited aspirations to wean itself off fossil

fuels, though it leads the nation in wind generation and has big

expectations for solar power in coming years.

Rivals have jostled for years to buy Energy Future's 80% stake

in Oncor, which delivers electricity to 10 million Texas homes.

NextEra first bid on the company two years ago as Energy Future

became mired in chapter 11 proceedings. When NextEra announced it

was interested, Energy Future invited other offers.

Warren Buffett's Berkshire Hathaway Inc. was a final contender,

but dropped out after multiple rounds of bidding, according to one

person with knowledge of the discussions. Edison International also

expressed interest, this person said.

Berkshire and Edison couldn't immediately be reached to

comment.

Investors saw value in Oncor as a regulated utility business,

which was operating free and clear of Energy Future's financial

woes.

Other suitors that came calling included Hunt Consolidated Inc.

of Texas, which proposed putting the utility into a real-estate

investment trust -- a type of company designed pay out most of its

profit to investors. That deal, valued at about $19 billion, fell

apart in May when Texas regulators ruled that certain tax benefits

associated with the investment structure would have to be shared

with the utility's customers.

The NextEra-Oncor deal is "just another step in a very long

process" and still requires approval by Texas utility regulators

and the bankruptcy court, Hunt said in a statement Friday. "Hunt

will remain involved as the process unfolds, as the advantages of

maintaining ownership of Oncor by Texans for Texans are clear."

In addition to its electricity-transmission business, Energy

Future owns Luminant, the biggest electricity-generation business

in Texas, and a large retail-power sales company called TXU

Energy.

The Oncor name and the company's management will be retained,

along with its Dallas headquarters, when the deal closes, NextEra

Chief Executive Jim Robo said Friday.

"Our commitment to the Lone Star state runs deep," Mr. Robo

said. Next Era has operated in Texas for 15 years and invested more

than $8 billion in power transmission and generation there.

The Public Utility Commission of Texas still needs to approve

the deal, and a bankruptcy judge will have to sign off on the sale

as part of Energy Future's plan to exit bankruptcy, which has taken

a year longer than expected.

"If approved, it is a turnabout to the Energy Futures

nightmare," said Erik Gordon, a professor at the University of

Michigan's Ross School of Business.

Energy Future on Friday cleared another bankruptcy hurdle when

the U.S. Internal Revenue Service ruled that no massive tax bill

will be triggered as Energy Future divides up its business to exit

bankruptcy.

Proceeds from the Oncor deal will help pay off some creditors.

NextEra said it would fund the transaction with $9.5 billion in

cash and additional shares of its stock.

In Friday trading, NextEra stock ticked up less than 1% to

$128.29 a share.

Energy Future's boom-to-bust saga started nearly a decade ago

when a group of private-equity firms, including KKR & Co., TPG

and Goldman Sachs Group, bought the old TXU Corp. for $32 billion

plus $13 billion in assumed debt in a deal that closed Oct. 10,

2007, the day before the Dow Jones Industrial Average hit its

prerecession peak of 14,164.

At the time, TXU was riding high. It was the only investor-owned

utility left intact after the state deregulated the power industry

in 1999 and it boasted the biggest annual returns of any U.S.

utility.

The future looked even brighter. Texas was growing rapidly and

the utility had plans to bolster its profit by building more

nuclear reactors and massive coal-fired power plants. High

natural-gas prices at the time let the company sell its wholesale

power at expensive prices, too. But it all came crashing down after

2009 amid the global recession and an energy glut.

Energy Future's profit projections collapsed and the company

strained under the weight of the heavy borrowing that had propelled

its leveraged buyout. By the time it declared bankruptcy in 2014,

the original investors had been forced to write down nearly all the

$8 billion they had invested.

Write to Rebecca Smith at rebecca.smith@wsj.com and Peg Brickley

at peg.brickley@wsj.com

(END) Dow Jones Newswires

July 30, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

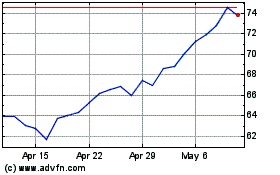

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024