FISCAL 2015 THIRD QUARTER KEY FINANCIAL

HIGHLIGHTS

- Revenues of $2.06 billion compared

to $2.08 billion in the prior year

- Reported Total Segment EBITDA of

$163 million compared to $175 million in the prior year

- Adjusted EPS were $0.05 compared to

$0.11 in the prior year – Reported EPS were $0.04 compared to $0.08

in the prior year

News Corporation (“News Corp” or the “Company”)

(NASDAQ:NWS)(NASDAQ:NWSA)(ASX:NWS)(ASX:NWSLV) today reported

financial results for the three months ended March 31, 2015.

Commenting on the results, Chief Executive Robert Thomson

said:

“The new News Corp continues to build a firm foundation for

digital growth. We see that most clearly in the successful

integration of realtor.com®, which grew audience and revenue at

record levels in the third quarter. News Corp is now a global

leader in digital real estate, which we believe will underpin

long-term expansion and complement our expertise in news and

financial analysis, both of which have been important ingredients

in realtor.com®'s accelerated growth. While the quarter faced some

revenue challenges, particularly at News and Information Services,

including currency headwinds, our adjusted EBITDA was relatively

stable, underscoring the strength of our assets and the

diversification of our revenue base. We believe the company is

firmly on track and the signs are positive for year-over-year

EBITDA growth in the fourth quarter.”

THIRD QUARTER RESULTS

The Company reported fiscal 2015 third quarter total revenues of

$2.06 billion, a 1% decline as compared to prior year third quarter

revenues of $2.08 billion. The majority of the revenue decline

reflects negative foreign currency fluctuations and lower

advertising revenues at the News and Information Services segment,

offset in large part by growth in the Book Publishing and Digital

Real Estate Services segments as a result of the acquisition of

Harlequin Enterprises Limited (“Harlequin”) and Move, Inc.

(“Move”), respectively. Adjusted revenues (as defined in Note 1)

declined 2% compared to the prior year.

The Company reported third quarter Total Segment EBITDA of $163

million, a 7% decline as compared to $175 million in the prior

year. These results include $15 million and $20 million in fees and

costs – net of indemnification – related to the U.K. Newspaper

Matters (as defined below) in the three months ended March 31, 2015

and 2014, respectively. Declines at the News and Information

Services segment, including higher legal costs at News America

Marketing, negative foreign currency fluctuations and increased

stock-based compensation expense resulting from the acquisition of

Move were partially offset by lower expenses at Amplify and

increased revenues in the Book Publishing segment due to the

inclusion of Harlequin results. Adjusted Total Segment EBITDA (as

defined in Note 1) declined 1% compared to the prior year.

Net income available to News Corporation stockholders was $23

million as compared to $48 million in the prior year, due to lower

Total Segment EBITDA as well as a higher effective tax rate, lower

equity earnings of affiliates, and lower interest income. Adjusted

net income available to News Corporation stockholders (as defined

in Note 3) was $28 million compared to $66 million in the prior

year. Impairment and restructuring charges were $10 million in both

the three months ended March 31, 2015 and 2014.

Net income available to News Corporation stockholders per share

was $0.04 as compared to $0.08 in the prior year. Adjusted EPS (as

defined in Note 3) were $0.05 compared to $0.11 in the prior

year.

Free cash flow available to News Corporation decreased by $105

million in the nine months ended March 31, 2015 to $391 million,

primarily as a result of certain one-time items.

SEGMENT REVIEW

For the three months ended For the nine months ended March

31, March 31, 2015 2014

% Change 2015 2014

% Change (in millions) (in millions)

Revenues: News and Information Services

$ 1,353 $ 1,488 (9 ) % $ 4,327 $ 4,595 (6 ) % Book Publishing 402

354 14 % 1,277 1,073 19 % Cable Network Programming 116 113 3 % 367

355 3 % Digital Real Estate Services 170 102 67 % 436 295 48 %

Digital Education 21 21 - % 85 70 21 % Other -

- ** -

- **

Total Revenues $ 2,062

$ 2,078 (1 ) % $ 6,492 $

6,388 2 %

Segment EBITDA: News and

Information Services $ 113 $ 146 (23 ) % $ 434 $ 534 (19 ) % Book

Publishing 56 53 6 % 188 164 15 % Cable Network Programming 27 27 -

% 113 109 4 % Digital Real Estate Services(a) 42 53 (21 ) % 156 152

3 % Digital Education (21 ) (45 ) 53 % (69 ) (140 ) 51 % Other(b)

(54 ) (59 ) 8 %

(161 ) (176 ) 9 %

Total Segment EBITDA

$ 163 $ 175 (7 ) % $ 661

$ 643 3 % ** - Not meaningful

(a) Digital Real Estate Services Segment EBITDA for the

three and nine months ended March 31, 2015 includes one-time

transaction related costs of $1 million and $19 million,

respectively, related to the acquisition of Move. (b) Other Segment

EBITDA for the three and nine months ended March 31, 2015 includes

fees and costs, net of indemnification, related to the U.K.

Newspaper Matters of $15 million and $42 million, respectively.

Other Segment EBITDA for the three and nine months ended March 31,

2014 includes fees and costs, net of indemnification, related to

the U.K. Newspaper Matters of $20 million and $56 million,

respectively.

News and Information Services

Revenues for the third quarter of fiscal 2015 decreased $135

million, or 9%, compared to the prior year. Total segment

advertising revenues declined 12%, driven primarily by negative

foreign currency fluctuations, weakness in the print advertising

market and lower revenues at News America Marketing. Circulation

and subscription revenues declined 6%, due to negative foreign

currency fluctuations, a decline in professional information

business revenues at Dow Jones and lower print circulation volume,

partially offset by higher subscription pricing, cover price

increases and higher digital subscription volume. Adjusted revenues

declined 3% compared to the prior year.

Segment EBITDA decreased $33 million in the quarter, or 23%, as

compared to the prior year. Results were impacted by lower

advertising revenues, negative foreign currency fluctuations and $8

million of higher legal expenses at News America Marketing,

partially offset by lower expenses at News Corp Australia. Adjusted

Segment EBITDA decreased 21% compared to the prior year.

Book Publishing

Revenues in the quarter increased $48 million, or 14%, compared

to the prior year driven by the inclusion of the results of

Harlequin and strong backlist sales in General Books resulting from

the continued popularity of American Sniper by Chris Kyle,

partially offset by lower revenues from the Divergent series.

E-book revenues declined 3% versus the prior year period, driven by

lower contribution from the Divergent series as well as a shift

towards the non-fiction genre, which has lower e-book conversion,

partially offset by the inclusion of Harlequin results. E-book

revenues represented 22% of consumer revenues for the quarter.

Segment EBITDA for the quarter increased $3 million, or 6%, from

the prior year, primarily due to the inclusion of the results of

Harlequin and lower expenses, partially offset by lower

contribution from the Divergent series. Adjusted revenues decreased

5% and Adjusted Segment EBITDA decreased 8% compared to the prior

year.

Cable Network Programming

In the third quarter of fiscal 2015, revenues increased $3

million, or 3%, compared to the prior year primarily due to higher

affiliate and advertising revenues, partially offset by negative

foreign currency fluctuations. Segment EBITDA in the quarter was

flat compared with the prior year, as the higher revenues were

offset by negative foreign currency fluctuations and higher

programming rights costs. Both Adjusted revenues and Adjusted

Segment EBITDA increased 15% compared to the prior year.

Digital Real Estate Services

Revenues in the quarter increased $68 million, or 67%, compared

to the prior year, primarily driven by the inclusion of the results

of Move, coupled with higher residential listing depth product

penetration and higher pricing at REA Group Limited (“REA Group”),

partially offset by negative foreign currency fluctuations and a

decline in Australian listing volumes across the market which are

down against the prior comparative period. Segment EBITDA in the

quarter decreased $11 million, or 21%, compared to the prior year

primarily due to negative foreign currency fluctuations, partially

offset by increased revenues. Segment EBITDA also includes $11

million of stock-based compensation expense related to awards

assumed in the acquisition of Move, of which $5 million is related

to the acceleration of stock-based compensation resulting from the

departures of senior executives. Excluding the impact of Move,

divestitures and foreign currency fluctuations, Adjusted revenues

and Adjusted Segment EBITDA increased 9% and 7%, respectively,

compared to the prior year. In the third quarter, Move saw strength

in its Connection for Co-Brokerage product and Media revenues.

Based on Move’s internal data, average monthly unique users of

realtor.com®’s web and mobile sites for the quarter grew 34%

year-over-year to approximately 39 million, which was driven by

more than 70% growth in mobile users; traffic accelerated in April

to 44 million monthly unique users, or 38% growth

year-over-year.

Digital Education

Revenues in the quarter were $21 million, which was flat

compared with the prior year. Segment EBITDA in the quarter

improved $24 million, or 53%, from the prior year, primarily due to

the impact of the capitalization of Amplify Learning’s software

development costs of $12 million and lower operating expenses.

Other

Segment EBITDA in the quarter improved by $5 million compared to

the prior year, primarily due to lower fees and costs, net of

indemnification, related to the claims and investigations arising

out of certain conduct at The News of the World (the “U.K.

Newspaper Matters”) of approximately $5 million.

The net expense related to the U.K. Newspaper Matters was $15

million for the three months ended March 31, 2015 as compared to

$20 million for the three months ended March 31, 2014.

REVIEW OF EQUITY EARNINGS OF AFFILIATES’ RESULTS

Quarterly equity earnings from affiliates were $7 million

compared to $23 million in the prior year.

For

the three months ended For the nine months ended March 31, March

31, 2015 2014 2015 2014 (in

millions) (in millions) Foxtel(a) $ 8 $

23 $ 48 $ 53 Other equity affiliates, net (1 )

- - - Total equity earnings of

affiliates $ 7 $ 23 $ 48 $ 53

(a) The Company amortized $14 million and $44 million

related to excess cost over the Company’s proportionate share of

its investment’s underlying net assets allocated to finite-lived

intangible assets during the three and nine months ended March 31,

2015, respectively, and $15 million and $46 million in the

corresponding periods of fiscal 2014, respectively. Such

amortization is reflected in Equity earnings of affiliates in the

Statements of Operations.

On a U.S. GAAP basis, Foxtel revenues, for the three months

ended March 31, 2015, decreased $77 million to $620 million from

$697 million in the prior year period due to negative foreign

currency fluctuations. Foxtel EBITDA decreased $61 million to $163

million from $224 million due to increased programming costs,

higher marketing and support costs for the new Foxtel pricing and

packaging, and investment in Presto and the launch of Triple Play,

as well as negative foreign currency fluctuations. In local

currency, Foxtel revenues increased 1% and EBITDA declined 17%.

Total closing subscribers were approximately 2.8 million as of

March 31, 2015, a 7% increase compared to the prior year period, as

a result of higher subscriber sales and lower churn, driven by the

new pricing and packaging strategy that was implemented in November

2014. In the quarter, cable and satellite churn improved to 10.9%

from 13.1% in the prior year.

Foxtel operating income for the three months ended March 31,

2015 and 2014 after depreciation and amortization of $75 million

and $92 million, respectively, was $88 million and $132 million,

respectively. Operating income decreased as a result of the factors

noted above. Foxtel’s net income of $44 million decreased from $76

million in the prior year period as a result of lower operating

income as noted above.

FREE CASH FLOW AVAILABLE TO NEWS CORPORATION

Free cash flow available to News Corporation is a non-GAAP

financial measure defined as net cash provided by operating

activities, less capital expenditures, and REA Group free cash

flow, plus cash dividends received from REA Group.

The Company considers free cash flow available to News

Corporation to provide useful information to management and

investors about the amount of cash generated by the business after

capital expenditures, which can then be used for strategic

opportunities including, among others, investing in the Company’s

business, strategic acquisitions, strengthening the Company’s

balance sheet, dividend payouts and repurchasing stock. A

limitation of free cash flow available to News Corporation is that

it does not represent the total increase or decrease in the cash

balance for the period. Management compensates for the limitation

of free cash flow available to News Corporation by also relying on

the net change in cash and cash equivalents as presented in the

Company’s consolidated statements of cash flows prepared in

accordance with GAAP which incorporates all cash movements during

the period.

The following table presents a reconciliation of net cash

provided by operating activities to free cash flow available to

News Corporation:

For the nine months endedMarch 31,

2015 2014 (in millions)

Net cash provided by operating activities $ 702 $ 803

Less: Capital expenditures (268 ) (244

) 434 559 Less: REA Group free cash flow (88 ) (98 ) Plus: Cash

dividends received from REA Group 45

35 Free cash flow available to News Corporation $

391 $ 496

Free cash flow available to News Corporation in the nine months

ended March 31, 2015 declined $105 million to $391 million from

$496 million in the prior year. The decrease was primarily due to

the absence of the net receipts related to a foreign tax refund of

$73 million and lease incentives of $35 million received during the

nine months ended March 31, 2014, as well as higher net tax

payments of $53 million and approximately $45 million of higher

deferred compensation payments related to the acquisition of

Wireless Generation incurred in the current year period. The

decrease was partially offset by lower restructuring payments of

$62 million, lower payments for fees and costs related to the U.K.

Newspaper Matters of $46 million and higher dividends received from

REA Group.

COMPARISON OF ADJUSTED INFORMATION TO U.S. GAAP

INFORMATION

Adjusted revenues, Adjusted Total Segment EBITDA, Total Segment

EBITDA, Adjusted net income available to News Corporation

stockholders, Adjusted EPS and Free cash flow available to News

Corporation are non-GAAP financial measures contained in this

earnings release. This information is provided in order to allow

investors to make meaningful comparisons of the Company’s operating

performance between periods and to view the Company’s business from

the same perspective as Company management. These non-GAAP measures

may be different than similar measures used by other companies and

should be considered in addition to, not as a substitute for,

measures of financial performance calculated in accordance with

GAAP. Reconciliations for the differences between non-GAAP measures

used in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2

and 3 and the reconciliation of Net cash provided by operating

activities to Free cash flow available to News Corporation is

included above.

Conference call

News Corporation’s earnings conference call can be heard live at

4:30pm EDT on May 5, 2015. To listen to the call, please visit

http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management’s views and

assumptions regarding future events and business performance as of

the time the statements are made. Actual results may differ

materially from these expectations due to changes in global

economic, business, competitive market and regulatory factors. More

detailed information about these and other factors that could

affect future results is contained in our filings with the

Securities and Exchange Commission. The “forward-looking

statements” included in this document are made only as of the date

of this document and we do not have any obligation to publicly

update any “forward-looking statements” to reflect subsequent

events or circumstances, except as required by law.

About News Corporation

News

Corporation (NASDAQ:NWS)(NASDAQ:NWSA)(ASX:NWS)(ASX:NWSLV) is a

global, diversified media and information services company focused

on creating and distributing authoritative and engaging content to

consumers throughout the world. The company comprises

businesses across a range of media, including: news and information

services, book publishing, cable network programming in Australia,

digital real estate services, digital education, and pay-TV

distribution in Australia. Headquartered in New York, the

activities of News Corporation are conducted primarily in the

United States, Australia, and the United Kingdom. More information

is available at: www.newscorp.com.

NEWS CORPORATION CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited; in millions, except share and per

share amounts)

For the three months ended For the nine months

ended March 31, March 31, 2015 2014

2015 2014

Revenues: Advertising $ 904 $ 952 $ 2,862 $ 2,990 Circulation and

Subscription 650 665 1,989 2,005 Consumer 385 342 1,223 1,030 Other

123 119 418 363

Total Revenues 2,062 2,078 6,492 6,388

Operating expenses (1,216 ) (1,259 ) (3,796 ) (3,828 ) Selling,

general and administrative (683 ) (644 ) (2,035 ) (1,917 )

Depreciation and amortization (132 ) (142 ) (398 ) (421 )

Impairment and restructuring charges (10 ) (10 ) (31 ) (73 ) Equity

earnings of affiliates 7 23 48 53 Interest, net 12 17 42 50 Other,

net 12 (1 ) 70 (673 )

Income (loss) before income tax (expense) benefit 52 62 392 (421 )

Income tax (expense) benefit (18 ) (1 ) (107 )

686 Net income 34 61 285 265 Less: Net income

attributable to noncontrolling interests (11 ) (13 )

(54 ) (39 ) Net income attributable to News

Corporation stockholders $ 23 $ 48 $ 231 $ 226 Less: Adjustments to

Net income attributable to News Corporation stockholders –

Redeemable Preferred Stock Dividends - -

(1 ) (1 ) Net income available to News

Corporation stockholders $ 23 $ 48 $ 230 $ 225

Weighted average shares outstanding: Basic 582 579

581 579 Diluted 583 580 582 580 Net income available to News

Corporation stockholders per share: Basic and diluted $ 0.04 $ 0.08

$ 0.40 $ 0.39

NEWS CORPORATION CONSOLIDATED

BALANCE SHEETS (in millions)

As of March 31,2015

As of June 30,2014

ASSETS (unaudited) (audited) Current assets: Cash and

cash equivalents $ 2,027 $ 3,145 Amounts due from 21st Century Fox

52 66 Receivables, net 1,308 1,388 Other current assets 701

671 Total current assets 4,088 5,270

Non-current assets: Investments 2,382 2,609 Property, plant and

equipment, net 2,699 3,009 Intangible assets, net 2,313 2,137

Goodwill 3,510 2,782 Other non-current assets 694 682

Total assets $ 15,686 $ 16,489

LIABILITIES AND EQUITY

Current liabilities: Accounts payable $ 225 $ 276 Accrued expenses

1,121 1,188 Deferred revenue 399 369 Other current liabilities

528 431 Total current liabilities 2,273

2,264 Non-current liabilities: Retirement benefit

obligations 266 272 Deferred income taxes 295 224 Other non-current

liabilities 306 310 Commitments and contingencies

Redeemable preferred stock 20 20 Equity: Class A common

stock 4 4 Class B common stock 2 2 Additional paid-in capital

12,450 12,390 Retained earnings 467 237 Accumulated other

comprehensive (loss) income (554) 610 Total News

Corporation stockholders' equity 12,369 13,243 Noncontrolling

interests 157 156 Total equity 12,526

13,399 Total liabilities and equity $ 15,686 $ 16,489

NEWS CORPORATION CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited; in millions)

For the nine months ended March 31, 2015

2014

Operating

activities: Net Income $ 285 $ 265

Adjustments to reconcile net income to cash provided by operating

activities: Depreciation and amortization 398 421 Equity earnings

of affiliates (48 ) (53 ) Cash distributions received from

affiliates 69 47 Impairment charges, net of tax - 12 Other, net (70

) (48 ) Deferred income taxes and taxes payable 31 85 Change in

operating assets and liabilities, net of acquisitions: Receivables

and other assets 60 (140 ) Inventories, net (46 ) (32 ) Accounts

payable and other liabilities 41 281 Pension and postretirement

benefit plans (18 ) (35 ) Net cash

provided by operating activities 702

803

Investing activities: Capital

expenditures (268 ) (244 ) Acquisitions, net of cash acquired

(1,188 ) (39 ) Investments in equity affiliates and other (257 )

(12 ) Proceeds from dispositions 134 109 Other 16

- Net cash used in investing activities

(1,563 ) (186 )

Financing

activities: Net transfers from 21st Century Fox and affiliates

- 217 Repayment of borrowings acquired in the Move acquisition (129

) - Dividends paid (29 ) (23 ) Other, net (2 )

(3 ) Net cash (used in) provided by financing activities

(160 ) 191

Net

(decrease) increase in cash and cash equivalents (1,021 ) 808

Cash and cash equivalents, beginning of period 3,145 2,381 Exchange

movement on opening cash balance (97 )

18

Cash and cash equivalents, end of period $

2,027 $ 3,207

NOTE 1 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, costs

associated with the U.K. Newspaper Matters and foreign currency

fluctuations (“Adjusted Revenues, Adjusted Total Segment EBITDA and

Adjusted Segment EBITDA”) to evaluate the performance of the

Company’s operations exclusive of certain items that impact the

comparability of results from period to period. The calculation of

Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted

Segment EBITDA may not be comparable to similarly titled measures

reported by other companies, since companies and investors may

differ as to what type of events warrant adjustment. Adjusted

Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA

are not measures of performance under generally accepted accounting

principles and should not be construed as substitutes for amounts

determined under GAAP as measures of performance.

However, management uses these measures in comparing the

Company’s historical performance and believes that they provide

meaningful and comparable information to investors to assist in

their analysis of our performance relative to prior periods and our

competitors.

The following table reconciles reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three and nine months ended March 31, 2015

and 2014.

Revenues Total Segment EBITDA For the three months ended March 31,

For the three months ended March 31, 2015 2014

Difference 2015 2014

Difference (in millions) (in millions)

As

reported $ 2,062 $ 2,078 $ (16 ) $ 163 $ 175 $ (12 )

Impact of acquisitions (148 ) - (148 ) 3 - 3 Impact of

divestitures - (3 ) 3 - 1 (1 ) Impact of foreign currency

fluctuations 119 - 119 13 - 13 Net impact of U.K. Newspaper

Matters - - - 15 20 (5 )

As adjusted $

2,033 $ 2,075 $ (42 ) $ 194 $ 196 $ (2 )

Revenues Total Segment EBITDA For the nine months

ended March 31, For the nine months ended March 31, 2015 2014

Difference 2015 2014 Difference (in millions) (in millions)

As reported $ 6,492 $ 6,388 $ 104 $ 661 $ 643 $ 18

Impact of acquisitions (330 ) - (330 ) 8 - 8 Impact of

divestitures (1 ) (45 ) 44 - (3 ) 3 Impact of foreign

currency fluctuations 151 - 151 26 - 26 Net impact of U.K.

Newspaper Matters - - - 42 56 (14 )

As

adjusted $ 6,312 $ 6,343 $ (31 ) $ 737 $ 696

$ 41

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three and nine months ended March 31, 2015 and 2014 are as

follows:

For the three months

ended March 31, 2015 2014

% Change (in millions)

Adjusted

Revenues: News and Information Services $ 1,436 $ 1,486 (3 ) %

Book Publishing 336 354 (5 ) % Cable Network Programming 130 113 15

% Digital Real Estate Services 110 101 9 % Digital Education 21 21

- % Other - - - %

Total

Adjusted Revenues $ 2,033 $ 2,075 (2 ) %

Adjusted Segment EBITDA: News and Information Services $ 116

$ 146 (21 ) % Book Publishing 49 53 (8 ) % Cable Network

Programming 31 27 15 % Digital Real Estate Services 58 54 7 %

Digital Education (21 ) (45 ) 53 % Other (39 ) (39 )

- %

Total Adjusted Segment EBITDA $ 194 $ 196

(1 ) % For

the nine months ended March 31, 2015

2014 % Change (in millions)

Adjusted Revenues: News and Information Services $

4,417 $ 4,556 (3 ) % Book Publishing 1,071 1,069 - % Cable Network

Programming 389 355 10 % Digital Real Estate Services 350 293 19 %

Digital Education 85 70 21 % Other - -

- %

Total Adjusted Revenues $ 6,312 $ 6,343

- %

Adjusted Segment EBITDA: News and

Information Services $ 445 $ 530 (16 ) % Book Publishing 167 164 2

% Cable Network Programming 121 109 11 % Digital Real Estate

Services 192 153 25 % Digital Education (69 ) (140 ) 51 % Other

(119 ) (120 ) 1 %

Total Adjusted Segment

EBITDA $ 737 $ 696 6 %

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended March 31, 2015 and 2014.

For the three

months ended March 31, 2015

AsReported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

AsAdjusted

(in millions)

Revenues: News and Information Services

$ 1,353 $ - $ - $ 83 $ - $ 1,436 Book Publishing 402 (75 ) - 9 -

336 Cable Network Programming 116 - - 14 - 130 Digital Real Estate

Services 170 (73 ) - 13 - 110 Digital Education 21 - - - - 21 Other

- - - - - -

Total Revenues $ 2,062 $ (148 ) $ - $ 119 $ -

$ 2,033

Segment EBITDA: News and Information

Services $ 113 $ 1 $ - $ 2 $ - $ 116 Book Publishing 56 (7 ) - - -

49 Cable Network Programming 27 - - 4 - 31 Digital Real Estate

Services 42 9 - 7 - 58 Digital Education (21 ) - - - - (21 ) Other

(54 ) - - - 15 (39

)

Total Segment EBITDA $ 163 $ 3 $ - $ 13 $ 15

$ 194 For

the three months ended March 31, 2014

AsReported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

AsAdjusted

(in millions)

Revenues: News and Information Services

$ 1,488 $ - $ (2 ) $ - $ - $ 1,486 Book Publishing 354 - - - - 354

Cable Network Programming 113 - - - - 113 Digital Real Estate

Services 102 - (1 ) - - 101 Digital Education 21 - - - - 21 Other

- - - - - -

Total Revenues $ 2,078 $ - $ (3 ) $ - $ - $

2,075

Segment EBITDA: News and Information

Services $ 146 $ - $ - $ - $ - $ 146 Book Publishing 53 - - - - 53

Cable Network Programming 27 - - - - 27 Digital Real Estate

Services 53 - 1 - - 54 Digital Education (45 ) - - - - (45 ) Other

(59 ) - - - 20 (39

)

Total Segment EBITDA $ 175 $ - $ 1 $ - $ 20

$ 196

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the nine months ended March 31, 2015 and 2014.

For the nine

months ended March 31, 2015

AsReported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

AsAdjusted

(in millions)

Revenues: News and Information Services

$ 4,327 $ (8 ) $ - $ 98 $ - $ 4,417 Book Publishing 1,277 (215 ) -

9 - 1,071 Cable Network Programming 367 - - 22 - 389 Digital Real

Estate Services 436 (107 ) (1 ) 22 - 350 Digital Education 85 - - -

- 85 Other - - - -

- -

Total Revenues $ 6,492 $

(330 ) $ (1 ) $ 151 $ - $ 6,312

Segment

EBITDA: News and Information Services $ 434 $ 5 $ - $ 6 $ - $

445 Book Publishing 188 (21 ) - - - 167 Cable Network Programming

113 - - 8 - 121 Digital Real Estate Services 156 24 - 12 - 192

Digital Education (69 ) - - - - (69 ) Other (161 ) -

- - 42 (119 )

Total

Segment EBITDA $ 661 $ 8 $ - $ 26 $ 42 $

737

For the nine months ended March 31, 2014

AsReported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

AsAdjusted

(in millions)

Revenues: News and Information Services

$ 4,595 $ - $ (39 ) $ - $ - $ 4,556 Book Publishing 1,073 - (4 ) -

- 1,069 Cable Network Programming 355 - - - - 355 Digital Real

Estate Services 295 - (2 ) - - 293 Digital Education 70 - - - - 70

Other - - - - -

-

Total Revenues $ 6,388 $ - $ (45 ) $

- $ - $ 6,343

Segment EBITDA: News and

Information Services $ 534 $ - $ (4 ) $ - $ - $ 530 Book Publishing

164 - - - - 164 Cable Network Programming 109 - - - - 109 Digital

Real Estate Services 152 - 1 - - 153 Digital Education (140 ) - - -

- (140 ) Other (176 ) - - -

56 (120 )

Total Segment EBITDA $ 643 $

- $ (3 ) $ - $ 56 $ 696

NOTE 2 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: Depreciation and amortization, impairment and

restructuring charges, equity earnings of affiliates, interest,

net, other, net, income tax (expense) benefit and net income

attributable to noncontrolling interests. Management believes that

Segment EBITDA is an appropriate measure for evaluating the

operating performance of the Company’s business segments because it

is the primary measure used by the Company’s chief operating

decision maker to evaluate the performance of and allocate

resources within the Company’s businesses. Segment EBITDA provides

management, investors and equity analysts with a measure to analyze

operating performance of each of the Company’s business segments

and its enterprise value against historical data and competitors’

data, although historical results may not be indicative of future

results (as operating performance is highly contingent on many

factors, including customer tastes and preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income,

cash flow and other measures of financial performance reported in

accordance with GAAP. In addition, this measure does not reflect

cash available to fund requirements and excludes items, such as

depreciation and amortization and impairment and restructuring

charges, which are significant components in assessing the

Company’s financial performance. The following table reconciles

Total Segment EBITDA to net income.

For the three months ended March 31, 2015

2014 Change % Change ( in

millions)

Revenues $ 2,062 $ 2,078 $ (16 ) (1 ) %

Operating expenses (1,216 ) (1,259 ) 43 3 % Selling, general and

administrative (683 ) (644 ) (39 ) (6 ) %

Total Segment EBITDA 163 175 (12 ) (7 ) % Depreciation and

amortization (132 ) (142 ) 10 7 % Impairment and restructuring

charges (10 ) (10 ) - - % Equity earnings of affiliates 7 23 (16 )

(70 ) % Interest, net 12 17 (5 ) (29 ) % Other, net 12

(1 ) 13 ** Income (loss) before income

tax (expense) benefit 52 62 (10 ) (16 ) % Income tax (expense)

benefit (18 ) (1 ) (17 ) **

Net

income $ 34 $ 61 $ (27 ) (44 ) % ** - Not

meaningful For the nine months ended March 31, 2015

2014 Change % Change ( in millions)

Revenues $

6,492 $ 6,388 $ 104 2 % Operating expenses (3,796 ) (3,828 ) 32 1 %

Selling, general and administrative (2,035 ) (1,917 )

(118 ) (6 ) %

Total Segment EBITDA 661 643 18 3 %

Depreciation and amortization (398 ) (421 ) 23 5 % Impairment and

restructuring charges (31 ) (73 ) 42 58 % Equity earnings of

affiliates 48 53 (5 ) (9 ) % Interest, net 42 50 (8 ) (16 ) %

Other, net 70 (673 ) 743 **

Income (loss) before income tax (expense) benefit 392 (421 )

813 ** Income tax (expense) benefit (107 ) 686

(793 ) **

Net income $ 285 $ 265

$ 20 8 % ** - Not meaningful

NOTE 3 – ADJUSTED NET INCOME AVAILABLE TO NEWS CORPORATION

STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income available to News Corporation

stockholders and diluted earnings per share (“EPS”) excluding

expenses related to U.K. Newspaper Matters, Impairment and

restructuring charges, and “Other, net”, net of tax (“adjusted net

income available to News Corporation stockholders and adjusted

EPS”) to evaluate the performance of the Company’s operations

exclusive of certain items that impact the comparability of results

from period to period. The calculation of adjusted net income

available to News Corporation stockholders and adjusted EPS may not

be comparable to similarly titled measures reported by other

companies, since companies and investors may differ as to what type

of events warrant adjustment. Adjusted net income available to News

Corporation stockholders and adjusted EPS are not measures of

performance under generally accepted accounting principles and

should not be construed as substitutes for consolidated net income

available to News Corporation stockholders and net income per share

as determined under GAAP as a measure of performance.

However, management uses these measures in comparing the

Company’s historical performance and believes that they provide

meaningful and comparable information to investors to assist in

their analysis of our performance relative to prior periods and our

competitors.

The following tables reconcile reported net income available to

News Corporation stockholders and reported diluted EPS to adjusted

net income available to News Corporation stockholders and adjusted

EPS for the three and nine months ended March 31, 2015 and

2014.

For the

three months ended For the three months ended March 31, 2015 March

31, 2014

Net incomeavailable tostockholders

EPS

Net incomeavailable tostockholders

EPS (in millions, except per share data)

As reported $ 23 $ 0.04 $ 48 $ 0.08 U.K.

Newspaper Matters 15 0.02 20 0.03 Impairment and

restructuring charges 10 0.02 10 0.02 Other, net (12 ) (0.02

) 1 - Tax impact on items above (8 ) (0.01 ) (13 ) (0.02 )

As adjusted $ 28 $ 0.05

$ 66 $ 0.11 For the nine

months ended For the nine months ended March 31, 2015 March 31,

2014

Net incomeavailable tostockholders

EPS

Net incomeavailable tostockholders

EPS (in millions, except per share data)

As reported

$ 230 $ 0.40 $ 225 $ 0.39 U.K. Newspaper Matters 42 0.07 56

0.10 Impairment and restructuring charges 31 0.05 73 0.13

Other, net (a) (70 ) (0.12 ) 673 1.16 Tax impact on

items above(b) (10 ) (0.02 ) (765 ) (1.33 ) Impact of

noncontrolling interest on items included in Other, net above 11

0.02 - -

As adjusted $ 234 $ 0.40

$ 262 $ 0.45 (a)

Other, net for the nine months ended March 31, 2015 primarily

includes a gain on the sale of marketable securities and dividends

received from cost method investments. Other, net for the nine

months ended March 31, 2014 primarily includes a foreign tax refund

paid or payable to 21st Century Fox, offset by a gain on a third

party pension contribution. (b) Tax impact on items above for the

nine months ended March 31, 2014 primarily includes a foreign tax

refund of $721 million which has an offsetting payable to 21st

Century Fox included within Other, net above.

News CorporationMichael Florin, 212-416-3363Investor

Relationsmflorin@newscorp.comorJim Kennedy, 212-416-4064Corporate

Communicationsjkennedy@newscorp.com

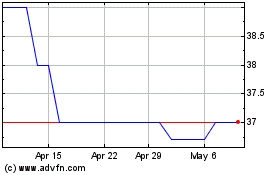

News (ASX:NWSLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

News (ASX:NWSLV)

Historical Stock Chart

From Apr 2023 to Apr 2024