New York Community Bancorp, Inc. Discloses Its 2016 Dodd-Frank Act Company-Run Stress Test Results under the Severely Adverse...

October 27 2016 - 4:31PM

Business Wire

In accordance with the Dodd-Frank Wall Street Reform and

Consumer Protection Act (the “Dodd-Frank Act”) and the regulations

promulgated thereunder by the Board of Governors of the Federal

Reserve System (the “FRB”), New York Community Bancorp, Inc. (NYSE:

NYCB) (the “Company”) today disclosed the results of its 2016

Dodd-Frank Act company-run stress test (“DFAST”) under the Severely

Adverse Scenario established by the FRB on January 28, 2016.

The Company’s DFAST results, and those of its savings bank

subsidiary, New York Community Bank, have been posted to the

Company’s website, www.myNYCB.com, under “Investor Relations” and

can be accessed by clicking on “Financial Results” and then on

“Regulatory Disclosures.”

The DFAST results reflect the Company’s estimates of losses,

pre-provision net revenue, provisions for loan and lease losses,

net income, and capital levels under the FRB’s Severely Adverse

Scenario over a nine-quarter planning horizon beginning December

31, 2015 and ending on March 31, 2018.

The Company’s DFAST results are not intended to be a forecast of

the Company’s future financial condition or results of operations

but, rather, a possible outcome based on the hypothetical severely

adverse macroeconomic conditions developed by the FRB for 2016

DFAST purposes.

About New York Community Bancorp,

Inc.

One of the largest U.S. bank holding companies, with assets of

$49.5 billion, New York Community Bancorp, Inc. is a leading

producer of multi-family loans on non-luxury, rent-regulated

apartment buildings in New York City, and the parent of New York

Community Bank and New York Commercial Bank. With deposits of $29.1

billion and 255 branches in Metro New York, New Jersey, Florida,

Ohio, and Arizona, the Company also ranks among the largest

depositories in the United States.

Reflecting its growth through a series of acquisitions, the

Community Bank currently operates through seven local divisions,

each with a history of service and strength: Queens County Savings

Bank, Roslyn Savings Bank, Richmond County Savings Bank, and

Roosevelt Savings Bank in New York; Garden State Community Bank in

New Jersey; Ohio Savings Bank in Ohio; and AmTrust Bank in Florida

and Arizona. Similarly, New York Commercial Bank currently operates

18 of its 30 New York-based branches under the divisional name

Atlantic Bank. Additional information about the Company and its

bank subsidiaries is available at www.myNYCB.com and

www.NewYorkCommercialBank.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027006885/en/

New York Community Bancorp, Inc.Investors:Ilene A. Angarola,

516-683-4420orMedia:Kelly Maude Leung, 516-683-4032

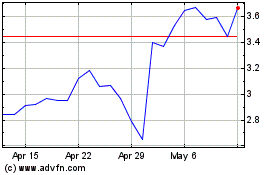

New York Community Bancorp (NYSE:NYCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

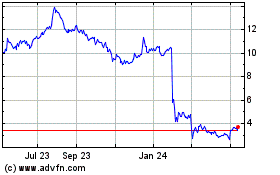

New York Community Bancorp (NYSE:NYCB)

Historical Stock Chart

From Apr 2023 to Apr 2024