New Technology Hubs Offer Strong Growth & Diversification Opportunities, MetLife Investment Management Study Finds

May 23 2017 - 6:30AM

Business Wire

A new study by the real estate division of MetLife Investment

Management entitled “Tech Markets 2.0”, highlights the emergence of

a new generation of technology hubs with positive long-term drivers

that offer real estate investors growth and diversification

opportunities beyond the traditional “core” tech markets.

These “NextTech” markets, including Washington, D.C.;

Pittsburgh; Salt Lake City; and San Diego, provide investors with

the ability to craft focused investment strategies that target real

estate demand driven by specific tech industries.

Often supported by strong university systems, enjoying

substantially lower costs of living, and benefiting from the skill

and experience of transplants from the core tech markets, the

NextTech markets have witnessed a rapid increase in science,

technology, engineering and mathematics (STEM) jobs over the last

three years. These increases are gradually reshaping their local

economies as STEM employment makes up an ever greater share of the

total.

While core tech markets such as Boston and San Francisco still

top the nation in the rate of STEM growth and its role in local

economies, many of the NextTech markets are not far behind.

According to the study, during the three-year period from 2014 to

2016, STEM jobs accounted for 20 percent of the total job growth in

core tech markets, compared to 11 percent in the primary NextTech

markets and 13 percent in the secondary NextTech markets.

Specifically during this three-year period, the study notes that

there were 490,000 new STEM jobs created in the U.S., with more

than two-thirds of them created outside of the core tech markets.

In many of these NextTech markets, STEM job growth accounted for a

significant share of the total, including 44 percent in Pittsburgh,

19 percent in Provo, Utah, and 15 percent in Washington, D.C.

“The NextTech markets are poised to outperform in this cycle and

the next,” said Adam Ruggiero, associate director, MetLife

Investment Management. “The shift towards specializations in these

markets also offers investors the opportunity to place strong bets

on the technologies of the future and the real estate demand their

success will generate. They offer lower concentration risk, strong

starting yields, solid income growth, and rich future

valuations.”

A copy of the study is available upon request.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the largest life insurance

companies in the world. Founded in 1868, MetLife is a global

provider of life insurance, annuities, employee benefits and asset

management. Serving approximately 100 million customers, MetLife

has operations in nearly 50 countries and holds leading market

positions in the United States, Japan, Latin America, Asia, Europe

and the Middle East. For more information, visit

www.metlife.com.

L0517495339[exp0518][All States]

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170523005190/en/

MetLifeJillian Palash, 212-578-1538

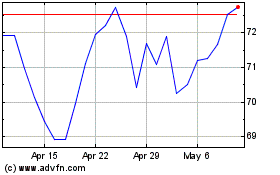

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024