New Investment

April 11 2006 - 3:01AM

UK Regulatory

RNS Number:3324B

Dolphin Capital Investors Limited

11 April 2006

For release

Dolphin Capital Investors Limited ("DCI" or the "Company")

Euro31 million of new investments in Greece

Dolphin Capital Investors, the real estate investment company focused on the

Residential Resort sector in Southeast Europe and managed by Dolphin Capital

Partners, announces two further investments in Greece with a total commitment of

Euro31 million as follows:

*Euro9 million for a 50% stake in Scorpio Bay Resort, a master-planned

leisure integrated community in Greece on a site of 172 hectares with 2km

of sea frontage.

*Euro22 million additional investment to expand the Kilada Hills Golf Resort

in Greece, a project 80% owned by DCI.

Highlights:

*The site of Scorpio Bay Resort is situated one-hour's drive from Athens

International Airport and when developed, will probably be the closest

sea-side residential resort to the Greek capital.

*Kilada Hills Golf Resort has received two key development permits from

the Greek Government and it is very likely that it will be the first golf

integrated resort development in Greece to come to market.

*With these two new investments, DCI has committed Euro54 million of the Euro104

million raised through its flotation on AIM on 8 December 2005.

*With other pre-IPO portfolio projects to be finalized soon and a current

additional project pipeline of more than Euro200 million, the Investment

Manager expects to fully commit the IPO proceeds earlier than anticipated.

Said Miltos Kambourides, Managing Partner, Dolphin Capital Partners: "We are

very delighted for the signing of Scorpio Bay Resort and at the same time very

pleased with the progress achieved so far with Kilada Hills Golf Resort, and our

strong project pipeline. We are confident that Dolphin will continue to be ahead

of its investment plan and to fully capitalize on the growth of this very

exciting sector in our region."

- ENDS -

Further Details:

Scorpio Bay Resort

The site of Scorpio Bay Resort is located one hour north from Athens

International Airport in the region of Skorponeri. It is a mountainous peninsula

of un-spoilt natural beauty with approximately 2km of sea frontage overlooking a

secluded bay.

The project will comprise of a five-star hotel and residential resort. Net total

construction of the development is estimated to be at least 100,000 buildable

square metres, of which at least 80,000 buildable square metres will be

residences to be sold in a combination of freehold, fractional ownership and

condo-hotel options.

The total construction cost is expected to be approximately Euro130 million while

the total turnover should exceed Euro250 million.

The other 50% of the Project is owned by a group of business partners from the

Greek shipping and banking community who have already contributed Euro9 million for

the acquisition of the site.

DCI will initially invest Euro3 million to cover site transfer taxes and expenses

and to fund the permit application process. The remaining Euro6 million will be

invested once the final permits and approvals are obtained.

Kilada Hills Golf Resort

Project Kilada Hills Golf Resort is a high-end master-planned golf integrated

development, situated in the area of Porto Heli in Greece, which is considered

the country's most prime holiday home area.

The project, owned 80% by DCI, has received the main required permits for its

development, namely approval of the Suitability Permit from EOT (Ministry of

Tourism) and the Environmental Impact Study (MPE). This includes permits for an

18-hole championship standard golf course and a combination of hotel and

residential units of over 700 beds.

Due to the considerable progress with the permits, it is very likely that Kilada

Hills Golf Resort will be the first one of its kind in Greece to come to market.

As per DCI's past announcement on 23 January 2006, DCI have already invested Euro23

million to acquire or lease approximately 160 hectares now holding the above

permits. The additional investment of Euro22 million will be used to acquire

additional adjacent land to expand the site from 160 hectares to more than 250

hectares and secure direct access to the sea. This expansion will also integrate

Kilada Hills Collection into the project, a sea front development of 10 luxury

villas that are already under construction, to be contributed in the project by

DCI's development partner who currently owns 20% of Kilada Hills Golf Resort.

After this expansion, DCI's shareholding in the entire project will become 85%.

When fully developed, the construction cost of the expanded project is expected

to reach Euro150 million while the total turnover should exceed Euro300 million.

Dolphin Capital Partners, the Company's Investment Manager, is in advanced

negotiations regarding investments in other residential resort projects as

outlined in the Company's AIM Admission Document, together with other investment

opportunities that have arisen subsequently, totaling over Euro200 million.

For further information, please contact:

Dolphin Capital Partners Limited Tel: +30 210 3614 255

Miltos Kambourides / Pierre Charalambides

miltos@dolphincp.com / pierre@dolphincp.com

Grant Thornton Corporate Finance Tel: +44 (0) 20 7383 5100

(Nominated Adviser)

Philip Secrett

Panmure Gordon Tel: +44 (0) 20 7459 3600

(Broker)

Richard Gray / Dominic Morley / Andrew Potts

Binns & Co PR Ltd Tel: +44 (0) 20 7786 9600

(Financial PR)

Peter Binns / Annie Evangeli

Notes to Editors

Dolphin Capital Partners ("DCP")

DCP is an independent investment management business founded in 2004 by Miltos

Kambourides and Pierre Charalambides after leaving Soros Real Estate Partners.

DCP specialises in providing capital to rigorously selected real estate

developments in Southeast Europe and matching local developers with DCP's

international network of sophisticated operators, designers, master-planners,

marketing agents and financial institutions.

The partners combine extensive local knowledge and contacts with an

international network following expertise gained at some of the world's leading

financial institutions including Soros Real Estate Partners, Goldman Sachs,

JPMorgan, GE Capital and Citibank.

DCP contributed to DCI an attractive prospective investment portfolio and a

strong pipeline of potential projects sourced over the past two years.

DCP is incorporated in the British Virgin Islands and has presence in Greece and

Cyprus.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFIFASSMSEEL

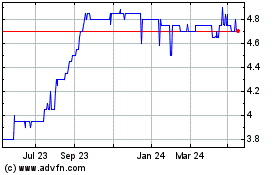

Dci Advisors (LSE:DCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

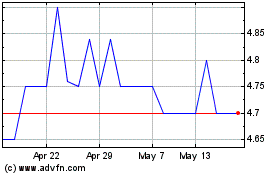

Dci Advisors (LSE:DCI)

Historical Stock Chart

From Apr 2023 to Apr 2024