New Inversion Rules Test Pending Deals

April 05 2016 - 1:58PM

Dow Jones News

By Liz Hoffman

Treasury's latest shot at stopping corporate inversions could

present a real problem for Pfizer Inc.'s pending $150 billion

takeover of Allergan PLC -- the largest such deal ever -- but will

likely have less of an impact on similar transactions that have yet

to close, like Tyco International PLC's tie-up with Johnson

Controls Inc.

Inversions are deals that became popular in recent years in

which a U.S. company buys a foreign rival and adopts its lower-tax

jurisdiction. Such companies frequently proceed to make more

acquisitions of U.S. companies to bring them on to their lower-tax

platforms.

Inversions have met stiff resistance in Washington, though the

government had been unable to do much to stop them. That may have

changed with the publication late Monday of a third installment of

proposed rule changes, the stringency of which came as a surprise

to many.

In an effort to crack down on what Treasury calls "serial

inverters" -- companies that have done other tax-lowering deals

after inverting -- the regulations unveiled Monday included a

three-year look-back. That means Treasury will disregard three

years' worth of U.S. acquisitions when determining a foreign

company's true size under the tax code.

That complicates the finely tuned math that is crucial for

inversions to work. To reap maximum benefits, shareholders of the

inverting company should own between 50% and 60% of the combined

entity. Between 60% and 80% also works, but the tax perks are

diminished, and above 80%, they are lost entirely. So U.S.

companies need an inversion partner that is at least one-quarter

their size, and ideally more like two-thirds.

When the Allergan deal was struck last year, Pfizer's market

capitalization was about $200 billion and Allergan's was about $123

billion. Pfizer's shareholders would own 56% of the combined

company.

But if you strip out three years' worth of deals done by

Allergan -- which Treasury most certainly would consider a serial

inverter -- that math no longer works. Allergan has 395 million

shares outstanding. It has issued about 260 million shares for big

deals including the $25 billion takeover of Forest Laboratories and

the $66 billion combination of Actavis and Allergan last year.

Stripping those out leaves about 130 million shares, worth only

about $31 billion. Under the current merger ratio, Allergan

shareholders' stake in the combined company would likely drop into

the high teens. In other words, in the eyes of Treasury, Allergan

is likely too small to be Pfizer's inversion partner.

The two companies said Monday that they are reviewing the

regulation and haven't yet commented further.

The move by Treasury has spooked Allergan shareholders who worry

it will make the deal uneconomical for Pfizer and cause the drug

giant to walk away. Allergan shares are down 16%, erasing more than

$16 billion of the company's market value, in a stark signal that

many investors are leaving the deal for dead.

Investors in other companies pursuing inversions took a more

sanguine approach, perhaps because the three-year rule is unlikely

to trip them up. Tyco, the target of Johnson Controls' pending

inversion, has made few acquisitions in the past three years. The

same goes for Canada's Progressive Waste Solutions Ltd., which is

Waste Connections Inc.'s ticket out of the U.S. tax net.

Shares in those companies are falling today, though less

dramatically than Allergan's. Progressive Waste is down 6.5%, and

Waste Connections has fallen 5.6%. Meanwhile, Tyco has dropped

about 2.7%, and Johnson Controls has declined 2.2%. IHS Inc. and

its planned inversion partner, Markit Ltd., are each off about

3%.

Waste Connections and Progressive Waste said in a statement

Tuesday that they are committed to their deal. They expect the

regulations to affect less than 3% of the combined company's

expected first-year adjusted free cash flow of $625 million.

A spokesman for Johnson Controls said the companies were

reviewing the regulations.

Those deals aren't entirely immune from the new regulations.

Treasury also is attacking a practice known as earnings stripping,

which is when inverted companies lend money to their American

subsidiaries and use the interest payments, which are tax

deductible, to lower their U.S. taxes. Treasury will stop treating

those loans as debt, negating their benefits.

To the extent Johnson Controls or Waste Connections hinged their

deals on earnings stripping, they could see their allure

diminished. If the math no longer works -- for example, if the

lessened savings can't support the new company's debt -- some

transactions could be recut or abandoned.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

April 05, 2016 13:43 ET (17:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

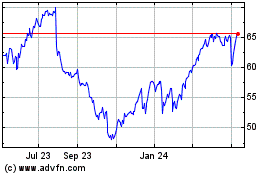

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

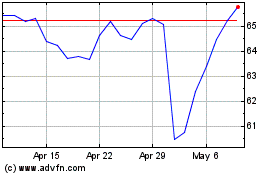

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024