New-Car Dealers Shine in Merger and Acquisitions This Year

December 21 2015 - 8:09PM

Dow Jones News

By Jeff Bennett

U.S. car dealerships changed hands at an accelerated pace this

year boosted by robust new-car demand, strong dealer profits and an

increased focus on the business following Warren Buffett's purchase

of a Phoenix-based chain.

A total of 456 dealerships have been acquired thus far in 2015,

a 40% increase over the prior year, according to The Banks Report,

which tracks merger and acquisitions in car retailing. The gains

comes as industry analysts expect U.S. vehicle sales to reach 17.5

million this year and expand again next year.

The rosy outlook is a dramatic reversal from 2009, when

thousands of dealerships were forced to close as Chrysler LLC, now

owned by Fiat Chrysler Automobiles NV, and General Motors Co. filed

for bankruptcy protection. Sales of new vehicles fell to 10.4

million that year, and many dealers' survival was in question.

Total dealerships in the U.S. has increased modestly to about

18,000 since the financial crisis and steady volume gains have

stirred new interest in the business. "Warren Buffett and others

have come to see dealerships as stable, slow predictable growth,"

Banks Report founder Cliff Banks said in an interview.

About 10% of the acquisitions this year were generated by large

publicly-traded dealer groups, such as AutoNation Inc. The Fort

Lauderdale, Fla.-based retailer bought more than 30 dealerships

expected to generate $1.7 billion in revenue. "We will continue to

seek acquisitions to leverage our scale," said Mike Jackson, chief

executive officer.

Still, there was plenty of opportunity for smaller players. Mark

McLarty, founder of McLarty Automotive Group in Little Rock,

acquired 15 stores this year bringing the total number of stores he

operates to 20. He has grown by snapping up stores from older

retailers who hung on through economic crisis are using the rebound

to call it quits while valuations are high.

"A lot of these guys who got through the recession now feel

their showroom values have recovered and now is the time to sell

rather than holding on and risk going through another downturn,"

Mr. McLarty said. "It's tough for the stand-alone, local

dealership."

The dealer said capital requirements continue to increase while

profit margins haven't expanded fast enough to keep up. "I think

you are only going to see more consolidation in the future," Mr.

McLarty said.

A trigger for the wider consolidation came in 2014, when Mr.

Buffett's Berkshire Hathaway Corp. bought 75 stores from

Arizona-based auto dealer Larry Van Tuyl.

Mr. Buffett said in March he would continue making such

acquisitions over the next couple of years.

U.S. new-car buyers are expected to spend $437 billion on

vehicles this year, a 7.3% increase over 2014.

Still, new-car price competition among dealers remains fierce

and auto manufacturers continue to demand hefty new

investments.

Mercedes-Benz USA, for example, is requiring its dealers to

invest about $200,000 to expand their showrooms and create a

special demonstration area if they want to sell the luxury auto

maker's AMG sports models next year. Those dealers who don't expand

risk falling to the end of the line when it comes to getting their

vehicle orders fulfilled.

Used-car sales and finance operations often offset weaker

profits in new-car departments and service bays, say industry

executives.

Despite such pressures, the value of the average dealership with

at least three stores increased 10% from 2014 to about $40 million,

according to Kerrigan Advisors, which helps dealers sell their

businesses. The typical new-car dealer owns three stores and the

real estate their franchises occupy.

Erin Kerrigan, founder of the Irvine, Calif.-based firm, expects

a new record for dealership mergers and acquisitions in 2016

because of the large number of dealership groups expected to go on

the block.

But she warns that "since car sales aren't going to grow much

more than where they are at today, there is little doubt in my mind

that we are at peak and many [dealership] sellers are choosing to

go to market."

Write to Jeff Bennett at jeff.bennett@wsj.com

(END) Dow Jones Newswires

December 21, 2015 19:54 ET (00:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

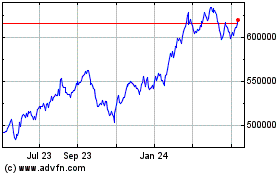

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

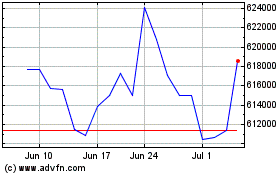

From Mar 2024 to Apr 2024

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024