Network Rail Prices Tap of Three Inflation-Linked Bonds

February 21 2013 - 10:03AM

Dow Jones News

By Ben Edwards

Network Rail Infrastructure Finance PLC, the U.K. authority

responsible for the country's railway network, Thursday increased

the size of three of its outstanding index-linked bonds, according

to one of the banks running the deal.

Bank of America Merrill Lynch, Deutsche Bank AG and HSBC

Holdings PLC are lead managers of the tap, which has the following

terms:

2027 Bond:

Amount: GBP420 million

Maturity: Nov. 22, 2027

Coupon: 1.75%

Reoffer Price: 128.513

Spread: 35 basis points over the 1.25% Nov. 2027 index-linked gilt

2037 Bond:

Amount: GBP195 million

Maturity: Nov. 22, 2037

Coupon: 1.375%

Reoffer Price: 127.482

Spread: 35 basis points over the 1.125% Nov. 2037 index-linked gilt

2047 Bond:

Amount: GBP135 million

Maturity: Nov. 22, 2047

Coupon: 1.125%

Reoffer Price: 124.953

Spread: 35 basis points over the 0.75% Nov. 2047 index-linked gilt

Common terms:

Guarantor: United Kingdom government

Debt Ratings: Aaa (Moody's)

AAA (Standard & Poor's)

AAA (Fitch)

Denominations: GBP1,000; GBP50,000

Write to Ben Edwards at ben.edwards@dowjones.com

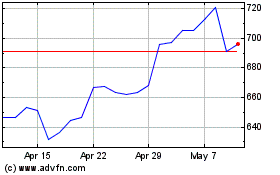

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

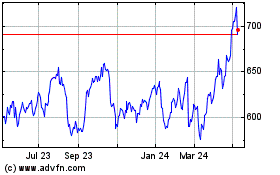

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024