NetApp Posts Loss Amid Product Overhaul, Restructuring

August 19 2015 - 8:00PM

Dow Jones News

By Maria Armental

NetApp Inc. swung to a loss in the first quarter as product

revenue dropped sharply amid a major product overhaul and the

data-storage company logged $27 million in costs tied to a

previously announced restructuring.

Product revenue fell to $664 million, down 27% from the previous

quarter and 25% from the year-ago period, largely tied to a decline

on Data ONTAP 7-Mode sales. NetApp is trying to shift customers to

its latest storage operating system, what is calls clustered Data

ONTAP or cDOT.

Company officials, who called this a transition year, said

product revenue would pick up in the second quarter and return to

its target operating margin of 8% to 20% in the second half of the

year.

"The IT industry as a whole is going through fundamental change

as enterprises transform themselves with digital capabilities. Data

is at the heart of these transformations," Chief Executive George

Kurian said. He added: "Our first fiscal quarter marks the

beginning of a new chapter for NetApp."

Mr. Kurian, who previously oversaw strategy and development of

the company's product and solutions portfolio, became the chief

executive in June, less than two weeks after the Silicon Valley

company said it would lay off 500 workers, or about 4% of its

global workforce. NetApp said it expected to complete the overhaul

by the third quarter and estimated the cost at $25 million to $35

million.

Shares, which set a 52-week-low during regular trading

Wednesday, rose 10% to $32.85 in late trading.

For the current quarter, NetApp projects 55 cents to 60 cents a

share in profit on $1.4 billion to $1.5 billion in revenue,

compared with the consensus of 46 cents a share on $1.39 billion in

revenue, according to analysts surveyed by Thomson Reuters.

Over all, for the quarter ended July 31, NetApp reported a loss

of $30 million, or 10 cents a share, compared with a year-earlier

profit of $88 million, or 27 cents a share. The most recent quarter

had 7.6% fewer shares outstanding than the year-earlier period.

Excluding stock-based compensation and other items, earnings

fell to 29 cents a share from 60 cents a share a year earlier.

Net revenue fell 10% to $1.34 billion.

NetApp had projected profit of 20 cents to 25 cents a share on

$1.28 billion to $1.38 billion in revenue.

Gross margin narrowed to 61.1% from 63% a year earlier.

The Sunnyvale, Calif., company ended the quarter with $5 billion

in cash.

Through Wednesday's close, the company's stock was down 28% for

the year.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 19, 2015 19:45 ET (23:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

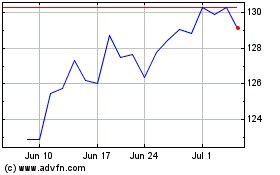

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

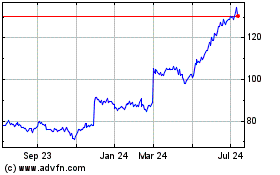

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024