Nestlé Scrambles to Score Points -- WSJ

June 28 2017 - 3:02AM

Dow Jones News

Share buybacks, acquisition search are part of plan flushed out

by investor pressure

By Saabira Chaudhuri and Brian Blackstone

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the US print

edition of The Wall Street Journal (June 28, 2017).

Nestlé on Tuesday announced plans to launch a $20.8 billion

share buyback, focus its capital spending on categories like coffee

and pet care and look for consumer health-care acquisitions, a move

that comes after it found itself the target of activist investor

Third Point LLC.

Nestlé wasn't expected to deliver an update to shareholders

until September, but its plans were fast-tracked amid investor

pressure that culminated with Third Point founder Daniel Loeb on

Sunday night publishing a letter on how Nestlé should change its

business. His recommendations include a formal margin target, more

share buybacks and a sale of Nestlé's stake in French cosmetics

giant L'Oréal SA.

Mr. Loeb began amassing shares in Nestlé early this year,

according to a person familiar with the matter, and now owns 1.25%

of the company making him Nestlé's fourth-biggest shareholder.

Nestlé shares jumped following Mr. Loeb's letter, which promised

the company's growth and earnings would "dramatically improve" if

his recommendations were followed.

"All seems to have happened very quickly, but probably not a

huge surprise given the strength of the balance sheet and pressure

from Third Point and others," said Jon Cox, head of Swiss equities

at Kepler Cheuvreux.

Nestlé applied for Swiss regulatory approval of its share

buyback last week, and received the go-ahead on Tuesday.

Under new Chief Executive Mark Schneider, Nestlé has already

dropped a sales-growth target that investors had labeled as

outdated after the company fell short for four straight years. Mr.

Schneider also recently said Nestlé would look to sell its U.S.

confectionery business, which lags behind rivals Hershey Co., Mars

Inc. and Chocoladefabriken Lindt & Spruengli AG.

Nestlé on Tuesday indicated it could make more divestitures,

saying it "will continue to adjust its portfolio in line with its

strategy and growth objectives." There have been calls for Nestlé

to consider selling its frozen-food arm, which includes brands like

Lean Cuisine and Stouffer's, another business that has struggled as

consumers increasingly look to fresh options. Mr. Loeb suggested

that Nestlé sell its 23% stake in L'Oréal.

Nestlé will kick off a share buyback of up to 20 billion Swiss

francs ($22.4 billion) next week that will run through June 2020.

In addition to investing in beverages, infant nutrition and other

high-growth categories, the company said it would also look to make

acquisitions in consumer health care that "build on" the

faster-growing parts of its core food and drinks business. It

didn't specifically refer to its frozen and prepared-foods

business, although Nestlé is the world's largest packaged-food

company.

"The company is likely to exit more commoditized packaged food

in favor of nutrition," Mr. Cox said.

The Vevey, Switzerland-based company said it would examine ways

to boost margins through cost cuts but cautioned that it would not

do so at the expense of its growth categories.

Mr. Schneider has criticized as unsustainable the aggressive

cost-cutting that Brazilian investment firm 3G has backed for

companies it owns, like Kraft Heinz Co. and Anheuser-Busch InBev

NV. Nestlé's announcement on Tuesday echoes that of rival Unilever

PLC, which in April unveiled a EUR5 billion ($5.7 billion) share

buyback and plans to sell its spreads division after fending off a

takeover approach by Kraft.

Nestlé, Unilever and other consumer-goods stalwarts have

struggled to deliver the consistent growth that investors had come

to expect. The industry headwinds include weaker global growth,

volatile currencies and interest rates, higher commodity costs,

rapidly changing consumer tastes and difficulty raising prices in a

low-inflation environment.

Nestlé said the buyback could be curtailed should it make a big

acquisition before 2020 and that most of the monthly share

repurchases will be made in 2019 and 2020 to allow it to pursue

deals. The buyback is Nestlé's biggest since 2007. It has bought

back 47 billion francs in shares since 2005.

The company said it had been examining its capital structure and

ways to deliver higher shareholder returns since the start of the

year, when Mr. Schneider became CEO.

Mr. Loeb has had several conversations with Nestlé's

investor-relations team, and more recently met with Mr. Schneider

to convey his recommendations, according a person familiar with

those talks. Third Point declined to comment on Tuesday.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Brian Blackstone at brian.blackstone@wsj.com

Corrections & Amplifications Nestlé will buy back up to

$20.8 billion of its shares. An earlier version of the summary of

this article that appeared on some WSJ.com pages incorrectly said

it was buying back $2.08 billion of shares. (June 27)

(END) Dow Jones Newswires

June 28, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

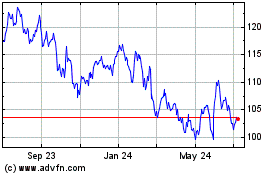

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024