TIDMNG. TIDM82HZ

RNS Number : 2097G

National Grid PLC

18 November 2015

This half year report is available from the Investors section of

the National Grid website (www.nationalgrid.com/investors).

18 November 2015

National Grid Gas plc

Half year report for the six months ended 30 September 2015

Solid underlying first half performance

-- Progress towards another year of good performance

-- Continued delivery of capital programme cost savings

Portfolio development

-- Commencing a process for the potential sale of a majority stake in Gas Distribution

Financial results

Six months ended Adjusted results(1) Statutory results

30 September

GBPm (unaudited) 2015 2014 % change 2015 2014 % change

----------------------- ------ ------ --------- ------ ------ ---------

Revenue 1,477 1,402 5 1,477 1,402 5

Operating profit 580 633 (8) 580 548 6

Profit before tax 465 492 (5) 465 399 17

Capital investment 404 340 19 404 340 19

----------------------- ------ ------ --------- ------ ------ ---------

Outlook

-- On track to deliver another year of good returns

STRATEGIC AND OPERATIONAL REVIEW

Proposed majority sale of Gas Distribution business

On 10 November 2015, National Grid plc (the ultimate parent

company of National Grid Gas plc) announced the proposed sale of a

majority stake in the UK Gas Distribution Business. The National

Grid plc Board expects to return substantially all of the net

proceeds to shareholders. In light of this announcement, National

Grid plc is commencing a process for this potential sale. The

process is likely to be completed in early 2017.

Market developments

The UK's gas market and sources of gas are changing. Domestic

demand has fallen over the last five years and a significant

increase is not expected in future years. The UK continental shelf

(UKCS) now makes up less than half our total gas supply, with the

remainder coming from Norway, continental Europe, or further afield

via shipped imports of Liquefied Natural Gas (LNG).

Overall, supply capacity now exceeds peak demand by more than

25%, giving National Grid Gas plc's (the Company's) customers

significant flexibility over which sources of gas they choose to

meet demand. Newer sources of supply, such as LNG importation

terminals and storage sites, can respond to demand more quickly

than traditional UKCS supplies. The Company's network therefore

needs to be able to respond to changing day-to-day supply and

demand patterns.

UK reliance on imported gas supplies will vary depending on the

level of gas supply from the UKCS and the development of indigenous

gas sources. The Company is therefore working closely with its

customers and stakeholders to meet these operational challenges.

The Company is focused on continuing to develop its network and

services to meet their needs safely, reliably and efficiently.

Businesses continue to perform well

In the first six months of the year, the Company continued to

drive capital and operating cost efficiencies across its network

business, reinforcing the Company's expectation for another year of

strong UK operational returns.

The business maintains its drive for outperformance under its

regulatory arrangements, delivering outputs at lower cost than the

regulatory targets alongside good incentive performance.

Specifically, performance against our leakage and capacity

incentives has continued to be strong and our focus over the

forthcoming periods will continue to improve our customer

performance. During the period we have completed a benchmarking

exercise in order to help deliver better performance against the

RIIO outputs and allowances.

Maintained strong safety and reliability for customers

The Company targets world class safety performance, measured as

a lost time injury frequency rate of 0.10 or better (i.e. less than

0.1 lost time injury per 100,000 hours worked in a 12 month period)

and has achieved this target of 0.10 for three out of the last four

months. The business remains focused on maintaining this good level

of performance as it goes into the winter period.

This encouraging safety performance has been achieved throughout

a period of significant network investment activity, and the

business has also maintained a very good level of reliability over

this period.

Businesses continue to deliver efficiency savings to create

value under regulatory arrangements

To maximise the benefit of the Company's regulatory

arrangements, the Company continues to focus on improving the

efficiency and effectiveness of its operations through innovation

and an ongoing performance improvement agenda. Alongside value for

money, customers also need safe and reliable networks and good

customer service, which sets out the foundation for the critical,

non-financial success factors for the long-term performance of the

Company.

Focus on performance excellence drives efficiencies and

significant savings to customers

The businesses continue to deliver totex efficiencies, in

particular in relation to the mains replacement programme in Gas

Distribution. This is being achieved through a focus on delivering

the lowest sustainable cost solutions to delivering customer

outputs. These solutions are the result of a variety of approaches,

including contracting efficiencies, improved design and project

planning and other alternative solutions to delivering the benefits

of traditional capital and replacement projects. The business is

further expanding the use of the performance excellence framework

to drive further efficiencies.

The RIIO-T1 and RIIO-GD1 price controls included provision for a

potential mid-period review. In November 2015, Ofgem commenced a

consultation process on potential issues that may be relevant for

triggering mid-period reviews. Any mid-period reviews will focus on

changes to outputs that can be justified by clear changes in

government policy and new outputs that are needed to meet the needs

of consumers and other network users. The reviews will not re-open

the RIIO-T1 or RIIO-GD1 price controls or change the key financial

parameters. As a result the Company expects customers to continue

to be able to benefit from innovation and initiatives throughout

the full eight year RIIO period.

Access to innovative, low cost funding options enabled by a

strong balance sheet

The Company's balance sheet remains strong after another period

of significant investment in new assets. The Company continues to

enjoy strong credit ratings from Moody's, Standard & Poor's and

Fitch.

Board changes

As reported in the National Grid Gas plc Annual Report and

Accounts 2014/15, Nick Winser stepped down from the Board of

Directors on 1 July 2015. John Pettigrew assumed the role of

non-independent Chairman of the Board on this date. Following the

resignation of Emma Fitzgerald on 30 April 2015 as a director of

the Company, Chris Train was appointed as a Director on 1 July

2015.

On 24 September 2015, Mike Calviou resigned as a Director of the

Board and was replaced by Cordi O'Hara on the same date. On 25

September 2015, Neil Pullen resigned as a Director of the Board and

was replaced by Pauline Walsh on the same date.

REVIEW OF OPERATIONS

Six months ended 30 September Adjusted Capital

operating investment

profit

(GBPm) 2015 2014* 2015 2014

------------------------------- ----- ------ ------ ------

Gas Transmission 73 25 91 85

Gas Distribution 417 421 286 226

Other activities 90 89 27 29

------------------------------- ----- ------ ------ ------

580 535 404 340

------------------------------- ----- ------ ------ ------

* The 2014 adjusted operating profit above has been presented on

a basis consistent with the current year classification, to include

exceptional pension deficit charges of GBP98m, as noted on page

15.

Gas Transmission

Gas Transmission operating profit increased by GBP48m in the

first six months of the year, compared to the first six months of

2014/15, reflecting lower prior year revenues which were phased

more than usual towards the second half of the year. This increase

was partly offset by higher controllable costs and increased

depreciation. Timing increased operating profit in the period by

GBP51m.

As last year, capital investment was almost entirely driven by

non-load related investment including compressor replacement. As

part of this work, the business commissioned two new electric drive

compressors at St Fergus in the period. The business also continued

its excellent safety record, with the Operations and Asset

Management team working for over two years without a lost time

injury (LTI) and the specialist pipeline maintenance centre having

passed 1,000 days LTI free.

The Gas Transmission business expects to deliver its regulatory

outputs for the year for a level of totex broadly in line with the

associated regulatory allowance. As a result, the business does not

expect totex incentive performance to significantly affect achieved

returns for the year as a whole. Totex for the first half of the

year was approximately GBP150m compared to GBP130m in the first

half of 2014/15.

At this half way point in the year the business expects to

deliver a good outturn for the year under annual revenue incentive

schemes as a whole, although below the exceptionally high level

delivered in 2014/15 due to the expiry of the gas permit incentive

scheme. During the period, Ofgem published final stakeholder scores

for 2014/15, confirming that Gas Transmission had increased its

score for the second year of RIIO, earning additional incentive

revenues.

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

The business continues to work with Ofgem to determine

appropriate levels of workload and investment over the remainder of

the RIIO-T1 period associated with compressor emissions and

reliability.

The Winter Outlook, published on 15 October 2015, indicates that

sufficient gas supply and gas in storage is expected to be

available for the winter of 2015/16 to meet the demands of a 1 in

20 winter. The Gas Transmission business has further improved its

processes in relation to winter preparation this year in order to

ensure maximum availability of its assets during the highest demand

periods of the year.

Gas Distribution

Operating profit in the first six months decreased by GBP4m

compared to the first six months of 2014/15. Increased regulatory

revenue, principally due to increased allowances relating to the

tax treatment of replacement expenditure, was offset by increased

depreciation and increases in operating costs. Timing reduced

operating profit in the period by GBP5m.

Investment was principally driven by GBP224m of replacement

expenditure compared to GBP170m in the first half of 2014/15. This

reflected an increased level of workload, in line with the

business' target to replace a required length of main over the

course of the RIIO-GD1 period. Totex for the first half of the year

was approximately GBP480m compared to GBP410m in the first half of

2014/15.

Gas Distribution is focused on improving key regulatory

performance metrics across its networks over the course of 2015/16.

The business is working closely with the partners of its Gas

Distribution Strategic Partnerships, Balfour Beatty and tRIIO,

ensuring that sharing of best practice and innovation continues to

deliver benefits, and the required workload increases for this year

and next year are resourced most effectively in order to drive

maximum benefit from the contractual arrangements and continued

savings for customers.

The Gas Distribution business is also continuing its initiatives

to deliver improved levels of customer service scores for 2015/16,

in particular in planned interruptions and customer connection

activities.

Other activities

Other activities include National Grid Metering and Xoserve.

National Grid Metering continues to provide installation and

maintenance services to energy suppliers in the regulated market in

Great Britain, maintaining around 13.7 million domestic, industrial

and commercial meters. National Grid Metering has witnessed a

marginal decrease in operating profit largely resulting from

reduced domestic meter populations affecting rental income.

Domestic meter populations are expected to continue to fall as the

smart meter roll-out across the UK continues.

APPENDIX: BASIS OF PRESENTATION AND DEFINITIONS

BASIS OF PRESENTATION

Adjusted and Statutory Results

Unless otherwise stated, all financial commentaries in this

release are given on an adjusted basis.

'Adjusted' results are a key financial performance measure used

by the Company, being the results for continuing operations before

exceptional items and remeasurements. Remeasurements comprise gains

or losses recorded in the income statement arising from changes in

the fair value of derivative financial instruments to the extent

that hedge accounting is not achieved or is not fully effective.

Commentary provided in respect of results after exceptional items

and remeasurements is described as 'statutory'. Further details are

provided in note 3 on page 15. A reconciliation of business

performance to statutory results is provided in the consolidated

income statement on page 8.

DEFINITIONS

Post-employment costs

Post-employment costs include the cost of pensions and other

post-employment benefits.

Timing

Under the Company's regulatory frameworks, the majority of the

revenues that the Company is allowed to collect each year are

governed by a regulatory price control. If the Company collects

more than this allowed level of revenue, the balance must be

returned to customers in subsequent years, and if it collects less

than this level of revenue it may recover the balance from

customers in subsequent years. These variances between allowed and

collected revenues give rise to "over and under-recoveries". In

addition, a number of costs are pass-through costs, and are fully

recoverable from customers. Any timing differences between costs of

this type being incurred and their recovery through revenues are

also included in over and under-recoveries. Timing differences also

include an estimation of the difference between revenues earned

under revenue incentive mechanisms and any associated revenues

collected. Timing balances and movements exclude any adjustments

associated with changes to controllable cost (totex) allowances or

adjustments under the totex incentive mechanism.

Identification of these timing differences enables a better

comparison of performance from one period to another. Opening

balances of under and over-recoveries have been restated where

appropriate to correspond with regulatory filings and

calculations.

Totex

Under the RIIO regulatory arrangements the Company is

incentivised to deliver efficiencies against cost targets set by

the regulator. In total, these targets are set in terms of a

regulatory definition of combined total operating and capital

expenditure, also termed "totex". The definition of totex differs

from the total combined regulated controllable operating costs and

regulated capital expenditure as reported in this statement

according to IFRS accounting principles. Key differences are

capitalised interest, capital contributions, exceptional costs,

costs covered by other regulatory arrangements and unregulated

costs.

CAUTIONARY STATEMENT

This announcement contains certain statements that are neither

reported financial results nor other historical information. These

statements are forward-looking statements. These statements include

information with respect to National Grid Gas plc's (the Company's)

financial condition, its results of operations and businesses,

strategy, plans and objectives. Words such as 'aims',

'anticipates', 'expects', 'should', 'intends', 'plans', 'believes',

'outlook', 'seeks', 'estimates', 'targets', 'may', 'will',

'continue', 'project' and similar expressions, as well as

statements in the future tense, identify forward-looking

statements. These forward-looking statements are not guarantees of

the Company's future performance and are subject to assumptions,

risks and uncertainties that could cause actual future results to

differ materially from those expressed in or implied by such

forward-looking statements. Many of these assumptions, risks and

uncertainties relate to factors that are beyond the Company's

ability to control or estimate precisely, such as changes in laws

or regulations, announcements from and decisions by governmental

bodies or regulators (including the timeliness of consents for

construction projects); the timing of construction and delivery by

third parties of new generation projects requiring connection;

breaches of, or changes in, environmental, climate change and

health and safety laws or regulations, including breaches or other

incidents arising from the potentially harmful nature of its

activities; network failure or interruption, the inability to carry

out critical non network operations and damage to infrastructure,

due to adverse weather conditions including the impact of major

storms as well as the results of climate change due to

counterparties being unable to deliver physical commodities or due

to the failure of or unauthorised access to or deliberate breaches

of the Company's IT systems and supporting technology; performance

against regulatory targets and standards and against the Company's

peers with the aim of delivering stakeholder expectations regarding

costs and efficiency savings, including those related to investment

programmes and internal transformation and remediation plans; and

customers and counterparties (including financial institutions)

failing to perform their obligations to the Company. Other factors

that could cause actual results to differ materially from those

described in this announcement include fluctuations in exchange

rates, interest rates and commodity price indices; restrictions and

conditions (including filing requirements) in the Company's

borrowing and debt arrangements, funding costs and access to

financing; regulatory requirements for the Company to maintain

financial resources in certain parts of its business and

restrictions on some transactions such as paying dividends, lending

or levying charges; inflation or deflation; the delayed timing of

recoveries and payments in the Company's regulated business and

whether aspects of its activities are contestable; the funding

requirements and performance of the Company's pension scheme and

other post-employment benefit schemes; the failure to attract,

train or retain employees with the necessary competencies,

including leadership skills, and any significant disputes arising

with the Company's employees or the breach of laws or regulations

by its employees; and the failure to respond to market

developments, including competition for onshore transmission, and

grow the Company's business to deliver its strategy, as well as

incorrect or unforeseen assumptions or conclusions (including

unanticipated costs and liabilities) relating to business

development activity, including assumptions in connection with

joint ventures. For further details regarding these and other

assumptions, risks and uncertainties that may impact the Company,

please read the Strategic Report section and the 'Risk factors' on

pages 22 to 23 of the Company's most recent Annual Report and

Accounts. In addition, new factors emerge from time to time and the

Company cannot assess the potential impact of any such factor on

its activities or the extent to which any factor, or combination of

factors, may cause actual future results to differ materially from

those contained in any forward-looking statement. Except as may be

required by law or regulation, the Company undertakes no obligation

to update

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

any of its forward-looking statements, which speak only as of

the date of this announcement.

UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

Consolidated income statement

for the six months ended

30 September 2015 2014

Notes GBPm GBPm

----------------------------------------------- ----- ----- -----

Revenue 2(a) 1,477 1,402

Operating costs (897) (854)

Operating profit

Before exceptional items and remeasurements 2(b) 580 633

Exceptional items and remeasurements 3 - (85)

Total operating profit 2(b) 580 548

Finance income 4 1 2

Finance costs

Before exceptional items and

remeasurements 4 (116) (143)

Exceptional items and remeasurements 3 - (8)

Total finance costs 4 (116) (151)

Profit before tax

Before exceptional items and remeasurements 2(b) 465 492

Exceptional items and remeasurements 3 - (93)

Total profit before tax 2(b) 465 399

Tax

Before exceptional items and remeasurements 5 (100) (109)

Exceptional items and remeasurements 3 - 22

Total tax (100) (87)

Profit after tax

Before exceptional items and remeasurements 365 383

Exceptional items and remeasurements 3 - (71)

Profit for the period 365 312

------------------------------------------------- ----- ----- -----

Attributable to:

Equity shareholders of the

parent 362 311

Non-controlling interests 3 1

365 312

----------------------------------------------- ----- ----- -----

Consolidated statement of comprehensive

income

for the six months ended 30 September 2015 2014

GBPm GBPm

---------------------------------------- ---- ----

Profit for the period 365 312

Other comprehensive income/(loss):

Items that are or may be reclassified

subsequently to profit or loss

Net (losses)/gains taken to equity

in respect of cash flow hedges (5) (7)

Transferred to profit or loss

on cash flow hedges/recycling 6 5

----------------------------------------- ---- ----

Total items that may be reclassified

subsequently to profit or loss 1 (2)

----------------------------------------- ---- ----

Other comprehensive income/(loss)

for the period, net of tax 1 (2)

Total comprehensive income for

the period 366 310

----------------------------------------- ---- ----

Total comprehensive income attributable

to:

Equity shareholders of the parent 363 309

Non-controlling interests 3 1

----------------------------------------- ---- ----

366 310

---------------------------------------- ---- ----

Consolidated statement of financial 30 September 31 March

position 2015 2015

Notes GBPm GBPm

------------------------------------------ ----- ------------ --------

Non-current assets

Intangible assets 257 250

Property, plant and equipment 12,552 12,440

Other non-current assets 5,610 5,610

Derivative financial assets 6 859 988

------------------------------------------- ----- ------------

Total non-current assets 19,278 19,288

------------------------------------------- ----- ------------ --------

Current assets

Inventories and current intangible assets 29 26

Trade and other receivables 392 485

Financial and other investments 8 175 384

Derivative financial assets 6 64 70

Cash and cash equivalents 8 - 1

------------------------------------------- ----- ------------ --------

Total current assets 660 966

------------------------------------------- ----- ------------ --------

Total assets 19,938 20,254

------------------------------------------- ----- ------------ --------

Current liabilities

Borrowings 8 (1,620) (2,191)

Derivative financial liabilities 6 (51) (133)

Trade and other payables (918) (911)

Current tax liabilities (34) (34)

Provisions (48) (39)

------------------------------------------- ----- ------------ --------

Total current liabilities (2,671) (3,308)

------------------------------------------- ----- ------------ --------

Non-current liabilities

Borrowings 8 (7,158) (7,158)

Derivative financial liabilities 6 (467) (481)

Other non-current liabilities (1,048) (1,047)

Deferred tax liabilities (1,642) (1,654)

Provisions (145) (171)

------------------------------------------- ----- ------------ --------

Total non-current liabilities (10,460) (10,511)

------------------------------------------- ----- ------------ --------

Total liabilities (13,131) (13,819)

------------------------------------------- ----- ------------ --------

Net assets 6,807 6,435

------------------------------------------- ----- ------------ --------

Equity

Share capital 45 45

Share premium account 204 204

Retained earnings 5,277 4,908

Cash flow hedge reserve (55) (56)

Other equity reserves 1,332 1,332

------------------------------------------- ----- ------------ --------

Shareholders' equity 6,803 6,433

Non-controlling interests 4 2

------------------------------------------- ----- ------------ --------

Total equity 6,807 6,435

------------------------------------------- ----- ------------ --------

Consolidated statement of changes in equity

Cash

Share flow Total

Share premium Retained hedge Other share-holders' Non-controlling Total

capital account earnings reserves reserves equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Changes in equity

for the period:

At 1 April 2015 45 204 4,908 (56) 1,332 6,433 2 6,435

Profit for the

period - - 362 - - 362 3 365

Total other

comprehensive

income for the

period - - - 1 - 1 - 1

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Total

comprehensive

income for the

period - - 362 1 - 363 3 366

Other movements

in

non-controlling

interests - - 3 - - 3 (1) 2

Share-based

payment - - 4 - - 4 - 4

-

At 30 September

2015 45 204 5,277 (55) 1,332 6,803 4 6,807

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Cash

Share flow Total

Share premium Retained hedge Other share-holders' Non-controlling Total

capital account earnings reserves reserves equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Changes in equity

for the period:

At 1 April 2014 45 204 4,812 (34) 1,332 6,359 - 6,359

Profit for the

period - - 311 - - 311 1 312

Total other

comprehensive

loss for the

period - - - (2) - (2) - (2)

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Total

comprehensive

income/(loss) for

the period - - 311 (2) - 309 1 310

Other movements

in

non-controlling

interests - - - - - - (1) (1)

Share-based

payment - - 4 - - 4 - 4

Tax on share-based

payment - - (2) - - (2) - (2)

At 30 September

2014 45 204 5,125 (36) 1,332 6,670 - 6,670

------------------ -------- -------- --------- --------- --------- --------------- --------------- -------

Consolidated cash flow statement

for the six months ended 30

September 2015 2014

Notes GBPm GBPm

------------------------------------- ----- ----- -----

Cash flows from operating activities

Total operating profit 2(b) 580 548

Adjustments for:

Exceptional items 3 - 85

Depreciation, amortisation and

impairment 279 267

Share-based payment charge 4 4

Changes in working capital 55 (31)

Changes in provisions (20) (31)

Loss on disposal of property,

plant and equipment 5 4

Cash generated from operations 903 846

Tax paid (67) (95)

--------------------------------------- ----- -----

Net cash inflow from operating

activities 836 751

--------------------------------------- ----- ----- -----

Cash flows from investing activities

Purchases of intangible assets (36) (36)

Purchases of property, plant

and equipment (361) (268)

Disposals of property, plant

and equipment - 11

Interest received 1 2

Net movements in short-term

financial investments 207 (189)

--------------------------------------- ----- ----- -----

Net cash flow used in investing

activities (189) (480)

--------------------------------------- ----- ----- -----

Cash flows from financing activities

Repayment of loans - (39)

Net movements in short-term

borrowings and derivatives (582) (163)

Interest paid (72) (72)

Net cash flow used in financing

activities (654) (274)

--------------------------------------- ----- ----- -----

Net decrease in cash and cash

equivalents (7) (3)

Net cash and cash equivalents

at start of period 1 (9)

--------------------------------------- ----- ----- -----

Net cash and cash equivalents

at end of period1 8 (6) (12)

--------------------------------------- ----- ----- -----

1. Net of bank overdrafts of GBP6m (2014: GBP12m).

Notes

1. Basis of preparation and new accounting standards,

interpretations and amendments

The half year financial information covers the six month period

ended 30 September 2015 and has been prepared under International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), and IFRS as adopted by the

European Union, in accordance with International Accounting

Standard 34 'Interim Financial Reporting' and the Disclosure and

Transparency Rules of the Financial Conduct Authority. The half

year financial information is unaudited but has been reviewed by

the auditors and their report is attached to this document.

The following standards, interpretations and amendments, issued

by the IASB and by the IFRS Interpretations Committee (IFRIC), are

effective for the year ending 31 March 2016. None of the

pronouncements had a material impact on the Company's consolidated

results or assets and liabilities for the six month period ended 30

September 2015.

-- Amendment to IAS 19 'Defined Benefit Plans: Employee Contributions';

-- Annual Improvements to IFRSs 2010-2012 Cycle;

-- Annual Improvements to IFRSs 2011-2013 Cycle.

The half year financial information has been prepared in

accordance with the accounting policies expected to be applicable

for the year ending 31 March 2016 and consistent with those applied

in the preparation of the accounts for the year ended 31 March

2015.

In preparing this half year financial information, the areas of

judgement made by management in applying the National Grid Gas

plc's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements for the year ended 31 March 2015.

The half year financial information does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. It should be read in conjunction with the statutory accounts

for the year ended 31 March 2015, which were prepared in accordance

with IFRS as issued by the IASB and as adopted by the European

Union, and have been filed with the Registrar of Companies. The

auditors' report on these statutory accounts was unqualified and

did not contain a statement under Section 498 of the Companies Act

2006.

Having made enquiries and reassessed the principal risks, the

Directors consider that the Company and its subsidiary undertakings

have adequate resources to continue in business, and that it is

therefore appropriate to adopt the going concern basis in preparing

the half year financial information.

2. Segmental analysis

The Board of Directors is National Grid Gas plc's chief

operating decision making body (as defined by IFRS 8 'Operating

segments'). The segmental analysis is based on the information the

Board of Directors uses internally for the purposes of evaluating

the performance of operating segments and determining resource

allocation between segments. The performance of operating segments

is assessed principally on the basis of operating profit before

exceptional items and remeasurements.

The following table describes the main activities for each

operating segment:

Gas Transmission The gas transmission network in

Great Britain and UK LNG storage

activities.

----------------- -------------------------------------

Gas Distribution Four of the eight regional networks

of Great Britain's gas distribution

system.

----------------- -------------------------------------

Other activities relate to the gas metering business which

provides regulated gas metering activities in the UK, the Xoserve

business which provides transportation transaction services on

behalf of all the major gas network transportation companies,

including ourselves, together with corporate activities.

Sales between operating segments are priced having regard to the

regulatory and legal requirements to which the businesses are

subject. Our segments are unchanged from those reported in the

financial statements for the year ended 31 March 2015. All of the

Company's sales and operations take place within the UK.

(a) Revenue

Six months ended 30 September 2015 2015 2015 2014 2014 2014

Sales Sales Sales Sales

Total between to third Total between to third

sales segments parties sales segments parties

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------ ------ --------- --------- ------ --------- ---------

Operating segments

Gas Transmission 435 (58) 377 375 (49) 326

Gas Distribution 952 (14) 938 929 (20) 909

Other activities 184 (22) 162 182 (15) 167

1,571 (94) 1,477 1,486 (84) 1,402

------------------------------ ------ --------- --------- ------ --------- ---------

(b) Operating profit

Before exceptional After exceptional

items and remeasurements items and remeasurements

--------------------------- ---------------------------

Six months ended

30 September 2015 2014 2015 2014

GBPm GBPm GBPm GBPm

-------------------- ------------- ------------ ------------- ------------

Operating segments

Gas Transmission 73 110 73 25

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

Gas Distribution 417 434 417 434

Other activities 90 89 90 89

---------------------- ------------- ------------ ------------- ------------

580 633 580 548

-------------------- ------------- ------------ ------------- ------------

Reconciliation to

profit before tax:

Operating profit 580 633 580 548

Finance income 1 2 1 2

Finance costs (116) (143) (116) (151)

Profit before tax 465 492 465 399

---------------------- ------------- ------------ ------------- ------------

3. Exceptional items and remeasurements

Exceptional items and remeasurements are items of income and

expenditure that, in the judgment of management, should be

disclosed separately on the basis that they are important to an

understanding of our financial performance and may significantly

distort the comparability of financial performance between periods.

Remeasurements comprise gains or losses recorded in the income

statement arising from changes in the fair value of derivative

financial instruments to the extent that hedge accounting is not

achieved or is not effective.

Six months ended 30 September 2015 2014

GBPm GBPm

------------------------------------------- ---- ----

Included within operating profit:

Exceptional items:

Sale of surplus land to National

Grid Property - 13

Pension deficit charges(1) - (98)

- (85)

------------------------------------------- ---- ----

Included within finance costs:

Remeasurements

Net losses on derivative financial

instruments(2) - (8)

-------------------------------------------- ---- ----

Total included within profit before

tax - (93)

-------------------------------------------- ---- ----

Included within tax:

Exceptional credit arising on items

not included in profit before tax:

Tax on exceptional items - 20

Tax on remeasurements - 2

-------------------------------------------- ---- ----

- 22

------------------------------------------- ---- ----

Total exceptional items and remeasurements

after tax - (71)

-------------------------------------------- ---- ------

Analysis of exceptional items and

remeasurements after tax:

Total exceptional items after tax - (65)

Total remeasurements after tax - (6)

-------------------------------------------- ---- ----

Total - (71)

-------------------------------------------- ---- ----

1. Pension deficit charges in 2014 arose from recovery plan

contributions in the National Grid UK Pension Scheme. In the

National Grid Gas plc Annual Report and Accounts 2014/15 these

charges were presented as exceptional items. For the six months

ended

30 September 2015 these recurring charges are no longer

presented as exceptional.

2. Remeasurements - net gains and losses on derivative financial

instruments comprise gains and losses arising on derivative

financial instruments reported in the income statement. These

exclude gains and losses for which hedge accounting has been

effective, which have been recognised directly in other

comprehensive income or which are offset by adjustments to the

carrying value of debt.

4. Finance income and costs

Six months ended 30 September 2015 2014

GBPm GBPm

------------------------------------------ ----- -----

Interest income on financial instruments 1 2

------------------------------------------- ----- -----

Finance income 1 2

------------------------------------------- ----- -----

Interest expense on financial liabilities

held at amortised cost (114) (151)

Unwinding of discount on provisions (3) (1)

Other interest (1) -

Less: interest capitalised 2 9

------------------------------------------- ----- -----

Finance costs before exceptional

items and remeasurements (116) (143)

Net losses on derivative financial

instruments included in remeasurements - (8)

------------------------------------------- ----- -----

Exceptional items and remeasurements

included within finance costs - (8)

------------------------------------------- ----- -----

Finance costs (116) (151)

------------------------------------------- ----- -----

Net finance costs (115) (149)

------------------------------------------- ----- -----

5. Tax

The tax charge for the period, excluding tax on exceptional

items and remeasurements is GBP100m (2014: GBP109m). The effective

tax rate of 21.5% (2014: 22.2%) for the period is based on the best

estimate of the annual income tax rate expected for the full year,

excluding tax on exceptional items and remeasurements. The

effective tax rate for the year ended 31 March 2015 was 24.0%.

The Finance Act 2013 enacted reductions in the UK corporation

tax rate to 20% from 1 April 2015 (2014: to 21%). Deferred tax

balances are currently reported at the 20% rate. A reduction in the

corporation tax rate to 19% from April 2017 and a further reduction

to 18% from April 2020 was announced in the 2015 Summer Budget.

Although these reductions in the UK corporation tax rate have now

been substantively enacted, they had not been as at the reporting

date and consequently are not reflected in these interim financial

statements. Following the change in rates becoming substantively

enacted the Company will finalise its assessment during the second

half of this year of the estimated impact on deferred tax, based on

the latest projections of when the deferred tax balances will

reverse.

6. Fair value measurement

Carrying values and fair values of certain financial assets and

liabilities

Certain of the Company's financial instruments are measured at

fair value. The following table categorises these financial assets

and liabilities by the valuation methodology applied in determining

their fair value using the fair value hierarchy described on page

72 of the Annual Report and Accounts 2014/15.

30 September 2015 31 March 2015

------------------ --------------

Level 1 Level Level Total Level Level Level Total

GBPm 2 3 GBPm 1 2 3 GBPm

GBPm GBPm GBPm GBPm GBPm

---------------------- --------- ------ ------ ------ ------ ------ ------ ------

Assets

Available-for-sale

investments - - - - 194 - - 194

Derivative financial

instruments - 923 - 923 - 1,058 - 1,058

- 923 - 923 194 1,058 - 1,252

-------------------------------- ------ ------ ------ ------ ------ ------ ------

Liabilities

Derivative financial

instruments - (452) (66) (518) - (546) (68) (614)

Total - 471 (66) 405 194 512 (68) 638

---------------------- --------- ------ ------ ------ ------ ------ ------ ------

Financial assets and liabilities in the consolidated statement

of financial position are either held at fair value or the carrying

value if it approximates to fair value, with the exception of

borrowings, which are held at amortised cost.

The estimated fair value of total borrowings using market values

at 30 September 2015 is GBP9,791m (31 March 2015: GBP10,978m).

Level 1: Financial instruments with quoted prices for identical

instruments in active markets.

Level 2: Financial instruments with quoted prices for similar

instruments in active markets or quoted prices for identical or

similar instruments in inactive markets and financial instruments

valued using models where all significant inputs are based directly

or indirectly on observable market data.

Level 3: Financial instruments valued using valuation techniques

where one or more significant inputs are based on unobservable

market data.

Our level 3 derivative financial instruments include currency

swaps where the currency forward curve is illiquid and in

ation-linked swaps where the in ation curve is illiquid. In valuing

these instruments a third party valuation is obtained to support

each reported fair value.

As disclosed in note 3, gains/losses on our recurring financial

instruments are recorded in remeasurements in the consolidated

income statement.

The impacts on a post-tax basis of reasonably possible changes

in significant level 3 assumptions for our derivative financial

instruments are as follows:

2015(2) 2014(2)

Six months ended 30 September GBPm GBPm

---------------------------------------------------- ------- -------

+20 basis point change in Limited Price

Inflation (LPI) market curve(1) (29) (24)

* 20 basis point change in LPI market curve(1) 28 23

---------------------------------------------------- ------- -------

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

1. A reasonably possible change in assumption of other level 3

derivative financial instruments is unlikely to result in a

material change in fair values.

2. Tax rates applied above: Derivative financial instruments 20% (2014: 21%).

Movements in the six months to 30 September for derivative

financial instruments measured using level 3 valuation methods are

presented below:

2015(3) 2014

GBPm GBPm

At 1 April (68) (46)

Net gains/(losses) for the period 3 (2)

Settlements (1) (1)

At 30 September (66) (49)

---------------------------------- ------- -----

3. Gains of GBP3m (2014: loss of GBP2m) are attributable to

derivative financial instruments held at the end of the reporting

period.

7. Reconciliation of net cash flow to movement in net debt

Six months ended 30 September 2015 2014

GBPm GBPm

-------------------------------------- ------- -------

Decrease in cash and cash equivalents (7) (3)

(Decrease)/increase in financial

investments (207) 189

Decrease in borrowings and related

derivatives 582 202

Net interest paid on the components

of net debt 71 70

--------------------------------------- ------- -------

Change in net debt resulting from

cash flows 439 458

Changes in fair value and exchange

movements (4) (7)

Net interest charge on the components

of net debt (113) (149)

--------------------------------------- ------- -------

Movement in net debt (net of related

derivative financial instruments)

in the period 322 302

Net debt (net of related derivative

financial instruments) at start of

period (8,520) (8,440)

--------------------------------------- ------- -------

Net debt (net of related derivative

financial instruments) at end of

period (8,198) (8,138)

--------------------------------------- ------- -------

8. Net debt

30 September 31 March

2015 2015

GBPm GBPm

--------------------------------------- ------------ --------

Cash and cash equivalents - 1

Bank overdrafts (6) -

---------------------------------------- ------------ --------

Net cash and cash equivalents (6) 1

Financial investments 175 384

Borrowings (excluding bank overdrafts) (8,772) (9,349)

Derivatives 405 444

---------------------------------------- ------------ --------

Total net debt (8,198) (8,520)

---------------------------------------- ------------ --------

9. Commitments and contingencies

At 30 September 2015 there were commitments for future capital

expenditure contracted but not provided for of GBP316 million (31

March 2015: GBP446 million).

We also have other commitments relating primarily to energy

purchase commitments, operating leases and contingencies in the

form of certain guarantees and letters of credit. These commitments

and contingencies are described in further detail on page 64 of the

Annual Report and Accounts 2014/15.

Litigation and claims

Through the ordinary course of our operations, we are party to

various litigation, claims and investigations. We do not expect the

ultimate resolution of any of these proceedings to have a material

adverse effect on our results of operations, cash flows or

financial position.

10. Related party transactions

Related party transactions in the six months ended 30 September

2015 were the same in nature to those disclosed on page 65 of the

Annual Report and Accounts 2014/15. There were no related party

transactions in the period that have materially affected the

financial position or performance of the Group.

11. Principal risks and uncertainties

The principal risks and uncertainties which could affect

National Grid Gas plc for the remaining six months of the financial

year are consistent with those disclosed for the year ended 31

March 2015 on pages 22 and 23 of the National Grid Gas plc Annual

Report and Accounts 2014/15. Our overall risk management process is

designed to identify, manage, and mitigate our business risks,

including financial risks.

The principal risks and uncertainties included in the National

Grid Gas plc Annual Report and Accounts 2014/15 are as follows:

-- Aspects of the work we do could potentially harm employees,

contractors, members of the public or the environment.

-- We may suffer a major network failure or interruption, or may

not be able to carry out critical operations due to the failure of

infrastructure, data, technology or a lack of supply.

-- Changes in law or regulation or decisions by governmental

bodies or regulators could materially adversely affect us.

-- Current and future business performance may not meet our

expectations or those of our regulators and stakeholders.

-- Changes in interest rates could materially impact earnings or our financial condition.

-- Our results of operations could be affected by inflation or deflation.

-- We may be required to make significant contributions to fund

pension and other post-retirement benefits.

-- An inability to access capital markets at commercially

acceptable interest rates could affect how we maintain and grow our

businesses.

-- Customers and counterparties may not perform their obligations.

12. National Grid Gas plc to adopt FRS 102 in company financial

statements

National Grid Gas plc (the Company) prepares its annual company

financial statements in accordance with UK GAAP. The Financial

Reporting Council, which is responsible for UK accounting

standards, has withdrawn the previous accounting standards and

issued new financial reporting standards. Under the new financial

reporting standards, the Company may choose to adopt either FRS 101

or FRS 102 to prepare its company financial statements for the year

ending 31 March 2016. The Company intends to adopt FRS 102.

Statement of Directors' Responsibilities

The half year financial information is the responsibility of,

and has been approved by, the Directors. The Directors are

responsible for preparing the half year report in accordance with

the Disclosure and Transparency Rules (DTR) of the United Kingdom's

Financial Conduct Authority.

The Directors confirm that the financial information has been

prepared in accordance with IAS 34 as issued by the International

Accounting Standards Board and as adopted by the European Union,

and that the half year report herein includes a fair review of the

information required by DTR 4.2.7.

The Directors of National Grid Gas plc are as listed in the

National Grid Gas plc Annual Report and Accounts for the year ended

31 March 2015 with the exception of the following changes to the

Board:

-- Nick Winser resigned 1 July 2015

-- Emma Fitzgerald resigned 30 April 2015

-- Chris Train appointed 1 July 2015

-- Mike Calviou resigned 24 September 2015

-- Cordi O'Hara appointed 24 September 2015

-- Neil Pullen resigned 25 September 2015

-- Pauline Walsh appointed 25 September 2015

By order of the Board

.......................... ..........................

John Pettigrew Andy Agg

17 November 2015 17 November 2015

Chairman Chief Financial Officer

Independent review report to National Grid Gas plc

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed National Grid Gas plc's consolidated interim

financial statements (the "interim financial statements") in the

half year financial information of National Grid Gas plc for the 6

month period ended 30 September 2015. Based on our review, nothing

has come to our attention that causes us to believe that the

interim financial statements are not prepared, in all material

respects, in accordance with International Accounting Standard 34,

'Interim Financial Reporting', as adopted by the European Union and

the Disclosure Rules and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

This conclusion is to be read in the context of what we say in

the remainder of this report.

What we have reviewed

The interim financial statements comprise:

-- the consolidated statement of financial position as at 30

September 2015;

-- the consolidated interim income statement and consolidated

statement of comprehensive income for the period then ended;

-- the consolidated interim statement of cash flows for the

period then ended;

-- the consolidated interim statement of changes in equity for

the period then ended; and

-- the explanatory notes to the interim financial

statements.

The interim financial statements included in the half year

financial information have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Disclosure

Rules and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

(MORE TO FOLLOW) Dow Jones Newswires

November 18, 2015 11:29 ET (16:29 GMT)

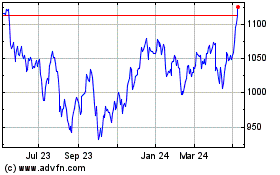

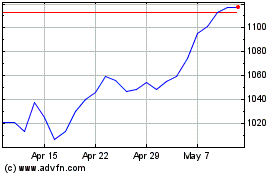

National Grid (LSE:NG.)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Grid (LSE:NG.)

Historical Stock Chart

From Apr 2023 to Apr 2024