TIDM82HZ TIDMNG. TIDMBD56

RNS Number : 0644K

National Grid Gas PLC

16 September 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO

ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS

TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO, THE U.S. VIRGIN

ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA

ISLANDS), ANY STATE OF THE UNITED STATES OF AMERICA OR THE DISTRICT

OF COLUMBIA (the United States) OR IN OR INTO ANY JURISDICTION

WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS

ANNOUNCEMENT.

16 September 2016

NATIONAL GRID GAS PLC (NGG) AND

NATIONAL GRID ELECTRICITY TRANSMISSION PLC (NGET)

INDICATIVE RESULTS OF CASH TER OFFERS

NGG announces the indicative results of its invitations to

holders of its outstanding GBP484,000,000 6.375 per cent.

Instruments due 3 March 2020 (ISIN: XS0348431551) (the 2020 Notes),

its outstanding GBP503,078,000 4.1875 per cent. Guaranteed

Index-Linked Bonds due 2022 (ISIN: XS0103338140) (the 2022 Notes),

its outstanding GBP503,078,000 7.0 per cent. Guaranteed Fixed Rate

Bonds due 2024 (ISIN: XS0103338496) (the December 2024 Notes), its

outstanding GBP275,000,000 8.75 per cent. Bonds due 2025 (ISIN:

XS0058343251) (the 2025 Notes) and its outstanding GBP457,000,000

6.00 per cent. Instruments due May 2038 (ISIN: XS0363511873) (the

2038 Notes), and

NGET announces the indicative results of its invitations to

holders of its outstanding GBP450,000,000 5.875 per cent. Bonds due

2024 (ISIN: XS0094073672) (the February 2024 Notes), its

outstanding GBP525,000,000 4.00 per cent. Instruments due 8 June

2027 (ISIN: XS0789331948) (the 2027 Notes), its outstanding

GBP360,000,000 6.50 per cent. Notes due 2028 (ISIN: XS0132735373)

(the 2028 Notes) and its outstanding GBP379,000,000 7.375 per cent.

Instruments due January 2031 (ISIN: XS0407912053) (the 2031

Notes)

(the 2020 Notes, the 2022 Notes, the February 2024 Notes, the

December 2024 Notes, the 2025 Notes, the 2027 Notes, the 2028

Notes, the 2031 Notes and the 2038 Notes together, the Notes and

each a Series and all holders of such Notes the Noteholders)

to tender their Notes for purchase by NGG or NGET, as the case

may be, for cash subject to the New Issue Condition (each such

invitation, an Offer and together, the Offers).

The Offers were announced on 6 September 2016 and were made on

the terms and subject to the conditions contained in the tender

offer memorandum dated 6 September 2016 (the Tender Offer

Memorandum) prepared by NGET and NGG in connection with the Offers.

Capitalised terms used but not otherwise defined in this

announcement shall have the meaning given to them in the Tender

Offer Memorandum.

The Expiration Deadline for the Offers was 4.00 p.m. (London

time) on 15 September 2016.

Indicative (Non-Binding) Results for Any and All Offer Notes

As at the Expiration Deadline, the aggregate nominal amount of

each Series of Any and All Offer Notes set out in the table below

had been tendered for purchase pursuant to the relevant Offer.

Aggregate nominal amount of the relevant Notes tendered for

purchase pursuant to the relevant

Any and All Offer Notes ISIN / Common Code Offer

------------------------ -------------------------- ----------------------------------------------------------------

2020 Notes XS0348431551 / 034843155 GBP139,350,000

2022 Notes XS0103338140 / 010333814* GBP138,584,000

December 2024 Notes XS0103338496 / 010333849* GBP135,254,000

2025 Notes XS0058343251 / 005834325 GBP88,808,000

2038 Notes XS0363511873 / 036351187 GBP395,579,000

* Interests in (i) the 2022 Notes are represented by a global receipt with ISIN: XS0103338140

and (ii) the December 2024 Notes are represented by a global receipt with ISIN: XS0103338496,

as further described in the Tender Offer Memorandum.

In respect of each Series of the Any and All Offer Notes, in the

event that NGG decides to accept valid tenders of any Notes of such

Series for purchase pursuant to the relevant Offer, NGG will accept

all Notes of such Series validly tendered for purchase, with no pro

rata scaling.

Indicative (Non-Binding) Results for Capped Offer Notes

As at the Expiration Deadline, the aggregate nominal amount of

each Series of Capped Offer Notes set out in the table below had

been validly tendered pursuant to the relevant Offer.

In the event that NGET decides to accept valid tenders of Capped

Offer Notes pursuant to the Offers, NGET expects to set (i) the

Capped Offer Notes Acceptance Amount at GBP866,996,000 and (ii) the

Capped Offer Notes Series Acceptance Amount for each Series of

Capped Offer Notes as set out in the table below. On the basis of

such expected Capped Offer Notes Series Acceptance Amounts, NGET

expects to accept for purchase all Capped Offer Notes validly

tendered with no pro rata scaling. Noteholders should note that

this is a non-binding indication of the levels at which NGET

expects to set the Capped Offer Notes Acceptance Amount and the

Capped Offer Notes Series Acceptance Amounts.

Aggregate nominal amount

of the relevant Notes tendered Expected Capped Offer Notes

for purchase pursuant to the Series Acceptance Amount

Capped Offer Notes ISIN / Common Code relevant Offer for the relevant Series

-------------------- ------------------------- ---------------------------------- ---------------------------------

February 2024 Notes XS0094073672 / 009407367 GBP174,119,000 GBP174,119,000

2027 Notes XS0789331948 / 078933194 GBP273,741,000 GBP273,741,000

2028 Notes XS0132735373 / 013273537 GBP200,488,000 GBP200,488,000

2031 Notes XS0407912053 / 040791205 GBP218,648,000 GBP218,648,000

Pricing and New Issue Condition

Final pricing for the Offers will take place at or around 12.00

(noon) (London time) today, 16 September 2016 (the Pricing Time).

As soon as reasonably practicable after the Pricing Time, NGET and

NGG will announce each Benchmark Security Rate and the final

pricing details for each Series in the event that NGG and/or NGET

decide to accept valid tenders of Notes pursuant to any or all of

the Offers.

Whether NGET and/or NGG will purchase any Notes validly tendered

in the Offers is subject, without limitation, to the successful

completion (in the sole determination of NGET and NGG) of the issue

of the New Notes (the New Issue Condition). NGET and NGG will

announce whether the New Issue Condition has been satisfied and, if

so, their decision of whether to accept valid tenders of Notes

pursuant to any or all of the Offers and, if so accepted, the

aggregate nominal amount of Notes of each Series accepted for

purchase pursuant to the Offers and any Scaling Factor (if

applicable), on or prior to the Settlement Date.

The New Notes, and the guarantee thereof, are not being, and

will not be, offered or sold in the United States. Nothing in this

announcement and/or the Tender Offer Memorandum constitutes an

offer to sell or the solicitation of an offer to buy the New Notes,

or the guarantee thereof, in the United States or any other

jurisdiction. Securities may not be offered, sold or delivered in

the United States absent registration under, or an exemption from

the registration requirements of, the United States Securities Act

of 1933, as amended (the Securities Act). The New Notes, and the

guarantee thereof, have not been, and will not be, registered under

the Securities Act or the securities laws of any state or other

jurisdiction of the United States and may not be offered, sold or

delivered, directly or indirectly, within the United States or to,

or for the account or benefit of, U.S. persons.

No action has been or will be taken in any jurisdiction in

relation to the New Notes to permit a public offering of

securities.

The Settlement Date in respect of the Notes accepted for

purchase pursuant to the Offers is expected to be 22 September

2016.

Barclays Bank PLC, BNP Paribas, HSBC Bank plc, Merrill Lynch

International and Morgan Stanley & Co. International plc are

acting as Dealer Managers for the Offers. Lucid Issuer Services

Limited is acting as Tender Agent.

DEALER MANAGERS

Barclays Bank PLC BNP Paribas HSBC Bank plc

5 The North Colonnade 10 Harewood Avenue 8 Canada Square

Canary Wharf London NW1 6AA London E14 5HQ

London E14 4BB United Kingdom United Kingdom

United Kingdom

Telephone: +44 20 Telephone: +44 Telephone: +44

3134 8515 20 7595 8668 20 7992 6237

Attention: Attention: Attention:

Liability Management Liability Management Liability Management

Group Group Group

Email: Email: Email: liability.management@hsbcib.com

eu.lm@barclays.com liability.management@bnpparibas.com

Merrill Lynch International Morgan Stanley & Co. International

2 King Edward Street plc

London EC1A 1 HQ 25 Cabot Square

United Kingdom Canary Wharf

London E14 4QA

Telephone: +44 20 7996 5420 United Kingdom

Attention: Liability Management Telephone: +44 20 7677 5040

Group Attention: Liability Management

Email: DG.LM_EMEA@baml.com Group

Email: liabilitymanagementeurope@morganstanley.com

TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Telephone: +44 20 7704 0880

Fax: +44 20 3004 1590

Attention: Paul Kamminga / Arlind Bytyqi

Email: ngrid@lucid-is.com

Further details relating to the contents of this announcement

can be obtained from:

National Grid Electricity National Grid Gas plc

Transmission plc 1-3 Strand

1-3 Strand London WC2N 5EH

London WC2N 5EH United Kingdom

United Kingdom

Attention (treasury matters): Kwok Liu (Deputy Treasurer,

+44 20 7004 3367)

Attention (legal matters): Mark Noble (Deputy Group

General Counsel, +44 20 7004 3212)

DISCLAIMER

This announcement must be read in conjunction with the Tender

Offer Memorandum. No offer or invitation to acquire any securities

is being made pursuant to this announcement. The distribution of

this announcement and the Tender Offer Memorandum in certain

jurisdictions may be restricted by law. Persons into whose

possession this announcement and/or the Tender Offer Memorandum

comes are required by each of NGG, NGET, the Dealer Managers and

the Tender Agent to inform themselves about, and to observe, any

such restrictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

RTELFMLTMBTBMMF

(END) Dow Jones Newswires

September 16, 2016 05:27 ET (09:27 GMT)

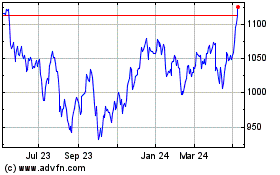

National Grid (LSE:NG.)

Historical Stock Chart

From Mar 2024 to Apr 2024

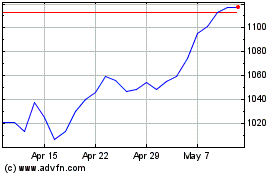

National Grid (LSE:NG.)

Historical Stock Chart

From Apr 2023 to Apr 2024