National Bank of Canada Hit by Maple Bank Probe

February 07 2016 - 8:30PM

Dow Jones News

TORONTO—National Bank of Canada on Sunday warned that its

regulatory-capital level would take a hit after Germany's financial

watchdog BaFin effectively shuttered one of its foreign

investments, the German unit of Maple Financial Group.

Montreal-based National Bank, Canada's sixth-largest bank by

assets, owns a 24.9% stake in Maple Financial Group Inc., which is

the Canadian parent of Germany's Maple Bank GmbH. As a result of

the regulatory action, Maple Bank is effectively closed to customer

transactions.

Consequently, National Bank plans to set aside enough cash to

take a "full reserve" of its equity investment which, at last

check, had a carrying value of 165 million Canadian dollars ($119

million), the bank said.

That means National Bank's CET 1 capital ratio would take a

13-basis-point hit for its fiscal first quarter which ended on Jan

31. The bank's CET 1 capital ratio was 9.9 % at the end of its

fiscal fourth quarter.

National Bank is scheduled to report its fiscal first-quarter

results on Feb. 23.

Maple Bank is under investigation by German prosecutors over

alleged tax irregularities. The focus of the prosecutors' probe,

first disclosed in September 2015, is potential irregularities for

the tax years 2006 to 2010.

For its part, BaFin on Sunday said it issued "a prohibition on

transfer of ownership and payment, due to imminent over

indebtedness. In addition BaFin has ordered the bank to be closed

for dealings with customers."

A Maple spokeswoman in Germany said customer deposits would be

protected in line with the deposit-insurance law. "We ask for your

understanding that we at present can't make any comments about the

further course of the measures," she said.

BaFin said Maple Bank "has no systemic relevance and thus

doesn't pose a threat to financial stability." BaFin said the

bank's balance sheet totaled about 5 billion euros ($5.58

billion).

National Bank noted that German authorities were focusing on

"selected trading activities by Maple Bank, and certain of its

current and former employees" during the specified tax years.

"The German authorities have alleged that these trading

activities violated German tax laws," National Bank said in a news

release on Sunday, adding none of its employees was believed to be

under investigation.

Still, National Bank cautioned that it could be on the hook for

future costs as a result of the tax probe.

"National Bank has advised the German authorities that if it is

determined portions of dividends received from Maple Financial

Group Inc. could be reasonably attributable to tax fraud by Maple

Bank, arrangements will be made to repay those amounts to the

relevant authority," the bank said, noting it didn't expect any

required repayments would be material to its financial results.

In October, National Bank said Maple Financial contributed less

than 1% to its annual net income in each of the last two years.

This isn't the first time, however, that National Bank has seen

its regulatory capital level dented in recent months.

Last fall, National Bank announced fourth-quarter restructuring

charges that were unrelated to its Maple investment, which dented

its CET 1 capital ratio. As a result, the bank undertook a C$300

million common-share offering to plump up its capital base.

"I don't like raising equity," CEO Louis Vachon told investors

at an industry conference last month. "So, I can assure you if we

felt that we have to raise equity, it's really because we felt it

was the right thing to do for the long term," he later added.

The German investigation of Maple Bank "was a surprise," he

said, adding the bank felt compelled to disclose that a substantial

part of its investment could be at risk.

A spokesman for National Bank didn't immediately respond to a

message seeking further comment on Sunday.

Write to Rita Trichur at rita.trichur@wsj.com and Todd Buell at

todd.buell@wsj.com

(END) Dow Jones Newswires

February 07, 2016 20:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

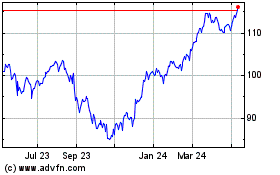

National Bank of Canada (TSX:NA)

Historical Stock Chart

From Mar 2024 to Apr 2024

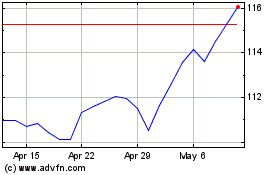

National Bank of Canada (TSX:NA)

Historical Stock Chart

From Apr 2023 to Apr 2024