NZ Dollar Falls Amid Rising Risk Aversion

February 23 2017 - 7:29PM

RTTF2

The New Zealand dollar weakened against the other major

currencies in the Asian session on Friday, as Asian stock markets

traded lower following the lackluster cues from Wall Street and as

weaker commodity prices weighed on resources stocks.

Investors also digested mixed corporate earnings results.

Thursday, the NZ dollar rose 0.65 percent against the U.S.

dollar, 0.35 percent against the yen, 0.38 percent against the euro

and 0.39 percent against the Australian dollar.

In the Asian trading, the NZ dollar fell to 1.4664 against the

euro and 0.7214 against the U.S. dollar, from yesterday's closing

quotes of 1.4631 and 0.7229, respectively. If the kiwi extends its

downtrend, it is likely to find support around 1.49 against the

euro and 0.70 against the greenback.

Against the yen, the kiwi dropped to 81.35 from an early high of

81.59. The kiwi may test support near the 79.00 region.

The kiwi edged down to 1.0688 against the Australian dollar,

from an early 4-day high of 1.0656. On the downside, 1.07 is seen

as the next support level for the kiwi.

Looking ahead, the German import price index for January is due

to be released in the pre-European session at 2:00 am ET.

U.K. BBA mortgage approvals for January is slated for release at

4:30 am ET.

In the New York session, Canada CPI data for January, U.S. new

home sales data for January, U.S. University of Michigan final

consumer sentiment index for February and U.S. Baker Hughes rig

count data are set to be announced.

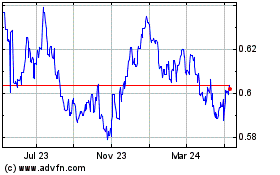

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

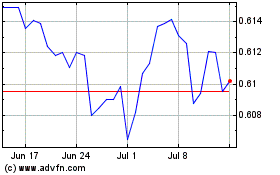

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024