NZ Dollar Falls After RBNZ Keeps Rate Steady

April 30 2015 - 12:23AM

RTTF2

The New Zealand dollar weakened against the other major

currencies in the Asian session on Thursday after the Reserve Bank

of New Zealand's Monetary Policy Board decided to hold its Official

Cash Rate steady.

The board elected to hold its Official Cash Rate steady at 3.50

percent - in line with expectations.

It was the sixth straight month with no change for the RBNZ,

which had hiked the OCR by 25 basis points in each of previous four

meetings prior to September.

The board also pointed to the easing NZ dollar, adding that

further depreciation is to be expected.

The bank also cited several factors for taking its time in

taking any further actions, including weak global inflation,

declines in international oil prices and the high exchange

rate.

"The timing of future adjustments in the OCR will depend on how

inflationary pressures evolve in both the non-traded and traded

sectors. It would be appropriate to lower the OCR if demand

weakens, and wage and price-setting outcomes settle at levels lower

than is consistent with the inflation target," the bank said.

Meanwhile, data from the Statistics New Zealand showed that the

total number of building permits issued in New Zealand advanced a

seasonally adjusted 11.0 percent on month in March, standing at

2,271, a nine-year high. That topped forecasts for an increase of

2.0 percent following the 6.3 percent contraction in February.

Wednesday, the NZ dollar showed mixed trading against its majors

rivals. While the NZ dollar rose against the U.S. dollar and the

Yen, it fell against the U.S. dollar and the yen. In the Asian

trading today, the NZ dollar fell to 3-day lows of 0.7592 against

the U.S. dollar and 90.40 against the yen, from yesterday's closing

quotes of 0.7677 and 91.36, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.72 against the

greenback and 83.50 against the yen.

Against the euro and the Australian dollar , the kiwi dropped to

more than 1-1/2-month lows of 1.4639 and 1.0518 from yesterday's

closing quotes of 1.4471 and 1.0408, respectively. The kiwi may

test support near 1.59 against the euro and 1.07 against the

aussie.

Looking ahead, Japan construction orders and housing starts for

March is due to be released at 1:00 am ET. In the European session,

German retail sales for March and unemployment rate for April,

Swiss KOF leading indicator for April and Eurozone CPI for April

and unemployment rate for March are slated for release.

In the New York session, Canada GDP for February, U.S. weekly

jobless claims for the week ended April 25, U.S. personal income

and spending data for March are set to be published.

At 8:30 am ET, Federal Reserve Governor Daniel Tarullo will

deliver a speech titled "Tailoring Community Bank Regulation and

Supervision" at the Independent Community Bankers of America Policy

Summit, in Washington DC.

At 10:30 am ET, BOC Governor Stephen Poloz will testify, along

with Senior Deputy Governor Carolyn Wilkins, before the Senate

Finance Committee, in Ottawa.

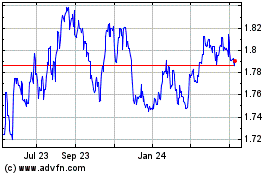

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

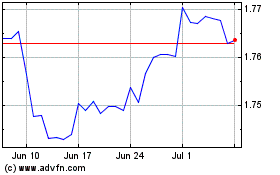

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024