Myriad Genetics, Inc. (NASDAQ:MYGN), a global leader in molecular

diagnostics and personalized medicine, today announced financial

results for its fiscal third-quarter 2017, provided an update on

recent business highlights and updated its fiscal year 2017

financial guidance.

"We were very encouraged to see sequential growth in hereditary

cancer testing volumes for the second consecutive quarter,” said

Mark C. Capone, president and CEO, Myriad Genetics. “Coupled

with meaningful sequential volume growth in all of our major

pipeline tests including GeneSight, Vectra DA, Prolaris, and

EndoPredict, we believe we are rapidly approaching an important

inflection in our business where our new products will drive

accelerated revenue growth and profitability.”

Financial Highlights

- The following table summarizes the financial results and

product revenue for our fiscal third-quarter 2017:

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Third-Quarter |

|

|

| ($

in millions) |

|

|

2017 |

|

|

|

2016 |

|

|

%Change |

| Molecular

diagnostic testing revenue |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Hereditary cancer

testing revenue |

|

|

$ |

140.8 |

|

|

$ |

156.3 |

|

|

(10 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| |

GeneSight testing

revenue |

|

|

|

23.9 |

|

|

|

NA |

|

NM |

| |

|

|

|

|

|

|

|

|

|

|

| |

Vectra DA testing

revenue |

|

|

|

11.2 |

|

|

|

12.3 |

|

|

(9 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| |

Prolaris testing

revenue |

|

|

|

3.4 |

|

|

|

5.2* |

|

|

(35 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| |

EndoPredict testing

revenue |

|

|

|

2.3 |

|

|

|

1.1 |

|

|

109 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| |

Other testing

revenue |

|

|

|

3.6 |

|

|

|

2.5 |

|

|

44 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Total

molecular diagnostic testing revenue |

|

|

185.2 |

|

|

|

177.4 |

|

|

4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Pharmaceutical and clinical service revenue |

|

|

11.7 |

|

|

|

13.1 |

|

|

(11 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| Total

Revenue |

|

$ |

196.9 |

|

|

$ |

190.5 |

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Third-Quarter |

|

|

| ($

in millions) |

|

|

2017 |

|

|

|

2016 |

|

|

%Change |

| Total

Revenue |

|

$ |

196.9 |

|

|

$ |

190.5 |

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

152.6 |

|

|

|

150.3 |

|

|

2 |

% |

| |

Gross Margin |

|

|

|

77.5 |

% |

|

|

78.9 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

139.7 |

|

|

|

107.7 |

|

|

30 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Operating

Income |

|

|

12.9 |

|

|

|

42.6 |

|

|

(70 |

%) |

| |

Operating Margin |

|

|

|

6.6 |

% |

|

|

22.4 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Adjusted

Operating Income |

|

|

24.0 |

|

|

|

45.8 |

|

|

(48 |

%) |

| |

Adjusted Operating

Margin |

|

|

|

12.2 |

% |

|

|

24.0 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

Income |

|

|

4.2 |

|

|

|

34.5 |

|

|

(88 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| Diluted

EPS |

|

|

0.06 |

|

|

|

0.47 |

|

|

(87 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| Adjusted

EPS |

|

$ |

0.27 |

|

|

$ |

0.41 |

|

|

(34 |

%) |

| * Included

Medicare retrospective payments |

|

|

|

|

|

|

|

|

Business Highlights

• myRisk® Hereditary Cancer

- Hereditary cancer volumes grew on a sequential basis for the

second consecutive quarter.

- A publication in The Oncologist by researchers at Northwestern

University compared 4,250 variants from ClinVar to those from

Myriad Genetics. In the study, only 73 percent of the

classifications in ClinVar were consistent with Myriad

classifications with 27 percent discordant. In addition, it was

shown that Myriad could definitely classify up to 60 percent of the

variants of uncertain significance from other

laboratories.

• GeneSight®

- Volume grew 44 percent year-over-year to more than 60,000 tests

performed in the fiscal third-quarter.

- Completed enrollment ahead of schedule in a 1,200 patient

clinical utility study evaluating GeneSight in patients with

treatment resistant depression. The company anticipates top line

data by the end of calendar year 2017.

- Published data in Clinical Therapeutics which evaluated 2,168

patients whose treatment was either congruent or non-congruent with

the GeneSight test result which demonstrated health savings of

$3,998 for primary care physicians and $1,308 for patients treated

by psychiatrists after paying for the cost of the test.

- Completed a payer demonstration project using the Optum

healthcare informatics platform from United Health that

demonstrated substantial cost savings associated with the use of

GeneSight. Initiated similar demonstration projects with Humana and

HealthCore, a subsidiary of Anthem Blue Cross Blue Shield.

- Launched a highly successful pilot sales program for GeneSight

in the preventive care market with the average sales territory

already generating a 300 sample annual run rate.

• Vectra® DA

- Volumes increased five percent sequentially with approximately

38,500 tests performed.

- Creaky Joints, a leading advocacy group for arthritis patients

added Vectra DA to its professional guidelines. This builds upon

the recent addition of Vectra DA to the United Rheumatology

guidelines, a physician guideline body comprising approximately 10

percent of practicing rheumatologists.

• Prolaris®

- Volumes grew 17 percent year-over-year and nine percent

sequentially with approximately 5,100 tests ordered in the third

quarter.

- The comment period ended on a draft local coverage

determination from Palmetto GBA for favorable-intermediate

patients, a new indication that would represent a market expansion

of approximately 30,000 patients per year in the United States.

Prolaris is the only test to receive proposed Medicare coverage in

this patient population.

- At the upcoming American Urology Association meeting, Myriad

will be presenting a 767 patient study that demonstrated the

ability of Prolaris to predict metastases from biopsy samples with

a high degree of statistical significance.

• EndoPredict®

- Revenues grew 109 percent year-over-year to $2.3 million in the

fiscal third-quarter.

- Launched EndoPredict in the United States at the end of the

fiscal third-quarter.

- In aggregate, Myriad has now received positive coverage

decisions from payers in the United States representing 83 million

lives.

• myPath® Melanoma

- Myriad’s third clinical validation study, which demonstrated

myPath Melanoma was able to differentiate melanoma from benign nevi

with 95 percent diagnostic accuracy, was published in Cancer

Epidemiology.

- Myriad has submitted its reimbursement dossier for myPath

Melanoma to Medicare and private payers.

• Companion Diagnostics

- AstraZeneca announced that olaparib met its primary endpoint in

BRCA positive, HER2- metastatic breast cancer in the OlympiAD

study, demonstrating a statistically significant benefit in

progression free survival. This represents a potential 60,000

patient per year market for BRACAnalysis CDx as a companion

diagnostic.

- Myriad signed a research collaboration with BeiGene which is a

global pharmaceutical company developing the PARP inhibitor BGB-290

in the United States.

- Signed a commercial collaboration with Clovis Oncology to

perform BRACAnalysis CDx testing. Myriad is now performing

companion diagnostic testing for every major company developing a

PARP inhibitor.

- Submitted our regulatory filing in Japan for BRACAnalysis CDx

as the companion diagnostic for Lynparza in conjunction with our

collaboration with AstraZeneca.

• International

- International revenue grew 41 percent year-over-year and

comprised five percent of total revenue in the fiscal

third-quarter.

- International EndoPredict revenue grew 109 percent

year-over-year, largely as a result of recent French and German

reimbursement.

Fiscal Year 2017 and Fiscal Fourth-Quarter 2017

Financial GuidanceBelow is a table summarizing Myriad’s

updated fiscal year 2017 and fiscal fourth-quarter 2017 financial

guidance:

| |

|

Revenue |

|

GAAP DilutedEarnings PerShare |

|

AdjustedEarnings PerShare |

| Fiscal Year 2017 |

|

$763-$765million |

|

$0.23-$0.25 |

|

$1.01-$1.03 |

| |

|

|

|

|

|

|

| Fiscal

Fourth-Quarter 2017 |

|

$192-$194million |

|

$0.11-$0.13 |

|

$0.26-$0.28 |

These projections are forward-looking statements and are subject

to the risks summarized in the safe harbor statement at the end of

this press release. The Company will provide further details

on its business outlook during the conference call today to discuss

the fiscal third-quarter financial results, fiscal year 2017, and

fiscal fourth-quarter 2017 financial guidance.

Conference Call and WebcastA conference call

will be held today, Tuesday, May 2, 2017, at 4:30 p.m. EDT to

discuss Myriad’s financial results for the fiscal third-quarter,

business developments and financial guidance. The dial-in

number for domestic callers is (888) 225-2744. International

callers may dial (303) 223-2690. All callers will be asked to

reference reservation number 21849837. An archived replay of

the call will be available for seven days by dialing (800) 633-8284

and entering the reservation number above. The conference

call along with a slide presentation will be available through a

live webcast at www.myriad.com.

About Myriad GeneticsMyriad Genetics Inc., is a

leading personalized medicine company dedicated to being a trusted

advisor transforming patient lives worldwide with pioneering

molecular diagnostics. Myriad discovers and commercializes

molecular diagnostic tests that: determine the risk of developing

disease, accurately diagnose disease, assess the risk of disease

progression, and guide treatment decisions across six major medical

specialties where molecular diagnostics can significantly improve

patient care and lower healthcare costs. Myriad is focused on

three strategic imperatives: maintaining leadership in an

expanding hereditary cancer market, diversifying its product

portfolio through the introduction of new products and increasing

the revenue contribution from international markets. For more

information on how Myriad is making a difference, please visit the

Company's website: www.myriad.com.

Myriad, the Myriad logo, BART, BRACAnalysis, Colaris, Colaris

AP, EndoPredict, myPath, myRisk, Myriad myRisk, myRisk Hereditary

Cancer, myChoice, myPlan, BRACAnalysis CDx, Tumor BRACAnalysis CDx,

myChoice HRD, Vectra DA, GeneSight, EndoPredict and Prolaris are

trademarks or registered trademarks of Myriad Genetics, Inc. or its

wholly owned subsidiaries in the United States and foreign

countries. MYGN-F, MYGN-G

| MYRIAD GENETICS, INC. AND

SUBSIDIARIES |

|

| CONSOLIDATED INCOME STATEMENTS

(Unaudited) |

|

| (in millions, except

per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

2017 |

|

|

|

2016 |

|

|

| Molecular diagnostic

testing |

|

$ |

185.2 |

|

|

$ |

177.4 |

|

$ |

534.2 |

|

|

$ |

532.0 |

|

|

| Pharmaceutical and

clinical services |

|

|

11.7 |

|

|

|

13.1 |

|

|

36.7 |

|

|

|

35.4 |

|

|

| Total

revenue |

|

|

196.9 |

|

|

|

190.5 |

|

|

570.9 |

|

|

|

567.4 |

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

| Cost of

molecular diagnostic testing |

|

|

37.9 |

|

|

|

33.6 |

|

|

109.5 |

|

|

|

98.6 |

|

|

| Cost of

pharmaceutical and clinical services |

|

|

6.4 |

|

|

|

6.6 |

|

|

19.1 |

|

|

|

18.7 |

|

|

| Research

and development expense |

|

|

17.6 |

|

|

|

17.2 |

|

|

55.6 |

|

|

|

51.1 |

|

|

| Selling,

general, and administrative expense |

|

|

122.1 |

|

|

|

90.5 |

|

|

354.3 |

|

|

|

267.8 |

|

|

| Total

costs and expenses |

|

|

184.0 |

|

|

|

147.9 |

|

|

538.5 |

|

|

|

436.2 |

|

|

| Operating

income |

|

|

12.9 |

|

|

|

42.6 |

|

|

32.4 |

|

|

|

131.2 |

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

0.3 |

|

|

|

0.3 |

|

|

0.9 |

|

|

|

0.5 |

|

|

| Interest

expense |

|

|

(1.5 |

) |

|

|

— |

|

|

(4.8 |

) |

|

|

(0.2 |

) |

|

| Change in

the fair value of contingent consideration |

|

|

(5.2 |

) |

|

|

— |

|

|

(2.0 |

) |

|

|

— |

|

|

|

Other |

|

|

1.5 |

|

|

|

0.2 |

|

|

(2.4 |

) |

|

|

0.2 |

|

|

| Total

other income (expense): |

|

|

(4.9 |

) |

|

|

0.5 |

|

|

(8.3 |

) |

|

|

0.5 |

|

|

|

Income before income tax |

|

|

8.0 |

|

|

|

43.1 |

|

|

24.1 |

|

|

|

131.7 |

|

|

| Income tax

provision |

|

|

3.8 |

|

|

|

8.6 |

|

|

15.2 |

|

|

|

29.7 |

|

|

| Net income |

|

$ |

4.2 |

|

|

$ |

34.5 |

|

$ |

8.9 |

|

|

$ |

102.0 |

|

|

| Net loss attributable

to non-controlling interest |

|

|

— |

|

|

|

— |

|

|

(0.1 |

) |

|

|

— |

|

|

| Net income attributable

to Myriad Genetics, Inc. stockholders |

|

$ |

4.2 |

|

|

$ |

34.5 |

|

$ |

9.0 |

|

|

$ |

102.0 |

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.06 |

|

|

$ |

0.49 |

|

$ |

0.13 |

|

|

$ |

1.46 |

|

|

|

Diluted |

|

$ |

0.06 |

|

|

$ |

0.47 |

|

$ |

0.13 |

|

|

$ |

1.39 |

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

68.1 |

|

|

|

70.9 |

|

|

68.1 |

|

|

|

70.1 |

|

|

|

Diluted |

|

|

68.3 |

|

|

|

73.5 |

|

|

68.5 |

|

|

|

73.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Consolidated Balance Sheets

(Unaudited) |

|

| (in millions) |

|

|

|

|

|

|

|

|

March 31, |

|

June 30, |

|

|

ASSETS |

|

|

2017 |

|

|

|

2016 |

|

|

| Current

assets: |

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

123.8 |

|

|

$ |

68.5 |

|

|

|

Marketable investment securities |

|

|

48.3 |

|

|

|

90.5 |

|

|

| Prepaid

expenses |

|

|

9.5 |

|

|

|

18.4 |

|

|

|

Inventory |

|

|

47.4 |

|

|

|

38.3 |

|

|

| Trade

accounts receivable, less allowance for doubtful accounts of $8.1

March 31, 2017and $6.8 June 30, 2016 |

|

|

114.8 |

|

|

|

91.7 |

|

|

| Prepaid

taxes |

|

|

0.1 |

|

|

|

3.8 |

|

|

| Other

receivables |

|

|

4.4 |

|

|

|

3.3 |

|

|

| Total

current assets |

|

|

348.3 |

|

|

|

314.5 |

|

|

|

Property, plant and equipment, net |

|

|

53.0 |

|

|

|

58.3 |

|

|

|

Long-term marketable investment securities |

|

|

53.4 |

|

|

|

79.9 |

|

|

|

Intangibles, net |

|

|

498.1 |

|

|

|

227.5 |

|

|

|

Goodwill |

|

|

315.0 |

|

|

|

195.3 |

|

|

| Other

assets |

|

|

— |

|

|

|

5.0 |

|

|

| Total

assets |

|

$ |

1,267.8 |

|

|

$ |

880.5 |

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| Accounts

payable |

|

$ |

26.8 |

|

|

$ |

21.1 |

|

|

| Accrued

liabilities |

|

|

64.0 |

|

|

|

49.5 |

|

|

|

Short-term contingent consideration |

|

|

128.2 |

|

|

|

— |

|

|

| Deferred

revenue |

|

|

2.7 |

|

|

|

1.7 |

|

|

| Total

current liabilities |

|

|

221.7 |

|

|

|

72.3 |

|

|

|

Unrecognized tax benefits |

|

|

24.9 |

|

|

|

24.0 |

|

|

| Other

long-term liabilities |

|

|

7.2 |

|

|

|

7.8 |

|

|

|

Contingent consideration |

|

|

14.3 |

|

|

|

10.4 |

|

|

|

Long-term debt |

|

|

167.1 |

|

|

|

— |

|

|

|

Long-term deferred taxes |

|

|

84.7 |

|

|

|

17.9 |

|

|

| Total

liabilities |

|

|

519.9 |

|

|

|

132.4 |

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

| Common

stock, 68.1 and 69.1 shares outstanding at March 31, 2017 and

June 30, 2016 respectively |

|

|

0.7 |

|

|

|

0.7 |

|

|

|

Additional paid-in capital |

|

|

839.5 |

|

|

|

830.1 |

|

|

|

Accumulated other comprehensive loss |

|

|

(10.6 |

) |

|

|

(9.5 |

) |

|

|

Accumulated deficit |

|

|

(81.4 |

) |

|

|

(73.2 |

) |

|

| Total

Myriad Genetics, Inc. stockholders’ equity |

|

|

748.2 |

|

|

|

748.1 |

|

|

|

Non-Controlling Interest |

|

|

(0.3 |

) |

|

|

— |

|

|

| Total

stockholders' equity |

|

|

747.9 |

|

|

|

748.1 |

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,267.8 |

|

|

$ |

880.5 |

|

|

|

|

|

|

|

|

|

| Consolidated Statement of Cash Flows

(Unaudited) |

|

| (in millions) |

|

|

|

|

|

|

|

|

Nine months ended |

|

|

|

|

March 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| Net income |

|

$ |

8.9 |

|

|

$ |

102.0 |

|

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

35.0 |

|

|

|

20.0 |

|

|

| Non-cash

interest expense |

|

|

0.4 |

|

|

|

— |

|

|

| Gain on

disposition of assets |

|

|

(0.2 |

) |

|

|

(0.4 |

) |

|

|

Share-based compensation expense |

|

|

22.7 |

|

|

|

23.9 |

|

|

|

Impairment of cost basis investment |

|

|

2.4 |

|

|

|

— |

|

|

| Bad debt

expense |

|

|

27.3 |

|

|

|

23.5 |

|

|

| Loss on

extinguishment of debt |

|

|

1.3 |

|

|

|

— |

|

|

| Deferred

income taxes |

|

|

2.0 |

|

|

|

31.5 |

|

|

|

Unrecognized tax benefits |

|

|

0.9 |

|

|

|

(2.4 |

) |

|

| Change in

fair value of contingent consideration |

|

|

2.0 |

|

|

|

— |

|

|

| Changes

in assets and liabilities: |

|

|

|

|

|

| Prepaid

expenses |

|

|

10.9 |

|

|

|

(8.7 |

) |

|

| Trade

accounts receivable |

|

|

(40.3 |

) |

|

|

(28.7 |

) |

|

| Other

receivables |

|

|

(3.2 |

) |

|

|

(1.0 |

) |

|

|

Inventory |

|

|

(6.5 |

) |

|

|

(0.2 |

) |

|

| Prepaid

taxes |

|

|

3.6 |

|

|

|

(27.7 |

) |

|

| Accounts

payable |

|

|

2.0 |

|

|

|

(6.9 |

) |

|

| Accrued

liabilities |

|

|

(0.6 |

) |

|

|

2.9 |

|

|

| Deferred

revenue |

|

|

1.0 |

|

|

|

— |

|

|

| Net cash provided by

operating activities |

|

|

69.6 |

|

|

|

127.8 |

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

| Capital

expenditures |

|

|

(5.4 |

) |

|

|

(2.8 |

) |

|

| Acquisitions, net of

cash acquired |

|

|

(216.1 |

) |

|

|

— |

|

|

| Sale of cost basis

investment |

|

|

2.6 |

|

|

|

— |

|

|

| Purchases of marketable

investment securities |

|

|

(74.6 |

) |

|

|

(131.4 |

) |

|

| Proceeds from

maturities and sales of marketable investment securities |

|

|

142.9 |

|

|

|

86.6 |

|

|

| Net cash used in

investing activities |

|

|

(150.6 |

) |

|

|

(47.6 |

) |

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

| Net proceeds for common

stock issued under share-based compensation plans |

|

|

1.3 |

|

|

|

85.9 |

|

|

| Net proceeds from

revolving credit facility |

|

|

204.0 |

|

|

|

— |

|

|

| Net proceeds from term

loan |

|

|

199.0 |

|

|

|

— |

|

|

| Repayment of term

loan |

|

|

(200.0 |

) |

|

|

— |

|

|

| Repayment of revolving

credit facility |

|

|

(37.0 |

) |

|

|

|

| Fees paid for

extinguishment of debt |

|

|

(0.6 |

) |

|

|

— |

|

|

| Repurchase and

retirement of common stock |

|

|

(31.6 |

) |

|

|

(107.9 |

) |

|

| Net cash provided by

(used in) financing activities |

|

|

135.1 |

|

|

|

(22.0 |

) |

|

| Effect of foreign

exchange rates on cash and cash equivalents |

|

|

1.2 |

|

|

|

(1.8 |

) |

|

| Net increase in cash

and cash equivalents |

|

|

55.3 |

|

|

|

56.4 |

|

|

| Cash and cash

equivalents at beginning of the period |

|

|

68.5 |

|

|

|

64.1 |

|

|

| Cash and

cash equivalents at end of the period |

|

$ |

123.8 |

|

|

$ |

120.5 |

|

|

| |

|

|

|

|

|

Safe Harbor StatementThis press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements relating to the Company’s anticipated volumes, revenue

and profitability from existing and new products; the Company’s

belief that it is rapidly approaching an important inflection in

its business where its new products will drive accelerated revenue

growth and profitability; the Company’s expectation of receiving

top line data from a 1,200 patient clinical utility study

evaluating GeneSight in patients with treatment resistant

depression by the end of calendar year 2017; the potential market

expansion of approximately 30,000 patients per year for Prolaris

based on Palmetto GBA’s draft coverage determination; the potential

60,000 patient per year market for BRACAnalysis CDx as a companion

diagnostic to olaparib; the Company’s anticipated study

presentation at the upcoming American Urology Association meeting;

the Company’s fiscal fourth-quarter guidance of total revenue of

$192 to $194 million, diluted earnings per share of $0.11 to $0.13,

and adjusted earnings per share of $0.26 to $0.28, and the

Company’s updated fiscal full year guidance of total revenue of

$763 to $765 million, diluted earnings per share of $0.23 to $0.25,

and adjusted earnings per share of $1.01 to $1.03, as further

discussed under the caption “Fiscal Year 2017 and Fiscal

Fourth-Quarter 2017 Financial Guidance”; and the Company’s

strategic directives under the caption “About Myriad Genetics.”

These “forward-looking statements” are based on management’s

current expectations of future events and are subject to a number

of risks and uncertainties that could cause actual results to

differ materially and adversely from those described or implied in

the forward-looking statements. These risks include, but are not

limited to: the risk that sales and profit margins of our existing

molecular diagnostic tests and pharmaceutical and clinical services

may decline or will not continue to increase at historical rates;

risks related to our ability to transition from our existing

product portfolio to our new tests; risks related to changes in the

governmental or private insurers’ reimbursement levels for our

tests or our ability to obtain reimbursement for our new tests at

comparable levels to our existing tests; risks related to increased

competition and the development of new competing tests and

services; the risk that we may be unable to develop or achieve

commercial success for additional molecular diagnostic tests and

pharmaceutical and clinical services in a timely manner, or at all;

the risk that we may not successfully develop new markets for our

molecular diagnostic tests and pharmaceutical and clinical

services, including our ability to successfully generate revenue

outside the United States; the risk that licenses to the technology

underlying our molecular diagnostic tests and pharmaceutical and

clinical services tests and any future tests are terminated or

cannot be maintained on satisfactory terms; risks related to delays

or other problems with operating our laboratory testing facilities;

risks related to public concern over our genetic testing in general

or our tests in particular; risks related to regulatory

requirements or enforcement in the United States and foreign

countries and changes in the structure of the healthcare system or

healthcare payment systems; risks related to our ability to obtain

new corporate collaborations or licenses and acquire new

technologies or businesses on satisfactory terms, if at all; risks

related to our ability to successfully integrate and derive

benefits from any technologies or businesses that we license or

acquire, including but not limited to our acquisition of Assurex,

Sividon and the Clinic; risks related to our projections about the

potential market opportunity for our products; the risk that we or

our licensors may be unable to protect or that third parties will

infringe the proprietary technologies underlying our tests; the

risk of patent-infringement claims or challenges to the validity of

our patents; risks related to changes in intellectual property laws

covering our molecular diagnostic tests and pharmaceutical and

clinical services and patents or enforcement in the United States

and foreign countries, such as the Supreme Court decision in the

lawsuit brought against us by the Association for Molecular

Pathology et al; risks of new, changing and competitive

technologies and regulations in the United States and

internationally; the risk that we may be unable to comply with

financial operating covenants under our credit or lending

agreements; the risk that we will be unable to pay, when due,

amounts due under our credit or lending agreements; and other

factors discussed under the heading “Risk Factors” contained in

Item 1A of our Annual report on Form 10-K for the fiscal year ended

June 30, 2016, which has been filed with the Securities and

Exchange Commission, as well as any updates to those risk factors

filed from time to time in our Quarterly Reports on Form 10-Q or

Current Reports on Form 8-K.

Statement regarding use of non-GAAP financial

measuresIn this press release, the Company’s financial

results and financial guidance are provided in accordance with

accounting principles generally accepted in the United States

(GAAP) and using certain non-GAAP financial measures. Management

believes that presentation of operating results using non-GAAP

financial measures provides useful supplemental information to

investors and facilitates the analysis of the Company’s core

operating results and comparison of operating results across

reporting periods. Management also uses non-GAAP financial measures

to establish budgets and to manage the Company’s business. A

reconciliation of the GAAP financial results to non-GAAP financial

results is included in the attached schedules.

Following is a description of the adjustments made to GAAP

financial measures:

- Acquisition - amortization of intangible assets: Represents

recurring amortization charges resulting from the acquisition of

intangible assets, including developed technology and database

rights.

- Acquisition – integration related costs: Costs related to

closing and integration of acquired companies

- Tax impact related to equity compensation – Changes in

effective tax rate based upon ASU 2016-09

- Tax expense associated with R&D tax credit reserves – One

time net benefits associated with the release of R&D tax credit

reserves.

- Potential future consideration related to acquisitions –

Non-cash expenses related to valuation adjustments of earn-out and

milestone payments tied to recent acquisitions

- One-time debt restructuring charges – Charges related to the

restructuring of the company’s debt from a one-year term loan to a

revolving credit facility

- One-time non-deductible costs – One-time non-deductible tax

items

- Impairment of Raindance Investment – One-time impairment charge

associated with Myriad’s investment in Raindance Technologies

The Company encourages investors to carefully consider its

results under GAAP, as well as its supplemental non-GAAP

information and the reconciliation between these presentations, to

more fully understand its business. Non-GAAP financial results are

reported in addition to, and not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP.

| Reconciliation

of GAAP to Non-GAAP Financial

Measures |

|

|

|

|

|

|

|

|

|

| for

the Three and Nine Months ended March 31, 2017 and

2016 |

|

|

|

|

|

|

|

| (Unaudited data in

millions, except per share amount) |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

Mar 31, 2017 |

|

Mar 31, 2016 |

|

Mar 31, 2017 |

|

Mar 31, 2016 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

196.9 |

|

|

|

190.5 |

|

|

|

570.9 |

|

|

|

567.4 |

|

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Cost of

molecular diagnostic testing |

|

$ |

37.9 |

|

|

$ |

33.6 |

|

|

$ |

109.5 |

|

|

$ |

98.6 |

|

|

| GAAP Cost of

pharmaceutical and clinical

services |

|

|

6.4 |

|

|

|

6.6 |

|

|

|

19.1 |

|

|

|

18.7 |

|

|

|

Acquisition - Integration related costs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

Acquisition - amortization of intangible assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Non-GAAP

COGS |

|

$ |

44.3 |

|

|

$ |

40.2 |

|

|

$ |

128.6 |

|

|

$ |

117.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Gross

Margin |

|

|

78 |

% |

|

|

79 |

% |

|

|

77 |

% |

|

|

79 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Research

and Development |

|

$ |

17.6 |

|

|

$ |

17.2 |

|

|

$ |

55.6 |

|

|

$ |

51.1 |

|

|

|

Acquisition - Integration related costs |

|

|

(0.1 |

) |

|

|

- |

|

|

|

(0.2 |

) |

|

|

- |

|

|

|

Acquisition - amortization of intangible assets |

|

|

- |

|

|

|

(0.1 |

) |

|

|

(0.2 |

) |

|

|

(0.3 |

) |

|

| Non-GAAP

R&D |

|

$ |

17.5 |

|

|

$ |

17.1 |

|

|

$ |

55.2 |

|

|

$ |

50.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Selling,

General and Administrative |

|

$ |

122.1 |

|

|

$ |

90.5 |

|

|

$ |

354.3 |

|

|

$ |

267.8 |

|

|

|

Acquisition - Integration related costs |

|

|

(1.8 |

) |

|

|

- |

|

|

|

(12.8 |

) |

|

|

- |

|

|

|

Acquisition - amortization of intangible assets |

|

|

(9.2 |

) |

|

|

(3.1 |

) |

|

|

(23.6 |

) |

|

|

(9.2 |

) |

|

| Non-GAAP

SG&A |

|

$ |

111.1 |

|

|

$ |

87.4 |

|

|

$ |

317.9 |

|

|

$ |

258.6 |

|

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Operating

Income |

|

$ |

12.9 |

|

|

$ |

42.6 |

|

|

$ |

32.4 |

|

|

$ |

131.2 |

|

|

|

Acquisition - Integration related costs |

|

|

1.9 |

|

|

|

- |

|

|

|

13.0 |

|

|

|

- |

|

|

|

Acquisition - amortization of intangible assets |

|

|

9.2 |

|

|

|

3.2 |

|

|

|

23.8 |

|

|

|

9.5 |

|

|

| Non-GAAP

Operating Income |

|

$ |

24.0 |

|

|

$ |

45.8 |

|

|

$ |

69.2 |

|

|

$ |

140.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Operating Margin |

|

|

12 |

% |

|

|

24 |

% |

|

|

12 |

% |

|

|

25 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP Net Income

Attributable to Myriad Gentics, Inc.

Stockholders |

|

$ |

4.2 |

|

|

$ |

34.5 |

|

|

$ |

9.0 |

|

|

$ |

102.0 |

|

|

|

Acquisition - Integration related costs |

|

|

1.9 |

|

|

|

- |

|

|

|

13.0 |

|

|

|

- |

|

|

|

Acquisition - amortization of intangible assets |

|

|

9.2 |

|

|

|

3.2 |

|

|

|

23.8 |

|

|

|

9.5 |

|

|

| Tax

impact related to equity compensation |

|

|

(0.1 |

) |

|

|

(1.9 |

) |

|

|

2.9 |

|

|

|

(12.4 |

) |

|

| Tax

expense associated with R&D tax credit reserves |

|

|

|

|

(6.0 |

) |

|

|

- |

|

|

|

(6.0 |

) |

|

| Earn out

true-up |

|

|

5.2 |

|

|

|

- |

|

|

|

0.6 |

|

|

|

- |

|

|

| One-time

debt restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

1.3 |

|

|

|

- |

|

|

| One-time

non-deductible costs |

|

|

(1.5 |

) |

|

|

- |

|

|

|

2.7 |

|

|

|

- |

|

|

|

Impairment of Raindance Investment |

|

|

(0.1 |

) |

|

|

- |

|

|

|

3.3 |

|

|

|

- |

|

|

| Tax

effect associated with non-GAAP adjustments |

|

|

(0.7 |

) |

|

|

- |

|

|

|

(4.9 |

) |

|

|

- |

|

|

| Non-GAAP Net

Income |

|

$ |

18.1 |

|

|

$ |

29.8 |

|

|

$ |

51.7 |

|

|

$ |

93.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Diluted

EPS |

|

$ |

0.06 |

|

|

$ |

0.47 |

|

|

$ |

0.13 |

|

|

$ |

1.39 |

|

|

| Non-GAAP

Diluted EPS |

|

$ |

0.27 |

|

|

$ |

0.41 |

|

|

$ |

0.75 |

|

|

$ |

1.27 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Diluted shares

outstanding |

|

|

68.3 |

|

|

|

73.5 |

|

|

|

68.5 |

|

|

|

73.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Free Cash Flow

Reconciliation |

|

|

|

|

|

|

|

|

|

| (Unaudited data in

millions) |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

Mar 31, 2017 |

|

Mar 31, 2016 |

|

Mar 31, 2017 |

|

Mar 31, 2016 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP cash flow

from operations |

|

$ |

41.1 |

|

|

$ |

45.9 |

|

|

$ |

69.6 |

|

|

$ |

127.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

|

|

(1.5 |

) |

|

|

(0.7 |

) |

|

|

(5.4 |

) |

|

|

(2.8 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Free cash

flow |

|

$ |

39.6 |

|

|

$ |

45.2 |

|

|

$ |

64.2 |

|

|

$ |

125.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition -

Integration related costs |

|

|

1.9 |

|

|

|

- |

|

|

|

9.8 |

|

|

|

- |

|

|

| Cash paid at closing to

Assurex vendors |

|

|

- |

|

|

|

- |

|

|

|

6.8 |

|

|

|

- |

|

|

| Tax effect associated

with non-GAAP adjustments |

|

|

(0.7 |

) |

|

|

- |

|

|

|

(6.4 |

) |

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-GAAP Free

cash flow |

|

$ |

40.8 |

|

|

$ |

45.2 |

|

|

$ |

74.4 |

|

|

$ |

125.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP for Fiscal Year 2017

and Fiscal Fourth-Quarter 2017 Financial GuidanceThe

Company’s future performance and financial results are subject to

risks and uncertainties, and actual results could differ materially

from guidance set forth below. Some of the factors that could

affect the Company’s financial results are stated in the safe

harbor statement of this press release. More information on

potential factors that could affect the Company’s financial results

are included under the heading "Risk Factors" contained in Item 1A

in the Company’s most recent Annual Report on Form 10-K filed with

the Securities and Exchange Commission, as well as any updates to

those risk factors filed from time to time in the Company’s

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

| |

|

|

Fiscal Year 2017 |

|

Diluted net income per share |

|

|

| GAAP

diluted net income per share |

|

$0.23 -

$0.25 |

| Acquisition

- amortization of intangible assets |

|

0.48 |

| Acquisition

costs & one-time expenses |

|

0.30 |

|

Non-GAAP diluted net income per share |

|

$1.01 - $1.03 |

| |

|

|

|

| |

|

|

|

| |

|

|

Fiscal Fourth-Quarter2017 |

|

Diluted net income per share |

|

|

| GAAP

diluted net income per share |

|

$0.11 -

$0.13 |

| Acquisition

- amortization of intangible assets |

|

0.13 |

| Acquisition

costs & one-time expenses |

|

0.02 |

|

Non-GAAP diluted net income per share |

|

$0.26 - $0.28 |

Media Contact:

Ron Rogers

(801) 584-3065

rrogers@myriad.com

Investor Contact:

Scott Gleason

(801) 584-1143

sgleason@myriad.com

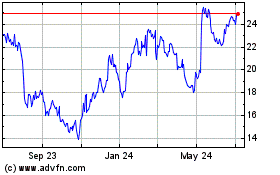

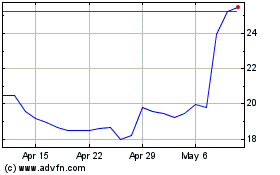

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024