Myriad Genetics

(MYGN) reported earnings per share (EPS) of 60 cents in the third

quarter of fiscal 2014, registering a remarkable 30.4% beat over

the Zacks Consensus Estimate as well as the year-over-year adjusted

number. EPS growth was boosted by a strong top line and a reduced

share count. Without these adjustments, reported EPS came in at 48

cents, up 4.3% year over year.

However, despite outperforming all

estimates, shares of Myriad slashed 9.8% to close at $36.87

following the earnings release.

Quarter in

Detail

Revenues increased 17% year over

year to $182.9 million, sailing past the Zacks Consensus Estimate

of $174 million. Growth was mainly driven by strong performance in

the core markets, complemented by international expansion.

According to the company, it is perfectly in sync with the

strategic initiatives of expanding core hereditary cancer market,

growing international business and launching new life-saving

products. The company noted that, this quarter is more reflective

of a true year-over-year performance sans the impact from

additional publicity involving celebrities, which had otherwise

acted as a major factorboosting revenues for the past few

quarters.

Segments in

Detail

Myriad operates through two major

segments. Molecular diagnostic tests contributed 96% to total

revenue in the quarter while Companion diagnostic tests accounted

for the remaining 4% of sales.

Molecular diagnostic tests recorded

revenues of $176.2 million, up 19% year over year. Molecular

diagnostic testing revenues were, in turn, derived from the

Oncology (down 3.5% to $92.4 million) and Women’s Health (up 53% to

$80.7 million) segments. Myriad noted that, the year-over-year

decline in Oncology sales resulted from aMedicare reimbursement

reduction of $6 million for BRACAnalysis, effective from

Jan 1, 2014. However, the company is looking forward to the 37%

increase in reimbursement rate that is now in effect since Apr 1,

2014.

The Hereditary Cancer test

generated revenues of $169.6 million in the third quarter, up 16%

year over year. Under this segment, BRACAnalysis revenues

grossed $119.7 million, BART revenues were $21.1 million,

myRisk(TM) Hereditary Cancer revenues totaled $14.5 million, and

Colarisand Colaris APrevenues came in at $14.4 million.

Other molecular diagnostic tests

generated revenues of $3.5 million, up 25% from the comparable

quarter in fiscal 2013.

Companion diagnostic service

revenues declined 17% from the year-ago quarter to $6.7 million.

According to the company, this segment may reflect fluctuation in

sales performance going forward due to the timing of research

projects with Myriad’s pharmaceutical partners.

Operational

Update

Adjusted gross margin in the

reported quarter declined 130 basis points (bps) to 85.7% due to

the inclusion of revenues from the Crescendo acquisition, which at

current volumes has lower margins. Adjusted research and

development expenses declined 29.5% to $9.5 million while adjusted

selling, general and administrative expenses increased 21.2% to

$78.1 million. This led to a 40 bps expansion in adjusted operating

margin to reach 37.8%.

Financial

Update

Myriad Genetics exited the quarter

with cash, cash equivalents and marketable securities of $277.7

million, compared with $531.1 million at the end of fiscal 2013.

Myriad’s Board of Directors repurchased 1.6 million shares for

$41.9 million during the reported quarter.

Guidance

Banking on core market growth that

led to another solid quarter and several recent positive takeaways

including the recent acquisition of Crescendo Bioscience; the

three-year contract with United Healthcare to provide coverage for

Myriad's myRisk Hereditary Cancer test; and the collaboration with

Tesaro for the use of Myriad's proprietary HRD test to identify

tumor subtypes that may respond to Tesaro's investigational new

PARP inhibitor niraparib, Myriad has raised its revenue outlook for

fiscal 2014.

The company expects revenues in the

range of $770–$775 million, higher than the prior forecast of

$740–$750 million implying annualized growth of 26% (from earlier

21% to 22%). The current Zacks Consensus Estimate of $776 million

remains marginally ahead of the company’s guidance.

Myriad has also hauled up its EPS

guidance for the fiscal year. The company currently projects its

earnings to vary between $2.37 and $2.40, up from the previous

range of $2.09 to $2.12. The revised outlook reflects growth of 34%

to 35% as compared to the earlier range of 18% to 20%. However, the

Zacks Consensus Estimate for EPS is pegged at $2.22, which falls

below the guided range.

Our

Take

Myriad Genetics has been

consistently reporting impressive results over the past few

quarters. The higher-than-expected earnings guidance for the

current fiscal is also encouraging. With positive results from the

company’s major cancer tests and the recent acquisitions and

collaborations, we believe Myriad Genetics will tread steadily on

the growth trajectory going forward.

However, as Myriad rolls out its

myRisk hereditary cancer test in the U.S., it plans to gradually

discontinue its legacy products including BRACAnalysis, Colaris,

Colaris AP, Melaris and Panexia. In line with its strategy to

replace these legacy products with the more innovative myRisk,

Myriad plans to convert the hereditary cancer testing market by the

summer of 2015. Per the company, the period 2013-2015 will serve as

the conversion phase toward the pan-cancer panel.

Although the company expects to

increase its addressable market with myRisk in the near future, we

remain cautious owing to the market conversion phase with the

discontinuance of the company’s successful legacy products.

Zacks Rank

Currently, the stock carries a

Zacks Rank #1 (Strong Buy). Some other top-placed stocks that are

worth a look include Alexion Pharmaceuticals, Inc.

(ALXN), Gilead Sciences Inc. (GILD) and

Affymetrix Inc. (AFFX). While ALXN and GILD sport

a Zacks Rank #1 (Strong Buy), AFFX carries a Zacks Rank #2

(Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

AFFYMETRIX INC (AFFX): Free Stock Analysis Report

ALEXION PHARMA (ALXN): Free Stock Analysis Report

GILEAD SCIENCES (GILD): Free Stock Analysis Report

MYRIAD GENETICS (MYGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

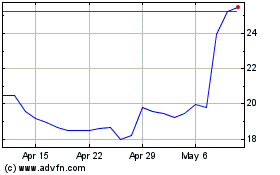

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

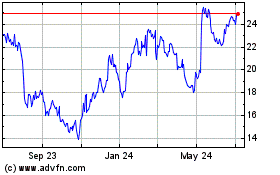

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024