~ Third Quarter Revenue of $190.7 Million

~

~ EPS of $0.75 and Adjusted EPS of $1.04

~

~ Raises Fiscal 2018 Outlook ~

~ Board Declares Quarterly Dividend

~

Movado Group, Inc. (NYSE:MOV) today announced third quarter

results for the period ended October 31, 2017.

- Net sales increased 6.0% to $190.7

million, or 5.4% on a constant dollar basis

- Operating income of $25.2 million;

Adjusted operating income of $33.6 million versus operating income

of $31.1 million in the prior year period

- Diluted EPS of $0.75; Adjusted diluted

EPS of $1.04 compared to adjusted diluted EPS of $0.91 in prior

year period

Efraim Grinberg, Chairman and Chief Executive Officer, stated,

“Our powerful portfolio of brands combined with the strength of our

innovation pipeline and solid execution of our strategies by our

team led to a productive quarter, highlighted by increased sales

and growth in adjusted diluted EPS. This performance was delivered

even as the U.S. retail environment remains challenged.

International sales growth led our performance with particular

strength in Europe, Latin America, China and the Middle East. We

were very pleased by the initial performance of our newest brand to

our portfolio, Olivia Burton. The investments we have and continue

to make in digital have elevated our brands with retailers and

consumers alike and this, along with the changing retail landscape

and the growing importance of online channels, has led us to make

the decision to no longer exhibit at the Baselworld fair. While

this has resulted in a charge in the third quarter, we believe the

move is the right choice for our Company as it will yield annual

expense savings in future years that we will reinvest in demand

creation and marketing efforts to further drive sales.”

Mr. Grinberg continued, “We believe we are well positioned as we

enter the final quarter of the year. Our strong product innovation

and marketing programs will allow us to capitalize on the holiday

season. We have a strong balance sheet with $155.5 million of cash,

affording us the ability to continue to reinvest in our business

while returning value to shareholders. As a result of our

performance year-to-date, we are increasing our outlook, excluding

one-time charges.”

During the third quarter of fiscal 2018, the Company recorded a

$1.4 million pre-tax charge, with a related tax benefit of $0.3

million, or $0.05 per diluted share, in conjunction with the

acquisition of the Olivia Burton brand and a $7.0 million pre-tax

charge, with a related tax benefit of $1.2 million or $0.24 per

diluted share, associated with the Company’s cost savings

initiatives. The $7.0 million charge for cost savings initiatives

is comprised of $6.3 million related to the Company’s decision to

no longer exhibit at Baselworld and the remainder is primarily due

to the reduction of leased space in the Company’s Swiss operations.

During the second quarter of fiscal 2018, the Company recorded a

$4.5 million pre-tax charge, with a related tax benefit of $0.1

million, or $0.19 per diluted share, in conjunction with the

acquisition of the Olivia Burton brand and a $0.1 million pre-tax

charge related to the cost savings initiatives. In the first

quarter of fiscal 2018, the Company recorded a $6.3 million pre-tax

charge, with a related tax benefit of $1.9 million, or $0.19 per

diluted share, related to its cost savings initiatives.

In the prior year period, during the third quarter of fiscal

2017, the Company recorded a pre-tax charge to non-operating

expense of $1.3 million, with a related tax benefit of $0.4

million, or $0.04 per diluted share, for an impairment of a

long-term investment in a privately held company. In the first

quarter of fiscal 2017, the Company recorded a $1.8 million pre-tax

charge, with a related tax benefit of $0.7 million, or $0.05 per

diluted share, for the immediate vesting of stock awards and

certain other compensation related to the announcement of the

retirement of the Company’s former Vice Chairman and Chief

Operating Officer, in fiscal 2017 (“COO’s retirement”).

Third Quarter Fiscal 2018 (See attached

table for GAAP and Non-GAAP measures)

- Net sales increased 6.0% to $190.7

million compared to $179.8 million in the third quarter of fiscal

2017. Net sales on a constant dollar basis increased 5.4% compared

to net sales in the third quarter of fiscal 2017.

- Gross profit was $104.1 million, or

54.6% of sales, compared to $98.6 million, or 54.8% of sales, in

the third quarter last year. Adjusted gross profit was $104.7

million, or 54.9% of sales, which primarily excludes $0.6 million

of amortization of acquisition accounting adjustments related to

the Olivia Burton brand. The increase in adjusted gross margin

percentage was primarily the result of a reduction of certain fixed

costs due to the cost savings initiatives and favorable changes in

foreign currency exchange rates, partially offset by channel and

product mix.

- Operating expenses increased $11.4

million to $78.9 million compared to $67.5 million in the third

quarter last year. Adjusted operating expenses in the third quarter

of fiscal 2018 were $71.1 million which excludes $0.8 million of

expenses and amortization related to the acquisition of the Olivia

Burton brand and $7.0 million of expenses related to the cost

savings initiatives. The increase in adjusted operating expenses

was primarily the result of higher performance-based compensation

of $1.5 million, higher distribution costs of $1.3 million, higher

marketing expenses of $1.2 million and other selling and other

operating costs, offset by a decrease in compensation and benefit

expenses primarily related to the Company’s cost savings

initiatives.

- Operating income was $25.2 million

compared to operating income of $31.1 million in the same period

last year. Adjusted operating income in the third quarter of fiscal

2018 was $33.6 million which excludes $1.4 million of expenses and

amortization related to the acquisition of the Olivia Burton brand

and $7.0 million of expenses related to the cost savings

initiatives.

- The Company recorded a tax provision of

$7.5 million, which equates to an effective tax rate of 30.1%, as

compared to a tax provision of $9.3 million or an effective tax

rate 31.5% in the third quarter of fiscal 2017. For the third

quarter of fiscal 2018, the Company recorded an adjusted tax

provision of $9.0 million or an adjusted tax rate of 27.1%, as

compared to an adjusted tax provision of $9.7 million or adjusted

tax rate of 31.5% for the third quarter of fiscal 2017.

- Net income was $17.4 million, or $0.75

per diluted share, compared to net income of $20.2 million, or

$0.87 per diluted share, in the third quarter of fiscal 2017. For

the third quarter of fiscal 2018, adjusted net income was $24.3

million, or $1.04 per diluted share, which excludes $1.1 million of

expenses and amortization, net of $0.3 million of tax, related to

the acquisition of the Olivia Burton brand, and $5.8 million

associated with the cost savings initiatives, net of $1.2 million

of tax. For the third quarter of fiscal 2017, adjusted net income

was $21.1 million, or $0.91 per diluted share, which excludes $0.9

million, net of $0.4 million of tax, related to the impairment

charge on a long-term investment in a privately held company.

Nine Month Results Fiscal 2018 (See

attached table for GAAP and Non-GAAP measures)

- Net sales decreased 0.8% to $418.7

million compared to $422.0 million in the same period of fiscal

2017. Net sales on a constant dollar basis decreased 0.3% compared

to net sales in the first nine months of fiscal 2017.

- Gross profit was $219.3 million, or

52.4% of sales, compared to $230.1 million, or 54.5% of sales, in

the same period last year. Adjusted gross profit for the first nine

months of fiscal 2018, which excludes $0.8 million of amortization

of acquisition accounting adjustments related to the Olivia Burton

brand and $1.4 million in charges related to the cost savings

initiatives, was $221.6 million, or 52.9% of sales. The decrease in

the adjusted gross margin percentage from the first nine months of

last year was primarily the result of channel and product mix as

well as changes in foreign currency exchange rates, partially

offset by a reduction of certain fixed costs as a result of cost

savings initiatives.

- Operating expenses were $189.5 million

as compared to $183.6 million in the same period last year. For the

first nine months of fiscal 2018, adjusted operating expenses were

$172.4 million, excluding $5.1 million of expenses and amortization

related to the acquisition of the Olivia Burton brand and $12.0

million of expenses related to the cost savings initiatives. For

the first nine months of fiscal 2017, adjusted operating expenses

were $181.8 million, which excludes $1.8 million of expenses

related to the COO’s retirement in the first quarter of fiscal

2017. The decrease in adjusted operating expenses was primarily the

result of decreased compensation and benefit expenses primarily

related to the Company’s cost savings initiatives, fluctuations in

foreign currency rates and decreased marketing expenses, partially

offset by higher performance-based compensation.

- Operating income was $29.9 million

compared to operating income of $46.5 million in the same period

last year. Adjusted operating income for the first nine months of

fiscal 2018 was $49.2 million, which excludes $5.9 million of

expenses and amortization related to the acquisition of the Olivia

Burton brand and $13.4 million of expenses related to the cost

savings initiatives. Adjusted operating income for the first nine

months of fiscal 2017 was $48.3 million, which excludes $1.8

million of expenses related to the COO’s retirement in the first

quarter of fiscal 2017.

- The Company recorded a tax provision of

$10.3 million as compared to $14.5 million for the first nine

months of fiscal 2017. Based upon adjusted pre-tax income, the

adjusted tax provision was $13.9 million in the first nine months

of fiscal 2018 compared to an adjusted tax provision of $15.5

million in the first nine months of fiscal 2017.

- Net income was $18.7 million, or $0.80

per diluted share, compared to net income for the first nine months

of fiscal 2017 of $29.8 million, or $1.28 per diluted share.

Adjusted net income for the first nine months of fiscal 2018 was

$34.5 million, or $1.48 per diluted share, which excludes $5.5

million of expenses and amortization related to the acquisition of

the Olivia Burton brand, net of tax, and $10.3 million of expenses

related to the cost savings initiatives, net of tax. For the first

nine months of fiscal 2017, adjusted net income was $31.8 million,

or $1.37 per diluted share, which excludes $1.1 million in

expenses, net of tax, related to the COO’s retirement in the first

quarter of fiscal 2017, as well as $0.9 million, net of tax,

related to the impairment charge on a long-term investment in a

privately held company in the third quarter of fiscal 2017.

Baselworld Update

Given the expanding digital world and the changing retail

landscape, the Company has decided to no longer exhibit its brands

at the annual Baselworld Watch and Jewelry Fair in Switzerland. The

Company plans to reinvest the approximate $10 million of annual

savings in other marketing activities, including digital

brand-building and sales growth initiatives. As a result of this

decision, the Company recorded a pre-tax charge of $6.3 million in

the third quarter of fiscal 2018 as part of its cost savings

initiatives. The majority of this charge comprises the non-cash net

book value of the exhibition booths, with the balance primarily

comprising the Company’s remaining contractual lease obligation for

its space at the March 2018 fair. The Company does not anticipate

any savings in operating expenses related to this decision for

fiscal year 2018.

Fiscal 2018 Outlook

The Company is updating its outlook for fiscal 2018. The Company

now expects net sales will be in a range of $550.0 million to

$555.0 million and operating income will be approximately $58.0

million to $60.0 million. The Company anticipates net income in

fiscal 2018 to be approximately $39.7 million to $41.0 million, or

$1.70 to $1.75 per diluted share, reflecting a 30% anticipated

effective tax rate. The Company's outlook assumes no further

significant fluctuations from prevailing foreign currency exchange

rates.

The above outlook excludes $13.4 million in pre-tax charges

related to cost savings initiatives recorded in the first nine

months of fiscal 2018, including $6.3 million related to the

above-mentioned Baselworld charge. The Company continues to expect

to realize approximately $12.0 million of savings in fiscal 2018

from these initiatives. This outlook also excludes approximately

$7.0 million in anticipated pre-tax costs in fiscal 2018, of which

$5.9 million was recorded in the first nine months of fiscal 2018,

related to transaction costs and the amortization of acquisition

accounting adjustments for the Olivia Burton brand.

Quarterly Dividend and Share Repurchase

Program

The Company also announced that on November 21, 2017, the Board

of Directors approved the payment on December 15, 2017 of a cash

dividend in the amount of $0.13 for each share of the Company’s

outstanding common stock and class A common stock held by

shareholders of record as of the close of business on December 1,

2017.

During the third quarter of fiscal 2018, the Company repurchased

49,000 shares under its share repurchase program. As of October 31,

2017, the Company had $48.7 million remaining under the $50.0

million share repurchase authorization.

Conference Call

The Company’s management will host a conference call and audio

webcast to discuss its results today, November 21st at 9:00 a.m.

Eastern Time. The conference call may be accessed by dialing (866)

548-4713. Additionally, a live webcast of the call can be accessed

at www.movadogroup.com. The webcast will be archived on the

Company’s website approximately one hour after the conclusion of

the call. Additionally, a telephonic re-play of the call will be

available at 12:00 p.m. ET on November 21, 2017 until 11:59 p.m. ET

on November 28, 2017 and can be accessed by dialing (844) 512-2921

and entering replay pin number 1578421.

Movado Group, Inc. designs, sources, and distributes MOVADO®,

OLIVIA BURTON®, EBEL®, CONCORD®, COACH®, TOMMY HILFIGER®, HUGO

BOSS®, JUICY COUTURE®, LACOSTE®, SCUDERIA FERRARI®, REBECCA

MINKOFF® and URI MINKOFF® watches worldwide, and operates Movado

company stores in the United States.

In this release, the Company presents certain financial measures

that are not calculated according to generally accepted accounting

principles in the United States (“GAAP”). Specifically, the Company

is presenting adjusted gross profit, adjusted gross margin,

adjusted operating expenses and adjusted operating income, which

are gross profit, gross margin, operating expenses and operating

income, respectively, under GAAP, adjusted to eliminate expenses

and the amortization of acquisition accounting adjustments related

to the Olivia Burton brand acquisition, charges for the cost

savings initiatives and the COO’s retirement. The Company is also

presenting adjusted tax provision, which is the tax provision under

GAAP, adjusted to eliminate charges for the Olivia Burton brand

acquisition, cost savings initiatives, impairment of a long-term

investment in a private company and the COO’s retirement. The

Company believes these adjusted measures are useful because they

give investors information about the Company’s financial

performance without the effect of certain items that the Company

believes are not characteristic of its usual operations. The

Company is also presenting adjusted net income, adjusted earnings

per share and adjusted effective tax rate, which are net income,

earnings per share and effective tax rate, respectively, under

GAAP, adjusted to eliminate the after-tax impact of the expenses

and the amortization of acquisition accounting adjustments related

to the Olivia Burton brand acquisition, the cost savings

initiatives, impairment of a long-term investment in a private

company and the COO’s retirement. The Company believes that

adjusted net income, adjusted earnings per share and adjusted

effective tax rate are useful measures of performance because they

give investors information about the Company’s financial

performance without the effect of certain items that the Company

believes are not characteristic of its usual operations.

Additionally, the Company is presenting constant currency

information to provide a framework to assess how its business

performed excluding the effects of foreign currency exchange rate

fluctuations in the current period. Comparisons of financial

results on a constant dollar basis are calculated by translating

each foreign currency at the same US dollar exchange rate as in

effect for the prior-year period for both periods being compared.

The Company believes this information is useful to investors to

facilitate comparisons of operating results. These non-GAAP

financial measures are designed to complement the GAAP financial

information presented in this release. The non-GAAP financial

measures presented should not be considered in isolation from or as

a substitute for the comparable GAAP financial measures, and the

methods of their calculation may differ substantially from

similarly titled measures used by other companies.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The Company has tried, whenever possible, to identify

these forward-looking statements using words such as “expects,”

“anticipates,” “believes,” “targets,” “goals,” “projects,”

“intends,” “plans,” “seeks,” “estimates,” “may,” “will,” “should”

and variations of such words and similar expressions. Similarly,

statements in this press release that describe the Company's

business strategy, outlook, objectives, plans, intentions or goals

are also forward-looking statements. Accordingly, such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company's

actual results, performance or achievements and levels of future

dividends to differ materially from those expressed in, or implied

by, these statements. These risks and uncertainties may include,

but are not limited to general economic and business conditions

which may impact disposable income of consumers in the United

States and the other significant markets (including Europe) where

the Company’s products are sold, uncertainty regarding such

economic and business conditions, trends in consumer debt levels

and bad debt write-offs, general uncertainty related to possible

terrorist attacks, natural disasters, the stability of the European

Union (including the impact of the June 23, 2016 referendum

advising that the United Kingdom exit from the European Union) and

defaults on or downgrades of sovereign debt and the impact of any

of those events on consumer spending, changes in consumer

preferences and popularity of particular designs, new product

development and introduction, the ability of the Company to

successfully implement its business strategies, competitive

products and pricing, the impact of “smart” watches and other

wearable tech products on the traditional watch market,

seasonality, availability of alternative sources of supply in the

case of the loss of any significant supplier or any supplier’s

inability to fulfill the Company’s orders, the loss of or curtailed

sales to significant customers, the Company’s dependence on key

employees and officers, the ability to successfully integrate the

operations of acquired businesses (including Olivia Burton) without

disruption to other business activities, the possible impairment of

acquired intangible assets including goodwill if the carrying value

of any reporting unit were to exceed its fair value, the

continuation of the company’s major warehouse and distribution

centers, the continuation of licensing arrangements with third

parties, losses possible from pending or future litigation, the

ability to secure and protect trademarks, patents and other

intellectual property rights, the ability to lease new stores on

suitable terms in desired markets and to complete construction on a

timely basis, the ability of the Company to successfully manage its

expenses on a continuing basis, information systems failure or

breaches of network security, the continued availability to the

Company of financing and credit on favorable terms, business

disruptions, disease, general risks associated with doing business

outside the United States including, without limitation, import

duties, tariffs, quotas, political and economic stability, changes

to existing laws or regulations, and success of hedging strategies

with respect to currency exchange rate fluctuations, and the other

factors discussed in the Company’s Annual Report on Form 10-K and

other filings with the Securities and Exchange Commission. These

statements reflect the Company's current beliefs and are based upon

information currently available to it. Be advised that developments

subsequent to this press release are likely to cause these

statements to become outdated with the passage of time. The Company

assumes no duty to update its forward looking statements and this

release shall not be construed to indicate the assumption by the

Company of any duty to update its outlook in the future.

MOVADO GROUP, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data)

(Unaudited) Three

Months Ended Nine Months Ended October 31,

October 31, 2017

2016 2017

2016 Net sales $ 190,693 $ 179,818 $

418,739 $ 421,967 Cost of sales 86,623

81,268 199,406 191,837

Gross profit 104,070 98,550 219,333 230,130 Operating

expenses 78,885 67,479 189,479

183,590 Operating income 25,185 31,071

29,854 46,540 Other expense - (1,282 ) - (1,282 ) Interest

expense (445 ) (333 ) (1,191 ) (1,039 ) Interest income 110

45 361 138

Income before income taxes 24,850 29,501 29,024 44,357

Provision for income taxes 7,490 9,286

10,341 14,450 Net income 17,360

20,215 18,683 29,907 Less: Net income attributed to

noncontrolling interests - - -

78 Net income attributed to Movado

Group, Inc. $ 17,360 $ 20,215 $ 18,683 $

29,829

Per Share Information: Net income

attributed to Movado Group, Inc. $ 0.75 $ 0.87 $ 0.80 $ 1.28

Weighted diluted average shares outstanding 23,273 23,230 23,261

23,259

MOVADO GROUP, INC. GAAP AND NON-GAAP MEASURES

(In thousands, except for percentage data)

(Unaudited) As

Reported % Change Three Months Ended %

Change Constant October 31, As

Reported Dollar 2017

2016 Total Net sales $ 190,693 $ 179,818

6.0 % 5.4 %

As Reported % Change Nine

Months Ended % Change Constant October 31,

As Reported Dollar

2017 2016 Total Net

sales $ 418,739 $ 421,967 -0.8 % -0.3 %

MOVADO GROUP, INC.

GAAP AND NON-GAAP MEASURES (In thousands, except per

share data) (Unaudited)

Net Sales Gross Profit Operating Income

Pre-tax Income Provisions for Income Taxes

Net Income Attributed to Movado Group,

Inc.

EPS Three Months Ended October 31, 2017 As

Reported (GAAP) $ 190,693 $ 104,070 $ 25,185 $ 24,850 $ 7,490 $

17,360 $ 0.75 Olivia Burton Costs (1) 567 1,383 1,383 263 1,120

0.05 Cost Savings Initiatives (2) 37 7,018

7,018 1,245 5,773 0.24

Adjusted

Results (Non-GAAP) $ 190,693 $ 104,674 $ 33,586 $ 33,251 $

8,998 $ 24,253 $ 1.04

Three Months Ended October 31,

2016 As Reported (GAAP) $ 179,818 $ 98,550 $ 31,071 $

29,501 $ 9,286 $ 20,215 $ 0.87 Impairment of a Long-Term Investment

(3) - - - 1,282 398 884

0.04

Adjusted Results (Non-GAAP) $ 179,818 $ 98,550 $

31,071 $ 30,783 $ 9,684 $ 21,099 $ 0.91

Nine

Months Ended October 31, 2017 As Reported (GAAP) $

418,739 $ 219,333 $ 29,854 $ 29,024 $ 10,341 $ 18,683 $ 0.80 Olivia

Burton Costs (1) 846 5,898 5,898 387 5,511 0.24 Cost Savings

Initiatives (2) - 1,439 13,437 13,437

3,181 10,256 0.44

Adjusted Results

(Non-GAAP) $ 418,739 $ 221,618 $ 49,189 $ 48,359 $ 13,909 $

34,450 $ 1.48

Nine Months Ended October 31, 2016

As Reported (GAAP) $ 421,967 $ 230,130 $ 46,540 $ 44,357 $

14,450 $ 29,829 $ 1.28 Impairment of a Long-Term Investment (3) - -

- 1,282 398 884 0.04 Retirement Charge (4) - -

1,806 1,806 687 1,119 0.05

Adjusted Results (Non-GAAP) $ 421,967 $ 230,130 $ 48,346 $

47,445 $ 15,535 $ 31,832 $ 1.37 (1) Related to transaction

charges and the amortization of acquisition accounting adjustments

associated with the acquisition of the Olivia Burton brand. (2)

Related to a charge for severance and payroll related, asset

retirement, other expenses and occupancy expenses. (3) Related to a

charge for the impairment of a long-term investment. (4) Related to

a charge for the retirement of the former Vice Chairman and Chief

Operating Officer.

MOVADO GROUP, INC. CONSOLIDATED

BALANCE SHEETS (In thousands) (Unaudited)

October 31, January 31,

October 31, 2017

2017 2016

ASSETS

Cash and cash equivalents $ 155,484 $ 256,279 $ 199,758

Trade receivables, net 132,941 66,847 130,076 Inventories 169,866

153,167 169,402 Other current assets 26,361 28,487

28,096 Total current assets 484,652 504,780

527,332 Property, plant and equipment, net 24,637

34,173 34,867 Deferred and non-current income taxes 23,610 24,837

20,614 Goodwill 56,316 - - Other intangibles, net 22,568 1,633

1,730 Other non-current assets 47,783 42,379

39,935 Total assets $ 659,566 $ 607,802 $ 624,478

LIABILITIES AND

EQUITY

Loans payable to bank, current $ 5,000 $ 5,000 $ 3,000

Accounts payable 28,014 27,192 22,443 Accrued liabilities 62,666

35,061 52,895 Income taxes payable 5,192 4,149

5,601 Total current liabilities 100,872 71,402

83,939 Loans payable to bank 25,000 25,000 35,000 Deferred

and non-current income taxes payable 7,501 3,322 3,145 Other

non-current liabilities 38,752 34,085 32,297 Noncontrolling

interests - - - Shareholders' equity 487,441 473,993

470,097 Total liabilities and equity $ 659,566 $ 607,802 $

624,478

MOVADO GROUP, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited) Nine Months Ended

October 31, 2017

2016 Cash flows from operating

activities: Net income $ 18,683 $ 29,907 Depreciation and

amortization 9,842 8,520 Other non-cash adjustments 5,434 11,805

Cost savings initiatives 13,437 - Changes in working capital

(56,087 ) (59,668 ) Changes in non-current assets and liabilities

(735 ) (1,405 )

Net cash (used in) operating

activities (9,426 ) (10,841

) Cash flows from investing activities:

Capital expenditures (3,575 ) (3,847 ) Acquisition, net of cash

acquired (78,991 ) - Restricted cash deposits 1,018 (1,156 )

Short-term investment - (151 ) Trademarks and other intangibles

(500 ) (296 )

Net cash (used in) investing

activities (82,048 ) (5,450

) Cash flows from financing activities:

Proceeds from bank borrowings - 3,000 Repayments of bank borrowings

- (5,000 ) Dividends paid (8,953 ) (8,951 ) Stock repurchase (3,004

) (3,263 ) Purchase of incremental ownership of U.K. joint venture

- (1,320 ) Other financing (626 ) (1,256 )

Net

cash (used in) financing activities (12,583

) (16,790 ) Effect of exchange

rate changes on cash and cash equivalents 3,262 4,651 Net change in

cash and cash equivalents (100,795 ) (28,430 ) Cash and cash

equivalents at beginning of period 256,279

228,188

Cash and cash equivalents at end of

period $ 155,484 $ 199,758

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171121005316/en/

ICR, Inc.Rachel Schacter/Allison Malkin203-682-8200

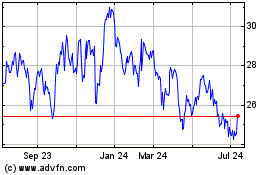

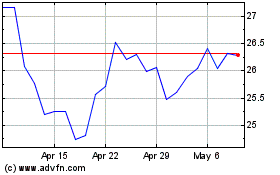

Movado (NYSE:MOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Movado (NYSE:MOV)

Historical Stock Chart

From Apr 2023 to Apr 2024