~ Board Approves Increase in Share

Repurchase Program to $100 million and Declares a Regular Quarterly

Dividend ~

Movado Group, Inc. (NYSE:MOV) today announced third quarter

results for the period ended October 31, 2014.

Efraim Grinberg, Chairman and Chief Executive Officer, stated,

“Our third quarter results were in line with the updated guidance

we issued on November 14, 2014 and reflected softer than expected

sales and earnings that were impacted by our strategic investment

in initiatives that position our Company to drive long-term growth.

Our largest brand, Movado, continues to perform very well in the

United States and, although the brand had recent weaker than

expected performance overseas, we believe it continues to have

significant international growth opportunities in the future. On

the licensed brand front, our largest brands continue to experience

growth. As we begin the fourth quarter, we believe we are well

positioned to capitalize on the holiday season with our powerful

portfolio of brands, strong product innovation and high impact

advertising campaigns.”

The Company recorded no unusual items in the third quarter of

fiscal 2015 or the third quarter of fiscal 2014. During the second

quarter of fiscal 2014, the Company recorded a $1.0 million tax

benefit, or $0.04 per diluted share, primarily related to the

release of liabilities for uncertain tax positions as a result of

favorable U.S. and foreign audit settlements. Also, during the

first quarter of fiscal 2014, the Company recorded a $1.5 million

pre-tax gain, or $0.04 per diluted share, related to the sale of a

Company-owned building in Switzerland, which was reflected in other

income.

Third Quarter Fiscal

2015

- Net sales decreased 0.6% to $188.6

million compared to $189.7 million in the third quarter of fiscal

2014 driven by a decline in the luxury brand category and certain

licensed brands.

- Gross profit was $99.8 million, or

53.0% of sales, compared to $101.3 million, or 53.4% of sales, in

the third quarter last year. The decrease in gross margin

percentage was primarily the result of a shift in channel and

product mix and the unfavorable impact of fluctuations in foreign

currency exchange rates, partially offset by a reduction of certain

fixed costs.

- Operating expenses decreased $0.7

million, or 1.0%, to $66.5 million compared to $67.2 million in the

third quarter last year. The decrease in operating expenses was

primarily the result of a decrease in the accrual for

performance-based compensation offset by higher compensation and

benefit expense in support of our brand building and growth

initiatives, marketing expense and other operating expenses.

- Operating income decreased to $33.3

million compared to operating income of $34.1 million in the same

period last year.

- The Company recorded a tax provision of

$10.9 million in the third quarter of fiscal 2015 as compared to a

tax provision of $10.6 million in the prior year. The effective tax

rate in the third quarter of fiscal 2015 was 32.7% compared to an

effective tax rate of 31.1% in the third quarter of fiscal

2014.

- Net income was $22.2 million, or $0.87

per diluted share, compared to net income of $23.0 million, or

$0.89 per diluted share, in the third quarter of fiscal 2014.

Nine Month Results Fiscal

2015

- Net sales increased 3.4% to $453.1

million compared to $438.0 million in the same period of fiscal

2014 led by growth in our licensed brand and retail

categories.

- Gross profit was $242.6 million, or

53.5% of sales, compared to $236.0 million, or 53.9% of sales in

the same period last year. The decrease in gross margin percentage

was primarily the result of the unfavorable impact of changes in

foreign currency exchange rates and a shift in channel and product

mix, partially offset by leverage gained on certain fixed costs due

to increased sales volume.

- Operating expenses increased $6.3

million, or 3.6%, to $181.2 million versus $174.9 million in the

same period last year. The $6.3 million increase in operating

expenses was primarily the result of increased compensation and

benefit costs in support of our brand building and growth

initiatives, the unfavorable effects of foreign currency exchange

rates, selling expenses, expenses associated with the Baselworld

Watch and Jewelry Show and higher marketing expenses, partially

offset by a decrease in the accrual for performance-based

compensation.

- Operating income increased to $61.4

million compared to operating income of $61.1 million in the same

period last year.

- The Company recorded a tax provision of

$19.2 million for the nine month period of fiscal 2015 as compared

to a tax provision of $18.2 million for the nine month period of

fiscal 2014. The effective tax rate in the fiscal 2015 period was

31.4% compared to an effective tax rate of 29.1% in the fiscal 2014

period. As mentioned above, the Company recorded a $1.0 million tax

benefit, or $0.04 per diluted share, related to certain items, and

a $1.5 million pre-tax gain, or $0.04 per diluted share, related to

the sale of a Company-owned building in Switzerland, which resulted

in an adjusted effective tax rate of 30.8% for the first nine

months of fiscal 2014. (See attached table for GAAP and Non-GAAP

measures.)

- Net income was $41.7 million, or $1.63

per diluted share, compared to net income for the nine month period

of fiscal 2014 of $43.7 million, or $1.69 per diluted share.

Adjusted net income for the first nine months of fiscal 2014 was

$41.6 million, or $1.61 per diluted share, excluding the $1.0

million tax benefit, or $0.04 per diluted share, taken in the

second quarter of fiscal 2014 and the $1.5 million pre-tax gain, or

$0.04 per diluted share, related to the sale of a building in

Switzerland in the first quarter of fiscal 2014. (See attached

table for GAAP and Non-GAAP measures.)

Rick Coté, Vice Chairman and Chief Operating Officer, stated,

“We remain confident in our ability to drive sustainable profitable

growth for next year and the long-term. Our brands are performing

well in the marketplace and given what we are seeing in the

strength of our brands, we would expect to continue to outperform

the watch category at retail. Going forward, we expect wholesale

and retail sales will trend together and our expenses will be in

line with sales. We are pleased to announce that our Board has

approved an increase in our share buyback program authorization to

$100 million, as well as a $0.10 quarterly dividend, which

highlights the strength of our financial position and our

commitment to shareholder value.”

Fourth Quarter and Fiscal 2015

Guidance

As announced on November 14, 2014 for fiscal 2015, the Company

currently anticipates that net sales will increase approximately 1%

to 2% to a range of $585 million to $590 million, operating profit

will be approximately $68 million to $70 million and earnings per

diluted share will be in the range of $1.80 to $1.85, assuming a

31% effective tax rate, excluding any unusual items. For the fourth

quarter, the Company currently anticipates net sales in the range

of $132 million to $137 million, operating profit of $6.5 million

to $8.5 million and earnings per diluted share in the range of

$0.18 to $0.23 assuming no significant fluctuations in foreign

currency exchange rates. Our operating profit will continue to be

impacted due to our continued strategic investment in brand

building and growth initiatives despite lower sales growth. This

guidance is on a comparable basis to non-GAAP fiscal 2014 results

adjusted for unusual items.

The Company also anticipates recording a $3.0 million one-time

pre-tax charge related to operating savings initiatives in either

the fourth quarter of fiscal 2015 or early in fiscal 2016. This

charge is excluded from the guidance provided above.

Share Repurchase Program and Quarterly

Dividend

On November 25, 2014, the Board of Directors approved an

increase in the Company’s share buyback program from the original

authorized amount of $50 million to $100 million. The authorization

expires on January 31, 2016. Under this share buyback program, the

Company may purchase its outstanding common shares from time to

time, depending on market conditions, share price and other

factors. As of October 31, 2014, $23.6 million was utilized of the

original $50 million that was authorized on March 21, 2013.

Additionally, the Board of Directors approved a regular quarterly

cash dividend of $0.10 for each share of the Company’s outstanding

common stock and class A common stock. This dividend will be paid

on December 19, 2014 to all shareholders of record as of the close

of business on December 5, 2014.

Conference Call

The Company’s management will host a conference call and audio

webcast to discuss its results today, November 25th at 9:00 a.m.

Eastern Time. The conference call may be accessed by dialing (888)

277-7115. Additionally, a live webcast of the call can be accessed

at www.movadogroup.com. The webcast will be archived on the

Company’s website approximately one hour after the conclusion of

the call. Additionally, a telephonic re-play of the call will be

available at 12:00 p.m. ET on November 25, 2014 until 11:59 p.m. ET

on December 2, 2014 and can be accessed by dialing (877) 870-5176

and entering replay pin number 2250251.

Movado Group, Inc. designs, sources, and distributes MOVADO®,

EBEL®, CONCORD®, ESQ® Movado, COACH®, TOMMY HILFIGER®, HUGO BOSS®,

JUICY COUTURE®, LACOSTE® and SCUDERIA FERRARI® watches worldwide,

and operates Movado company stores in the United States.

In this release, the Company presents certain financial measures

that are not calculated according to generally accepted accounting

principles in the United States (“GAAP”). Specifically, the Company

is presenting adjusted net income, adjusted earnings per share and

adjusted effective tax rate, which is net income, earnings per

share and effective tax rate under GAAP adjusted to eliminate the

effects of the sale of a building and tax adjustments resulting

from favorable changes in connection with domestic and foreign tax

audits. The Company believes that adjusted net income, adjusted

earnings per share and adjusted effective tax rate are useful

measures of performance because they give investors information

about the Company’s financial performance without the effect of

certain items that the Company believes are not characteristic of

its usual operations. Additionally, the Company is presenting

constant currency information to provide a framework to assess how

its business performed excluding the effects of foreign currency

exchange rate fluctuations in the current year. The Company

believes this information is useful to investors to facilitate

comparisons of operating results. These non-GAAP financial measures

are designed to complement the GAAP financial information presented

in this release. The non-GAAP financial measures presented should

not be considered in isolation from or as a substitute for the

comparable GAAP financial measures, and the methods of their

calculation may differ substantially from similarly titled measures

used by other companies.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The Company has tried, whenever possible, to identify

these forward-looking statements using words such as “expects,”

“anticipates,” “believes,” “targets,” “goals,” “projects,”

“intends,” “plans,” “seeks,” “estimates,” “may,” “will,” “should”

and variations of such words and similar expressions. Similarly,

statements in this press release that describe the Company's

business strategy, outlook, objectives, plans, intentions or goals

are also forward-looking statements. Accordingly, such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause the Company's

actual results, performance or achievements and levels of future

dividends to differ materially from those expressed in, or implied

by, these statements. These risks and uncertainties may include,

but are not limited to general economic and business conditions

which may impact disposable income of consumers in the United

States and the other significant markets (including Europe) where

the Company’s products are sold, uncertainty regarding such

economic and business conditions, trends in consumer debt levels

and bad debt write-offs, general uncertainty related to possible

terrorist attacks, natural disasters, the stability of the European

Union and defaults on or downgrades of sovereign debt and the

impact of any of those events on consumer spending, changes in

consumer preferences and popularity of particular designs, new

product development and introduction, the ability of the Company to

successfully implement its business strategies, competitive

products and pricing, seasonality, availability of alternative

sources of supply in the case of the loss of any significant

supplier or any supplier’s inability to fulfill the Company’s

orders, the loss of or curtailed sales to significant customers,

the Company’s dependence on key employees and officers, the ability

to successfully integrate the operations of acquired businesses

without disruption to other business activities, the continuation

of licensing arrangements with third parties, the ability to secure

and protect trademarks, patents and other intellectual property

rights, the ability to lease new stores on suitable terms in

desired markets and to complete construction on a timely basis,

potential effects of economic and currency instability in Europe

and countries using the Euro as their functional currency, the

ability of the Company to successfully manage its expenses on a

continuing basis, the continued availability to the Company of

financing and credit on favorable terms, business disruptions,

disease, general risks associated with doing business outside the

United States including, without limitation, import duties,

tariffs, quotas, political and economic stability, and success of

hedging strategies with respect to currency exchange rate

fluctuations, and the other factors discussed in the Company’s

Annual Report on Form 10-K and other filings with the Securities

and Exchange Commission. These statements reflect the Company's

current beliefs and are based upon information currently available

to it. Be advised that developments subsequent to this press

release are likely to cause these statements to become outdated

with the passage of time. The Company assumes no duty to update its

forward looking statements and this release shall not be construed

to indicate the assumption by the Company of any duty to update its

guidance in the future.

MOVADO GROUP, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data)

(Unaudited) Three Months Ended Nine Months

Ended October 31, October 31,

2014 2013

2014

2013 Net sales $ 188,557 $

189,685 $ 453,069 $ 437,996 Cost of sales 88,715

88,415 210,470 201,989

Gross profit 99,842 101,270 242,599 236,007

Operating expenses 66,509 67,186

181,177 174,878 Operating income 33,333

34,084 61,422 61,129 Other income - - - 1,526 Interest

expense (78 ) (114 ) (272 ) (294 ) Interest income 51

14 97 53 Income

before income taxes 33,306 33,984 61,247 62,414 Provision

for income taxes 10,889 10,570

19,231 18,166 Net income 22,417 23,414

42,016 44,248 Less: Net income attributed to noncontrolling

interests 208 395 291

564 Net income attributed to Movado Group,

Inc. $ 22,209 $ 23,019 $ 41,725 $ 43,684

Per Share Information: Net income attributed

to Movado Group, Inc. $ 0.87 $ 0.89 $ 1.63 $ 1.69 Weighted diluted

average shares outstanding 25,616 25,842 25,661 25,855

MOVADO GROUP, INC. GAAP AND NON-GAAP MEASURES (In

thousands, except for percentage data) (Unaudited)

As Reported % Change Three Months Ended

% Change Constant October 31,

As Reported Dollar

2014 2013 Total Net

sales $ 188,557 $ 189,685 -0.6 % 0.1 %

As

Reported % Change Nine Months Ended %

Change Constant October 31,

As Reported Dollar

2014 2013 Total Net

sales $ 453,069 $ 437,996 3.4 % 3.0 %

MOVADO

GROUP, INC. GAAP AND NON-GAAP MEASURES (In thousands,

except per share data) (Unaudited) Net

Sales Gross Profit Operating Income Pre-tax

Income Net Income Earnings Per Share Three

Months Ended October 31, 2014 As Reported (GAAP) $

188,557 $ 99,842 $ 33,333 $ 33,306 $ 22,209 $ 0.87

Three Months Ended October 31, 2013 As

Reported (GAAP) $ 189,685 $ 101,270 $ 34,084 $ 33,984 $

23,019 $ 0.89

Nine Months Ended

October 31, 2014 As Reported (GAAP) $ 453,069 $ 242,599

$ 61,422 $ 61,247 $ 41,725 $ 1.63

Nine Months Ended October 31, 2013 As Reported (GAAP)

$ 437,996 $ 236,007 $ 61,129 $ 62,414 $ 43,684 $ 1.69 Tax

Adjustment (1) (1,000 ) (0.04 ) Building Sale (2)

(1,526 ) (1,099 ) (0.04 )

Adjusted

Results (Non-GAAP) (3) $ 437,996 $ 236,007 $ 61,129 $ 60,888

$ 41,585 $ 1.61 (1)

Reflects the release of liabilities for uncertain tax

positions as a result of favorable U.S. and foreign audit

settlements. (2) Reflects a gain on a sale of a building in

Switzerland. (3) The adjusted tax rate for the nine months ended

October 31, 2013, was 30.8%.

MOVADO GROUP, INC. CONSOLIDATED BALANCE

SHEETS (In thousands) (Unaudited)

October 31, January 31, October 31,

2014 2014

2013

ASSETS

Cash and cash equivalents $ 157,937 $ 157,659 $ 163,146

Short-term investments - 33,099 - Trade receivables 128,638 68,683

120,043 Inventories 182,663 181,305 178,714 Other current assets

37,927 44,564 35,429 Total current assets

507,165 485,310 497,332 Property, plant

and equipment, net 45,340 47,796 46,512 Deferred income taxes

13,899 14,891 21,881 Other non-current assets 35,365

30,613 29,266 Total assets $ 601,769 $ 578,610 $ 594,991

LIABILITIES AND

EQUITY

Accounts payable $ 29,746 $ 33,598 $ 36,620 Accrued

liabilities 49,933 43,573 51,172 Deferred and current income taxes

payable 12,713 6,422 15,272 Total current

liabilities 92,392 83,593 103,064

Deferred and non-current income taxes payable 3,578 3,518 3,930

Other non-current liabilities 28,989 25,509 25,329 Noncontrolling

interests 2,472 2,686 2,593 Shareholders' equity 474,338

463,304 460,075 Total liabilities and equity $

601,769 $ 578,610 $ 594,991

MOVADO GROUP, INC. CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (In thousands) (Unaudited)

Nine Months Ended October 31,

2014 2013

Cash flows from operating activities: Net income $

42,016 $ 44,248 Depreciation and amortization 9,195 8,693 Other

non-cash adjustments 4,309 1,898 Changes in working capital (54,051

) (36,608 ) Changes in non-current assets and liabilities

(120 ) (1,615 )

Net cash provided by operating

activities 1,349 16,616

Cash flows from investing activities: Capital

expenditures (7,485 ) (11,895 ) Proceeds from short-term

investments 33,736 - Proceeds from sale of an asset held for sale -

2,196 Long-term investments (1,200 ) - Other investing 232

(225 )

Net cash provided by / (used in) investing

activities 25,283 (9,924

) Cash flows from financing activities:

Dividends paid (7,591 ) (4,604 ) Stock repurchase (13,150 ) (7,450

) Other financing 1,242 334

Net cash

(used in) financing activities (19,499 )

(11,720 ) Effect of exchange rate

changes on cash and cash equivalents (6,855 ) 285 Net change in

cash and cash equivalents 278 (4,743 ) Cash and cash equivalents at

beginning of year 157,659 167,889

Cash and cash equivalents at end of period $

157,937 $ 163,146

ICR, Inc.Rachel Schacter/Allison Malkin203-682-8200

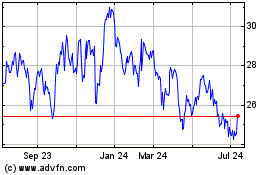

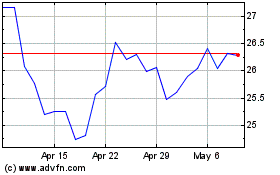

Movado (NYSE:MOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Movado (NYSE:MOV)

Historical Stock Chart

From Apr 2023 to Apr 2024