Morgan Stanley's Earnings Drop on Sharp Slide in Fixed-Income Revenue -- Update

April 18 2016 - 8:46AM

Dow Jones News

By Justin Baer and Peter Rudegeair

Morgan Stanley said its profit fell 53% in the first quarter

after concerns about the economy limited Wall Street clients'

appetite to trade or make deals.

Earnings beat estimates, however, sending shares up about 3% in

premarket trading. Net income dropped to $1.13 billion, or 55 cents

a share, from $2.39 billion a year earlier. Analysts polled by

Thomson Reuters had expected a per-share profit of 46 cents.

Revenue tumbled to $7.79 billion, shy of the $7.87 billion

forecast by analysts.

Morgan Stanley and other big banks are muddling through a steep

slump in their debt-trading business. The downturn prompted the

firm to cut jobs from the unit, which has weighed down Morgan

Stanley's return on equity, a key measure of banks'

profitability.

Return on equity fell to 6.2% from 13.5% in the first quarter a

year earlier, excluding an accounting adjustment. Morgan Stanley

executives have pledged to lift returns to 9% to 11%.

The volatile markets also conspired to weaken investment-banking

activity in the first quarter, hurting a division that had been a

bright spot last year.

Trading revenue fell 34% to $2.69 billion from $4.08 billion in

the first quarter of 2015, a sharper drop than some peers.

Debt, currencies and commodities trading revenue fell 56% to

$873 million, while the revenue from equity trading dropped 10% to

$2.06 billion.

In an interview, Morgan Stanley Chief Financial Officer Jonathan

Pruzan said January and February were "extremely turbulent" months

for its trading business, but that it saw improvement in March and

so far in April. "The environment is clearly better, client

activity is up a bit... [but] we're going to see bouts of

volatility."

The drop in trading revenue, especially at the firm's

fixed-income business, wasn't as sharp as many analysts and

investors had feared heading into April. Bank stocks have rallied

in the past week in part on relief that the most dire predictions

about the first quarter proved unfounded

Investment-banking revenue fell 16% to $990 million from $1.17

billion in the first quarter a year ago. Fees from advising on

mergers and other deals rose 25% to $591 million, while revenue on

stock and bond underwriting slipped 43% to $399 million.

Mr. Pruzan said that the bank's pipeline for mergers and

acquisitions remains healthy as muted economic growth and the rise

of activist investors continues to spur deals, even in a tough

market backdrop. "A lot of the themes we saw that drove activity

last year still exist," Mr. Pruzan said.

Revenue in Morgan Stanley's wealth-management arm was $3.67

billion, compared with $3.83 billion a year ago. In Morgan

Stanley's investment-management division, revenue fell 29% to $477

million due to losses on its private-equity and real-estate

funds.

The money-management arm also struggled with markdowns on

private-equity investments in the quarter.

Morgan Stanley's firm-wide expenses fell 14% to $6.05 billion

from $7.05 a year earlier. Cost from employee pay and benefits fell

19% to $3.68 billion, or 47% of revenue.

The firm's shares have tumbled 19% this year as investors

fretted over Morgan Stanley's ability to weather the slowdown.

Write to Justin Baer at justin.baer@wsj.com and Peter Rudegeair

at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

April 18, 2016 08:31 ET (12:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

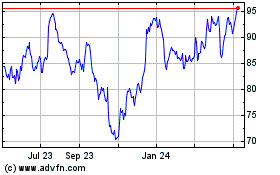

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

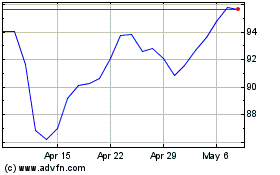

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024