Morgan Stanley elevated two of its longtime executives to bigger

jobs, highlighting a pair of strategic priorities for the Wall

Street firm while offering additional clues on its succession

plans.

Edward Pick, 46 years old, who oversaw the revival of Morgan

Stanley's stock-trading arm after the financial crisis, was named

global head of sales and trading, according to a memorandum sent to

Morgan Stanley employees Thursday. The new role gives Mr. Pick

oversight of fixed-income trading, a key profit driver for banks

that has been challenged by new regulations.

Morgan Stanley also tabbed Dan Simkowitz, an investment banker

who co-led the firm's stock- and debt-underwriting business, to be

head of investment management, reporting directly to Chairman and

CEO James Gorman, the memo said. Overshadowed by the firm's

wealth-advisory business, which had doubled in size in recent years

through the acquisition of Citigroup Inc.'s Smith Barney brokerage,

the money-management division had previously fit within the remit

of Gregory Fleming, one of the firm's two presidents serving under

Mr. Gorman.

Mr. Simkowitz, 50 years old, will join Mr. Pick on the firm's

operating committee, said the memo, signed by Mr. Gorman, Mr.

Fleming and Colm Kelleher, president of Morgan Stanley's

investment-banking and trading businesses.

"We always need to look to our future while managing the

present," the three executives wrote in the memo. "Our future

includes developing strong executives to serve at the most senior

levels of the firm, ensuring we regularly bring new energy and

intensity to areas where we can move the needle over the next five

years."

Messrs. Pick and Simkowitz each ran one of the firm's flagship

businesses, and both joined Morgan Stanley in 1990. They will now

be tasked with overseeing divisions with less impressive track

records, fixed income and investment management. Their promotions

follow other moves Mr. Gorman has made this year to cultivate a

group of managers who may one day succeed him or his top two

deputies, Messrs. Kelleher and Fleming.

"They're grooming the next generation, and the only way to do

that is to give them more responsibility," said Glenn Schorr, an

analyst with Evercore ISI.

As Mr. Gorman's turnaround plan gained steam, lifting the firm's

returns and its stock price, the CEO has increasingly focused on

ensuring the transition to a new generation of leaders is more

orderly than those in the recent past. In the years before the

financial crisis, Morgan Stanley's merger with Dean Witter gave way

to a bitter power struggle, an exodus of senior executives, and the

return of its former chieftain, John Mack.

While Mr. Gorman was Mr. Mack's choice as Morgan Stanley's next

CEO, the decision seemed far from settled when the former

management consultant and brokerage executive had arrived at the

firm from Merrill Lynch & Co. in 2006.

Left unsaid in Thursday's memo was the belief by many Morgan

Stanley executives that Mr. Gorman, 57 years old, is expected to

remain in his post for the foreseeable future. Indeed, all of the

significant management moves of the past year, including Jonathan

Pruzan's appointment as finance chief, appear to presage future

changes closer to the top.

Mr. Simkowitz's appointment marks the latest Morgan Stanley

investment banker to cross over into another division, part of a

push by Mr. Gorman to round out the experience of rising executives

at the firm. The decision to give Mr. Simkowitz a direct line to

Mr. Gorman was made to make the job more attractive, and to

highlight the division's potential, people familiar with the matter

said.

Nevertheless, it was difficult for some outsiders to avoid

concluding that Mr. Fleming had lost something in the latest

reshuffle. A former Merrill executive who once sat on BlackRock

Inc.'s board, Mr. Fleming is often cited as a potential CEO

candidate for financial-services companies considering a leadership

change.

People familiar with Morgan Stanley executives' thinking

rejected the notion that Mr. Fleming was losing favor with Mr.

Gorman or the firm's board. Mr. Fleming remains in a top lieutenant

to the CEO and, at 52 years old, is five years younger than Mr.

Gorman.

Messrs. Gorman and Fleming had discussed since early 2014 a plan

to hive off the money-management division from the latter's main

responsibilities running the wealth business, a unit that comprises

more than 40% of the firm's revenue, the people said.

Mr. Fleming is expected to push hard in building out the wealth

unit's banking arm, considered one of the firm's most-promising

areas of untapped growth. The bank has about $140 billion in

deposits, and that figure could surge above $200 billion in the

coming years as Morgan Stanley persuades its wealthy brokerage

clients to park more of their cash with the firm, one person

familiar with the matter said.

Investment management now accounts for just 10% of the firm's

revenue. The gradual strengthening of Morgan Stanley's balance

sheet, and its improved standing with regulators, has emboldened

its executives to consider more aggressive ways to build out the

unit, the people said.

Morgan Stanley may consider acquiring other money managers, the

people said. Many of the potential deals are expected to be

smaller, given the Federal Reserve's role in limiting how much

stockpiled capital big banks can deploy, but Morgan Stanley could

now be a player in larger acquisitions as businesses become

available.

The firm is also considering a further push into retail money

management,, one person familiar with the matter said.

Morgan Stanley executives had privately speculated for months

that Mr. Gorman would promote Mr. Pick, whose group has overtaken

Goldman Sachs Group Inc. as Wall Street's biggest equities business

in recent quarters.

Gradual changes to the way investors buy and sell bonds and

other debt securities, and the possibility that those markets will

eventually more closely resemble how the stock market functions,

convinced Morgan Stanley executives that the time was now to give

Mr. Pick these broader responsibilities, one person familiar with

the matter said.

Mr. Simkowitz had worked on some of biggest initial public

offerings in history, including Alibaba Group Holding Ltd. and

Facebook Inc. and served as a key adviser to the U.S . government

on General Motors Co.'s share sale.

In a separate memo, Morgan Stanley announced that Mo Assomull,

42, will become the firm's sole head of global capital markets.

Write to Justin Baer at justin.baer@wsj.com

Access Investor Kit for "CitiGroup Inc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US1729674242

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 01, 2015 13:45 ET (17:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

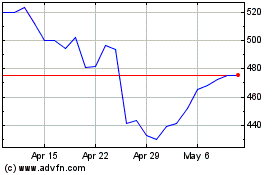

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

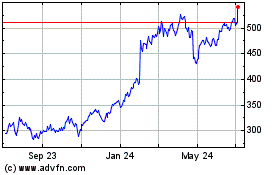

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024