Launch of online investing platform is part of Morgan Stanley’s

enhanced offering of digital tools to help investors meet financial

goals

Morgan Stanley Wealth Management today announced the launch of

Morgan Stanley Access Investing. The new online investing platform

is part of Morgan Stanley’s ongoing efforts to develop leading

digital tools that can deliver the firm’s human capital and

insights to more clients, with greater efficiency and

personalization.

Access Investing is an online investing platform designed to

help build, monitor, and automatically rebalance a diversified

portfolio. Building on the firm’s proprietary Goals-Based Wealth

Management technology, Access Investing is designed to help

investors who have less complex needs meet their unique financial

goals – whether they are saving for retirement, buying a new car or

purchasing a home – all while accounting for their time horizon and

risk tolerance. Additionally, Access Investing allows Morgan

Stanley’s financial advisors to expand their reach and nurture

future clients by building a pipeline to the next generation of

high net worth clients.

“Morgan Stanley Access Investing leverages the firm’s

intellectual capital to reach a broader audience of investors who

are looking to achieve their financial goals,” commented Naureen

Hassan, Chief Digital Officer, Morgan Stanley Wealth Management.

“Morgan Stanley Access Investing is an opportunity for financial

advisors to grow their book of business by making connections with

prospects earlier and eventually establishing full service

relationships when clients are ready.”

“We built Morgan Stanley Access Investing using our industry

state–of-the-art goals-based advisory platform,” said Chris

Randazzo, Chief Information Officer for Wealth Management and

Investment Management, Morgan Stanley. “We also used this

opportunity to optimize our technology foundation, delivering

broader benefits across our business and empowering us to release

product innovations faster.”

Built entirely in house, Access Investing provides investors

access to easy-to-use, low cost, high quality portfolios backed by

the investment expertise of Morgan Stanley. Portfolios are based on

asset allocation insights from Morgan Stanley’s Global Investment

Committee. They range across a core portfolio of mutual funds and

exchange-traded funds (ETFs)—combining elements of active and

passive management—an ETF-only market tracking portfolio, and seven

thematic portfolios. Sample themes include sustainability, gender

diversity, next wave technology and emerging market trends.

Morgan Stanley studies have shown that 86 percent of Millennials

– broadly defined as those born between the early 1980s and 2000 –

say they are interested in socially responsible investing.

Millennials are also twice as likely to invest in a fund if social

responsibility is part of the value-creation thesis.

“Our analysis has shown that the next generation of high net

worth individuals is looking for more than traditional portfolio

allocation. By offering a diverse set of portfolios, we are

enabling our clients to invest in what they believe,” said Lisa

Shalett, Head of Investment and Portfolio Solutions, Morgan Stanley

Wealth Management. “Morgan Stanley Access Investing portfolios are

backed by the same proprietary manager selection analytics used

throughout the firm, which we believe may improve the odds of

adding performance value for the end investor.”

Key features for Morgan Stanley Access Investing include:

- A dynamic, goals-based approach powered

by Morgan Stanley’s proprietary technology

- Portfolios guided by Morgan Stanley’s

investment experts, composed of mutual funds and ETFs, featuring a

blend of active and passive investment strategies

- Cutting-edge portfolio management

technology, including automated rebalancing and tax-loss harvesting

at no additional charge

- Simple online account opening,

servicing and funding options, including mobile check deposit

- A fully mobile-optimized experience,

allowing investors to access accounts across all devices

- An investment minimum of only

$5,000

- A low advisory fee of 0.35% of assets

under management

- No additional account service,

transaction or termination fees. For all investments in mutual

funds and ETFs, the client will incur fees and expenses related to

owning shares of a fund. These will be in addition to and will not

be included in the advisory fee.

About Morgan Stanley

Morgan Stanley Wealth Management, a global leader, provides

access to a wide range of products and services to individuals,

businesses and institutions, including brokerage and investment

advisory services, financial and wealth planning, cash management

and lending products and services, annuities and insurance,

retirement and trust services.

Morgan Stanley (NYSE: MS) is a leading global financial services

firm providing investment banking, securities, wealth management

and investment management services. With offices in more than 42

countries, the Firm's employees serve clients worldwide including

corporations, governments, institutions and individuals. For more

information about Morgan Stanley, please visit

www.morganstanley.com.

MORGAN STANLEY ACCESS INVESTING (MSAI)

Access Investing is a firm discretion investment advisory

program. While Financial Advisors may have limited visibility into

their client’s Access Investing accounts, Financial Advisors may

not provide advice with respect to the account or the investments.

Additional information about the Morgan Stanley Access Investing

program, including a description of the core portfolios and the

thematic tilts, is provided in the applicable Morgan Stanley Smith

Barney LLC ADV Brochure, which is available at

www.morganstanley.com/ADV.

This material has been prepared for informational purposes only

and is not an offer to buy or sell or a solicitation of any offer

to buy or sell any security or instrument, or to participate in any

trading strategy. Morgan Stanley does not provide legal, tax or

accounting advice. In light of the foregoing, we strongly recommend

that you consult your tax and/or legal advisors in connection with

this material and any withdrawals that you make from your

portfolio.

The Global Investment Committee is a group of seasoned

investment professionals who meet regularly to discuss the global

economy and markets. The committee determines the investment

outlook that guides our advice to clients. They continually monitor

developing economic and market conditions, review tactical outlooks

and recommend model portfolio weightings, as well as produce a

suite of strategy, analysis, commentary, portfolio positioning

suggestions and other reports and broadcasts.

Investors should carefully consider the investment objectives,

risks, charges and expenses of a mutual fund or exchange traded

fund before investing. The prospectus contains this and other

information about the mutual fund or exchange-traded fund. To

obtain a prospectus, contact your Financial Advisor or visit the

fund company’s website. Please read the prospectus carefully before

investing.

Investing in the markets entails the risk of market volatility.

The value of all types of investments, including mutual funds and

exchange-traded funds, may increase or decrease over varying time

periods. Investments are not FDIC insured or bank guaranteed, and

investors may lose money.

Asset allocation, diversification and rebalancing do not assure

a profit or protect against loss. There may be a potential tax

implication with a rebalancing strategy. Please consult your tax

advisor before implementing such a strategy.

An investment in an exchange-traded fund involves risks similar

to those of investing in a broadly based portfolio of equity

securities traded on exchange in the relevant securities market,

such as market fluctuations caused by such factors as economic and

political developments, changes in interest rates and perceived

trends in stock prices. The investment return and principal value

of ETF investments will fluctuate, so that an investor's ETF

shares, if or when sold, may be worth more or less than the

original cost.

Portfolios that invest a large percentage of assets in only one

industry sector (or in only a few sectors) are more vulnerable to

price fluctuation than those that diversify among a broad range of

sectors.

The returns on a portfolio consisting primarily of

environmental, social, and governance-aware investments (“ESG”) may

be lower or higher than a portfolio that is more diversified or

where decisions are based solely on investment considerations.

Because ESG criteria exclude some investments, investors may not be

able to take advantage of the same opportunities or market trends

as investors that do not use such criteria.

Morgan Stanley Smith Barney LLC is a registered

Broker/Dealer, Member SIPC, and not a bank. Where appropriate,

Morgan Stanley Smith Barney LLC has entered into arrangements with

banks and other third parties to assist in offering certain banking

related products and services.

Investment, insurance and annuity products offered through

Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE

VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY

ANY FEDERAL GOVERNMENT AGENCY

Morgan Stanley Access Investing ® is a registered service mark

of Morgan Stanley Smith Barney LLC.

©2017 Morgan Stanley Smith Barney LLC. Member SIPC.

i

https://www.morganstanley.com/ideas/millennial-sustainable-investing

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171204005573/en/

Media Relations:Morgan Stanley Wealth ManagementMargaret Draper,

914-225-6369

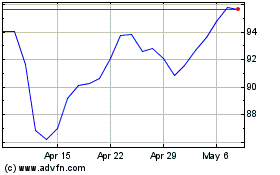

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

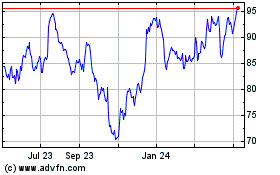

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024