More Luxury Houses Buying Back High-End Watches to Revive Sales: Hong Kong Dealers

August 05 2016 - 1:54AM

Dow Jones News

By Kathy Chu

HONG KONG--A growing number of luxury watch brands under Cie.

Financiere Richemont SA and LVMH Moet Hennessy Louis Vuitton SE

(MC.FR) are buying back high-end timepieces in Hong Kong in an

effort to revive sales in the world's largest luxury-watch market,

dealers say.

The buybacks--which allow watch dealers to trade in slow-moving

stock for newer items--could result in potentially thousands of

watches being returned to Swiss manufacturers, according to

analysts. The move comes as luxury watchmakers grapple with a

sluggish global economy and changing consumer tastes.

Hong Kong has been especially hard-hit, partly because of the

Chinese government's crackdown on gifting. In June, Swiss watch

exports dropped 16.1% globally, while exports to Hong Kong fell

29%.

LVMH had previously said it was buying back some of its Tag

Heuer watches, and Richemont had said it would take back mainly

Cartier watches.

In addition to those efforts, Hong Kong dealers and others in

the watch industry have told The Wall Street Journal that Richemont

has agreed to buy back timepieces on a case-by-case basis from its

high-end brands including Piaget, Montblanc and IWC

Schaffhausen.

Meanwhile, LVMH is buying back its older Bulgari and Zenith

watches and giving dealers credit to buy new models, also on a

case-by-case basis, according to dealers.

"This kind of buyback offer...hasn't happened in the last 20

years," said Alain Lam, executive director of Oriental Watch

Holdings Ltd. (0398.HK), a luxury watch dealer in Hong Kong that is

participating in the Richemont and LVMH buybacks.

Richemont declined to comment.

Previously, Richemont had said that it was mainly buying back

its Cartier watches in Hong Kong, with Chief Executive Richard

Lepeu calling the move an "exceptional measure" in "exceptional

circumstances."

A person familiar with the buyback said what is unusual is the

large numbers of watches being repurchased.

A LVMH spokeswoman said the luxury house isn't doing anything

"outside of the brand's normal commercial practices to create room

for new items."

LVMH, in a July call with analysts, said its buyback of Tag

Heuer watches has been "pretty painful" but will help overall

sales. In the first half of 2016, revenue in LVMH's watch and

jewelry division rose 4%.

Luxury brands want to clean up high levels of inventory in Hong

Kong so dealers can order watches that will sell better, according

to Bruno Lannes, a partner at consultancy Bain & Co.

Write to Kathy Chu at kathy.chu@wsj.com

(END) Dow Jones Newswires

August 05, 2016 01:39 ET (05:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

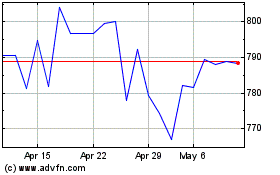

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

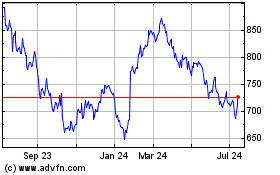

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024