Monte dei Paschi to Cut Jobs, Sell Units in Bid to Win Support for Rescue Plan

October 25 2016 - 4:40AM

Dow Jones News

MILAN—Troubled Italian lender Banca Monte dei Paschi di Siena

SpA on Tuesday said it would cut 2,600 jobs, shut 500 branches and

sell business units as part of a make-or-break plan aimed at

persuading skeptical investors to buy into a multibillion-euro

capital increase.

The bank plans to cut personnel costs by 9%, accelerate

investment in digital banking and place greater focus on its retail

and small business channels to achieve a net profit of more than

€1.1 billion ($1.2 billion) by 2019.

It will also sell its bad-loans recovery unit and its Merchant

Acquiring business activities, for which it has already received a

€520 million offer from Istituto Centrale delle Banche Popolari

Italiane SpA.

The bank's new strategy is crucial to convince investors to

support its efforts to regain financial footing and resolve its

troubles with souring loans.

In July, the lender announced plans to raise â,¬5 billion in

fresh equity and sell off €28 billion of bad loans. The bank said

Tuesday it had called a shareholder meeting for Nov. 24 to approve

the recapitalization plan, which it aims to complete by the end of

the year.

The plan is being closely watched as Monte dei Paschi, which was

the worst-capitalized bank in recent stress tests carried out by

the European Banking Authority, has been a source of major

instability for Italy's banking system.

The Tuscan bank has already tapped shareholders twice for €8

billion in fresh funds in the past few years, but its stock-market

value is only about €1 billion. Since the beginning of the year,

the bank's shares have lost almost three quarters of their

value.

If Monte dei Paschi fails to execute its plan it would be a

major headache for the Italian government, which is betting on a

solution to the lender's woes as a major step toward restoring

confidence in the country's battered banks.

The bank's new strategy has been pieced together by recently

appointed Chief Executive Marco Morelli, a veteran Italian banker

and former executive at Monte dei Paschi, who was brought in after

the bank's former CEO and chairmen were ditched amid muted investor

enthusiasm for the capital raising part of the plan.

The bank confirmed Tuesday it may ask junior bondholders to swap

debt for equity before completing the new shares sale and that it

may reserve a part of the capital increase to new investors willing

to buy a large portion of the new shares and another part to

existing shareholders.

It appointed J.P. Morgan to lead the work on evaluating and

selling the bad loans into a separate vehicle, which will likely be

funded with a loan from it and other banks. The U.S. bank, together

with Mediobanca SpA, has been casting about for investors who will

pump fresh capital into Monte dei Paschi.

In terms of the new strategy, the bank said it plans to rekindle

its mortgage business by boosting volumes of new mortgages to €6

billion in 2019, from the current level of €2.3 billion.

It also plans to grow its asset management and insurance

business. The bank also confirmed it will go on with its plans to

spin off its bad loans recovery unit.

Monte dei Paschi also said it posted a net loss of €1.15 billion

for the third quarter, compared with a net profit of €255.8 million

for the same quarter of last year. The loss was largely the result

of €1.3 billion of provisions for bad loans the bank booked for the

quarter.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

October 25, 2016 04:25 ET (08:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

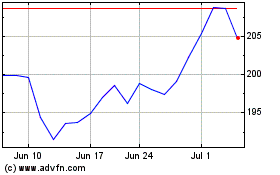

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024