Monte dei Paschi Investors Swap Junior Bonds for Shares

December 02 2016 - 2:50PM

Dow Jones News

ROME—Troubled lender Banca Monte dei Paschi Siena SpA said late

Friday a group of junior bondholders agreed to swap more than €1

billion ($1.07 billion) worth of debt they owned with shares in the

bank as part of a recapitalization plan it is carrying out to stay

afloat.

The bank offered the option to swap junior bonds, the riskiest

debt it issued, this week to both retail and institutional

investors as it tries to raise €5 billion in fresh capital.

It said the figure is preliminary and it will unveil the final

numbers on the offer on Monday.

The debt-to-equity swap is the first part of the

recapitalization plan the bank is implementing, which includes a

large equity investment by one or more cornerstone investors and a

public offer of new shares.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

December 02, 2016 14:35 ET (19:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

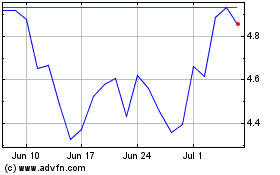

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

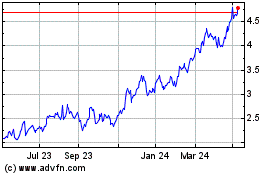

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Apr 2023 to Apr 2024