Monster Beverage Shares Jump After Earnings Beat

April 29 2016 - 3:10PM

Dow Jones News

Monster Beverage Corp. posted better-than-expected increases in

profit and revenue because of improvements in distribution through

its agreement with Coca-Cola Co., which owns nearly 17% of the

energy drink maker.

Shares rose 12.7% to $144.19, wiping out much of the year's

losses, and are now down 3.3% for the year.

Monster grappled in recent quarters with disruptions as it

switched who put its products on store shelves. Coca-Cola Co. paid

$2.15 billion in 2014 to acquire a 16.7% stake in Monster as part

of an asset swap in which it also became Monster's preferred

distributor. In the first quarter last year, the company took a

$206 million charge from terminating its previous distributor

agreements.

Chief Executive Rodney Sacks said Monster was "seeing

improvements in our levels of distribution" from Coke. He also said

that Monster had reached agreements with a number of other

international Coke bottlers. Monster energy drinks will start

selling in Australia and New Zealand in May as a result of a new

agreement with Coca-Cola Amatil.

Still, he said results were hurt by distributor transitions and

"uncertainties" in the international distribution network that

didn't include Coca-Cola.

Over all, Monster Beverage reported a profit of $168.9 million,

or 79 cents a share, up from $4.4 million, or 3 cents a share, a

year prior. Excluding the distribution deals written down in the

year-ago quarter and other items, per-share profit rose to 80 cents

from 64 cents.

Revenue increased 8.5% to $680.2 million.

Analysts polled by Thomson Reuters had projected adjusted profit

of 74 cents a share on $657 million in revenue.

Friday, Monster Beverage said it would buy up to $2 billion of

its shares through a modified "Dutch auction" tender offer, a move

consistent with the company's previously announced plan to return

capital to shareholders.

In a typical Dutch auction, all buyers submit the number of

shares and their selling price, from which the company determines

how much everyone will receive. Monster's two founders said they

may participate in the offer, but the company said the founders

will continue to hold a majority of their current shares if they do

participate.

Write to Austen Hufford at austen.hufford@wsj.com

Corrections & Amplifications: Revenue increased 8.5% to

$680.2 million. An earlier version of this article incorrectly

stated the company's revenue was $860.2 million. (April 29)

(END) Dow Jones Newswires

April 29, 2016 14:55 ET (18:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

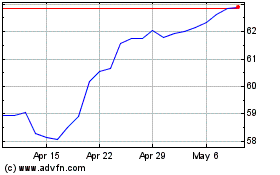

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

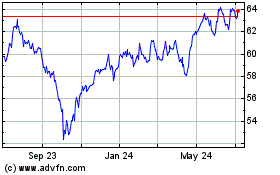

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024